Stanley Kurtz's new book, Spreading the Wealth: How Obama is Robbing the Suburbs to Pay for the Cities describes political forces closely tied to President Obama who have pursued an agenda to "destroy" the suburbs for many years. He expresses concern that a second Obama term will be marked by an intensification of efforts to destroy the suburbs through eviscerating their independence thought the imposition of "regionalism". The threat, however, long predates the Obama administration and has, at least in some cases, been supported by Republicans as well as by Democrats.

America is a suburban nation. Nearly three-quarters of the residents of major metropolitan areas (over 1,000,000 population) live in suburbs, most in smaller local government jurisdictions. Further, outside the largest metropolitan areas most people live in suburbs, smaller towns or smaller local government jurisdictions.

Smart Growth

The anti-suburban agenda has more than one dimension. The best known is smart growth, known by a variety of labels, such as compact development, growth management, urban consolidation, etc. Smart growth, from our research, also is associated with higher housing prices, a lower standard of living, greater traffic congestion and health threats from more intense local air pollution.

Regionalism

Another, less well-known anti-suburban strategy is regionalism, to which Kurtz grants considerable attention. Regionalism includes two principal strains, local government amalgamation and metropolitan tax sharing. Both of these strategies are aimed at transferring tax funding from suburban local governments to larger core area governments.

Social welfare and differing income levels are not an issue at this level of government. Local governments, cities, towns, villages, boroughs and townships, finance local services principally with their own local taxes. The programs aimed at social welfare or providing income support are generally administered and financed at the federal, state or regional (county) level. Any suggestion that local suburban jurisdictions are subsidized by core local governments simply reveals a basic unfamiliarity with US municipal finance.

Local Government Amalgamation

Opponents of the suburbs have long favored amalgamating local governments (such as cities, towns, villages, boroughs and townships). There are two principal justifications. One suggests "economies of scale" --- the idea that larger local government jurisdictions are more efficient than smaller governments, and that, as a result, taxpayers will save. The second justification infers that a larger tax base, including former suburbs, will make additional money available to former core cities, which are routinely characterized as having insufficient revenues to pay for their services. Both rationales are without foundation.

Proponents of amalgamation incessantly refer to the large number of local governments in some states, implying that this is less efficient. The late Elinor Ostrum put that illusion to rest in her acceptance speech for the Nobel Prize in economics in 2009:

Scholars criticized the number of government agencies rather than trying to understand why created and how they performed. Maps showing many governments in a metropolitan area were used as evidence for the need to consolidate.

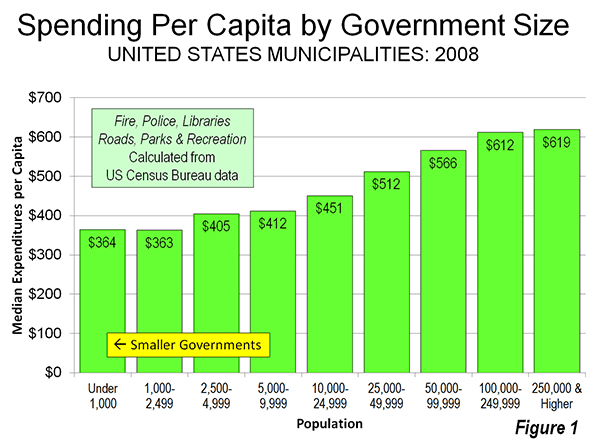

The reality is that there is a single measure of efficiency: spending per capita. Here there is a strong relationship between smaller local government units and lower taxes and spending. Our review of local government finances in four states (Pennsylvania, New York, Indiana and Illinois) indicates that larger local governments tend to be less efficient, not more. Moreover, the same smaller is more efficient dynamic is evident in both metropolitan areas as well as outside. "Smaller is better" is also evident at the national level (Figure 1).

Yet the "bigger is better" faith in local government amalgamation remains compelling to many from both the Right and Left. Proponents claim that smaller local governments are obsolete, characterizing them as being from the horse-and-buggy era. The same logic could be used to eliminate county and even state governments. However, democracy remains a timeless value. If people lose control of their governments to special interests (which rarely, if ever, lobby for less spending), then democracy is lost, though the word will still be invoked.

