Ben Bernanke made the following statement as he attempted to justify bailing out bad borrowers:

“…from a policy point of view, the large amount of foreclosures are detrimental not just to the borrower and lender but to the broader system. In many of these situations we have to trade off the moral hazard issue against the greater good.” – Ben Bernanke, February 25, 2009

I think he is wrong on this, and the moral hazard issue is only a small part of my objections.

One of the fundamental problems we have right now is that too many people own homes. It sounds harsh, but please bear with me a few sentences. I think we can agree that 100 percent home ownership is not possible, or even desirable. Most of us can remember a time when our income and our jobs were such that home ownership was a bad idea. Home ownership is a commitment that requires a significant amount of stability and discipline. Not everyone is so stable or has the discipline to keep up with the payments.

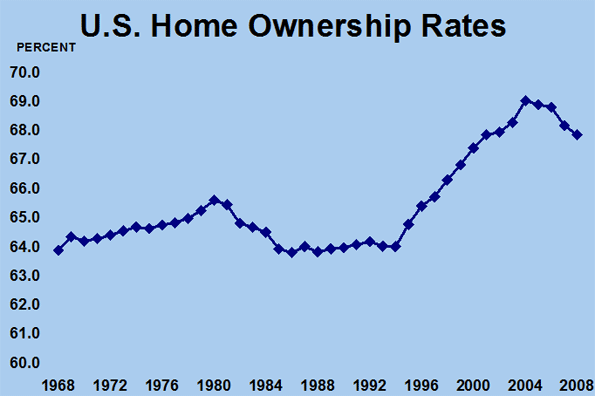

What is an appropriate national homeownership rate? Theory gives us no answer. We look to the data for a clue. Here’s a chart of home ownership rates since 1968:

It seems pretty clear that a homeownership rate between 63 percent and 65 percent works pretty well. When we get above that range, problems seem to crop up. This was true in 1980 – the worst recession of the past 30 years – and it is true now.

In light of these data, let’s think about what Bernanke is saying. He’s arguing that to execute the foreclosures required to move the rate back to that 63 percent to 65 percent range are bad for the economy. So bad in fact, that we’re better off not going there.

The problem with that argument lies in a lack of historic understanding of the proper levels of homeownership. Financial and real estate markets can’t stabilize until we get closer to that equilibrium. Until we lower the home ownership rate, financial institutions will have a cloud around them, and residential real estate markets will be lifeless. It may not be politically popular, but those are the realities.

This is a critical issue. For years, economists have believed that the failure of banks to recognize and remove bad assets contributed to Japan’s long period of economic malaise. I agree. Forbearance on bad real estate loans here in the states constitutes much the same thing. Our financial institutions are holding a bunch of bad assets; these are homes that are owned by people who can not afford them – never did, and likely never will. Until the financial institutions recognize those bad assets and get them off their books, our financial institutions won’t have the resources to fund, stabilize and then drive a broader economic recovery.

What we need is not more mindless beneficence to everyone from Wall Street to Detroit and Main Street. The more we bailout failed financial institutions, automobile manufactures, or any business, the longer we postpone our recovery.

Recessions are periods when assets are reallocated from less productive to more productive uses. That requires processes like repossession, foreclosure, mergers, and bankruptcy. These processes have been developed over centuries. They are the most efficient methods to restore an economy.

Why are we suddenly abandoning these processes that have proved themselves in many business cycles? I suppose part of it is the desire to eliminate the business cycle. This is the same thinking that had many – including conservatives – arguing that stocks could not fall during the dot.com bubble or that housing prices would also move up.

In reality the business cycle can not be eliminated. It can’t be done and it is pure hubris to try. One of the fundamental insights to come out of Real Business Cycle research is that recessions constitute the most efficient response to a negative shock.

We need to stop wasting resources trying to stem the tide. Instead, let us allow the recession to work for us. In the meantime we can provide a backstop through unemployment benefits and some reasonable fiscal stimulus. But we have to experience some pain and let our processes and institutions work for us. The sooner we get these foreclosures, repossessions, mergers, and bankruptcies behind us, the sooner we will see a return to the only sure cure for a sick economy: real economic growth.

Bill Watkins, Ph.D. is the Executive Director of the Economic Forecast Project at the University of California, Santa Barbara. He is also a former economist at the Board of Governors of the Federal Reserve System in Washington D.C. in the Monetary Affairs Division.

What do you think of the carbon tax idea I just wrote about?

epar

What do you think of the carbon tax idea I just wrote about on my profile?

Sincerely,

Ken Stremsky

Thanks for writing

Thanks for writing.

It is never a good idea to punish people for savings and investing because it discourages people from savings and investing. We need to reduce our need for capital from China and other countries. China may decide to stop providing us with capital within the next 5 years as it spends more money increasing domestic consumption in China.

It is better to put more money in the hands of many people by reducing social security taxes on many people who make under $30,000 a year for the next 2 years. This will make it easier for many people to make mortgage payments which may reduce the numbers of foreclosures. Many people will have more money to reduce their other debts. Many people will have more money to spend and feel for confident. If people are more confident, businesses are less likely to fire people. I discuss several ways of funding social security on my profile and http://www.myspace.com/kennethstremsky

We should be encouraging poor people and middle class people to invest via the changes I recommend dealing with 401(k) plans.

Reducing the federal corporate tax rate will encourage many businesses to employ more people, increase wages of many people, and increase dividends.

Reducing income taxation of wealthy people will encourage them to consume more, save more, and invest more. I discuss sales taxes I want the federal government to adopt on my profile. Some of the sales taxes mainly hit the wealthy. If sales taxes are too high, consumption may be significantly harmed which may increase unemployment.

The less that the federal government taxes individuals and businesses the more that state governments may be able to tax individuals and businesses. If state governments are able to tax individuals and businesses more, they may spend more money on education, infrastructure, energy transmission, energy development, public transportation, and other things. I think state governments often obtain better results spending money than the federal government does. State governments may do a better job reducing poverty via job training programs and cooperative education programs if they are able to tax individuals and businesses more.

Congress needs to regulate financial institutions a lot better.

Congress needs to at least triple the budget of the SEC and at least double the number of people employed by the SEC. I mentioned the SEC when I ran for United States Senate in 2002 on The Green Papers at http://www.thegreenpapers.com/Vox/?20020721-0. I warned people about former President Bush. I learned from the Savings and Loans Crisis how important COMPETENT government regulation is.

I recommend people read

"Obama budget would boost SEC

Plan would also give boon to agency monitoring complex financial instruments; lawmakers ponder agency mergers."

http://money.cnn.com/2009/02/26/news/economy/obama_budget/index.htm

Sincerely,

Ken Stremsky

I am also in favor in

I am also in favor in finding an economical equilibrium even if that means a huge sacrifice. The home ownership needs to stands under legal limits otherwise everything goes off track. I am grateful I can pay now for my home mortgage and my home insurance, I would have never closed a deal if I knew I can't afford it. That's what all these people should have done.