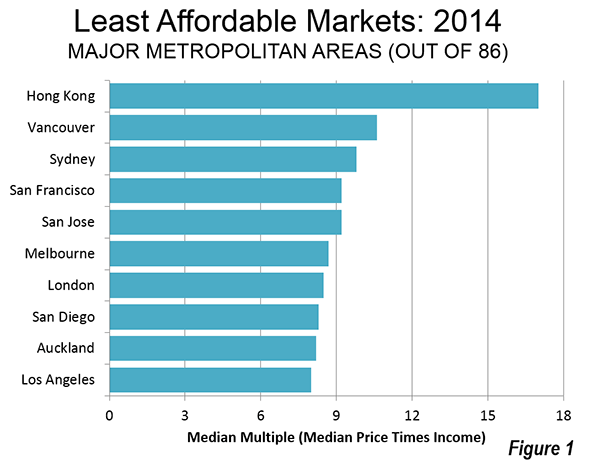

The just released 11th Annual Demographia International Housing Affordability Survey shows the least affordable major housing markets to be internationally to be Hong Kong, Vancouver, Sydney, along with San Francisco and San Jose in the United States. Honolulu, which should reach 1,000,000 population this year (and thus become a major metropolitan market) was nearly as unaffordable as San Francisco and San Jose. An interactive map in The New Zealand Herald illustrates the results.

Rating Housing Affordability

The Demographia International Housing Affordability Survey uses the "median multiple" price-to-income ratio. The median multiple is calculated by dividing the median house price by the median household income. Following World War II, virtually all metropolitan areas in Australia, Canada, Ireland, New Zealand, the United Kingdom and the United States had median multiples of 3.0 or below. Since that time, housing affordability has been seriously retarded in metropolitan areas that have been subjected to urban containment policies. This includes virtually metropolitan areas of the United Kingdom, Australia, New Zealand and some markets in the United States and Canada.

Housing affordability ratings are indicated in Table 1.

| Table 1 | |

| Demographia International Housing Affordability Survey | |

| Housing Affordability Rating Categories | |

| Rating | Median Multiple |

| Severely Unaffordable | 5.1 & Over |

| Seriously Unaffordable | 4.1 to 5.0 |

| Moderately Unaffordable | 3.1 to 4.0 |

| Affordable | 3.0 & Under |

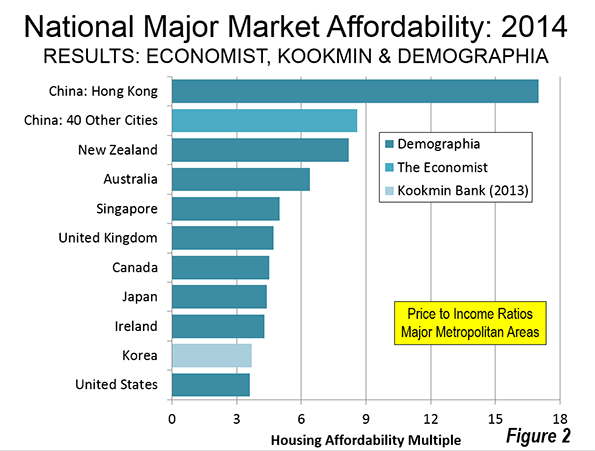

Table 2 summarizes housing affordability ratings for the 86 major metropolitan areas in the nine nations covered. Apart from China (Hong Kong), the least affordable nation among the major markets is New Zealand, at 8.2, followed by Australia at 6.4. Both nations (and Hong Kong) are rated severely unaffordable.

| Table 2 | ||||||

| Housing Affordability Ratings by Nation: Major Markets (Over 1,000,000 Population) | ||||||

| Nation | Seriously Unaffordable (4.1-5.0) | Severely Unaffordable (5.1 & Over) | ||||

| Affordable (3.0 & Under) | Moderately Unaffordable (3.1-4.0) | Total | Median Market | |||