Support of local government amalgamation arises from a misunderstanding of economics, politics and incentives (or perhaps worse, contempt for citizen control). When two jurisdictions merge, everything is leveled up, from labor costs to service levels. The labor contracts, for example, will reflect the wage, benefit and time off characteristics of the more expensive community, as the Toronto "megacity" learned to its detriment.

Further, special interests have more power in larger jurisdictions, not least because they are needed to finance the election campaigns of elected officials, who always want to win the next election. They are also far more able to attend meetings – sending paid representatives – than local groups. This is particularly true the larger the metropolitan area covered, since meeting are usually held in the core of urban area not in areas further on the periphery. This greater influence to organized and well-funded special interests – such as big real estate developers, environmental groups, public employee unions – and drains the influence of the local grassroots. The result is that voters have less influence and that they can lose financial control of larger local governments. The only economies of scale in larger local government benefit lobbyists and special interests, not taxpayers or residents.

Regional Tax Sharing

Usually stymied by the electorate in their attempts to amalgamate local governments, regional proponents often make municipal tax sharing a priority. The idea is that suburban jurisdictions should send some of their tax money to the core jurisdictions to make up for the claimed financial shortages of older cities. Yet this ignores the fact, as Figure 1 indicates, that larger jurisdictions generally spend more per capita already and generally tax more, as our state reports cited above indicate. Larger jurisdictions also tend to receive more in state and federal aid per capita. A principal reason is that the labor costs tend to be materially higher in larger jurisdictions. In addition to paying well above market employee compensation, many larger jurisdictions have burdened themselves with pension liabilities and post employment health benefits that are well above what their constituencies can afford. The regionalist solution is not to bring core government costs in line with suburban levels but force the periphery to help subsidize their out of control costs.

Howard Husock, of Harvard University's JFK School of Government (now at the Manhattan Institute) and I were asked to evaluate a tax sharing a plan put forward by former Albuquerque mayor David Rusk for Kalamazoo County, Michigan (The Kalamazoo Compact) more than a decade ago. Our report (Keeping Kalamazoo Competitive)found no justification for the suburban areas and townships of Kalamazoo County to share their tax bases with the core city of Kalamazoo. The city already spent substantially more per capita, received more state aid per capita and had failed to take advantage of opportunities to improve its efficiency (that is, lower the costs of service without reducing services). We concluded that the "struggling" core city had a spending problem, not a revenue problem. To the credit of the electorate of Kalamazoo County, the tax sharing proposal is gathering dust, having been made impractical by suburban resistance.

Spreading the Financial Irresponsibility

The wanton spending that has gotten many larger core jurisdictions into trouble should not have occurred. The core cities are often struggling because their political leadership has "given away the store," behavior that does not warrant rewarding. Elected officials in the larger jurisdictions had no business, for example, allowing labor costs to become higher than necessary or granting rich pension benefits paid for by private sector employees (taxpayers), most of whom enjoy only much more modest pension programs, if at all (See note below).

The voters are no match for the spending interests with more efficient access to City Hall. The incentives in such larger jurisdictions are skewed against fiscal responsibility and the interests of taxpayers. Making an even larger pool of tax revenues available can only make things worse.

At the same time, the smaller, suburban jurisdictions around the nation are often the bright spot in an environment of excessive federal, state and larger municipal government spending. Their governments, close to the people, are the only defense against the kind of beggar-the-kids-future spending that has already captured the federal government, state governments and some larger local jurisdictions.

Either Way the Threat is Very Real

Even if President Obama is not re-elected or if a second Obama Administration does not pursue the anti-suburban agenda, the threat to the suburbs will remain very real. This is not just about the suburbs, and it is certainly not some secret conspiracy. What opposing regionalism means is the preservation of what is often the last vestige of fiscal responsibility. It is not that the elected officials in smaller jurisdictions are better or that the electorate is better. The superior performance stems from the reality that smaller governments are closer to the people, and decision-making tends more to reflect their interests more faithfully than in a larger jurisdictions.

Ed. note: This piece was corrected to add quotation marks around the word "destroy" in the first paragraph. That clause is included in reference to Kurtz's characterization, not the author's.

