Housing affordability and dwelling shortages back to centre stage

The combined issues of housing affordability and dwelling shortages are once again emerging as key issues for the property industry, policy makers and the broader community.

Recent cyclical and relatively short-term movements in the property market – where we’ve moved from boom to moderation to a rebound again – have dominated discussion in recent years.

To an extent, the attention on the property cycle has overshadowed the larger and more important long-term question of how we adequately provide housing for a rapidly growing and changing population.

The human element

Although these are issues which I tackle every day in a professional setting it was on a recent trip to Sydney that I was reminded of the human element that is often ignored by some planners and even industry “experts”.

On checking out of my hotel the receptionist asked if I was returning home or continuing to travel. I answered I was returning home to Melbourne and a brief conversation ensued about the relative merits of both cities.

Of course, as a real estate economist the discussion invariably led to the property market and I mentioned that while both cities had seen robust price and rental growth in recent years, Melbourne was relatively more affordable.

“Indeed…. renting is so expensive in Sydney” came the response.

I was momentarily left speechless.

Of course, I was thinking about the cost of buying but was reminded, again, of the burgeoning number of renters. And, if buying property is increasingly difficult for many first home buyers, renting must be too, as more people compete in the increasingly expensive rental market.

Demand and supply

While taxation, lending and other factors might play a role, simple economics points to the fact that price, and therefore affordability, is first and foremost an issue of demand and supply.

Given that population growth is expected to remain reasonably strong for the foreseeable future, the need to maintain affordability by ensuring an adequate level of new dwellings over the medium to long term across all product types (houses, townhouses and apartments) is of paramount importance.

Unfortunately, current and emerging trends suggest housing supply may deteriorate further before it improves.

Building approvals continue to fall sharply highlighting the extent of the residential construction slowdown.

The recent release of the UDIA Victoria’s Residential Development Index suggests we will face an undersupply of new housing over the next 18-24 months.

Victorian dwelling building approvals declined by 21% to around 59,700 in 2018-19. This was down from around 75,600 in 2017-18 and follows an estimated shortfall of around 6,800 dwellings delivered in 2018-19.

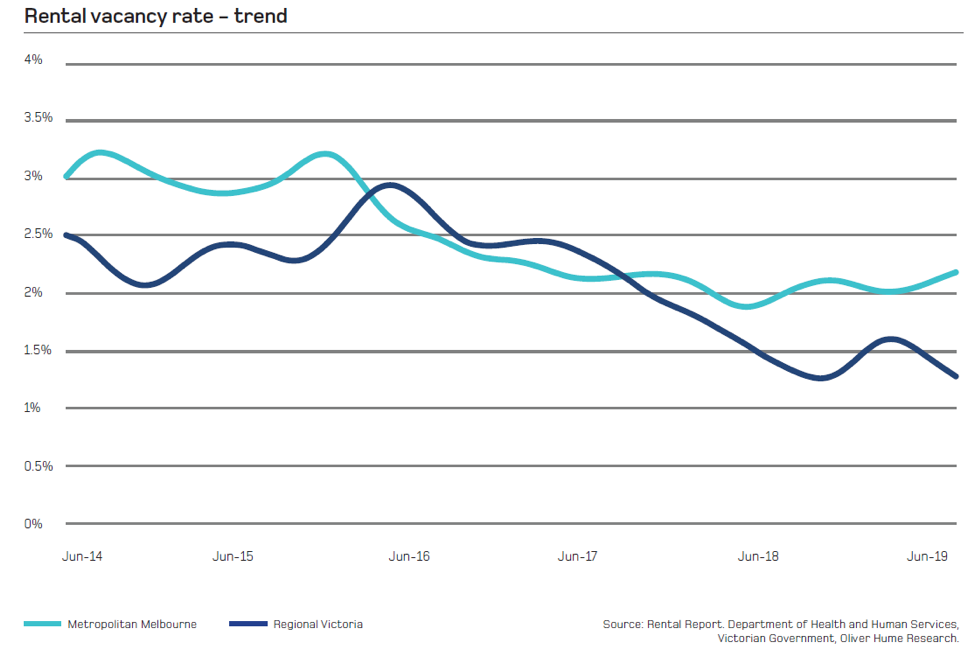

Similarly, vacancy rates remain low.

In metropolitan Melbourne the vacancy rate was 2.2% most recently and has remained below 3% (the estimated equilibrium rate) for several years.

Regional Victoria’s vacancy rate was even lower (1.3%) highlighting the strength of population growth and underlying housing demand in non-metropolitan areas.

