NewGeography.com blogs

The current economic recession has tarnished the Golden State’s employment opportunities in a major way.

A report released on Sunday by the California Budget Project says that two of five working-age Californians do not have a job.

The level of unemployment has not been this high since February 1977. In fact, the study found that “California now has the same amount of jobs as it did nine years ago.” The only difference? In 2000, the state was home to 3.3 million fewer working age people than today.

The nation is not faring much better, as the U.S. Labor Department reported last Friday that the nation’s jobless rate had climbed to 9.7 percent, the highest since 1983. California’s unemployment stands at over 11 percent.

Mark Hovind over at Jobbait.com released his monthly job market report, and this month he's expanded it significantly with sector-level data by state and metropolitan area.

Mark offers the numbers in an easily digestible format organized by state in color coded tables. It's a great way to get a feel for what's happening in your region or nationally.

Mark hopes this will help identify sectors with job prospects, even in regions where overall employment is declining.

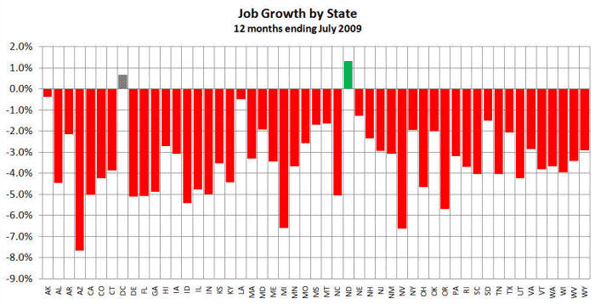

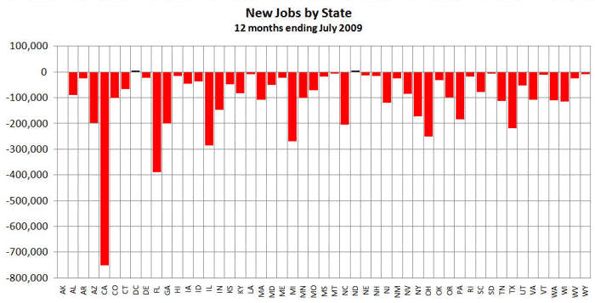

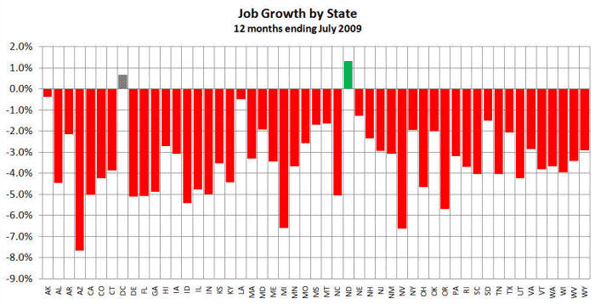

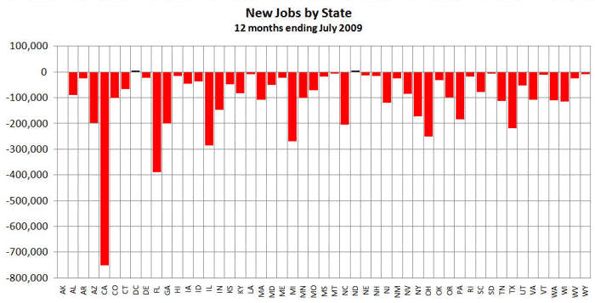

Looking at total job growth, North Dakota is still the only state showing year-over-year employment growth, followed by Washington, DC.

Fastest declining states by growth rate are Arizona, Michigan, Nevada and Oregon.

Fastest declining states by sheer numbers are California, Florida, Illinois, Michigan, Ohio and Texas.

See Jobbait.com for the full report.

Dwell Magazine and inhabitat.com have combined forces to sponsor the first ever “Reburbia Design Competition,” a design competition dedicated to re-envisioning the suburbs.

