NewGeography.com blogs

The Harlem Community Development Corporation has come up with a rather unique plan to combat high real estate prices in the district. It proposes establishing an open-air market under the Metro North tracks spanning one mile, or 22 city blocks. This new market would accommodate about 900 vendors, helping to increase the now low number of local entrepreneurs and independent retail stores in Harlem.

The market would not only attract vendors, but tourist traffic as well, which would help rejuvenate a neighborhood hampered by soaring commercial real estate costs. It costs anywhere from $125 to $225 per square foot for commercial space in Harlem’s prime locations, resulting in only 42 stores for every 10,000 residents. The Metro market project would ease pressure on small, independent retailers and allow potential entrepreneurs the chance to create viable businesses in the city.

This need for such a project reflects the economic trends and challenges facing the larger New York urban area’s middle class. New York City has the nation’s highest cost of living, and like the rest of the nation, is still experiencing the effects of the recession. The middle class, including small business owners facing high rents, struggles to make the six-figure salaries needed to meet the city’s high cost of living.

Harlem’s Metro market project, which would encourage an independent entrepreneurial spirit, embodies the required plan of action for New York City. The city needs to find inventive ways to deal with its economic reality in order to reverse the recession and revitalize its appeal to the energetic and the ambitious.

A few weeks ago, The New York Times touted purported savings that a household would save by living in the core city of New York (in Brooklyn) instead of the suburbs (South Orange, New Jersey). The article downplayed the 1,000 fewer square feet the money bought in Brooklyn and did not consider the 40% higher cost of living.

The Province in Vancouver has now followed with a near identical story, except that the urban household in will make do with even less space. The city of Vancouver household will live in 800 square feet, or 1,200 fewer square feet in the high rise condominium than in a suburban Coquitlam detached house used in the comparison. Like The Times, The Province is little concerned with the smaller size of the house and misses the fact that the cost of living is from 10% to 20% less in the suburbs and exurbs than it is in the city of Vancouver.

Nonetheless, according to Tsur Somerville, director of the University of British Columbia UBC Centre for Urban Economics and Real Estate, who assisted in developing the figures for The Province, "If all they cared about were the dollars, they wanted to have $600,000 worth of real estate and then minimize their out-of-pocket costs, all else being considered, then being in the city is better," A commenter appropriately notes the volatility of strata (condominium association) fees, which suggests that out-of-pocket costs could rise significantly.

Canadians are not listening to "their betters" any more than Americans. US Census data indicates a continuing strong migration of people from the central cities and strong migration to the suburbs, despite heroic efforts on the part of the media and others to mask the reality.

"Being in the city" may be preferable to some in the Vancouver area, however not to the majority of the age group (25 to 44 years) most likely to move is voting for the suburbs, according to a recent Statistics Canada report. According to the report:

"... there continues to be a migration of many young adults and families from central municipalities to surrounding municipalities, while few move in the opposite direction."

For every one person who moved from the suburbs to the city of Vancouver between 2001 and 2006 (in the age group):

- Among all in the age group, 1.8 people moved to the suburbs from the city for every person moving to city from the suburbs.

- Among those in the age group with advanced degrees, 1.7 people moved to the suburbs for every person moving to the city.

- Among those earning $100,000 to $150,000, 3.4 people moved to the suburbs for every person moving to the city. The ratio fell to 2.0 times for those making over $150,000.

- More than 25% of the age group population who had their first children between 2001 and 2006 moved to the suburbs from the city, more than five times as many as moved to the city from the suburbs.

A table in the Statistics Canada report shows people in "creative class" occupations moving in greater numbers to the suburbs than to the city.

However, not everyone is moving in larger numbers to the suburbs.

- More of the lowest income people are moving to the city than to the suburbs.

- Artists have moved in greater numbers to the city than to the suburbs.

- University professors and other university personnel have moved in greater numbers to the city than to the suburbs, perhaps explaining why so many in these groups misunderstand the direction of the migration.