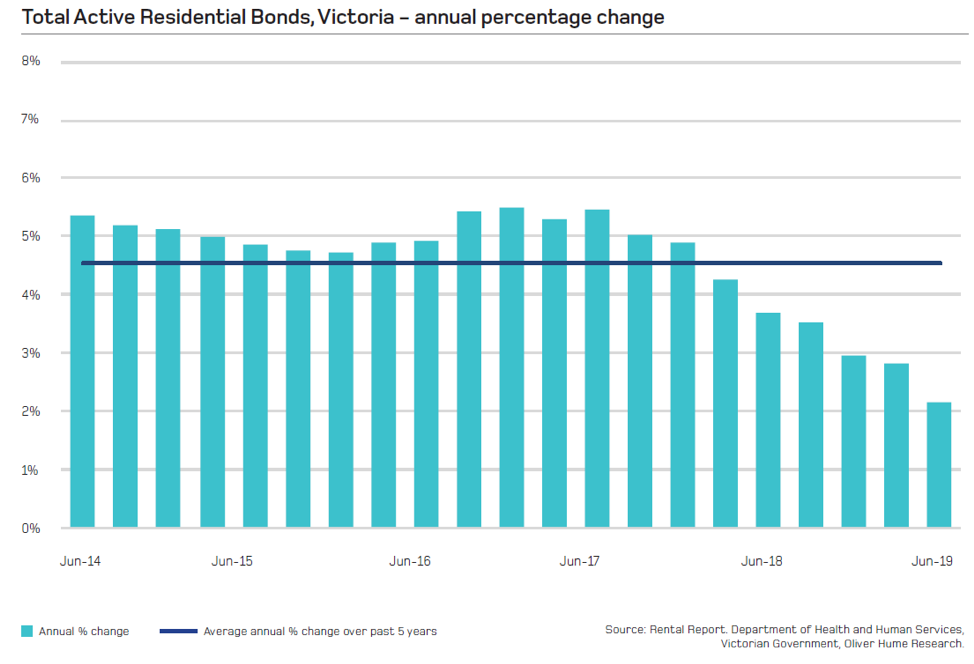

Furthermore, growth in the number of active bonds held in Victoria continues to moderate (the number of active bonds is a gauge of the rental housing stock).

The total number of active bonds in Victoria at the end of the June quarter 2019 rose by only 2.1% on an annual basis – the lowest increase since late 2002 and below the growth in the rental market over the last decade.

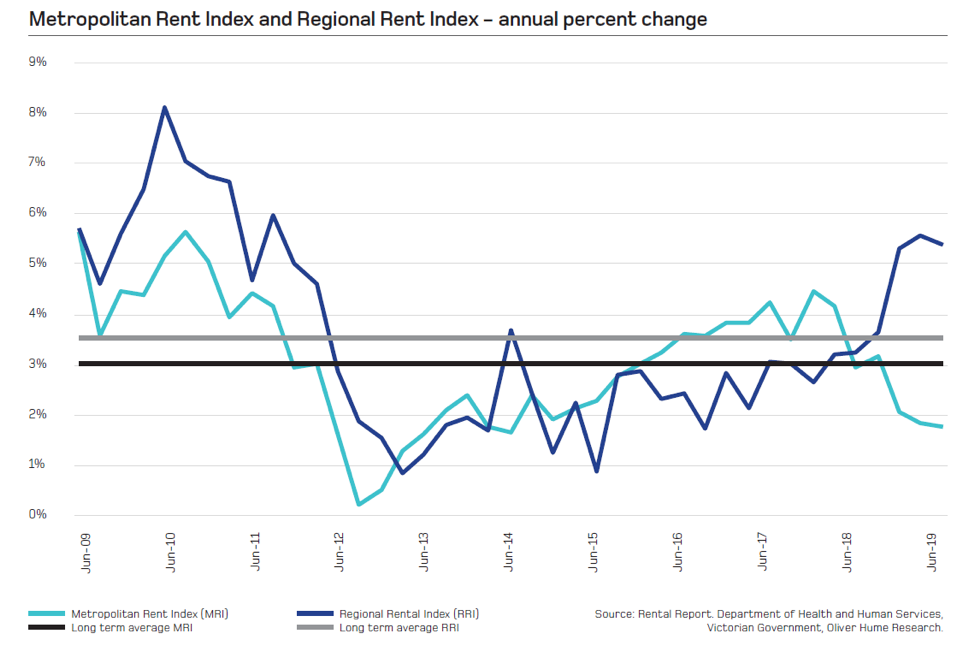

Similarly, rental growth continues to outstrip inflation especially in regional Victoria where rents continue to increase at a rapid rate.

