In recent decades, an unprecedented variation has developed in the price of new tract housing on the fringe of US metropolitan markets. Nearly all of this difference is in costs other than site preparation and construction, which indicates rising land and regulation costs.

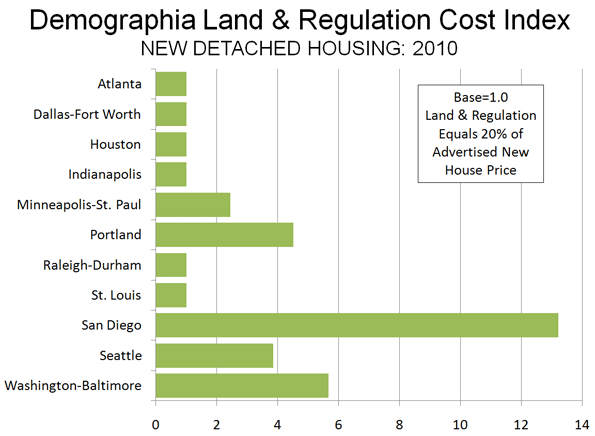

Our first annual Demographia Residential Land & Regulation Cost Index estimates the price of land and regulation for new entry level houses compared to the historic norm in 11 metropolitan regions (Note 1). Metropolitan regions in which land and regulation costs remain at or below normal have an Index of 1.0 while those with land and regulation costs above normal will have an Index above 1.0 (Figure 1).

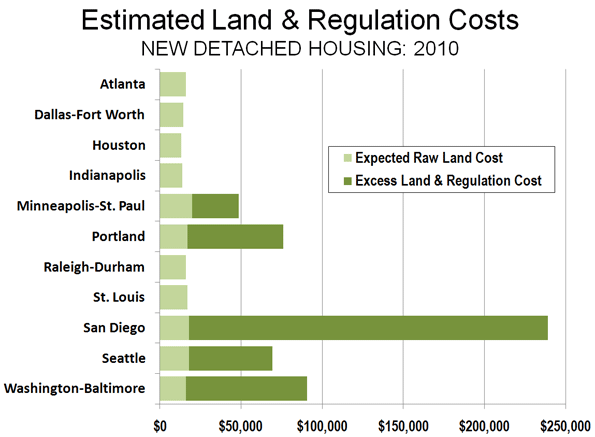

More restrictive land use regulation is variously referred to as "smart growth," "growth management" and other terms. More restrictive land use regulation is estimated to have added from nearly $30,000 (in Minneapolis-St. Paul) to more than $220,000 (In San Diego) to the price of a new home.

Economic research has associated rising residential land costs with more restrictive land use regulations. The table indicates some of the more important price increasing impacts of more restrictive land use regulation.

|

More Restrictive Land Use Regulation: Factors that Can Drive House Prices Higher |

|

1.. Increases underlying land costs |

|

2.. Increases planning and development costs |

|

3.. Raises financing costs |

|

4.. Encourages more expensive houses. |

|

5.. Increases construction costs |

|

6.. Encourages concentration of market power and land banking |

|

7.. Encourages land and housing speculation |

The Land and Regulation Ratio

For decades, construction costs of tract house on the urban fringe in the United States have represented 80% or more of the advertised house price. The balance of 20% or less has been for land and regulation costs and will be referred to as the "land and regulation cost ratio." In metropolitan markets with less restrictive land use regulation, the historic 20% or less land price ratio remains in place. The Demographia Residential Land & Regulation Cost Index assumes a 20% expected land and regulation ratio.

In some metropolitan markets, however, house prices have increased far more rapidly than in the rest of the nation. The greater increase in house prices and escalation of land costs above the historic 20% land and regulation cost ratio has occurred in metropolitan markets burdened by more restrictive land use regulations. Urban growth boundaries, limits on the number of houses that can be built, large lot zoning and excessive development impact fees and the like are regulation strategies that increase the cost of land for building houses. These land cost increases are not the result of more rapidly rising construction costs or underlying market forces such as consumer demand.