------

Note: A report by the Pew Charitable Trusts (Promises with a Price) indicated that "... in general, the private sector never offered the level of benefits that have been traditionally available in the public sector." The report further indicated that 90 percent of state and local government retirees are covered by the more expensive defined benefit pension programs, compared to 20 percent in the private sector. The median annual pension in the state and local government sector was cited at 130 percent higher than in the private sector. While 82 percent of state and local government retirees are covered by post-employment medical benefits, the figure is 33 percent in the private sector. According to the Bureau of Labor Statistics, after accounting for the one-third higher wages per hour worked among state and local government workers, employer contribution to retirement and savings is 160 percent higher than in the private sector (March 2012). A just published Pew Center on the States report (The Widening Gap Update) indicates that states are $1.3 trillion short of the funding required to pay the pension and post employment medical benefits of employees. This does not include programs administered by local governments.

Wendell Cox is a Visiting Professor, Conservatoire National des Arts et Metiers, Paris and the author of “War on the Dream: How Anti-Sprawl Policy Threatens the Quality of Life.”

Lead Photo: Damascus City Hall (Portland, Oregon metropolitan area) by Wiki Commons user Tedder.

DUO Residences is also near

DUO Residences is also near elite schools such as Stamford Primary School and Insworld Institute. St. Margaret Primary School and Singapore Management University (SMU) are also around in the area.

DUO Residences

_Visit: tu van dau tu nuoc

_Visit: tu van dau tu nuoc ngoai, cong bo thuc pham, thiet ke website ban hang, thanh lap cong ty, dang ky nhan hieu, cong bo luu hanh my pham...

chatrandom Your article is

chatrandom

Your article is very interesting and humorous. From your article, I can see the true meaning of the word happy. This article, I believe many people are helpful. Very fortunate to share this article to your. Look forward to your updates.

Thank you

Your post provides me with a great amount of information. Thank you very much. The figures are very accurate and those figures are very useful for my business. I'm working with Magento extensions which helps magento store owners enhance their stores with useful function.

We need better documentation of your argument

Dave c While I agree there is a progressive philosophical bias toward forced urbanization, your argument that smaller communities spend less per capita due to more active citizen control isn't substantiated by your chart nor the facts. As others have pointed out, core cities are forced to fund the cost of social, judicial, and health services for a large majority of a regions poor, while suburban governments get to spend their money on libraries and recreational services. How to provide those services without the bloat of regional government entities is a legitimate issue worth of consideration, though your solution of tiny local governments is unworkable. I live in the Houston metro area. We have so many regional taxing authorities I doubt any regular citizen could name them all much less be interested enough to try and control them and someone please tell me why every school district, transportation district, toll roal authority, etc, justifies their own union controlled police force?

Metro Areas Are Complex, with different benefits and needs

Before such hyperbolic language is used, there needs to be a better understanding of regional economics, and how cities and suburbs work together to deliver value in this economy. The starting point is that metropolitan areas are unified regions because they share a common labor market, transportation network, and media infrastructure, and (to a certain degree) a shared identity. Given that democracy ideally addresses problems at the level of appropriateness, it makes sense to deal with certain things at the metropolitan level.

First of all, to address Mr. Cox's main point about fiscal irresponsibility, I agree with him that there is no excuse for waste or corruption in municipal governments. With larger core cities, given that they have been around for longer and are a bigger target, there has been ample opportunity to attract counter-productive rent-seeking behavior. This is amplified by the large number of federal funds (e.g. community development block grants, etc) flowing into these communities, and a network of special interests that understand the often byzantine regulations surrounding these funds. These issues call for institutional reform and modernization, and using best practice methods for competitive contracting and double-blind processes. All governments should be efficient.

However, points about higher per capita spending in central cities obscure why this happens. Cities and suburbs occupy different roles within the metropolitan system. While thankfully there has been some reduction recently, residential segregation, by race and and income-level, is a reality in the United States. Many core cities provide a metro-level function of keeping the poor in America out-of-sight and out-of-mind. Such services cost money, in terms of more social workers per capita and increased public safety spending per capita.