There is no one commonly accepted definition of a housing shortage (or an affordability crisis) but the few statistics cited above suggest we could face a range of challenges in accommodating a growing population.

However, where there are challenges, there is also opportunity.

For investors, a tightening property market bodes well for capital and rental growth over the medium to long-term.

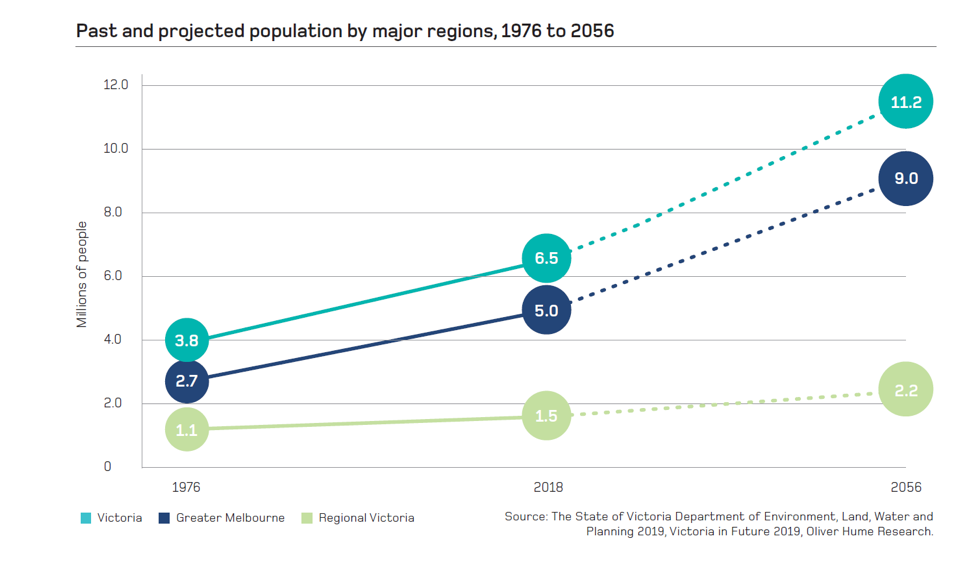

Importantly, population growth is forecast to remain robust requiring a sizeable number of new dwellings every year.

The Victorian Government’s population forecasts suggest the state will need around 66,000 to 68,000 new dwellings every year.

The state is projected to add 4.7 million people from 2018 to 2056 reaching a population of 11.2 million.

Most of this growth is expected to occur in Greater Melbourne with the region’s population projected to grow by around 4.0 million people (from 5.0 million in 2018 to 9.0 million in 2056).

Way Forward

Many of our capital cities and towns are faced by major challenges in the housing market including a lack of affordable housing. This problem is especially acute in areas where people want to live close to where they work.

Some commentators have labelled the current situation an affordability crisis and one which, over the short-term at least, could deteriorate as new housing supply fails to provide for underlying demand.

In Victoria, as in many other jurisdictions, a growing population could mean that, over the medium to long term, affordability could continue to worsen.

This is likely to coincide, if not directly lead to, several other issues including further falls in home ownership rates and increase in the distances travelled between home and work.

It is likely that solving the affordability challenge will require a range of approaches and tools including those that involve greater collaboration between industry and government.

Addressing the housing supply question, however, is likely to be a key part of the puzzle.

Of course, other solutions, including more and better transport infrastructure and employment and businesses being located closer to where people can afford to live, will also be important.

It won’t be easy but if we focus first on having an adequate number of new dwellings in the right locations to cater for our burgeoning population it will mean we are on the way to something truly worthwhile – making the great Australian dream possible for as many Australians as possible.

George Bougias is an economist, adviser and strategist specialising in real estate. He is the National Head of Research for Oliver Hume Corporation, one of Australia’s leading residential property funds and real estate services groups, and leads the firm’s in-house strategic research team. George has extensive experience across both private and public sectors, analysing and advising on Australia’s diverse property markets for government, private real estate developers and corporate and institutional clients. During his time in government George served as an advisor to the Innovation Economy Advisory Board (the Victorian State Government’s highest economic advisory body) and as an economist in the Department of Treasury and Finance and Department of State Development (Victorian State Government). He is a graduate of the University of Melbourne with a Bachelor of Commerce (Honours), majoring in economics, and a Bachelor of Arts, majoring in political science.

Photo credit: JamesA via Wikimedia, Public Domain