More restrictive land use land use regulation also creates obstacles to people buying houses, requiring them to devote more money to housing than necessary and increases their vulnerability to losses in the event of a financial downturn. This exposes mortgage lenders to increased risks of loan defaults. Finally, more restrictive land use regulation makes residential land development more dependent on politics, with the potential for greater influence through campaign contributions.

The first annual Demographia Residential Land & Regulation Cost Index estimates cost of land and regulation for new entry level houses compared to the historic norm in 11 metropolitan markets. Each of the metropolitan regions in which house prices have risen above normal have adopted more restrictive land use regulations. Conversely, in each of the metropolitan regions in which house prices have not risen above normal levels, there is less restrictive land use regulation. During much of the Post-World War II era, all metropolitan markets had less restrictive land use regulations.

Results

The overwhelming majority of new housing in the United States continues to be detached and is built near or on the urban fringe (Note 2). For new detached homes, the Index is 1.0 in six metropolitan markets (Atlanta, Dallas-Fort Worth, Houston, Indianapolis, Raleigh-Durham and St. Louis). This indicates that land use regulation is less restrictive and does not add more than normal to the price of new homes (Note 3).

In the other five metropolitan markets, the land and regulation cost ratio has risen above 20%, resulting in a higher Index. The Index is 2.4 in Minneapolis-St. Paul, 3.9 in Seattle, 4.5 in Portland, 5.7 in Washington-Baltimore and 13.2 in San Diego. It is estimated that more restrictive land use regulation raises the price of the least expensive detached houses from nearly $30,000 (in Minneapolis-St. Paul) to more than $220,000 (in San Diego) than would be expected if these metropolitan markets had retained less restrictive land use regulation (Figure 2).

The metropolitan markets with more restrictive regulation have an average Demographia Residential Land & Regulation Cost Index of 5.9 for detached housing, while the metropolitan markets with less restrictive regulation average 1.0.

Housing Affordability: Through the Bubble and Bust

There is increasing concern about declining housing affordability across the nation. Even after the deflation of the housing bubble, house prices in some metropolitan markets remain well above pre-bubble prices and historic affordability standards. The housing affordability of the included metropolitan markets is illustrated by land use regulatory category in Figure 3. The Figure indicates the National Association of Home Builders-Wells Fargo Housing Opportunity Index for 1995, the peak of the bubble and early 2010, showing the percentage of households able to afford the median priced house. Similar affordability measures can be reviewed in the Annual Demographia International Housing Affordability Survey.

Future Editions

The 11 metropolitan regions included in the initial Demographia Residential Land & Regulation Cost Index were selected to provide a geographical and regulatory balance and because they had sufficient data from which to develop the Index. Additional areas will be added in future editions, with the intention of including all metropolitan regions with more than 1,000,000 population.

-------

Note 1: The Index was derived from a database developed of new house offerings by national, regional and local builders, using internet sites and published metropolitan home guides. The period covered is January through June 2010.

Note 2: In 2006, more than 85% of new single family houses sold in the United States were detached, according to Bureau of the Census data. Detached housing represents approximately 62% of all US housing units (including multi-unit dwellings).

Note 3: In each of the metropolitan markets with less restrictive regulation, the estimated construction costs were more than 80% of the house price. By using a 20% land and regulation ratio, the house construction cost was capped at 80% of the house price. In each of the metropolitan markets with more restrictive regulation, the estimated construction cost was less than 80% of the house price.

Wendell Cox is a Visiting Professor, Conservatoire National des Arts et Metiers, Paris and the author of “War on the Dream: How Anti-Sprawl Policy Threatens the Quality of Life”

Photo: Will County, Chicago urban fringe (By author)

Have some balls and name the town

Dave Barnes

+1.303.744.9024

Let me guess: the

Let me guess: the Alameda.