Citing the current housing crisis, the sub-prime mortgage meltdown, and rising energy cost, as well as limited natural resources available to increased exurban growth, the two companies have called upon “future-forward architects” and “renegade planners” to reinvent the suburbs.

Finalists range from a “suburban airship” that facilitates eco-friendly and efficient transportation between the suburbs and the city center to mansions turned into wetlands and natural water filtration systems to freeway wind turbines. All intriguing ideas for the suburban future.

However, Sean Paige, of The American Contrarian, takes issue with the contest’s “darker side.”

“Strolling the streets of Reburbia isn't just an imaginative adventure. It also offers a revealing glimpse into the mind of the modern eco-Utopian, which melds dark apocalyptic forebodings with naive flights of fancy,” writes Paige.

He feels the contest might propel green zealots to use “levers of power” and the “force of government” to impose an “environmentally- and socially-correct vision of suburbia.”

How might this happen? Paige argues “that opportunity is there, thanks to the power granted government planners through the mania for "smart growth," new urbanism and other social engineering fads, combined with the totalitarian tendencies of those trying to "save the planet" from climate change.”

This is, of course, may be an exaggerated view. No doubt, the Gristers may say this contest would serve merely as a catalyst for developing more probable, and immediate, eco-friendly ideas but a sense of balance would not be inappropriate.

They might not have known it but Canned Heat’s classic Going Up the Country at the now 40 year-old festival was prognostic – at least in terms of where the Woodstock generation would be moving in the 2010s. John Cromartie and Peter Nelson’s recently released USDA report – Baby Boom Migration and Its Impact on Rural America – says that the baby boomers have already shown more affinity for moving to rural and small town destinations than older or younger cohorts. As many boomers end child-rearing duties, enter peak employment earnings and ponder retirement options they are now poised to significantly increase the population of 55-75 year olds in rural and small town America through 2020, with major social and economic implications for their chosen locations.

Between 2010 and 2020 boomers will make more than 200 million residential moves, most being within or between metro regions, where 80 percent of this cohort now reside. However, net migration to core metro counties is projected to decline by 643,000 during the 2010s, a dramatic shift from a population gain of 979,000 during the 90s. In the countryside the population of 55-75 year olds will increase two-thirds, from 8.6 million to 14.2 million between 2000 and 2020.

The big winners of course are those rural places with high levels of natural amenities and affordable housing that are already popular as second-home destinations. For these areas the economic future looks good as a potential influx of spending power and seasoned, footloose talent boosts development prospects.

Earlier this year, the Center for an Urban Future published an extensive report about the mounting challenges New York City faces in both retaining its middle class and elevating more low income residents into the ranks of the middle class. One of our key recommendations from that report, titled Reviving the City of Aspiration, was that "city and state officials must embrace community colleges as engines of mobility and dedicate the resources necessary to strengthen these institutions and ensure that a greater number of middle class, poor and working poor New Yorkers can attend these schools and complete their degrees."

City officials are now running with our suggestion. Today, Mayor Bloomberg announced a "Gateway to the Middle Class" plan that focuses on boosting community colleges. The mayor's proposal aims to "move more New Yorkers into the middle class by increasing the number of city residents that graduate from community colleges and training them for higher wage jobs in growing industries." The plan will invest an additional $50 million over the next four years to improve the system's quality, accessibility, affordability, and accountability.

The new attention and resources for community colleges is an important step in the right direction for the city. Our report found that community colleges in New York are overshadowed by virtually every other facet of the education system and have not received the financial support needed to effectively educate students that come from a wide variety of backgrounds and often require academic remediation. Click here to read the section of our report about community colleges, titled "A Platform For Mobility."