The Statistics Canada report provided a similar analysis for Canada's two larger metropolitan areas, Toronto and Montreal. In Toronto, moves to the suburbs were 3.5 times moves to the city, while in Montreal 2.7 central city dwellers moved to the suburbs for every suburbanite moving to the city. This does not, however, necessarily indicate that the exodus to the suburbs is stronger in Toronto and Montreal. It is rather an indication of the fact that these two central cities represent a larger share of their metropolitan population than Vancouver. This means that more of the core out-migration is captured in Toronto and Montreal.

So, the media continues the "drumbeat" and the people keep marching --- in the opposite direction.

The International Monetary Fund has published some of the most peculiar econometric research in recent history in Irrational Exuberance in the US Housing Market: Were Evangelicals Left Behind? In it, Christopher Crowe associates the financial behavior of Evangelical Protestant Christians with more stable US markets during the housing bubble. It is well known that the housing bubble was concentrated in some metropolitan areas and largely missed others, such as Dallas-Fort Worth, Atlanta, Houston, Indianapolis and many others, most of them with stronger underlying demand than in the metropolitan areas with huge house price increases. Crowe's research raises the possibility that Evangelicals kept house prices down by not speculating, due to their religious beliefs.

Evangelicals generally believe in missionary and conversion activities and tend to hold to beliefs that were largely liberalized in large portions, but not universally in the "mainstream" Protestant churches (such as Episcopal, United Church of Christ, Lutheran, Presbyterian, Methodist, Baptist and Disciples of Christ churches) during the first half of the 20th century. In recent decades, Evangelical churches have grown strongly, Evangelical membership is now 50% greater than that of "mainstream" Protestantism (even with its Evangelical remnants), which has been relegated to "mainstream" in name only.

The Crowe thesis is generally that Evangelicals, allegedly with an "intense" belief in "end times" theology (such as the "imminent" return or the "second coming" of Jesus Christ) were less inclined to speculate in housing, which kept house prices from rising strongly in metropolitan areas with larger concentrations of Evangelicals.

There are some rather substantial difficulties with the thesis.

The first problem is relates to speculation. Rising prices are needed for there to be any incentive to speculate. If, for example, the numerous Evangelicals in Dallas-Fort Worth had undertaken a furious speculative frenzy, prices would not have gone up, instead more houses would have been built. This is because the liberal land use regime in Dallas-Fort Worth permits housing to be built in response to demand and nullifies any potential for speculative gain. Evangelicals, of course, like Catholics, Mainstream Protestants, Jews and Atheists are not stupid and were no more inclined to speculate on housing in the plentiful Dallas-Fort Worth market than they would have been climb over one another to offer higher prices for sand on the beach.

Another difficulty is that Crowe's characterization of Evangelical beliefs is a caricature. In fact, the nation's 40 million Evangelicals, including 15 million Southern Baptists more than 2 million Missouri Synod Lutherans, more than 1 million members of the African Methodist Episcopal Zion Church, non-denominational megachurch members and others behave similarly to other Americans in the economic sphere. Crowe hypothesizes that "that a belief in the end times reduces incentives to save simply because agents put a lower expectation on the future being realized." It would have been equally reliable to conjecture on the subsurface geology of an undiscovered planet.

Evangelicals like nice houses. They like nice cars. They like their children to be well clothed and to go to good schools. They do not refuse raises offered by their bosses because they expect shortly to be caught up into heaven like the prophet Elijah. True, some "end times" Christians have sold their property and trekked to mountaintops or otherwise awaited dates wrongly prophesied by their leaders. It happened in 1844 and in 1914, but these were not Evangelicals. Evangelicals like nice houses. They like nice cars. They like their children to be well clothed and to go to good schools. They do not refuse raises offered by their bosses because they expect shortly to be caught up into heaven like the prophet Elijah. True, some "end times" Christians have sold their property and trekked to mountaintops or otherwise awaited dates wrongly prophesied by their leaders. It happened in 1844 and in 1914, but these were not Evangelicals.

