Back in 2002, I compared housing to gold. The surge in home buying in the 2000s looked like the 1970s rush to buy gold. Like the current times, the 1970s were a time of great economic uncertainty, followed by the rapid inflation of prices in the 1980s. Regardless of the actual return on investment, many people bought gold as a hedge against financial and economic turmoil. When Americans bought houses in the 2000s, they believed homes would provide some of that same protection, in addition to being a place to live.

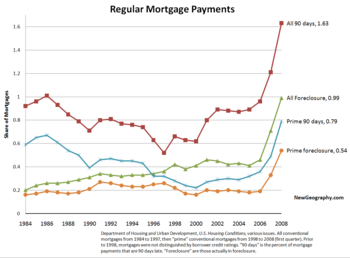

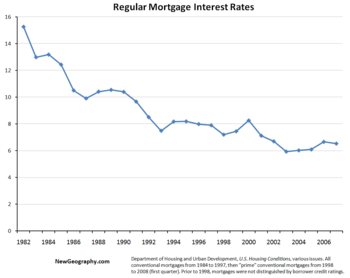

Today it is fashionable to believe that this shift to housing was a tremendous mistake. Yet our research suggests that, if done responsibly, investments in real estate have continued – even amidst the severe bubble in certain locales – to serve as a decent hedge against hard times. Real estate may have taken a dive, but, over time, the market has remained even further under water. The reality is that the percentage of regular (conventional and prime) mortgages past due and 90 days past due were higher in 1984 to 1989 (average 0.59%) than they were in 2007 (0.49%). The fact that foreclosures in regular mortgages spiked upward in 2007 and 2008 may have more to do with the Failure of Financial Innovation than with the behavior of homeowners. (Notice that the past due rate is historically much higher than foreclosure rate and they are now merging; and that regular mortgage interest rates remain at historically low levels.)

Today it is fashionable to believe that this shift to housing was a tremendous mistake. Yet our research suggests that, if done responsibly, investments in real estate have continued – even amidst the severe bubble in certain locales – to serve as a decent hedge against hard times. Real estate may have taken a dive, but, over time, the market has remained even further under water. The reality is that the percentage of regular (conventional and prime) mortgages past due and 90 days past due were higher in 1984 to 1989 (average 0.59%) than they were in 2007 (0.49%). The fact that foreclosures in regular mortgages spiked upward in 2007 and 2008 may have more to do with the Failure of Financial Innovation than with the behavior of homeowners. (Notice that the past due rate is historically much higher than foreclosure rate and they are now merging; and that regular mortgage interest rates remain at historically low levels.)

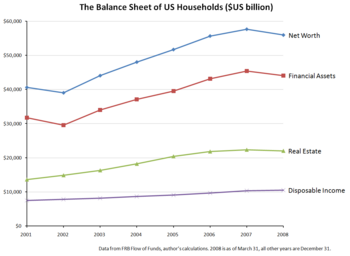

Let’s look at the record. Since the turn of the 21st century, the net worth of Americans grew six times faster than disposable income. Initially this was more the result of the increase in the value of financial assets than real estate. However, while financial assets dipped in value in 2002, real estate did not, hence the perception that houses could be a better “investment” than stocks and bonds. Real estate values continued to grow at a rate more than twice as fast as income. Last year the value of financial assets dropped 2.9%, but real estate assets dropped by only 1.4%.

Let’s look at the record. Since the turn of the 21st century, the net worth of Americans grew six times faster than disposable income. Initially this was more the result of the increase in the value of financial assets than real estate. However, while financial assets dipped in value in 2002, real estate did not, hence the perception that houses could be a better “investment” than stocks and bonds. Real estate values continued to grow at a rate more than twice as fast as income. Last year the value of financial assets dropped 2.9%, but real estate assets dropped by only 1.4%.

