The Internet Tax Freedom Act (ITFA), signed into law by President Clinton in 1998 and extended three times since, was scheduled to expire on November 1, 2014 if Congress did nothing – which they are very good at. ITFA placed a moratorium on new taxes either for Internet access services or for products and services not already taxed in local commerce. A more definitive action, the Marketplace Fairness Act (MFA), has been attached to various versions of the ITFA renewals. The MFA would force all remote vendors (regardless of physical presence) to collect and remit sales taxes for every state where buyers take delivery of goods (and services, if subject to sales taxes).

About seven states had charges on Internet access fees prior to the first ITFA, which included a grandfather clause for them. Eight states passed “Amazon Laws” since 2008. New York was first. Big retailers like Amazon and Overstock terminated agreements with small in-state e-tailers who earned revenue by linking their websites with the big companies’. Amazon sued the state of California over being forced to collect sales tax because they had related businesses in the state. The Direct Marketing Association got a U.S. District court to stop the state of Colorado from requiring remote vendors to notify residents that they are responsible for paying sales taxes and to provide information to the state for them to enforce collections.

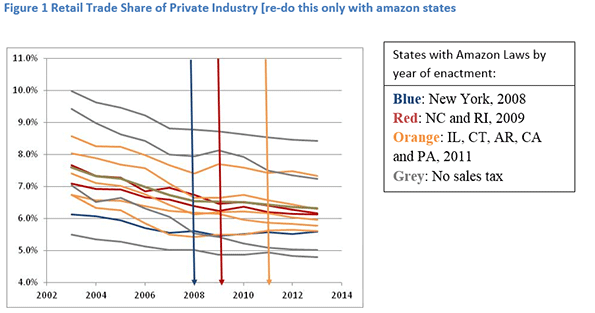

I ran a statistical analysis to test whether enacting Internet sales tax laws (“Amazon Laws”) had an impact on total retail sales in the state. When we control for the share of the population that are Internet users – something not taken into account by other data analysts – we found no statistically significant impact on retail trade from enacting Amazon Laws. A sample of our results are presented visually in the chart. Note, especially, that even states with no sales tax saw a decline in retail trade around 2008-2009, the time of the first Amazon Laws. The drop is likely due to the global economic recession.

After sixteen years and four extensions of ITFA, plus numerous lawsuits, Amazon is collecting sales taxes on purchases made by customers from 23 states with one more slated to be added in 2016. Including the five states without sales tax, that covers about 69% of Americans, according to the Wall Street Journal (October 1, 2014). Amazon has a physical presence in just 21 states and only 8 states have “Amazon Laws.”

Most news reports on the subject of Internet sales taxes present only a partial rhetoric, similar to this:

“At issue is a bill that would allow states to collect sales tax revenue from online retailers outside their borders. Right now, states can only collect sales taxes from a business with a physical location in that state.”

But the real point “at issue” is the inability of states to enforce existing tax laws. Forcing e-tailers to collect the tax means they will incur costs well-beyond that of terrestrial retailers because they must collect and remit for 49 more states than local retailers. To be completely fair, local retailers would have to check the identification of buyers and collect and remit state sales taxes to the states where the buyers reside. Imagine the burden on retailers in states with high visitor traffic – like Nevada, California, New York, or Florida.

Every state wants to know the potential income from extending sales tax to out-of-state Internet retailers. Recently, we completed an analysis of this potential in Nevada for the Las Vegas Global Economic Alliance. We found that the increased tax revenue would be quite small and likely to remain so for several more years. At the same time, the cost to the states could be quite high. These costs may diminish in the future as retailers and states with Amazon Laws are forced to work out operational solutions. Given that many states already have working arrangements with Amazon and other large national retailers (including through multi-state agreements), there appears to be little benefit from new state tax legislation on this issue.