Misstrial

4th Generation Californian

Why?

The above commentary could be for any city in the Bay Area.

Transportation costs?

How much does the average transportation cost vary in these areas? According to one estimate the average transportation cost in my area in Florida is as much as I pay for rent.

Mello-Roos is another cost

Mello-Roos is another cost here in parts of California.

It all began when people decided they didn't want to pay for associated costs of new subdivisions. Along with not underwriting the costs of operating a community and state college(s).

Sort of like expecting something for nothing...

Goes along with Prop 13 and the obscene run-up in housing.

Misstrial

4th Generation Californian

From the Author

Thank you for all of the good comments above. A couple of points.

1. We have been rating San Diego (and the other California markets until the bust) as more unaffordable than Portland in our annual Demographia International Housing Affordability Survey (http://www.demographia.com/dhi.pdf). All of this is testimony to the sad state of regulatory affairs that has been created in California. Portland has indisputably the better missionary department (and thus the world thinks of it as Nirvana), but as bad as Portland is, California has outdone it. That is no compliment, by the way, to Portland, where housing prices are at least 30% above what they should be relative to income. That is not good news for middle and lower income people.

2. The same report has been showing the Florida markets, most of which experienced strong escalation during the boom and big losses. Brookings rates Florida in its most restrictive market classification (as do we).

Best regards,

Wendell Cox

Demographia

www.demographia.com

Affordablity and "smart growth"

As a realtor I see this disconnect between new home prices and the cost of undeveloped land every day. Its very irritating to see the lot prices that are way too expensive for my market. Then there are all the no good "reasons" that I hear every day why they cannot be more affordable.

If developers were allowed to bring the prices in line with the demand, most would because they could sell out far faster. They aren't stupid, their hands are just tied.

In my market, which is Northwest Indiana just outside Chicago, we are considered the "affordable" segment of the Chicago-land area (though most of the south suburbs are actually cheaper) . We are no further away from the better known suburban area of Du Page County ( in some cases closer) so commute times to downtown Chicago are pretty close. Yet we are considerable more affordable, mostly due to people not knowing about it, or if they do have incorrect negative impressions of it. Another reason is we don't have the huge job center that Du Page has.

Up until the 1970's the average lot size for a new construction home was about half an acre, Its a size that is still very popular with a large amount of buyers even today. But to get a half acre lot in a desirable town in NW Indiana, the cost has skyrocketed in the last couple of decades. Please note that home prices here did not skyrocket even in the boom. They can be up to $300,000 (granted most are located in a golf or gated community) which is more then the average price of a existing house in NW Indiana.

So you have to be buying a million dollar house to get a half acre lot today. That is by far the very upper end of the market here. There are very few buyers for million dollar houses in Northwest Indiana. So there are very few homes built on half acre lots anymore. Most "big" lots for a new home would be just under a quarter acre. Most are less then that. But even with that the average price for a lot ready for development into a new house can cost between $70,000 to $100,000. Yes, there are some places you can get a lot for about $40,000 but even at that price its still high.

With the income level of this area, new home builders should be building new single family homes, for the middle class, for prices between about $140,000- $225,000. Builders that manage to do so (some actually manage to do so even the way it is) still sell homes fairly fast even in this terrible market! There is a fairly large builder that builds in this range and has actually done quite well in the last couple of years (they also are land developers).

But since the lot prices in the towns where most of the new homes are being built now are priced between $70,000 and $100,000, building homes in the price range in the last paragraph isn't possible. Builders have to build a house that will sell for between $300,000 and $500,000 due to the cost of the lot. And this lot isn't even the coveted half acre lot. There is more of a market for homes in that price range, but even that one isn't huge.

So you end up with a buyer who wants a new $225,000 home with a builder with a home priced at $400,000 (was $525,000 three years ago). Its only going to get worse as our land planning board has decided that "sprawl" is bad and they will oppose new subdivisions from now on.