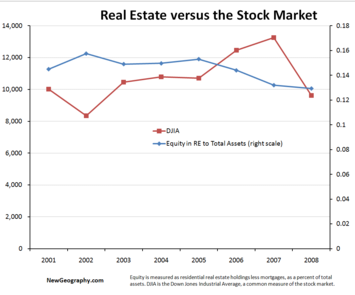

The relationship between real estate shares and stock values has changed direction and become more volatile. From 1945 through 1980, the DJIA moved with household investment in real estate and then in the opposite direction through about 2002. In 2003, 2004 and 2005, DJIA and household real estate moved in the same direction. Now, it seems to be shifting again, ironically again in favor of real estate.

The relationship between real estate shares and stock values has changed direction and become more volatile. From 1945 through 1980, the DJIA moved with household investment in real estate and then in the opposite direction through about 2002. In 2003, 2004 and 2005, DJIA and household real estate moved in the same direction. Now, it seems to be shifting again, ironically again in favor of real estate.

The stock market was never the “safe” investment. You could have invested in about 400 shares of General Motors stock at $83 a share in 2000; it closed at $3 today (with an analyst’s target price of $0). Or you could have made a down payment on a $315,000 condo in Santa Monica; and sold it this year for $680,000. When capital and productivity are again allowed to surge, we can expect the housing market to rebound first and more strongly than the stock market. Right now even amidst the perilous economic news, we believe the turn back to real estate is just beginning, although the effects probably won’t be fully felt till 2010. We see evidence of potential buyers sitting on the sidelines. There was already a surge in homes sales this summer as some buyers must have judged prices to have adjusted sufficiently in some regions.

The stock market was never the “safe” investment. You could have invested in about 400 shares of General Motors stock at $83 a share in 2000; it closed at $3 today (with an analyst’s target price of $0). Or you could have made a down payment on a $315,000 condo in Santa Monica; and sold it this year for $680,000. When capital and productivity are again allowed to surge, we can expect the housing market to rebound first and more strongly than the stock market. Right now even amidst the perilous economic news, we believe the turn back to real estate is just beginning, although the effects probably won’t be fully felt till 2010. We see evidence of potential buyers sitting on the sidelines. There was already a surge in homes sales this summer as some buyers must have judged prices to have adjusted sufficiently in some regions.

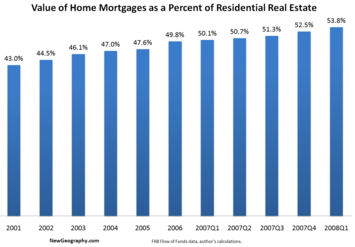

So then the question is: did the New Gold strategy work? Has homeownership shielded Americans from economic uncertainty? We think the answer is – surprisingly - “yes”. As financial markets have become increasingly volatile, regular Americans were able to access the value of their homes. The aggregate value of mortgages increased from 44.4 percent of household real estate values in 2002 to 53.8 percent at the end of the first quarter of 2008. Note that this is not merely a result of falling real estate values. Aggregate real estate holdings increased in every year except for the last one.

So then the question is: did the New Gold strategy work? Has homeownership shielded Americans from economic uncertainty? We think the answer is – surprisingly - “yes”. As financial markets have become increasingly volatile, regular Americans were able to access the value of their homes. The aggregate value of mortgages increased from 44.4 percent of household real estate values in 2002 to 53.8 percent at the end of the first quarter of 2008. Note that this is not merely a result of falling real estate values. Aggregate real estate holdings increased in every year except for the last one.

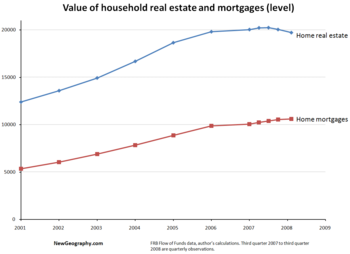

When real estate values slowed down, mortgage values slowed down even more. And, obviously, it isn’t because the bank reduced the value of the mortgage! It can only be because homeowners continued paying on existing balances.