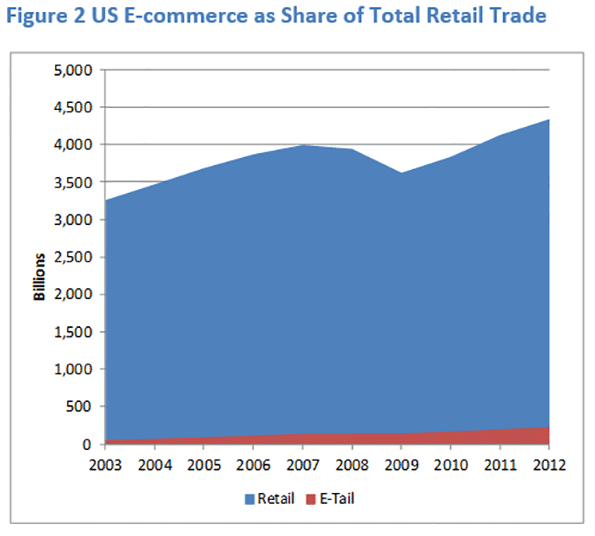

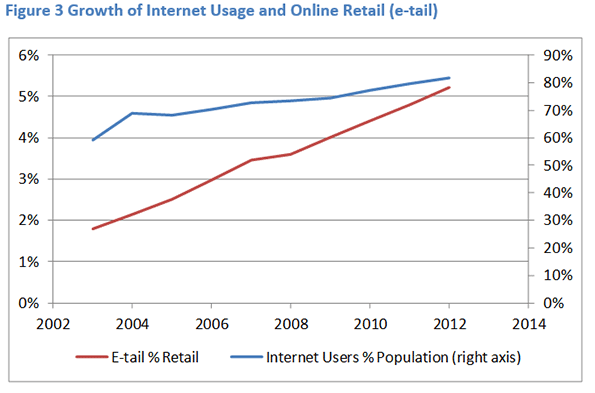

In reality, only a small part of internet commerce is taxable. Manufacturers’ e-commerce shipments were more than one-half of all online sales in 2012. Much of these sales are not subject to state sales tax regardless of the location of the buyer or the seller because they are purchased for re-sale. In most of the US, total retail trade is a declining share of private industry. The part of e-commerce that matters from a sales tax perspective is retail consumer sales: just $227 billion in 2012, or about 5.2% of total retail trade in the United States.

Business-to-business (B2B) sales are about 90% of all e-commerce, of which only about 13% is taxable. Of retail sales provided through e-commerce, more than 10% of the value is in motor vehicles where taxes are easily collected because most states require proof that taxes have been paid to register a vehicle. There is wide variation in the estimates of uncollected sales tax. One study from 2014 found significantly smaller estimates than an earlier study because they surveyed the states about compliance and then checked the online order platforms of several large e-tailers for compliance. The earlier study (2010) simply assumed an extremely small tax compliance rate among sellers.

Many online retailers are remote geographically and/or economically from their buyers. This connection of the e-tailer to the state is referred to as “nexus”. An important difficulty for e-tailers has to do with identifying the state entitled to the sales tax. A simple example illustrates this problem. If a resident of Nevada purchases a bar-b-que grill to be delivered and used at his vacation home in Utah from a retailer in California, who gets the tax? And who bears the cost of compliance which court decisions place on the taxing state?

Some e-commerce businesses claim state taxes on e-commerce are detrimental the states’ ability to compete with surrounding states. This attitude belies some lack of understanding about the issues. If these businesses are selling to residents in the same state, they should already be collecting sales tax. It is only the population of the other states that should be of concern. In fact, Amazon founder Jeff Bezos is reported to have selected Washington as home for his Internet retailer, at least in part, because of the small state population from which he would be obligated to collect sales taxes. Washington’s population ranks 13th among states – that leaves 37 states with fewer people for internet retailers to choose from, including many that have a lower share of internet usage in the population (see the table at the end of this article for a complete list).

More than 10% of e-commerce retail sales are conducted over Ebay, where many small retailers make up most of the sellers’ market. Legislative proposals generally include an exception for small sellers – usually those with between $500,000 and $1,000,000 sales annually delivered to the state. There is some evidence that buyers prefer to purchase from local sellers even when making online purchases: Ebay shoppers are 7% more likely to buy from an in-state vendor. But, research also indicates that states with no sales tax are no more likely than other states to generate in-state purchase preferences among online shoppers.

E-tail is growing but it has yet to reach the levels predicted in early research. For example, in 1999 the National Governors Association forecast e-commerce would reach $300 billion by 2002. Even ten years further into the future, e-commerce in the US was just $192 billion.

Forcing e-tailers to collect sales taxes for every states is wrought with technical and legal pitfalls and unproven financial payoffs. Many states are finding a fast and reliable way to increase collections without creating new sales tax schemes. States with income taxes provide a space on the form for reporting it and states without an income tax provide convenient online filing – a process already familiar to consumers of e-commerce a. Several states provide look-up tables based on income (compared to saving and calculating actual purchase receipts) to make paying your sales tax on out-of-state purchases more convenient.

One of the main reasons for low compliance with consumer sales tax payments is lack of knowledge: Ask a random person on the street if they know they are liable for sales taxes on out-of-state purchases and chances are they will say “no.” Oklahoma aired a television ad that included a list of the projects that sales tax collections could fund (e.g., education, police, and fire). As a result, the number of income tax returns with sales tax payments leaped by 20%. These options will produce faster results at a lower cost than defending new tax legislation at the state or federal level.

Susanne Trimbath, Ph.D. is CEO and Chief Economist of STP Advisory Services. Dr. Trimbath’s credits include appearances on national television and radio programs and the Emmy® Award nominated Bloomberg report Phantom Shares. She appears in four documentaries on the financial crisis, including Stock Shock: the Rise of Sirius XM and Collapse of Wall Street Ethicsand the newly released Wall Street Conspiracy. Dr. Trimbath was formerly Senior Research Economist at the Milken Institute. She served as Senior Advisor on United States Agency for International Development capital markets projects in Russia, Romania and Ukraine. Dr. Trimbath teaches graduate and undergraduate finance and economics.

