Economist Colm McCarthy says that urban containment policy played a major role in the formation of the housing bubble. In a commentary in the Sunday Independent, Ireland’s leading weekend newspaper, McCarthy relates how urban planning regulations led to higher house prices in the Dublin area (Note 1).

“Ireland passed its first major piece of land-use planning legislation in 1963, modelled on the UK's Town and Country Planning Act of 1947. The intentions were laudable, to restrict the construction of unwelcome developments and to empower local authorities to take a more active role in shaping the built environment. There was no desire to screw up the residential housing market, but that is eventually what happened.”

The Great Financial Crisis in Ireland

The bursting of the housing bubble led to an economic decline in Ireland that was among the most devastating of any nation during the Great Financial Crisis. Household incomes dropped, unemployment rose to above 15 percent and Ireland was eventually forced into a bailout loan of €67.5 billion (approximately $90 billion) from the European Union and the International Monetary Fund. Ireland’s economy (gross domestic product) declined nine percent, nearly four times the decline suffered by the United States, according to World Bank data.

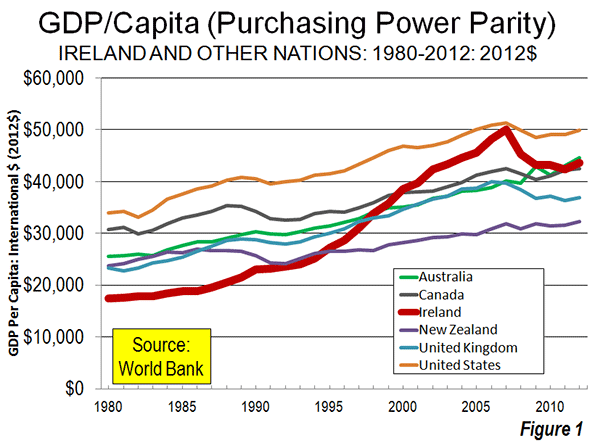

This is a sharp contrast to Ireland’s image as the “Celtic tiger”. In 1980, Ireland’s gross domestic product per capita (purchasing power adjusted) trailed those of the United Kingdom and the four strong new world economies (United States, Canada, Australia and New Zealand) by approximately 25 percent to 50 percent. By its 2007 peak, Ireland had passed all but the United States, which it nearly caught. By 2012, however, Ireland’s GDP per capita had fallen behind that of Australia (Figure 1).

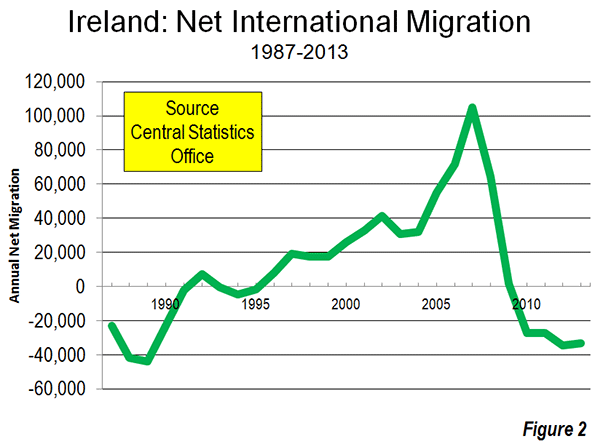

Migration trends reflect the result of this decline. Net in-migration reached 105,000 in 2007, when the economy peaked when, a notable number for a nation with only 4.5 million residents with a long history of sending its denizens out to the rest of the world (Note 2). In the less robust economy of the last four years, a net 125,000 migrants have left Ireland (Figure 2).

McCarthy, of University College, Dublin and one of the nation’s most respected economists was called in by the government to lead the “Special Group on Public Service Numbers and Expenditure Programs,” which published the McCarthy Report, detailing recommendations for public expenditure reductions to help Ireland “weather” the financial storm.

The Housing Bubble in the Dublin Area

As in the United States, a housing price bubble (centered in the Dublin area) precipitated an economic downturn, which was the greatest since the Great Depression. Our annual Demographia International Housing Affordability Surveys had shown house prices in the Dublin area to peak at a “severely unaffordable” median multiple (median house price divided by median household income) of 6.0, well above the normal 3.0 relationship between prices and incomes. Paying more for housing reduces household discretionary incomes and lowers the standard of living.

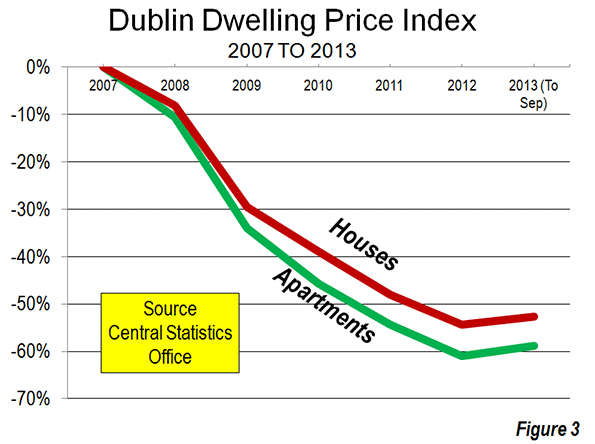

After peaking in 2007, Dublin house prices plummeted. Single family house prices fell 53 percent from 2007 to 2012, while apartment prices dropped 61 percent, according to the Central Statistics Office property price index (Figure 3). This year, finally, prices have begun to trend upward.