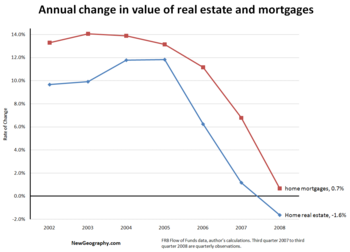

Before the “subprime crisis”, household real estate values grew at an increasing rate – from 9.9% in 2003 to 11.8% in 2004. But the growth of mortgages slowed from 14.1% in 2003 to 13.9% in 2004 and to 13.1% in 2005 when the growth of household real estate remained constant. What was happening here? I think millions of responsible American households were paying into equity. And when things got tough in 2007, some of them dipped into that equity. Not to remodel the kitchen or to buy a boat; but to expand their small business or start their kids in college. These homeowners are “the rest of us who have been prudent and responsible” as Roger Randall called them in a Letter to the Editor of USA Today (November 11, 2008). Mr. Randall asks the question: “Where can the prudent sign up for rewards?” The answer is: Anyone who protected their credit score over the last 8 years can still get a “no-doc” mortgage and bank credit for their small business. When a mortgage broker I know lamented that he couldn’t write a mortgage for anyone with a credit score under 600, I asked: “If someone has a credit score of 585, should they be buying a house?” Of course, the answer is “no.”

Before the “subprime crisis”, household real estate values grew at an increasing rate – from 9.9% in 2003 to 11.8% in 2004. But the growth of mortgages slowed from 14.1% in 2003 to 13.9% in 2004 and to 13.1% in 2005 when the growth of household real estate remained constant. What was happening here? I think millions of responsible American households were paying into equity. And when things got tough in 2007, some of them dipped into that equity. Not to remodel the kitchen or to buy a boat; but to expand their small business or start their kids in college. These homeowners are “the rest of us who have been prudent and responsible” as Roger Randall called them in a Letter to the Editor of USA Today (November 11, 2008). Mr. Randall asks the question: “Where can the prudent sign up for rewards?” The answer is: Anyone who protected their credit score over the last 8 years can still get a “no-doc” mortgage and bank credit for their small business. When a mortgage broker I know lamented that he couldn’t write a mortgage for anyone with a credit score under 600, I asked: “If someone has a credit score of 585, should they be buying a house?” Of course, the answer is “no.”

Sure, you can deride this activity as Americans “treating their homes like piggy banks.” But the reality is that millions of Americans planned it this way. With a fiscally responsible approach to homeownership and financing, they have been and will continue to be able to insulate themselves from the worst of economic times. Good as Gold!

Sure, you can deride this activity as Americans “treating their homes like piggy banks.” But the reality is that millions of Americans planned it this way. With a fiscally responsible approach to homeownership and financing, they have been and will continue to be able to insulate themselves from the worst of economic times. Good as Gold!

Susanne Trimbath, Ph.D. is CEO and Chief Economist of STP Advisory Services. Dr. Trimbath’s credits include appearances on national television and radio programs. Dr. Trimbath is a Technical Advisor to the California Economic Strategy Panel and Associate Professor of Finance and Business Economics at USC’s Marshall School of Business. Dr. Trimbath was formerly Senior Research Economist at the Milken Institute and Senior Advisor on the Russian capital markets project for KPMG.

Hmm

In 2003 you claimed that [t]his is very simple. If you can afford to buy, it's very difficult – though not impossible – to get hurt." You said that in 2003 (and still have it up on your web site). In fact housing prices were a vast bubble and despite the cheer leading of all manner of talking heads, it all came crashing down and millions have been badly hurt. I guess it wasn't all that simple eh?

Re: Hmm

It was simple for a lot of people, but certainly not for those who speculated. Price speculation (among other things) inflated the bubble; I shed no tears when speculators and flippers get hurt.

Tears?

Who's talking about tears? The fact remains that you were fantastically wrong and when the party was over a whole lot of naifs who thought prices would always rise --- not just flippers etc -- ended up holding the bag.

What bag?

Across the board, adjusted and unadjusted, in every region and for the USA as a whole, the home price index is up 5.6% from January 2003 to October 2008.

http://www.ofheo.gov/media/hpi/MonthlyIndex_to_1991.xls

What's your point?