Funds for these additional services have historically come from the federal government, because these cross-subsidies can be obscured by the complex appropriations process, and much federal welfare spending consists of transfers to disadvantaged groups. In a dynamic advanced economy, there will always be some role for cross-subsidy to provide a basic safety net. Given the current political environment, there seems to be a move to de-federalize this function to states and local areas, which honestly could be justified. In such a case, metro areas might be called on to shoulder some of this burden. Broad tax sharing, with a regional council to provide oversight (the long-standing Metropolitan Council in the Twin Cities is a great example) could be more common.

It goes back to how different communities within a metropolitan area serve different economic functions, and provide options to fulfill a market niche. That is why a small suburban city like Clawson, Michigan, with a population of 11,825, provides different services than would a large suburban city like Plano, Texas, with a population of 269,776, which has a large range of recreation options. However, do note that Mr. Cox would not take issue with regional tax sharing on a suburban county level, and that is why Clawson, Michigan, can enjoy a wonderful county-provided water park paid for by Oakland County, population 1.2 million. Good governance by L. Brooks Patterson (without the need to worry about providing many services to the poor) allows this jurisdiction to operate effectively.

Back to the main point. Decisions on taxation and spending should be made at the geographic level where they are appropriate. That is why infrastructure spending like transportation, that only works as a regional network, makes sense to have as part of regional-based taxing and spending authority. This was why Denver's Regional Transportation District is funded by a region-wide sales tax. Importantly, spending on improving the core city downtown CBD (and some suburban edge city business districts) also is salient region-wide. These areas provide business agglomeration functions, convention/meeting opportunities, cultural resources, and tourism/regional branding. Benefits like these accrue to the entire region. That is why Oklahoma City voters saw the value in passing 3 rounds of a 1-cent sales tax for Metropolitan Area Projects, supporting things like a ballpark, performing arts center, renovating a convention center, a new library, and new public transit.

Regionalism and regional funding strategies I agree should not fund fiscal irresponsibility. However, we obscure the argument and rationale behind regional strategies when we fail to understand the complexity of metro regions, and how each geographic component fulfills a different societal good, offers product for a different market niche, and functions as a different part of the regional economy.

The Complex Metro Area Gambit

Or, the reason that mostly useless public transit can be created is only because you can talk enough people in a region into voting to get someone else out of their car to allow them to get to work in theirs faster. Of course that never quite happens does it. And you are actually using the Oklahoma City projects as an example of good governance. Oklahoma City simply has a bunch of money burning a hole in their "regional" pocket at the moment so they decided to blow a bunch of it on some stuff that they hope will get people from elsewhere to quit making fun of them. That is unfortunate because there was nothing wrong with Oklahoma City before they wasted all that money, and hopefully after they realize that they got the wool pulled over their eyes they will go back to being the sensible people that they have always been.

szrggzsdg

kazino igri

First and foremost, the collapse of the Soviet Union brought an end to the Cold War, a period marked by almost five decades of tension and suspicion, backed by the

ever-present threat of nuclear war.

casino news

Rack City B*tch

I'm not sure I agree with much, if any, of this. You write like you've been going to a few too many "stop Agenda 21" meetings. You are giving far too much credit to the Federal government; this is no conspiracy to kill the suburbs. And even if it was, it wouldn't matter much. People have always voted, and will to continue to vote, with their own two feet. So why so defensive about "big" cities, regionalism, and the rest of the buzz words you've managed to sling around?

As an economist and frequent consultant to local and state governments; I could not disagree with you more on this meager attempt to justify the patchwork of tiny, repetitive, and growth-prohibiting local government jurisdictions that comprise many regions throughout the county: most notably in the Midwest. No disrespect to the late Elinor Ostrom, but honestly, what she studied was really not the relevant issue when considering the consolidation of local government entities. I am not surprised that a city of 250,000 people in New York, Pennsylvania, Indiana, or Illinois spends more per capita on public services than does a small suburban community of 12,423 mostly well-educated white people. It's not rocket science. The real important question is one of the displacement and substitution of economic activity within a region that relates directly to political fragmentation. But I'll get to that later.