Decoupling from the Fundamentals

Like in Dublin, this decoupling of housing from the fundamentals occurred not only in Dublin, but also in both vibrant other markets such as Sydney, Vancouver, and the San Francisco Bay area, as well as severely depressed markets like Liverpool, Glasgow. In each case, the decoupling has been accompanied by strictly enforced enforcement urban containment policies that prohibit development on considerable suburban and exurban land, through the use of such devices as urban growth boundaries and the priority growth areas (a euphemism for the only places that development is permitted). As is commonly the case, with these strategies upset the balance between the demand and supply for land, forcing house costs up substantially, just as oil embargoes lead to higher prices at the gas pump.

McCarthy places the blame squarely on urban containment policies.

“…there was and still is no shortage of land in the greater Dublin area, one of the lowest-density urban areas in Europe. There is, however, a shortage of planning permission – an entirely man-made creature of the planning legislation and its restrictive implementation by the Dublin-area councillors and planning officials.”

He describes how artificial scarcity raises prices (other things being equal), a process anyone who listened in Economics 101 would understand. McCarthy says:

“Before land-use zoning came along, house-builders extended the city by buying up farms on the city's edge and building at whatever densities the market would support. But as more and more lands were withdrawn from the buildable stock by the planners, prices began to rise and the house-builders moved further away from the city proper.”

With new house building consents so rigidly controlled, a Dublin area house prices escalated well beyond incomes and prices in the rest of the nation. As McCarthy puts it:

“In the principal residential suburbs of Dublin an artificial scarcity (of planning permission, not of buildable land) was allowed to develop and prices rose, from the mid-Seventies onwards, to a 50 per cent or 60 per cent premium over comparable homes outside Dublin.”

In addition to the houses for commuters that were further from Dublin, a government encouraged rural building boom led to over-building in more remote areas (Note 3).

Economics and Urban Containment

The consequences of urban containment policy have been known for a long time. More than four decades ago, Sir Peter Hall and his colleagues documented the extent to which house prices have been driven upward in England as a result of the land-use policies that have been copied in Ireland and elsewhere (See: The Costs of Smart Growth: A 40-Year Perspective).

More recently, Brian N. Jansen and urban economist Edwin S. Mills (Northwestern University) took the argument further (See: The Consequences of Urban Containment) and tied the Great Recession directly at the foot of smart growth policies. They noted that “…. it is difficult to imagine another plausible cause of the 2008–2009 financial crisis,” and concluded: “In the absence of excessive controls, housing construction would quickly deflate a speculative housing price bubble.”

My analysis of metropolitan markets for the National Center for Policy Analysis showed that 73 percent of the house price value losses from the peak of the US housing bubble to the housing bust precipitated Lehman Brothers bankruptcy occurred in just 11 markets in California, Florida, Arizona and Nevada, all of them with severe land restrictions (see The Housing Crash and Smart Growth). Had those losses been smaller (as they would have been if prices had not risen so high), the Great Financial Crisis might have been less severe or even avoided.

Ireland’s Challenge

More recently, there is good news out of Ireland. The government has announced that it will no longer need the EU/IMF line of credit and will exit the bailout program. The 2012 gross domestic product nudged above the 2007 peak. But that does not mean that those who suffered economic losses during the downturn were made whole. Economic downturns massively redistribute wealth, and there is good reason to not repeat history on this score.

McCarthy comments that: “It is quite remarkable that the contribution of restrictive zoning to the house price bubble has been so little acknowledged.” He stresses the importance of avoiding “Bubble Mark II,” and urges planning system reform:

“The key policy measure required is the zoning for residential development of the very large volume of derelict and undeveloped land in the Dublin area.”

Failing that, a another shock to the standard of living could face the Irish, who have already suffered one, at least partly due to urban containment policy. It could be time, again, for the government to follow Colm McCarthy’s advice. The only housing bubble that cannot burst is one that never forms.

Wendell Cox is a Visiting Professor, Conservatoire National des Arts et Metiers, Paris and the author of “War on the Dream: How Anti-Sprawl Policy Threatens the Quality of Life.

Dublin Bay photo by Colm MacCárthaigh.

----

Note 1: Leith van Onselen of Macrobusinessprovides additional analysis on the Irish housing bubble in How Planning Exacerbated Ireland’s Housing Bust.

Note 2: President John F. Kennedy referred to people as Ireland’s only export as people, on an Irish visit in 1963. The 1961 census had shown a population of 2.8 million, down from an 1841 6.5 million in the present area of the Republic of Ireland (before the pre-potato famine). This loss of 57 percent may be unprecedented in recent world history.

Note 3: This was due to the combination of “easy money” for building from the financial sector and generous central government tax credits for building in remote Ireland (since repealed). Nearly all of this vacant housing is beyond commuting distance from Dublin, according to the 2011 census (much of it in the northwest and in the counties the west coast). This also fed into the Irish financial reversals.