From the beginning of the mortgage crisis New York and other financial centers have acted as if they were immune to the suffering in the rest of country. As suburbs, exurbs and hard-scrabble out of the way urban neighborhoods suffered with foreclosures and endured predictions of their demise, the cognitive elites in places like Manhattan felt confident about their own prospects, property values and jobs. So what if the rubes in Phoenix, Las Vegas, Tampa and Riverside all teetered on the brink?

Now only a deluded real estate speculator --- or a flack for Mayor Michael Bloomberg --- could deny that the mortgage crisis wolf is now at Gotham’s door. Having underwritten and profited obscenely from the loans that launched the crisis, Wall Street is now reeling from the collapse of several of its strongest linchpins, including Lehman Brothers and Bear Stearns, while Merrill Lynch has become little more than an annex to Charlotte-based Bank of America. AIG has been forced on the federal teat and other giants, even Citibank, could be next.

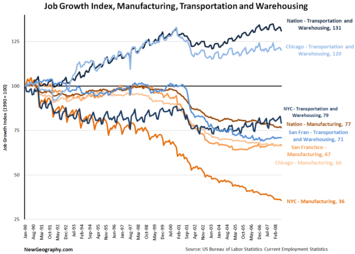

With perhaps tens of thousands of high-paying jobs about to evaporate, and with them the rich bonuses that fueled Mayor Bloomberg’s grandiose vision of a “luxury city,” New Yorkers should brace themselves for hard times. Bloomberg’s brave talk about media, tourism, bioscience or the arts making up the difference should not be taken too seriously. In reality New York has never been more dependent on Wall Street than it is today, in large part because most other middle class sectors, like manufacturing and warehousing, declined massively over the past seven years.

With perhaps tens of thousands of high-paying jobs about to evaporate, and with them the rich bonuses that fueled Mayor Bloomberg’s grandiose vision of a “luxury city,” New Yorkers should brace themselves for hard times. Bloomberg’s brave talk about media, tourism, bioscience or the arts making up the difference should not be taken too seriously. In reality New York has never been more dependent on Wall Street than it is today, in large part because most other middle class sectors, like manufacturing and warehousing, declined massively over the past seven years.

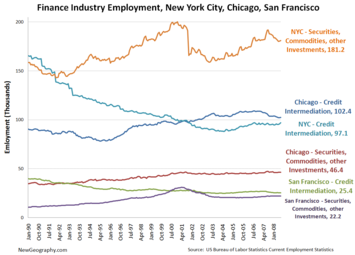

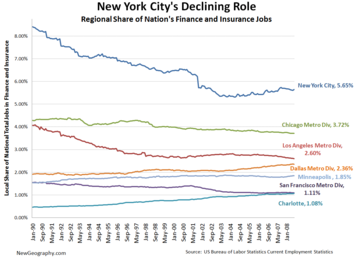

As a result, nearly one out of four dollars earned in New York --- although accounting for less than five percent of all jobs --- are tied to the financial sector. Overall job growth has been slow in finance, and stood well below historic highs even at the crest of the boom, and are now dropping radically. This means, as a result, a group of relatively few big earners are more and more important as overall employment in finance declines.

As a result, nearly one out of four dollars earned in New York --- although accounting for less than five percent of all jobs --- are tied to the financial sector. Overall job growth has been slow in finance, and stood well below historic highs even at the crest of the boom, and are now dropping radically. This means, as a result, a group of relatively few big earners are more and more important as overall employment in finance declines.

Tourism certainly cannot make up the balance since it is a notoriously low wage sector and may soon be subject to a major decline in visitors due to higher airline prices and a growing downturn in Europe. New York has a decent bioscience sector, but Gotham is far as dominant here as in finance or media. There’s strong competition from a host of places, notably St. Louis, Houston, Boston, San Diego and Silicon Valley.

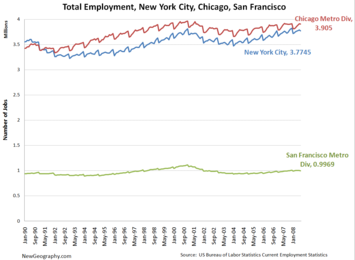

So where can a plutocratic Mayor look for inspiration for the future? He may not like it but arguably the best model for New York may be San Francisco. More than any American city, San Francisco epitomizes one possible future for American urbanism of the “luxury” variety.

The parallels between San Francisco and underlying trends in New York, and to some extent Chicago, are striking. Like New York on a smaller scale, San Francisco was once a corporate headquarters town and a powerful financial center. But starting in the 1980s and 1990s that all started to change. Corporations fled for the suburbs, or got merged with firms located elsewhere. It started with the exodus of Crocker Bank. In 1998 its most important company, started by an Italian immigrant in the city, the Bank of America, fled to North Carolina. Like New York, it has flushed away virtually its entire industrial sector and lost ground as a port.

The parallels between San Francisco and underlying trends in New York, and to some extent Chicago, are striking. Like New York on a smaller scale, San Francisco was once a corporate headquarters town and a powerful financial center. But starting in the 1980s and 1990s that all started to change. Corporations fled for the suburbs, or got merged with firms located elsewhere. It started with the exodus of Crocker Bank. In 1998 its most important company, started by an Italian immigrant in the city, the Bank of America, fled to North Carolina. Like New York, it has flushed away virtually its entire industrial sector and lost ground as a port.

Yet through this all, San Francisco managed to reinvent itself. First it anchored itself to Silicon Valley, becoming the playground, advertising and media center for the nerdistan to the south. Then, after the collapse of the dot.com bubble, the city fell back on its intrinsic appeal as a place, relying largely on tourism and its ability to attract high-end residents.