Town councils, county and regional "planners", existing homeowners, environmentalists, anti-growth nimbys, and even some developers are slowly destroying the affordable new home market (and the whole market, entry level and up). Some may not know they are doing it, and some are doing it on purpose.

Many times it is done by existing home owners, town councils and developers in order to keep a community overall home prices high. So you get the minimum lot and home size, disallowed low end materials, subdivisions with expensive features (fancy lighting, fencing, fountains) etc. Even if the communities market doesn't really support a development that upscale. There is one town here that does this every time without fail.

Today, believe or not, there is a small but very vocal group of people who don't think the American dream of owning their own home is a good thing and are working very hard at ending it. Many have become "urban planners", many are in government and universities, many are radical environmentalists. But their goal is stop new construction. Not just in the suburbs but everywhere. They have started in the suburbs due to their thinking that they have a bigger case for their cause and the fact that most of them don't live there. If they have success in the suburbs they will go after new construction in the cities as well. Ironically most of these people probably own their own homes.

But all these groups go about it the same way. Regulation! Its very effective. Make something too expensive for its market is the biggest one, because many will want the high values. The second best is slow new development down so much that it stops. It has made land development so expensive only those with very deep pockets can play. Holding onto undeveloped land waiting for a green light for construction is very expensive. So the longer it takes, its less likely something can go down for a reasonable amount of money. It leaves only the big developers that are easy to hate. Its far harder to go after a mom and pop developer because they have a face when the big bad corporation doesn't.

When there are no longer any affordable entry level houses both new and used, the overall housing market dries up. The whole business is dependent on the first time or entry level buyer. If you kick out the bottom, the rest of the market slows way down. Something is very wrong in a housing market where a little ranch house built in the 1950's costs a half million dollars. No place, not even California, is that prized that a house like that costs so much.

Affordability is going to be a big problem in the 21st century if the regulations continue to build up. "Smart growth" isn't very smart, it's actually very dumb.

Thank You

Thank you for your very thoughtful and well-stated post.

Everything you've written of for your locale in NW Indiana could be stated the same for many parts of California.

Best to you.

Misstrial

4th Generation Californian

Florida (with an aside on San Diego)

I'd be curious to see what would happen if you added Florida - say Miami and/or West Palm Beach - to the list, since I believe it has a fairly light regulatory burden in most cities, and yet prices plunged enormously in the bust.

I'd be curious to know if I am wrong about the regulatory burden, or if this is a significant outlier for your study.

Just in case you're not really watching, I should mention to the person who asked above that California has always been one of the most strictly regulated states in the Union. One example I know of personally: There is an agency called the Coastal commission that has an iron control of all development within two-odd miles of the coast. It has a complex decisionmaking process that means that to build a single family home, including any addition over 500 square feet, you need to work through a two year (!) process. I was wondering why you could, at one time, pick up a lot in Mailibu for $100k but you couldn't get a constructed house under $500k. Lots with plans and permits (meaning the development process had been run through) sold for $700k! That was my answer.

It might be added that even after the tiresome fire that swept away half the Malibu hillside, where there was a special Coastal Commission exemption that allowed as-right home rebuilding, it still took several years before most of Malibu was rebuilt. I wandered Malibu a couple of years after the fire and there were still plenty of burned out lots with awesome ocean views that were yet to be reconstructed. It takes a lot of really nasty government regulation to prevent people from rebuilding homes on such spectacular sites. I'll bet in South Florida there would have been construction started on equivalent lots within weeks.

David

San Diego, Holy Crap!

Wendell,

You cannot show these graphs and not explain why San Diego is so high. I mean that your readers (well, this one anyway) understand why Portland is more expensive than Houston.

But, I am amazed and confused by the SD number.

,dave

Dave Barnes

+1.303.744.9024

WebEnhancement Services Worldwide