As mine owners and their goons terrorized striking miners and their families during the Harlan County Coal wars in 1931, Florence Reece penned the iconic labor song, “Which Side Are You On.” It pleads for unity and collective resistance. As one verse puts it, “they say in Harlan County there are no neutrals there.”

I recalled these lyrics while listening to a cable channel business report contending that “skyrocketing worker wages” are driving up prices and inflation. That is balderdash. Workers’ incomes aren’t rising significantly, nor are wage increases causing inflation to accelerate. For some policymakers and commenters, claims like the cable report justify jacking interest rates ever higher and accepting the rising likelihood of a recession, protecting the interests of those with high income and wealth. They would sail onward unmolested, but workers would lose jobs and income. The little power workers gained recently to win better wages and working conditions would sharply diminish. Raising interest rates to cause a recession to control inflation is choosing sides against workers and their communities.

Wages are not skyrocketing, nor are they a primary cause of inflation. As economist Milton Friedman explained succinctly, “inflation is too much money chasing too few goods.” Pandemic-related supply chain woes and geopolitical instability made some goods scarce, and that exacerbated rising prices across many commodities. But if there really is “too much money,” who has it? It certainly is not workers. To understand what’s really going on, we need to remember 4 facts.

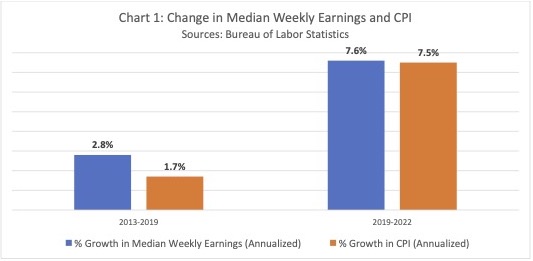

Fact 1: Workers’ incomes are barely keeping even with the cost of living. Between September in 2019 and 2022, the Consumer Price Index (CPI) rose by 7.5% on an annual average basis. Wages are up too, but not enough to fully offset inflation. After crushing job losses and soaring unemployment early in the pandemic, the job market tightened as COVID eased. Many workers won modest wage gains while others jumped to new and better jobs. Despite those trends, wages are barely keeping up with inflation.

As chart 1 shows, the cost of living has risen just about as much as median weekly earnings of full-time wage and salary workers. In fact, workers did better against inflation prior to the pandemic. Between 2013-2019, median weekly earnings grew ahead of inflation.

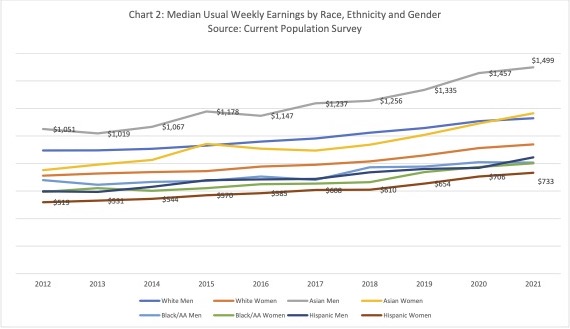

The people commonly bearing the burdens of low-wage work are women and/or Black and Latinx. Black and Latina women would barely make $40,000 a year if they were paid the median usual earnings for 52 weeks per year (an optimistic assumption). That may be above poverty level, however, it is only about half of the “living wage” in many states and cities for a family with two children and one wage earner.

The data is clear. Modestly rising workers’ pay is not driving inflation. That is not where “too much money” lies.

Fact 2: Rich households have the resources to “bid up” prices. Because too many jobs pay at or near poverty, most workers’ families are not the source of the “excess demand” that may push inflation. Rather, they navigate inflation by tightening their budgets and focusing on essentials, not frills. Many lack savings to cover an unexpected $400 emergency bill. They are not prepared to weather inflation, and a likely recession will just make things worse.

As charts 3 and 4 make clear, the income of the rich is rising faster than the cost of living. The bottom two fifths of the household income distribution achieved at best modest gains before the pandemic, and they lagged badly behind in the past two years. The top fifth enjoyed robust pre-pandemic gains and garnered even larger increases in the past two years. Further, America’s uber-rich top billionaires thrived extraordinarily through the pandemic and recovery. Their cumulative wealth jumped a whopping 58% or +$1.71 trillion according to inequality.org’s analysis of Forbes data. That’s who is responsible for the “too much money chasing too few goods” that drives inflation.

Read the rest of this piece at Working-Class Perspectives.

Mark G Popovich is the Director of the Good Companies Good Jobs Initiative at the Aspen Institute Economic Opportunities Program. The views expressed are his own. The author deeply appreciates the informative discussions about these issues with Maureen Conway, and thanks Sherry Linkon for her assist in shaping and editing the post.

Photo: Florence Reece, screenshot via YouTube.