The fastest-growing industry in the U.S since 2010 isn’t large or well-known. In fact, nearly half of the estimated 5,100 jobs in support activities for metal mining are located in one state: Nevada. Nonetheless, employment in this niche mining industry has ballooned 53% since 2010, and it creates a huge number of supply-chain jobs in other parts of the economy.

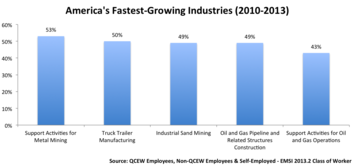

Four of the five fastest-growing industries from 2010-2013, based on EMSI’s 2013.2 employment dataset, are related in some form to mining and oil & gas. These industries (e.g., oil & gas pipeline construction and support activities for oil & gas operations) have been carried by the boom in oil and natural gas production in pockets of the U.S., from North Dakota to Pennsylvania to Texas. And their growth has sparked new jobs in other sectors.

This is especially the case for support activities for metal mining. For every job in this industry, another 6.1 supply-chain jobs are created elsewhere. That means the tiny industry accounts for a much more significant 36,180 jobs in all. (Note: This does not count the induced effects that come when employees and other income claimants spend what they make on food, clothes, and other goods and services.)

| NAICS Code | Description | 2013 Jobs | % Change Since 2010 | Supply-Chain Jobs Multiplier | Total Supply-Chain Jobs |

|---|---|---|---|---|---|

| Source: EMSI Wage-and-Salary and Self-Employed Workers (2013.2) and EMSI Input-Output Model | |||||

| 213114 | Support Activities for Metal Mining | 5,103 | 53% | 7.09 | 36,180 |

| 212322 | Industrial Sand Mining | 5,241 | 49% | 1.75 | 9,172 |

| 237120 | Oil and Gas Pipeline and Related Structures Construction | 145,870 | 49% | 1.68 | 245,062 |

| 213112 | Support Activities for Oil and Gas Operations | 302,077 | 43% | 2.15 | 649,466 |

| 212234 | Copper Ore and Nickel Ore Mining | 15,109 | 37% | 2.7 | 40,794 |

| 532412 | Construction, Mining, and Forestry Machinery and Equipment Rental and Leasing | 70,151 | 36% | 2.74 | 192,214 |

| 333132 | Oil and Gas Field Machinery and Equipment Manufacturing | 78,502 | 32% | 2.12 | 166,424 |

| 212221 | Gold Ore Mining | 15,738 | 32% | 1.86 | 29,273 |

| 211112 | Natural Gas Liquid Extraction | 6,374 | 28% | 1.85 | 11,792 |

| TOTAL | 644,165 | 1,380,376 | |||

Mining and similar extraction-based industries take a lot of equipment and materials to operate, so their growth is felt by a wide variety of suppliers. Altogether, the nine mining and oil & gas industries highlighted above — all of which have grown at least 28% since 2010 — account for 644,165 estimated jobs. And when you consider the spin-off jobs in their supply chain, the employment number more than doubles to 1,380,376. (As reader Gene Hayward calculated, when you add the direct and supply-chain jobs created since 2010, these nine industries account for nearly 600,000 total jobs created in three-plus years. Keep in mind EMSI’s 2013 job numbers are estimates and are based on historic and projected data).

To understand what we mean by “supply-chain jobs,” it’s helpful to look at the different components of EMSI’s job multiplier:

- Initial: Jobs in the focus industry (e.g., support activities for metal mining).

- Direct: Jobs in the supplying industries.

- Indirect: The subsequent ripple effect in further supply chains. These are the suppliers of the suppliers.

- Induced: This change is due to the impact of the new earnings created by the initial, direct, and indirect changes (otherwise known as the income effect). These earnings enter the economy as employees spend their paychecks in the region on food, clothing, and other goods and services.

As we mentioned earlier, we’ve only included the first three components in this analysis. These are the jobs directly related to these industries’ supply chains, and the indirect suppliers of their supply chain. So these industries, especially support activities for metal mining, have deep roots in the economy — the more they grow, the more the economy as a whole grows. But how do the supply-chain job multipliers in these mining and oil & gas industries compare to other export-based industries?

Comparing Supply-Chain Multipliers

Support activities for metal mining packs serious job-creation punch, and its 7.1 supply-chain job multiplier compares favorably with other industries with hefty multipliers. The largest supply-chain multiplier in the mainstream manufacturing sector belongs to light truck and utility vehicle manufacturing (a whopping 15.0), while cyclic crude and intermediate manufacturing and cheese manufacturing are both at 10.2. This means that every job in these these heavyweight sectors leads to between nine to 14 new jobs in the U.S.

Impressive. But various processing and refining industries have even larger supply-chain multipliers. The largest supply-chain multiplier in the U.S. is petroleum refineries (20.8), followed by soybean processing (19.1). What makes an industry’s multiplier so large (or so small)? Here’s an explanation from EMSI co-founder and chief economist Hank Robison:

The size of supply-chain employment multipliers generally reflects a mix of three things: 1) the number and complexity of steps involved in producing the good, 2) capital requirements, and 3) the vertical integration of the production process (in a vertically integrated industry most of the production steps occur within the industry itself). Producing a quart of common motor oil provides a good example of a process resulting in a large employment multiplier. Producing refined oil products entails a complex many-stepped process – starting with exploration, and then drilling, oil field to refinery transportation, testing, treating and refining, and finally packaging of the end product. Oil refining is as capital intensive as it gets; refineries represent enormous capital investments, with sophisticated cracking towers, gauges, piping and more. And finally the production of refined oil products reflects a very disintegrated production process: the bulk of the labor embodied in the final product is added in the earlier production steps, e.g., in exploration, drilling, transport, etc. It is little wonder then that at 20.83, the supply-chain employment multiplier for the petroleum refining (NAICS 324110) sector is the largest of all employment multipliers in the US IO Model.

Consider now an industry at the other end of the supply-chain employment multiplier spectrum, soil preparation, planting, and cultivating (NAICS 115112). Operating under contract from farmers, firms in this sector conduct a variety of basic farm support activities. Their capital investment in tractors, tillers and such is relatively modest, and they often use the equipment of the contracting farmer. Compared to manufacturing, and most other sectors, their production process entails few steps: buy some fuel, maybe some seed, and go to work. There is little room for vertical integration as they add all but the smallest sliver of the labor entailed in delivering their end product – season-ready land. It is little wonder that their supply-chain employment multiplier is a mere 1.02, one of the lowest of all supply-chain employment multipliers in the US IO Model.

Joshua Wright is an editor at EMSI, an Idaho-based economics firm that provides data and analysis to workforce boards, economic development agencies, higher education institutions, and the private sector. He manages the EMSI blog and is a freelance journalist. Contact him here.