While Crowe’s research suggests an Evangelical stabilizing effect on housing markets, an opposite, but no less improbable thesis was advanced in an Atlantic Monthly article entitled "Did Christianity Cause the Housing Crash?" This article suggests that the "prosperity" gospel preached in some Evangelical churches led parishioners to take on obligations they could not afford, leading to the bursting of the bubble, though it is mercifully devoid of spurious regressions. Author Hanna Rosin names names, such as Joel Osteen of Houston's Lakewood Church and Rick Warren, whose Saddleback Church in Southern California hosted President Obama as a candidate. It would not be surprising if a future article in The Atlantic pontificated about abandoned suburban megachurches.

One can only wonder what the other nearly 90 percent of Americans were doing while Evangelicals were simultaneously causing and preventing the housing bubble.

Wendell Cox a contributing editor of newgeography.com is the son of an Evangelical clergyman (Pentecostal), became Presbyterian and later an Episcopalian.

Photo: Hollywood Presbyterian Church: An Evangelical Church in a Mainstream Protestant Denomination (by the author).

California's precarious budget situation appears to be driving the state closer to potential fiscal ruin. The state is now 28 days into a new fiscal year, operating without a budget, and the deadlocked legislature in Sacramento appears unable and/or unwilling to strike a deal on a new budget able to cover the state's massive $19 billion deficit.

With no fix on the immediate horizon, California faces a cash shortage. State Controller John Chiang claims that at current burn rates, the state will find itself out of cash by October if the budget impasse continues. In order to sustain the state's remaining reserves for as long as possible, Chiang plans to start issuing IOUs to contractors "in August or September to preserve cash".

Today, in another effort to defer the date the state will run out of funds, Gov. Schwarzenegger issued an executive order requiring state employees to "take three unpaid days off per month." This move comes in the wake of the Governor's proposal to impose minimum wage pay on state workers to save money, currently stuck in the courts.

If the state legislature is unable to find a solution to the deficit, and creditors prove unwilling to accept more IOU's, California may be forced to effectively default on its debts. According to Newgeography contributor Bill Watkins, under such a scenario bond issues could fail, state operations grind to a halt, and the "mother of all financial crises" might be unleashed. Even if California is able to find ways to juggle debt load and convince creditors to accept IOU's while the budget impasse drags on, such stop-gap actions may place its already shaky credit rating at risk of being slashed further towards junk status. The state, legally unable to declare bankruptcy, must find some solution to its budget dilemma or it will become the first state to default since the Great Depression.

Los Angeles area transit officials celebrated 20 years of urban rail at a Staples Center event on July 23. Over the past 20 years, Los Angeles has opened 2 metro (subway) lines, 4 light rail lines and two exclusive busways (though apparently busways aren't worth celebrating). Surely, there is no question but that Los Angeles has been successful in opening a lot of new transit infrastructure.

At the same time, however, The Los Angeles Times reported that Professor James Moore of the University of Southern California, blames the disproportionate financial attention paid to rail projects reduced transit ridership by 1.5 billion (with a "b") over the same period. The reason is, as Tom Rubin put it, is that many more people can be carried for the same money on buses, "Had they run a lot of buses at low fares, they could have doubled the number of riders." Rubin was chief financial officer of the Southern California Rapid Transit District, one of the two predecessors of the present transit agency (MTA). The other was the Los Angeles County Transportation Commission, to which I was appointed to three terms.

Transportation experts were also quoted to the effect that the rail system has done little to reduce traffic congestion or increase the use of mass transit much beyond the level in 1985, when planning for the Metro Blue Line began. Indeed. Traffic congestion has gotten much worse, and traffic volumes have increased materially. Our recent article showed that transit market shares had declined.