State Sales Tax and Internet Usage

|

State |

Sales Tax Rate (%) |

Retail (% Private Industries GDP) |

Internet Users (% population) |

Private Industries GDP ($mil) |

|---|---|---|---|---|

|

Alabama |

4.0 |

8% |

65.0 |

156,917 |

|

Alaska |

0 |

4% |

84.0 |

49,414 |

|

Arizona |

5.6 |

9% |

78.5 |

233,547 |

|

Arkansas |

6.5 |

7% |

66.8 |

103,810 |

|

California |

7.5 |

6% |

79.7 |

1,851,147 |

|

Colorado |

2.9 |

6% |

79.9 |

243,303 |

|

Connecticut |

6.35 |

6% |

86.5 |

218,141 |

|

Delaware |

0.0 |

5% |

80.4 |

54,193 |

|

Florida |

6.0 |

9% |

78.8 |

668,823 |

|

Georgia |

4.0 |

7% |

76.5 |

378,343 |

|

Hawaii |

4.0 |

9% |

82.6 |

55,818 |

|

Idaho |

6.0 |

9% |

82.2 |

49,840 |

|

Illinois |

6.25 |

6% |

78.5 |

630,775 |

|

Indiana |

7.0 |

6% |

73.5 |

277,853 |

|

Iowa |

6.0 |

6% |

77.5 |

138,367 |

|

Kansas |

6.15 |

7% |

78.9 |

118,833 |

|

Kentucky |

6.0 |

7% |

68.8 |

151,035 |

|

Louisiana |

4.0 |

6% |

67.7 |

223,985 |

|

Maine |

5.5 |

10% |

82.8 |

45,636 |

|

Maryland |

6.0 |

7% |

82.3 |

265,329 |

|

Massachusetts |

6.25 |

5% |

86.2 |

381,249 |

|

Michigan |

6.0 |

7% |

78.4 |

367,147 |

|

Minnesota |

6.875 |

6% |

82.1 |

267,937 |

|

Mississippi |

7.0 |

10% |

53.3 |

83,605 |

|

Missouri |

4.225 |

7% |

72.4 |

235,769 |

|

Montana |

0.0 |

7% |

73.6 |

35,665 |

|

Nebraska |

5.5 |

6% |

80.2 |

89,736 |

|

Nevada |

6.85 |

8% |

80.0 |

113,774 |

|

New Hampshire |

0.0 |

8% |

90.1 |

57,963 |

|

New Jersey |

7.0 |

6% |

87.8 |

470,251 |

|

New Mexico |

5.125 |

8% |

68.0 |

68,052 |

|

New York |

4.0 |

6% |

81.5 |

1,130,320 |

|

North Carolina |

4.75 |

6% |

71.8 |

387,032 |

|

North Dakota |

5.0 |

6% |

75.9 |

44,281 |

|

Ohio |

5.75 |

7% |

76.7 |

484,156 |

|

Oklahoma |

4.5 |

7% |

67.9 |

144,100 |

|

Oregon |

0.0 |

5% |

86.1 |

186,325 |

|

Pennsylvania |

6.0 |

6% |

77.8 |

563,086 |

|

Rhode Island |

7.0 |

6% |

81.0 |

44,003 |

|

South Carolina |

6.0 |

9% |

67.0 |

147,884 |

|

South Dakota |

4.0 |

7% |

72.9 |

38,572 |

|

Tennessee |

7.0 |

8% |

72.9 |

246,840 |

|

Texas |

6.25 |

6% |

68.6 |

1,313,557 |

|

Utah |

5.95 |

7% |

87.6 |

116,212 |

|

Vermont |

6.0 |

9% |

81.7 |

24,170 |

|

Virginia |

5.3 |

6% |

77.8 |

359,664 |

|

Washington |

6.5 |

8% |

85.7 |

333,994 |

|

West Virginia |

6.0 |

8% |

70.5 |

58,325 |

|

Wisconsin |

5.0 |

6% |

83.0 |

240,059 |

|

Wyoming |

4.0 |

5% |

79.4 |

36,357 |

|

US Total |

-- |

7% |

84.2 |

14,058,314 |

Sources: State sales tax rates 2014 from Federal of Tax Administrators (does not include any municipal or special district sales tax); Internet Usage 2010 from InternetWorldStats.com; GDP 2012 from Bureau of Economic Analysis

Impossible

The main problem with internet taxation is the complicated mess that are state and local tax rules.

In Colorado, for example, there is no tax on food at the state level. But, there is a 2.9% tax on candy--except that KitKat bars are not taxed as they contain flour.