This should be filed with other improbable stories under the subject “beach running out of sand.” The St. Petersburg Times reports that Florida has lost population for the first time since 1946. University of Florida demographers are due to release a report that the state lost 50,000 residents in the year ended April of 2009. This is in stark contrast with the state’s addition of more than 300,000 residents in every year of the decade through 2006

The article cites housing price increases as driving out families with children and the resulting housing contraction with driving out construction workers. Florida’s housing bubble related price increases were perhaps the highest in the nation, following California.

There had already been ominous signs, with the United States Bureau of the Census reporting net outward domestic migration in 2008. As late as 2005, there had been a net gain in domestic migration of 267,000.

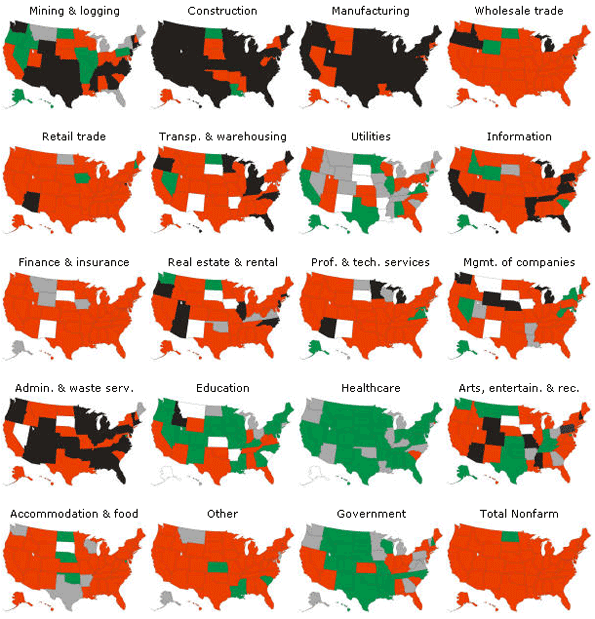

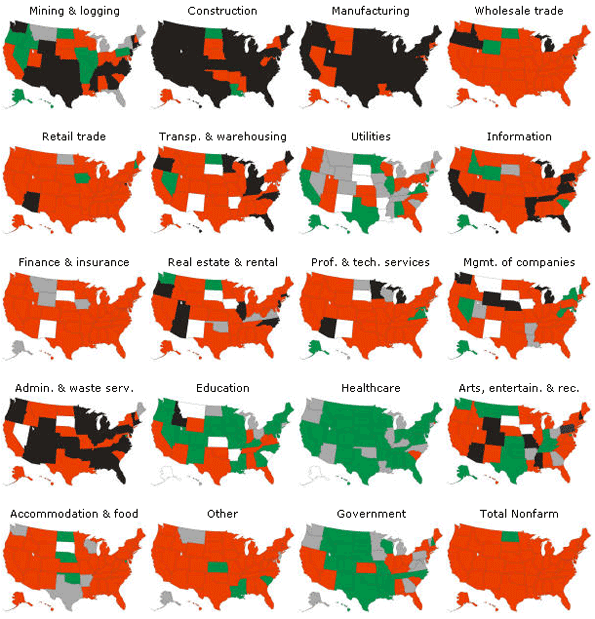

Mark Hovind at Jobbait.com has released another fascinating set of maps and data on industry employment trends by state over the past few months. Here's a taste:

The maps below show the employment trends by state and industry sector for the 12 months ending June 2009 (July will be available August 21). Green is growing faster than the workforce. Grey is growing slower. Red is declining. Black is declining more than 8%. White is not available.

Head over to Jobbait.com for the full analysis.

On-board sequestration could make zero carbon dioxide emission petroleum cars possible, according to research conducted by Dr. Andrei Federov and David Damm at the Woodruff School of Mechanical Engineering at Georgia Tech. According to Science Daily:

…the Georgia Tech team outlines an economically feasible strategy for processing fossil or synthetic, carbon-containing liquid fuels that allows for the capture and recycling of carbon at the point of emission. In the long term, this strategy would enable the development of a sustainable transportation system with no carbon emission.