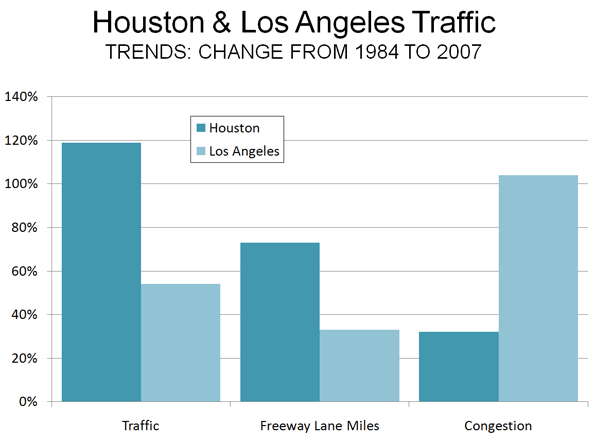

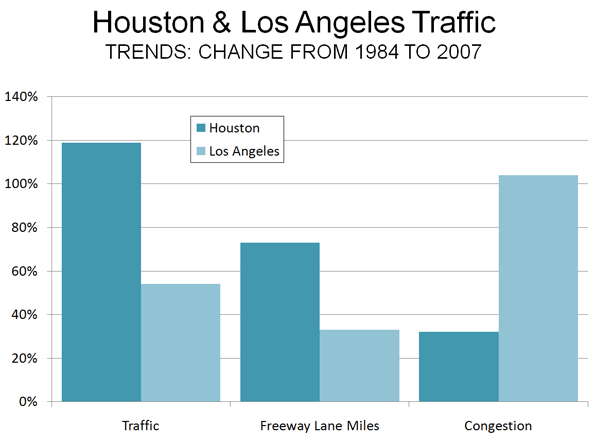

These results are in stark contrast to Houston, which in 1984 had the worst traffic congestion in the nation. Houston set about to solve the problem by expanding its roadway capacity. Since 1984, Houston's traffic grew twice as fast as that of Los Angeles, and population grew three times as fast (at least in part because many Californians were moving to Texas). Houston also added freeway mileage at double the percentage rate of Los Angeles. The reward was an increase in traffic congestion less than one-third that of Los Angeles (Figure). The most recent INRIX Scorecard shows Los Angeles traffic congestion to be more than 2.5 times as intense as Houston's.

Spending money on the right things makes a big difference. One can only wonder how different things might have been if Los Angeles had invested in the capacity people need (more roads) rather than in politically correct transit facilities that have no potential to reduce traffic congestion or to improve mobility and economic performance.

There is a lesson from Los Angeles experience both for other areas and other government functions. The test of government performance is outputs, not inputs. Thus, it is appropriate to celebrate large transit market share increases or significant improvements in student achievement, not how many miles of rail are built or how much money is spent on education. There is a lesson from Los Angeles experience both for other areas and other government functions. The test of government performance is outputs, not inputs. Thus, it is appropriate to celebrate large transit market share increases or significant improvements in student achievement, not how many miles of rail are built or how much money is spent on education.

Photograph: Los Angeles and the San Fernando Valley (by the author)

Late on July 26 (Washington time), The Fifth Estate corrected the attribution by Professor Peter Newman of Curtain University to the effect that driving was down 43% and transit up 65% in the United States. This issue had been the subject of my column on the same morning. It was a simple decimal error (in the reporting) and has now been corrected on the site. Driving is now reported as being down 4.3% and transit up 6.5%. Professor Newman provided slides with the data to Ms. Tina Perinotti, who forwarded them to me.

While the new figures are less inconsistent with the official figures than the former, there are still material inconsistencies.