| Australia | 0 | 0 | 0 | 5 | 5 | 6.4 |

| Canada | 0 | 2 | 2 | 2 | 6 | 4.3 |

| China (Hong Kong) | 0 | 0 | 0 | 1 | 1 | 17 |

| Ireland | 0 | 0 | 1 | 0 | 1 | 4.3 |

| Japan | 0 | 1 | 1 | 0 | 2 | 4.4 |

| New Zealand | 0 | 0 | 0 | 1 | 1 | 8.2 |

| Singapore | 0 | 0 | 1 | 0 | 1 | 5 |

| United Kingdom | 0 | 1 | 10 | 6 | 17 | 4.7 |

| United States | 14 | 23 | 6 | 9 | 52 | 3.6 |

| TOTAL | 14 | 27 | 21 | 24 | 86 | 4.2 |

Least Affordable Major Markets

Hong Kong registered the highest median multiple out of the 86 major markets and also in the history of the Survey, at 17.0. Vancouver reached 10.6. Sydney had its worst recorded housing affordability, with a median multiple of 9.8. Adjacent metropolitan areas San Francisco and San Jose had median multiples of 9.2, while Honolulu's median multiple was 9.0. The ten least affordable major metropolitan areas are shown in Figure 1. In nine of these markets, housing was affordable before adoption of urban containment policy (Hong Kong data is not available).

Affordable Major Markets

All of the affordable major markets are in the United States. This includes perhaps the most depressed market, Detroit as well as Atlanta, which has spent most of the last three decades as the fastest growing larger metropolitan area in the high income world. At the same time, Atlanta has consistently been among the most affordable. Detroit's median multiple is 2.0, while Atlanta's is 2.9.

Comparing Demographia Results to The Economist and Kookmin Bank

This year's edition includes a comparison of housing affordability multiple data from The Economist's survey of 40 metropolitan areas in China and Kookmin Bank's survey of major metropolitan areas in South Korea. The least affordable major markets are in China, New Zealand and Australia, all with severely unaffordable median multiples. The most affordable major markets are in the United States and Korea, both rated as moderately unaffordable (Figure 2).

Perspective

Hugh Pavletich, of performanceurbanplanning.com and I have published each of the annual editions, which began in 2005. The perspective of the Demographia International Housing Affordability Survey is that domestic public policy should, first and foremost be focused on improving the standard of living and reducing poverty. This requires policies that facilitate both higher household incomes and lower household expenditures (other things being equal). Housing costs are usually the largest component of household expenditure and it is therefore important that public policy both encourage and preserve housing affordability.

Housing Affordability and Urban Containment Policy

However, in recent years, land use policy has not been focused on this concern. Conventional urban theory sees urban containment as a necessity. Yet, urban containment policies are associated with the loss of housing affordability, due principally to their rationing of land for development. This effect is consistent with basic economics – restricting supply of a desired good tends to drive up prices – that has been long established.

Some of the most important contributions have come from Sir Peter Hall, et al (see The Costs of Smart Growth Revisited), Paul Cheshire at the London School of Economics (New Zealand Seeks to Avoid "Generation Rent") and William Fischel at Dartmouth University (The Consequences of Smart Growth). Donald Brash, former governor of the Reserve Bank of New Zealand attributed the housing affordability losses to "the extent to which governments place artificial restrictions on the supply of residential land" in his introduction to the 4th Annual Edition.

The Importance of Urban Expansion

This year's introduction is provided by Dr. Shlomo Angel, leader of the New York University Urban Expansion Program. Dr. Angel reminds us that "where expansion is effectively contained by draconian laws, it typically results in land supply bottlenecks that render housing unaffordable to the great majority of residents."

He describes the Urban Expansion Program is "dedicated to assisting municipalities of rapidly growing cities in preparing for their coming expansion, so that it is orderly and so that residential land on the urban fringe remains plentiful and affordable." Urban Expansion Program teams are already working with local officials in Ethiopia and Colombia to achieve this goal. Angel's previous work documented the association between urban containment policy in Seoul and large house price increases relative to incomes (see Planet of Cities).

Policies seeking the same goals of plentiful and affordable land on the urban fringe are just as necessary in high income world metropolitan areas.

As time goes on, the negative consequences of urban containment policy on housing affordability and the standard of living have been increasingly acknowledged. Christine Legarde, managing director of the International Monetary Fund said that "supply-side constraints will require further measures to increase the availability of land for development and to remove unnecessary constraints on land use." in a recent statement on housing affordability in the United Kingdom.

Similarly a recent feature article in The Economist (see PLACES APART: The world is becoming ever more suburban, and the better for it) noted that the only reliable way to stop urban expansion was to stop them forcefully (such as through urban containment policy). Yet, The Economist continued, "But the consequences of doing that are severe" and cites the higher property prices that have been the result:"

The Economist continued to note the effect of the policy on households: "It has also forced many people into undignified homes, widened the wealth gap between property owners and everyone else..."

