In every recent year, a black swan event has made top 10 lists appear quaintly naive and unimaginative. Our list is probably no better.

This time of year, top 10 predictions are all the rage. These lists can be interesting and entertaining but how useful are they really?

This question goes to the heart of forecasting. How futile or how useful is an attempt to forecast the economy, or technology, or world events for the next twelve months? There are three answers.

First, not futile and somewhat useful. Projecting the trends of 2016 into 2017 is a useful exercise to identify their linear logical trajectories and end points. For example, the automation of many job functions will continue as long as robotics and artificial intelligence make progress. Or, North Korea’s ability to deliver a nuclear warhead on a long-range missile will continue to improve if unchecked.

Second, futile and not that useful. When a desirable trend, say a decline in unemployment, is identified, policy makers will attempt to reinforce it. When an undesirable trend becomes obvious, they will work to counter it. However in both cases, the intervention can be either effective or counterproductive. It can either reinforce or roll back the trend. Human tinkering means that few trends are truly linear or logical beyond the near-term. There may be a slowdown in the spread of automation. There may be an agreement to stop North Korea’s nuclear ambitions.

Third, neither futile nor useful but somewhat irrelevant. While forecasters are focusing their sights on the high probability of a, b and c, there are always bigger low-probability events brewing under the surface. In fact, the most important event in any given year, the one event that shakes things up and that has wide long-lasting ramifications, is usually one that few people foresaw at the beginning of that year.

• In 2016, Brexit and the victory of Donald Trump. A large majority of experts gave either event a low probability.

• In 2015, the massive refugee influx into Europe. The numbers were rising in previous years but no one saw the surge coming.

• In 2014, the sudden rise of ISIS after it conquered large territories in Syria and Iraq. President Obama had famously dismissed them as the JV team a few months earlier.

• In 2013, the Boston Marathon bombing and Edward Snowden’s revelations.

And so on. If you look at it by decade, the most important events of the 1990s and 2000s were the collapse of the Soviet Union and the 9/11 terror attacks. Neither featured in top ten lists in any year but both had an enormous impact and repercussions that are still rippling around the world.

So instead of a list of top 10 higher probability predictions, we should consider a list of lower probability events each of which, were it to occur, would have a very large impact on the future of politics, economics, science etc. As extensively argued by Nassim Taleb, black swan events often have a much greater impact on the future.

Here is one attempt to compile such a list, with the caveat admission that it is only marginally better if at all than other lists and that the most important event of 2017 will likely be something else.

Low Probability high impact events

In no particular order:

• A major cyberattack that paralyzes the electric grid, payment exchanges, the stock market and/or other infrastructure. Until repaired, this would wreak havoc on daily life and the economy and would hit GDP for several quarters. It would also lead to new security measures and the attendant spending by corporations and governments.

• Putin removed from power. This has a low probability but it is not impossible. Referring to Putin, George Friedman recently wrote that “Russia must be led by a magician who can make small things appear large.” Through ways not always approved in the West, Putin has managed to spread Russia’s influence despite economic deterioration. But Russia has large demographic and economic challenges which could get worse after his departure.

• Another financial crisis starting in Europe or in emerging markets. Though regulation and oversight have increased since 2008, there was no deep overhaul of the cultural mindset at many leading financial institutions. The world is awash with credit and emerging markets are considerably weaker now than in 2008. If nothing else, moral hazard created by the bailouts means that the next crisis could be as severe as the last one, with little appetite in the public for saving the banks one more time.

• A joint Russia-NATO military operation against ISIS and a settlement of the Syrian war. ISIS has lost much territory in 2016 but is still effective at orchestrating terror attacks in other countries. During the campaign, Donald Trump vowed to hit them hard.

• A sharp economic slowdown in China. China has been a huge engine of growth for over two decades lifting its own economy and boosting commodity-based countries such as Brazil, Russia and the OPEC countries. Chinese demand also helped maintain strong demand for American and European goods at a time when growth in Western economies was sluggish or nonexistent. At the same time, China’s low-cost manufacturing and capital flows into the US lowered inflation and interest rates. A marked China slowdown could throw all of the above in reverse, lifting interest rates in the US and Europe and depressing demand for finished goods and commodities.

• Political turmoil in Saudi Arabia and/or Iran. Both countries have vast oil reserves and are the leading power brokers in the Middle East. Destabilization in either would have important near and long-term consequences.

• A coup d’état or populist revolt in an OECD country. OECD member Turkey experienced an aborted military takeover in 2016. Could it happen elsewhere? Highly improbable but not necessarily 100% out of the question, as far as black swans are concerned.

• The price of oil at $20 or $90 per barrel. Today oil is trading near $55 and a decline to $40 or a rise to $65 are neither here nor there in terms of their lasting impact. But a $30 to $40 rise or drop would certainly shake things up. It is not difficult to construct either scenario, improbable as it may be. For a drop, imagine China and/or the US economy weakening while production from Iran, Iraq, Libya and US shale producers surges back. For a rise, consider emerging markets recovering with a stronger India while turmoil in the Middle East threatens some production.

• A major terrorist attack with thousands of casualties. Unfortunately, this one will have to feature on the list every year for the foreseeable future. Though it has a low probability, its occurrence anywhere would shock and reshape the world for the several decades that follow.

• On the positive side, there will continue to be advances in science and medicine. Because positive developments tend to build on the previous years’ progress, they are by their nature incremental, and are therefore unlikely to generate surprise shock or awe headlines.

These are all low probability but not zero probability events. And the impact of each would be far greater than that of any higher probability event featuring in many top 10 predictions for 2017.

Sami Karam is the founder and editor of populyst.net and the creator of the populyst index™. populyst is about innovation, demography and society. Before populyst, he was the founder and manager of the Seven Global funds and a fund manager at leading asset managers in Boston and New York. In addition to a finance MBA from the Wharton School, he holds a Master's in Civil Engineering from Cornell and a Bachelor of Architecture from UT Austin.

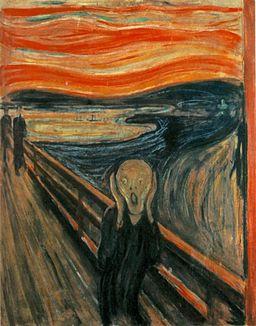

Photo: Edvard Munch [Public domain or Public domain], via Wikimedia Commons