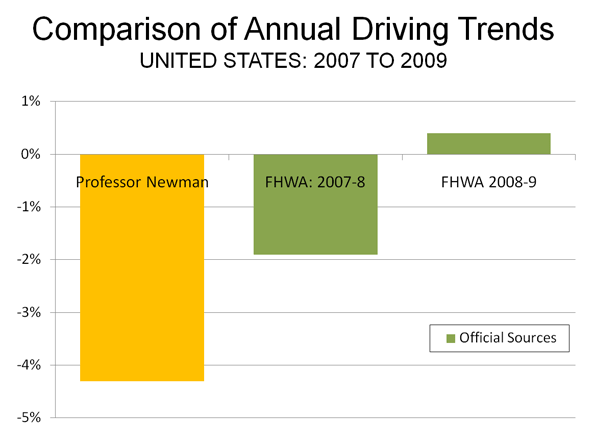

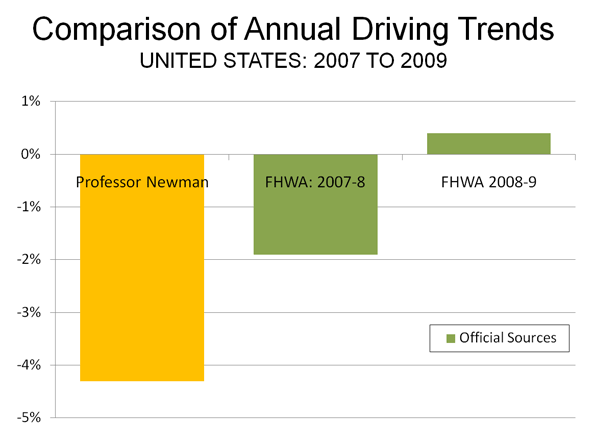

Driving Trend: Official Data: The slides provided simply refer to the two figures as relating to the past year, without a source or specific period. The 4.3% driving decline is more than double the largest annual decline reported by the official source for such information, the Federal Highway Administration (Figure 1).

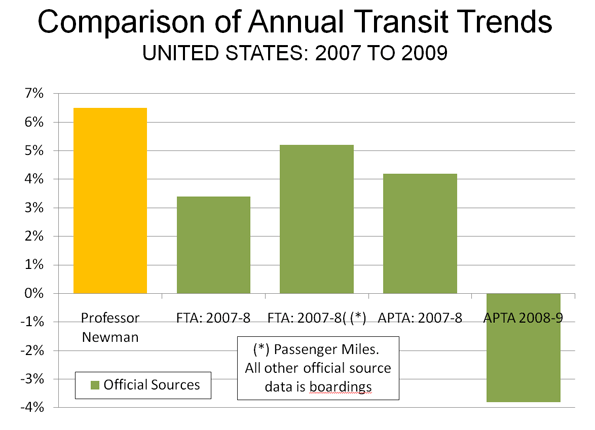

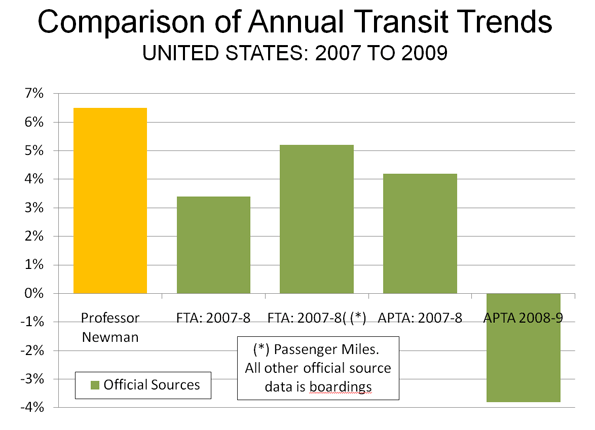

Transit Trend: Official Data: We reviewed the data published from the official sources for transit data (the American Public Transportation Association and the Federal Transit Administration) and found no recent annual data indicating a 6.5% increase in ridership (either in boardings or in passenger miles). Much of the transit ridership gain from 2007 to the peak year of 2008 was lost in 2009, according to data posted by APTA in early March (Figure 2). A later first quarter report by APTA indicates further losses. Moreover, as we indicated in our article, the percentage decline in transit use since the peak year of 2008 is many times that of the decline in driving.

Not All Percentages Are the Same: Care must also be used in comparing percentage changes between transit and driving, because so little travel is on transit. For example, a one percent increase in roadway urban travel converts to about one-third of a mile per person per day. A one percent increase in transit use converts to about 30 feet per person per day, about the same distance as walking from one side to the other of the average bedroom and back.

Note: It is possible that the 4.3% driving decline was taken from an interim Federal Highway Administration report indicating that driving declined 4.3% in March 2008 compared to March 2007 (a monthly comparison, not a year on year comparison). This FHWA report, however, is subject to annual revision based upon the more comprehensive Highway Performance Monitoring System, which in 2009 revised the March 2008 such that the annual change became 2.7%.