Ultimately, the approach would involve carbon capture within petroleum vehicles. The petroleum would be processed into hydrogen, for propulsion and carbon dioxide. The carbon dioxide would be converted, on board, to liquid fuel and removed at gasoline stations. The liquid fuel would then be sent to power plants, where it would be used to produce electricity. As the necessary infrastructure is being developed, the captured carbon dioxide would be removed at gasoline stations and “sequestered in geologic formations, under the ocean or in solid carbonite form.”

This breakthrough demonstrates that it is not necessary to target the automobile or the automotive lifestyle that pervades modern living to achieve sufficient reductions in greenhouse gases. This is particularly important, given the imperative for maintaining economic growth and employment growth, which is closely linked to high levels of personal mobility.

The research was financed by the United States federal government and the Georgia Tech “Creating Energy Options” program.

New York State Attorney General Andrew Cuomo delivered a report to Congress on the bonuses paid to the employees of nine recipients of the TARP bailout money. He called it “The ‘Heads I Win, Tails You Lose’ Bank Bonus Culture.” (July 30) AG Cuomo concluded that even “in these challenging economic times, compensation for bank employees has become unmoored from the banks’ financial performance.” The report is only about banks, of course, since all the investment banks and brokerage firms changed their status to “bank” to become eligible for TARP bailout money last fall.

Some of the banks that took the TARP money, like JP Morgan (NYSE: JM), Morgan Stanley (NYSE: MS) and American Express (NYSE: AXP), did what they could to return it as quickly as possible, including buying back the warrants. It will be very hard, indeed, for the financial institutions to change the public perception now that we have seen their willingness to take any risk, to make money at any cost – only to take a handout from the public coffers when things go badly so they can continue to “make money” for themselves. The banks are entities but they are run by people who have jobs and get bonuses and perks. Former-Treasury Secretary Hank Paulson’s plan to plunder the US Treasury on behalf of his former Goldman Sachs (NYSE: GS) mates on Wall Street set these banks up as the target of public scorn.

Late Friday, July 31, the House of Representatives approved a bill that would allow regulators to limit executive compensation at financial institutions with assets greater than $1 billion if they find that the programs would “induce excessive risk-taking” behavior among bank executives. This comes a full eight months after Bank of America (NYSE: BAC) was first subpoenaed by AG Cuomo about executive bonuses. It is a far cry from anything that would create a sense of justice out of a system where two TARP recipients, Citigroup (NYSE: C) and Merrill Lynch, operated in a way that lost $54 billion in 2008, took $55 billion in TARP bailout money, and then paid $9 billion in employee bonuses.

Despite the hue and cry of the public, these bonuses have continued. In my view they will continue into the future. Although we may think that sticking labels on the banks behavior, or asking Congress to legislate some discipline, will make a difference, it is unlikely to change anything. After the early 2009 bonuses were revealed, the banks claimed that the bonuses were required by contracts and could not be broken without violating the rule of law. They got away with this claim even as contracts with the United Auto Workers were being revised. It’s like a modern version of a folk story by Joel Chandler Harris. “Bred and born in a briar patch, Brother Fox, bred and born in a briar patch!” And with that Brother Banker skipped out just as lively as a cricket in the embers.

Thanks to David Friedman for bringing the FT article on the report to our attention.

There is a bend in the river – and that’s where they put the city of St. Louis.

St. Louis is fun – and here is a guide to finding your way around. Just remember the bend in the river.