Wendell Cox is principal of Demographia, an international public policy and demographics firm. He is co-author of the "Demographia International Housing Affordability Survey" and author of "Demographia World Urban Areas" and "War on the Dream: How Anti-Sprawl Policy Threatens the Quality of Life." He was appointed to three terms on the Los Angeles County Transportation Commission, where he served with the leading city and county leadership as the only non-elected member. He was appointed to the Amtrak Reform Council to fill the unexpired term of Governor Christine Todd Whitman and has served as a visiting professor at the Conservatoire National des Arts et Metiers, a national university in Paris.

Photo: Exurban London

this is the reason why a lot

this is the reason why a lot of fiolks are moving to CAbuy youtube worldwide views

Toronto Housing Affordability Report includes location costs

A new Royal Bank/Pembina report supports Todd Litman's comprehensive analysis of housing affordability: http://www.pembina.org/pub/location-matters. I hope this improves DIHA survey research.

Martin Collier

Founder, Transport Futures

www.transportfutures.ca

Baffling 'em with BS if the facts don't support your ideology

That report is subject to the same non-objective approach to housing affordability that Litman's is. It uses hypothetical households within a city under a status quo set of choices, which says NOTHING regarding the potential options if their city was a median-multiple-3 city rather than a median-multiple 6+ one.

It is utter nonsense that there are sufficient savings to be made ANYWHERE and everywhere in the system of household costs, to compensate for ALL potential housing choices being inflated in cost. In every single hypothetical household's case, the cheapest option by far, not mentioned, is moving to a median multiple 3 city. Even if in that city, they have less transit options. There is no lack of options anyway for arranging your lifestyle around walkability, this is a feature of individual choice, not something that planners enable more of by their smartness.

Philadelphia's high level of walking and cycling is very much helped by its low costs of most housing options, which in turn is a function of the total urban area's sprawl at low density for dozens of miles.

I have explained repeatedly on this forum: the inflation when there is growth containment policies, is all in the land. This results in depreciated structures on small lots near city centres, inflating in price from <$100,000 to >$500,000 - this has been experienced in city after city. The immediate result is to deny lower income earners the means by which they used to be able to live in more efficient locations.

Upzoning and building townhouses and apartment blocks NEVER restores any housing option as affordable as what existed prior to the growth containment policy. In systemically affordable cities with a freely-growing fringe, these efficiently located townhouse and apartment options are absurdly low cost because there is no capture of increased site rent - all increases in earnings by site owners, are return on actual capital invested in actual structures.

Also because of the inflation in the price of land, while the median multiple might increase from 3 to 6, the "bottom quintile multiple" almost certainly rises from 3 to 8 or 9 or 10. The <$100,000 home used to be bought by circa-$30,000 income earners - the lowest price option following the inflation tends to be at least $300,000 and generally higher. Hence a "bottom quintile multiple" of 8 or 9 or 10.

We live in a time where we allege to care more about the poor we might have in harsher, more conservative times. But the remaining harsh conservative cities with low house prices are where the lower income earners are migrating in droves because they know what is good for them, while the Marie Antoinettes in urban planning probably do not truly care, period, let alone know.

Demographia's Housing Affordability Survey Appears to be Biased

In a recent Planetizen column, "What is a 'House'? Critiquing the Demographia International Housing Affordability Survey" (http://www.planetizen.com/node/70829 ) I point out that Demographia's "International Housing Affordability Survey" is apparently biased by overweighting single-family homes and underweighting or ignoring multi-family housing, which tends to exaggerate housing inaffordability in more compact cities.

For example, the Survey rated Vancouver as the second least affordable housing among cities studied, with a 10.3 Median Multiple. In the Vancouver region, single-family housing prices average nearly a million dollars, but they represent less than half of all home sales. Townhouse prices are approximately half and apartments (including condominiums) about a third of the single-family housing prices. If calculated based on single-family housing prices the multiple is 13.1, but a more reasonable 8.8 if calculated using a weighted average, and only 5.1 for apartments.

As discussed in my column, "How Not To Measure Housing Affordability" (http://www.planetizen.com/node/68305 ), most experts now recommend that affordability be calculated based on combined housing and transportation expenses to account for the trade-offs households often make between these costs. In automobile-dependent communities households devote about 20% of their budgets to transportation, but this declines to about 5% in accessible, multi-modal locations. As a result, in accessible, multi-modal cities such as Vancouver, households can increase the portion of their household budget devoted to housing from 25% to 40% and still stay within a 45% total limit, a 60% increase. This means that is a 4.0 Median Multiple is considered affordable in an automobile dependent location then a 6.4 Multiple is affordable in a transit-oriented neighborhood.