Robert Sullivan’s recent article in New York magazine, “Subway on the Street”, marks a welcome addition to transportation discussions in New York City. New Yorkers are currently faced with seemingly paradoxical transportation plans that call for subway and bus service cuts, while relatively short and exceedingly expensive underground subways are being built (Sullivan discusses both).

However, also at the same time, a monumental partnership between the city’s transit agency (MTA) and the DOT is taking root. The result is a new bus rapid transit line in the Bronx – Bx12 SBS, short for “select bus service” – the focus of Sullivan’s article.

To be clear, bus rapid transit is not a New York innovation. Cities throughout the world, and in the United States, have experimented with bus rapid transit lines with general, albeit not absolute, success. But it is nonetheless refreshing to see the largest city in the United States accept buses as potential congestion relief tools.

Jay Walder, a New Yorker named head of the MTA after holding a similar position in London, brought the same promise of a more fully integrated bus and rail system to his home city.

Encouraging innovation, expanding applicability and increasing efficiency are not the exclusive domains of the private sector, even if it feels that way. New York is showing, as cities repeatedly do, the potential for public-sponsored reinvention as a result of resilience.

Howard Kozloff is Manager of Development Strategies and Director of Operations at Hart Howerton, an international strategy, planning and design firm based in New York, San Francisco and London.

For years, planners and others have raised concerns about the amount of land that urbanization occupies, especially in the United States and other developed nations. My attention was recently drawn to an estimate that 2.7% of the world's land (excluding Antarctica) is occupied by urban development. This estimate, which is perhaps the first of its kind in the world, is the product of the Columbia University Socioeconomic Data and Applications Center Gridded Population of the World and the Global Rural-Urban Mapping Project (GRUMP) and would amount to 3.5 million square kilometers.

While the scholars of Columbia are to be complimented for their ground breaking work, their estimate seems very high, especially in light of the fact that in the United States, with the world's lowest density urban areas, only 2.6% of land is urbanized. Further, the data developed for our Demographia World Urban Areas and Population Projections would seem to suggest a significant overstatement of urbanization's extent. Demographia World Urban Areas and Population Projections data are generally from national census authorities and examination of satellite photography.

The GRUMP overestimation is illustrated by the following.

GRUMP places the total of all urban extents in the United States at 754,000 square kilometers, more than three times the 240,000 square kilometers reported by the Bureau of the Census in 2000. This is despite the fact that GRUMP uses the same urbanization criteria as the Bureau of the Census. At the average GRUMP population density, most US urban areas would not even qualify as urban under the national standards used in countries such as the US, Canada, the UK and France.

The overestimation can be illustrated by Cairo, which surrounded by desert land virtually devoid of urbanization. GRUMP places Cairo's urban land area ("urban extent") at 10,900 square kilometers. Cairo is well known among demographers as one of the world's most dense urban areas. Yet the GRUMP urban density, at 1,550 per square kilometer would make Cairo no more dense than Fresno, though somewhat more dense than Portland. The Demographia Cairo urban area is estimated at 1,700 square kilometers, more than 80% smaller. The contrast between the GRUMP and Demographia land area estimates is illustrated in the figure. There are a numerous additional discrepancies of similar scope.

One problem with the GRUMP estimates is their reliance on lights at night as observed from satellites. The problem is that lights illuminate large areas and any estimates based upon them would be likely to be inflated. Documentation associated with GRUMP acknowledges this effect, which it refers to as "blooming."