This discreet charm has allowed San Francisco to enjoy a reasonable economic comeback, not so much as a corporate or economic center, but as a high-end destination for the nomadic rich, the culturally curious and the still adolescent twenty and even thirty somethings. Many of this last group have strong skills sets and remain a powerful asset to the city.

You can see the changes just by walking the streets. Three decades ago, when I worked in the City, San Francisco was still in large part a city of suits and blue-collar workers; today it’s black-garbed cool and casually elegant. There are more wealthy residents and decidedly less minorities, even Hispanics, and ever fewer children.

This pattern could represent the future --- and even the present --- in parts of New York and even on the fringes of Brooklyn. We have seen that the “baby boom” in Manhattan does not last much past age five. When Wall Streeters lose their ability to pay for nannies, summer camps, private schools, etc, many affluent families may not be able to hang out that long.

But then again there are those residents there will not lose their jobs. These include those tied to “luxury” industries, media, and non-profits. Not to be ignored also are the growing ranks of trustifarians, wealthy people living off their parents or grandparents’ labor. These are not the prototypical New Yorker on the make, like Charlie Sheen in “Wall Street,” but they have spending power, connections and often political influence.

None of these groups are likely to disappear because of a mere trifle like a financial system collapse. These are committed denizens of the urban pleasure dome, content either to live minimally or (for the time being at least) pursue such generally non-remunerative activities like working in the arts or making documentary films.

Of course, cities like New York and Chicago, also likely to be hard hit by the securities industry meltdown, may not be able to live as richly in hard times like San Francisco. Parts of Manhattan and Manhattanized Brooklyn might endure a metropolitan recession, but it may be tougher on the mostly minority, poor and working class residents who inhabit the outer reaches of the outer boroughs . These residents will suffer from the inevitable cutbacks in city services as well as the loss of retail, hospitality and construction jobs.

Of course, cities like New York and Chicago, also likely to be hard hit by the securities industry meltdown, may not be able to live as richly in hard times like San Francisco. Parts of Manhattan and Manhattanized Brooklyn might endure a metropolitan recession, but it may be tougher on the mostly minority, poor and working class residents who inhabit the outer reaches of the outer boroughs . These residents will suffer from the inevitable cutbacks in city services as well as the loss of retail, hospitality and construction jobs.

In contrast, “The City,” as San Francisco likes to be known, is both small, compact and surrounded largely by affluent, low-density suburbs. It effectively has no real analogue to the outer boroughs. To see the dark side of America’s urban reality, you increasingly have to go east across the Bay to the crime-infested streets of Oakland, where the once proud dream of civic renaissance appears to be slowly fading.

Of course, New Yorkers may reject this vision of their future. San Franciscans, have long prioritized joie de vive over imperial visions. In contrast, New Yorkers derive much of their civic self-esteem from their city’s role as the “capital of the world.”

But if New Yorkers want to keep this slogan to be more than a marketing jingle, they will have to transcend the lame “luxury city” zeitgiest. Spending nearly four billion on new sparkling sports stadiums, and even Bloomberg’s media mastery, won’t get it done. It will take hard work, a commitment to infrastructure and broad-based job growth.

It’s hard to know if New York still has the stomach for this kind of hard work. As someone whose familial roots in the city span over a century, I hope so. New Yorkers are a resilient lot, as they have shown many times in the past. But if they have lost their appetite for hard struggle, well, they can always consider becoming the next San Francisco.

Joel Kotkin is Executive Editor of NewGeography.com

Sad note for American Urbanism

'Joie de vivre' is still very much the order of the day in San Francisco and so far there hasn't been much effect from the Wall St. meltdown on the Bay Area technology sector. Yet, economic uneasiness can be readily observed in places like Oakland (where there has recently been a proliferation of restaurant robberies in what are considered upscale neighborhoods)and a general increase in crime in other East Bay cities like Richmond and Hercules.

It would be unfortunate to see New York turn into a boutique city like San Francisco but it can be argued that Manhattan is probably already there. Parts of Brooklyn, especially Williamsburg, seem to represent a new kind of urbanism where the culture of an affluent global citizenry has taken over and inhabited physical form reflective of pre-WWII society (ie closely spaced brownstones). Other neighborhoods like Bushwick and Bed-Stuy appear to be headed this way as well. I find it bizarre though, to find these new residents paying rents rivaling Manhattan to live in sometimes heavily fortified and luxurious loft buildings just blocks from public housing projects that look like they came right out of the Soviet Union and plopped down in Brooklyn. This mix of 'income diversity' is not the kind Jane Jacobs was talking about where there used to be social cohesion based on family ties and shared community. Rather, the neighborhoods consist of people who pay astronomically high rents next to those who are subsidized by the government. Obviously Bloomberg has no concern about what kind of chaos this juxtaposition of income disparity will create in an economically depressed area that has relied on the speculative real estate industry to keep it viable for the past few years.

Even more bizarre is the development of 'luxury' real estate in Jersey City! The bottom line is that, for most, it is easier to associate the downfall of the real estate economy with the vast amount of foreclosed tract homes developed in the exurbs around the country. Yet, what I find more tragic, and most people seem to miss, is the real estate exuberance perepetuated in our great cities! This article touches on a very sad note for American urbanism-no longer are our great cities the incubators the kind of capitalism that relied on trade and production of real goods and services but rather the cities themselves, coupled with their marketing of joie de vivre, have become the commodities.