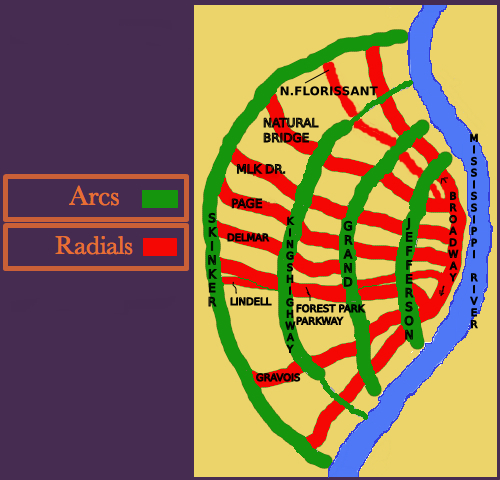

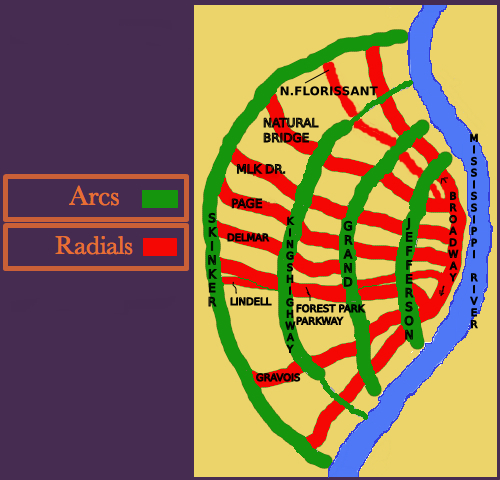

Imagine a bow (as in bow and arrow) aimed to the east. The imaginary arrow slides right through the Gateway Arch overlooking the river. Just to the west, behind the levee, is the old downtown.

The St. Louis westernmost city limit parallels Skinker Blvd. That boundary mirrors the river just as the string mirrors the bow. The city is almond-shaped, with the river on the east and Skinker Blvd. to the west. These two arcs meet at the northern and southern points of town. This is a simplification: Skinker Blvd. goes by that name for only a short part of the arc, roughly where the arrow’s feathers would be. To the north it becomes Goodfellow Blvd., and to the south it turns into McCausland Ave., along with other names. But those are details – the main point is this: following Skinker (or its renamed equivalents) to the north will eventually get you to the river, and likewise, following it to the south will also lead you to the river.

And this is helpful: north-south streets in St. Louis form arcs parallel to Skinker that lead from river to river. Let’s call them arc streets. The inner-most such street is Parnell/Jefferson, followed by Grand Blvd. (that’s where St. Louis University is), Kingshighway Blvd., and then Skinker. To a first approximation, all of these streets parallel Skinker and intersect the river at points north and south of downtown.

Superimposed on this are streets that radiate from downtown. Two important ones are North Florissant Ave., and South Broadway. These directly parallel the river, and (this is important) will intersect all of the arc streets. Thus North Grand Blvd. intersects North Florissant at approximately right angles – try something like that in Chicago. But in St. Louis it makes perfect sense – Grand is an arc that will intersect the river, and Florissant is a radial that parallels the river. (S. Grand Ave. should also intersect S. Broadway, but doesn’t because the very southern part of the city doesn’t follow the rules. I’ve never been there, so I don’t know why.)

Starting with Florissant, the important radial streets are Natural Bridge, Martin Luther King, Page Blvd., Delmar, Olive/Lindell, Market/Forest Park, Chouteau, Gravois, and Broadway. These radiate fan-like from downtown, and all of them intersect the arc streets at approximately right angles. Of these, Lindell, Forest Park, and Chouteau are roughly east-west streets; the others head either northwest or southwest. (Quiz: which radial streets also intersect the river?)

St. Louis University is at Grand & Lindell. Washington University is at Skinker & Forest Parkway. The justly famous Forest Park stretches along Forest Parkway from Kingshighway to Skinker. The Arch is at the foot of Market St. The cultural heart of the city is along Lindell Blvd. near Vandeventer Ave. (which, if it went through, would be an arc street west of Grand).

Will you meet me in St. Louis? How about at a nice restaurant near the corner of Delmar and Skinker?

You do know where that is, don’t you?

Daniel Jelski is Dean of Science & Engineering State University of New York at New Paltz.

|