But "blooming" is not the only problem. The poorest urban areas tend to have fewer lights and are thus illuminated to a larger degree than more affluent areas. The result, in the GRUMP data is that some of the project's most dense urban areas are in fact not the world's most dense. For example, low income Kinshasa (former Leopoldville), in the Democratic Republic of the Congo is indicated by GRUMP to be 40% more dense than Hong Kong. The reality is that Hong Kong is twice the density of Kinshasa, the difference being the effect of "blooming," combined with more sparse electricity consumption in the African urban area. But "blooming" is not the only problem. The poorest urban areas tend to have fewer lights and are thus illuminated to a larger degree than more affluent areas. The result, in the GRUMP data is that some of the project's most dense urban areas are in fact not the world's most dense. For example, low income Kinshasa (former Leopoldville), in the Democratic Republic of the Congo is indicated by GRUMP to be 40% more dense than Hong Kong. The reality is that Hong Kong is twice the density of Kinshasa, the difference being the effect of "blooming," combined with more sparse electricity consumption in the African urban area.

Demographia World Urban Areas and Population Projections accounts for more than 50% of world urbanization and includes all identified urban areas with 500,000 population or more. These urban areas cover only 0.3% of the world's land area. There is only the most limited data for smaller urban areas. However, it is generally known that smaller urban areas tend to be less dense than larger urban areas (which makes one wonder why the anti-sprawl interests have targeted larger urban areas). In the United States, the urban areas with less than 500,000 population average about one-half the density of larger urban areas. University of Avignon data indicates that the smaller urban areas of western Europe are about 60% less dense than the larger ones.

If it the US 50% less factor is assumed, then urbanization would cover approximately 0.85% of the world's land (1.1 million square kilometers).

If the European 60% less factor is assumed, then urbanization would cover 1% of the world's land (1.3 million square kilometers).

By these estimates, the GRUMP urbanization estimates would be more than 200% high.

GRUMP has contributed a useful term to the parlance of urban geography --- the "urban extent." An urban extent is simply continuous urbanization, without regard to labor markets or economic ties. For example,

The Tokyo urban extent might be considered to run from the southern Kobe suburbs, through the balance of the Osaka-Kobe-Kyoto urban area, Otsu, Nagoya, Hamamatsu, Shizuoka and through the Tokyo urban area to the northern suburbs, a distance of 425 miles (GRUMP calls the Tokyo urban extent the world's largest).

China's Pearl River Delta, with its physically connected but relatively economically disconnected, urban areas (including at least Hong Kong, Shenzhen, Dongguan, Guanzhou-Foshan, Zhongshan, Jiangmen, Zhuhai and Macao) is another example.

Despite its difficulties, the GRUMP project is an important advance and it is to be hoped will produce more accurate estimates in the future.

Note: The Demographia Cairo urban area is also the urban extent (the extent of continuous urban development). It includes the 6th of October new town and New Cairo, but excludes the 10th of Ramadan new town, which is physically disconnected from the Cairo urban extent.

Photograph: In the GRUMP Cairo Urban Area (by the author)

Here's three items from the Washington Post's "Top Secret America" series:

The Series: We've long known that high-security businesses warp the statistics describing Edge Cities. No matter how sophisticated the data source you go to, you find anomalies in which the numbers just wildly do not match the office buildings, retail locations and expensive homes you can plainly see. You know you're in this territory when the GPS in your car starts giving you screwy results -- because it's being jammed. Now my former Washington Post colleagues Dana Priest and William H. Arkin and a platoon of their associates have done an astounding job of lifting the veil. In their two-year investigation, "Top Secret America" -- sure to win a Pulitzer -- they've put together an authoritative data base of government and private job locations where 854,000 people with high-level clearances work. (That's one and a half times the population of the District of Columbia.) They call it "an alternative geography" of the United States, and they're right. Here's the home page for the sprawling report.

Some Numbers: Howard County, Md., has the largest secret Edge City in the United States and the numbers are eye-popping. The headquarters of the National Security Agency -- the communications intercept spooks -- is 6.3 million square feet - about the size of the Pentagon - and is surrounded by 112 acres of parking. It's on its way to 14 million square feet. (Downtown Memphis is 5 million square feet.) And that doesn't count the miles and miles of super-secure commercial office buildings housing the corporations in the NSA orbit. Finally we get more than rumors about why this is one of the richest counties in the U.S. We're talking a $20 billion payroll much of which doesn't show up in other data. In fact, most of the wealthiest counties in America turn out to have Top Secret Edge Cities.

