November 8, 2025 Last Update: 11/07/2025

|

|

Subscribe to NG ArticlesThe Coming of Neo-Feudalism

Infinite Suburbia

BooksAuthored by Aaron Renn, The Urban State of Mind: Meditations on the City is the first Urbanophile e-book, featuring provocative essays on the key issues facing our cities, including innovation, talent attraction and brain drain, global soft power, sustainability, economic development, and localism. Popular ContentMore from this authorRecommended Books

Blogroll and Partner SitesUser login |

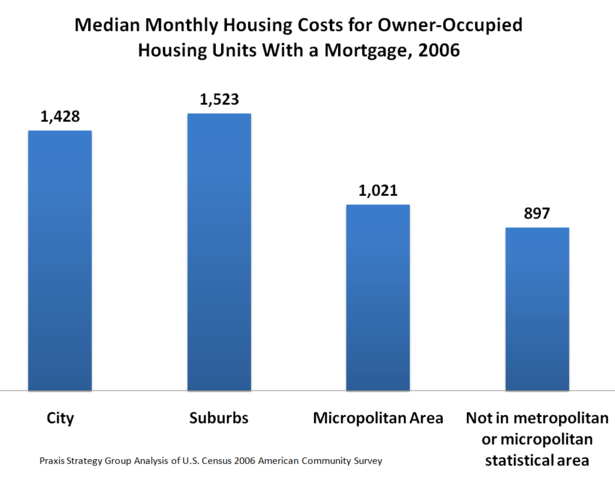

I live in the suburbs and my

I live in the suburbs and my aunt and cousins are into real estate they all saw this coming with the amount of people getting mortgages that couldn't afford them. Now banks and companies are getting bailed out and people lose everything. It's really not right. Looking at a mortgage calculator can tell you what you can afford, to bad more people don't use them and take their advice.