Described differently, although in Vancouver most moderate-income households may find single-family housing unaffordable, they can afford to purchase a townhouse or condominium in a walkable and transit-oriented neighborhood if they reinvest their transportation cost savings into their mortgage payments. It is therefore inaccurate to simply categorize Vancouver as unaffordable: single-family housing in popular neighborhoods may be, but not housing overall.

However, we cannot be sure of how and how much their analysis is biased because the Housing Affordability Survey does not clearly explain its methodologies or share data. I asked the authors to do so by email and in my Planetizen column, but they never responded.

Wendell, please make your data available to other researchers so it can be peer reviewed.

* * *

Todd Litman is founder and executive director of the Victoria Transport Policy Institute (www.vtpi.org), an independent research organization dedicated to developing innovative solutions to transport problems.

Litman the red herring specialist, the tool and the enabler

Todd Litman’s complaint is a red herring, one that he repeatedly resorts to against objective analysis of these issues.

If we compare the cost of stand-alone family housing in Houston (or any affordable city) and Vancouver, and the cost of city apartments in Houston (or any affordable city) and Vancouver, the difference is similar in both cases.

The housing plus transport cost options are the same everywhere, with the exception of the "housing" component of it. Transport cost savings capitalise into location values. If the housing cost component goes up, the "H+T" cost also goes up by the same amount. No-one who does not understand this, should be regarded as a credible voice on these issues.

These anti-objective arguments only get any traction at all because crony capitalist rentiers and financiers want to gouge the maximum possible out of the productive economy and its workers, and second, there is a constituency of economically illiterate, eco-crypto-totalitarians who love to be able to cite anything with an appearance of being "authoritative", in confirmation of their shallow and childish fantasies regarding how the world works.

The aggregate rent for a given footprint of land is tens, hundreds or thousands of times higher in cities that drink the growth containment Kool-Aid. This is essentially a tool of economic child abuse. Advocates imperviousness to evidence and reason in years of debate already, indicates a total lack of either competence or conscience.

This kind of mind never understands "unintended consequences".

From Litman's Planetizen articles:

"....even if sprawl can reduce housing costs it increases other costs (transportation costs, commute duration, traffic fatalities and other health problems)...."

Here is a source of data on total living costs by city:

comparebloomington.us/include/reportsmedia_157_2541343573.pdf

No correlation observable there, unless perhaps that denser cities with higher housing costs also have higher costs of EVERYTHING.

Increased commute duration: nonsense: in all data sets of sufficient scope, there are no lower density cities that are outliers on the high side. All the outliers on the high side are high density cities. Apart from that there is little correlation.

"Other health problems" are systematically higher in high density cities, period. Environmental quality related health issues, psychological health issues, crowding related health issues.

"....it is wrong to assume, as Smart Growth Critics often do, that urban containment policies are the main cause of housing unaffordability. Yes, constrains on urban expansion drive up land unit costs (dollars per acre), but this can be offset if housing policies allow more compact, land-efficient housing types, for example, shifts from large-lot (1 acre) to small-lot (1/10 acre) single-family; townhouses (1/20 acre); low-rise (1/40 acre); or high-rise (1/80 acres) housing types...."

In real life there is not a shred of evidence to support this assertion. In every city in the world where these policies are enacted, site rents rise faster than households trade off space and stack up. Hong Kong with 63,000 people per square mile has a median multiple of 15 or more and this is definitely a median with apartments as the main housing type. In contrast, all median multiple 3 cities range from 5000 people per square mile downwards, some as low as 1800. And the correlation between the extremes is in the direction of greater density, higher cost of housing UNIT. For example, UK cities fall between the US and Kong Kong in density and their median multiples range between 6 and 9.

Upzoning within growth boundaries merely increases site rents instantly even before they are developed or redeveloped. Even if they are not developed or redeveloped at all. In fact it becomes less likely they WILL be developed or redeveloped. See if you can explain the observation in the latest McKinsey Global Housing Affordability Report, that 45% of sites in London with development permission remain idle - in a city where "height limits" are a red herring excuse for unaffordability in the face of a market systemically distorted by the Green belt and strict Planning quotas. I snorted recently when I noticed a complaining-tone article from Auckland, NZ that since the growth boundary was imposed (and house prices have skyrocketed), site owners are sitting on inflating-value sites and not getting them developed at all. Well, DUH, urban planners!