The Map: Check out the interactive U.S. map of where the Top Secret Edge Cities are. Zoom around. These are the Edge Cities where "the extrovert is the one looking at somebody else's shoes."

California High Speed Rail officials and the Governor’s office seem to be suffering from selective hearing. Lawmakers and experts at the University of California’s Institute of Transportation continue to challenge the high-speed rail project’s viability due to precarious statistical projections on ridership and cost. One wonders if developers will reconsider upon hearing California treasurer Bill Lockyer’s recent criticisms.

Lockyer’s first major issue lies with the basics: the ability to raise enough capital from private sources needed to complete the project. The Rail Authority claims it would need $10 to $12 billion from private investment alone, although some analysts think that, like most of the monetary figures associated with the rail line, this number will ultimately grow. Investors are reluctant to fund such a risky venture, as nothing proposed in this project has proven stable or certain. If investors do indeed close their checkbooks, there is no way the Rail Authority will complete the project.

Lockyer doesn’t think selling the idea in smaller chunks would work either. He questions the willingness of anyone to buy state bonds for the HSR, even though voters approved $9.95 billion worth in November 2008.

Despite these reservations, Governor Schwarzenegger is protecting the funding promises made in the 2008 ballot measure. The Rail Authority is also ignoring the warnings of Lockyer and others. They are also trying to start building in the Bay Area in order to meet deadlines for federal funding. But the way things are going, it looks as if federal funding is all they will get. As more and more powerful people add their names to the list of skeptics, the high-speed rail line seems that much closer to complete failure.

Rather than overriding their critics and spending money they may not get, the Rail Authority should invest in consumer confidence. They need more concrete plans and more promising statistics to create a market for this line because right now, most think the project will turn out to be nothing more than a huge budgetary debacle.

|

Evangelicals like nice houses. They like nice cars. They like their children to be well clothed and to go to good schools. They do not refuse raises offered by their bosses because they expect shortly to be caught up into heaven like the prophet Elijah. True, some "end times" Christians have sold their property and trekked to mountaintops or otherwise awaited dates wrongly prophesied by their leaders. It happened in 1844 and in 1914, but these were not Evangelicals.

Evangelicals like nice houses. They like nice cars. They like their children to be well clothed and to go to good schools. They do not refuse raises offered by their bosses because they expect shortly to be caught up into heaven like the prophet Elijah. True, some "end times" Christians have sold their property and trekked to mountaintops or otherwise awaited dates wrongly prophesied by their leaders. It happened in 1844 and in 1914, but these were not Evangelicals.

There is a lesson from Los Angeles experience both for other areas and other government functions. The test of government performance is outputs, not inputs. Thus, it is appropriate to celebrate large transit market share increases or significant improvements in student achievement, not how many miles of rail are built or how much money is spent on education.

There is a lesson from Los Angeles experience both for other areas and other government functions. The test of government performance is outputs, not inputs. Thus, it is appropriate to celebrate large transit market share increases or significant improvements in student achievement, not how many miles of rail are built or how much money is spent on education.

But "blooming" is not the only problem. The poorest urban areas tend to have fewer lights and are thus illuminated to a larger degree than more affluent areas. The result, in the GRUMP data is that some of the project's most dense urban areas are in fact not the world's most dense. For example, low income Kinshasa (former Leopoldville), in the Democratic Republic of the Congo is indicated by GRUMP to be 40% more dense than Hong Kong. The reality is that Hong Kong is twice the density of Kinshasa, the difference being the effect of "blooming," combined with more sparse electricity consumption in the African urban area.

But "blooming" is not the only problem. The poorest urban areas tend to have fewer lights and are thus illuminated to a larger degree than more affluent areas. The result, in the GRUMP data is that some of the project's most dense urban areas are in fact not the world's most dense. For example, low income Kinshasa (former Leopoldville), in the Democratic Republic of the Congo is indicated by GRUMP to be 40% more dense than Hong Kong. The reality is that Hong Kong is twice the density of Kinshasa, the difference being the effect of "blooming," combined with more sparse electricity consumption in the African urban area.