First, you assert that some of push towards regionalism, or regional tax sharing, or "smart growth", whatever you want to call it, has something to do with bigger cities subsidizing smaller ones throughout the past. While they are not subsidized through a normal dollars-and-cents transfer of funds; the concept does have some truth to it. As a scholar, I can't believe you don't acknowledge or recognize that. Surely you must recognize that public protection costs are a huge part of municipal expenditures. Hell, it's even part of your own Chart title. I'm not sure how you can say that social welfare and income levels are not a part of local government finance: because they clearly are. How many bonds were issued over the past few years to pay for unfunded local police and fire pension liabilities? If you need more protection workers per-capita, those bond obligations will be undoubtedly be more $ per-capita.

Obviously, welfare checks and free-and-reduced lunches are not paid for by local governments. But the increased municipal service costs that 99-times-out-of-100 go hand-in-hand with those subsidy recipients ARE born by local governments. So yes, the "big" City is paying to protect their 250,000 population base adequately (more often than not - less than adequately) while the smaller suburban city has an entirely different public protection cost equation. You can't compare apples to oranges. In that sense, the big city is without a doubt subsidizing the public service costs of the region-at-large. What do you think would happen if larger central cities in the country went on a mass-gentrification spree and forced all less-desirable residents out to the lowest-cost suburban neighborhoods? There would be public outcry among suburban mayors and civic leaders for the "big" city to help subsidize the increased public service costs. This is not really an issue of scale on the municipal cost side. But on the economic incentive side - it certainly is. Because of the magnitude of economic opportunities for less-skilled and educated people are in urban central cities (relative to suburban areas, for example), it's not surprising that this is where they live - and can afford to live (see Edward Glaeser's book - Triumph of the City - for a far better explanation of this).

If suburban citizens don't want to pay for this cost on a regional-level: well then they should just move out of the region. But wait? That would pretty much require a move outside the USA, because all intra-dependant regions of the USA face the same dilemma. So either face the music of the broken record, or leave. Again, it's not rocket science. I'm tired of people (unfortunately, like you) acting like there's a simple and easy solution to everything - because it's quite obvious that there isn't these days.

But back to my more pertinent point.

Consolidation of local government entities has way more to do with regional competitiveness than it does per-capita local government spending. Bigger cities - like Chicago for example - catch a notable wrap for giving away the store. Property tax abatements, bond issuances on behalf of a private interest, other local tax breaks...the whole nine yards. This is a huge public cost that is not accurately portrayed in the "per capita spending" equation. When the fiscal balance is shifting negatively, cities spend more to finance those unfunded costs. In Chicago and many other dominant central cities surrounded by hundreds of relatively small local government jurisdictions, for example, this cost is certainly reflected - but it's an entirely avoidable public cost. It's just a fact - when there are more opportunities for subsidy - there are more subsidies secured. I am not suggesting that large central cities should be the sole recipient of economic growth. But when you have 15 different municipalities all offering goodies to the Next Best Company - it's not a productive situation to have. The Next Best Company was more likely than not going to relocate to- or expand within- the region anyways. This alone is an incredibly strong case for regionalism. The indebtedness incurred by the winning municipality usually swamps any difference in "per capita" municipal spending across larger and smaller cities in a region. And for what?

The region would have more than likely attracted the jobs, income and output even if it was comprised by one mega city. The people and workers (that most of the time represent the key impetus for major corporate move inspired by something other than a tax break) would organize themselves in the same manner as presently exists within city and suburb.

The displacement and substitution of economic activity - enabled by local incentives - within a region accounts for a much larger share of "public expenditure" than any of us would like admit. Fight that before you go fighting some bogus anti-suburban myth.

Re the regional problem

You overstate the size of metro regions. Once you get west of the Mississippi there is lots of land that is not naturally in a metro region dominated by a large city, Iowa, a good bit of Missouri, most of Kansas, Nebraska, the entire Dakotas, a good bit of both east and west Texas etc. (For example its about 200 mi from Houston to Dallas would you say F airfield, Tx (about 1/2 way in between) is in either region. Also once you get away from the Baton Rouge, New Orleans axis, Mississippi almost the entire state etc. But of course these are all in flyover country and uninteresting places.