Litman has always used the wrong statistics, breaching principles of statistical objectivity in the process, to support an argument; he uses cross-sectional analyses of hypothetical households within a city, he never uses big dataset comparisons of "whole city" outcomes over time. He is a moral inheritor of the tradition of grand central planning that turned millions of eastern European lives into tragedy for decades, and what is more, the related tradition of propaganda fed to the helpless victims. This kind of mind either never understands "unintended consequences", or is secretly driven by a vested interest in harmful land rent creation irrespective of that harm.

More Critique of International Housing Affordability Survey

Thank you for your comments, Mr. Best.

I can see that we will need to agree to disagree. I encourage anybody who wants to make their own judgement concerning whether the International Housing Survey is biased to read my latest Planetizen blog, "More Critique of Demographia's International Housing Affordability Survey" (http://www.planetizen.com/node/73400/more-critique-demographias-internat... ) which provides specific evidence that:

* The Survey overweights single-family housing and underweights multi-family housing, and so overstates average housing prices in compact cities where a greater share of affordable housing is multi-family. I have asked Mr. Cox to clarify this information, but he has not responded.

* The analysis ignores the additional transportation and infrastructure costs of sprawled locations, which offset lower housing costs. A low-priced house is not truly affordable if its location has high transport costs. Experts recommend that affordability be evaluated based on combined housing and transport expenditures in recognition of the trade-offs that households often make between these costs (www.locationaffordability.info ).

* The Survey argues that high housing costs in compact cities such as San Francisco and Washington DC result entirely from urban growth boundaries, ignoring other factors, such as regulations that limit urban infill, which many experts consider a larger cause of housing unaffordability (see, for example, this great analysis by Kim-Mai Cutler: http://techcrunch.com/2014/04/14/sf-housing ).

Todd Litman is founder and executive director of the Victoria Transport Policy Institute (www.vtpi.org), an independent research organization dedicated to developing innovative solutions to transport problems.

That is an argument???

Mr Litman: you have not engaged with a single point that I made. All you have done is smoothly repeat your falsehoods and those of other people like you, as if this makes them true. Yes, indeed, I encourage people to make their own judgements.

There are plenty of young people out there in the real world of housing choices who will know immediately who is stating the truth of this issue. The more of them who get enlightened and start a rebellion against this crony capitalist racket and its enablers, the better. This is an issue where young people on both the liberal left and the free market right can usefully agree on the morality implicit in the issue, and its importance.

Those "many experts" cannot point to a single growth-contained city where infill has resulted in systemic housing affordability. They cannot point to a single growth-contained city where smaller dwellings cost less than the large dwellings in median multiple 3 cities. In fact the correlation in the data runs in the direction the denser the city is, the higher its median multiple. ALL median multiple 3 cities are far lower density than ALL the fringe growth contained cities, NONE of which have a median multiple much below 6 and more usually well over it.

The "many experts" cannot point to a single CITY where "housing plus transport" costs in aggregate are lower because of a growth boundary - the difference in housing costs alone will exceed the average transport cost, per household, in the uncontained city. It is impossible for anyone in Toronto or Melbourne or Auckland to be better off with house prices as they now are, compared to little more than a decade ago.

The "many experts" are bought-and-paid-for tools of crony capitalist rentiers, including big finance.

I will agree that in some cities there is no specific growth boundary policy but rural zoning has the same effect. This is not "anti density" regulations, this is "anti fringe growth". This needs to be addressed by government just as urgently as specific growth boundary policies if economic harm and economic child abuse effects are to be averted.

More Critique of International Housing Affordability Survey

Thanks for your comments, Mr. Best,

Your evidence of reduced affordability in cities with smart growth policies is based on results from Demographia's Housing Affordability Survey which my research indicates is biased in ways that exaggerate the affordability of sprawled locations by underweighting more affordable, compact urban housing and overlooking the additional transport costs in sprawled locations. Similarly, the C2ER Cost of Living Index is designed to measure the expenditures of affluent (top income quintile) households and so does not reflect true affordability.

Evidence presented in my Planetizen blogs indicates that sprawled development increases various costs, and the relatively high housing costs in cities such as San Francisco, Vancouver and London result as much from restrictions on compact, infill development as on urban containment policies.

* * * *

Todd Litman is founder and executive director of the Victoria Transport Policy Institute (www.vtpi.org), an independent research organization dedicated to developing innovative solutions to transport problems.