Is long term privatization of government assets in the form of leases or concessions a good idea?

The answer is not Yes or No but rather What and How.

Done right, long-term privatization can be a great thing to the public. But given the multi-decade nature of some of these deals, the risk of getting it wrong is high.

My new Manhattan Institute research paper The Lessons of Long-Term Privatizations: Why Chicago Got It Wrong and Indiana Got It Right looks at two privatization deals, the Chicago parking meter lease and the Indiana toll road lease, and draws lessons about the right kinds of assets to lease and the things you need to get right while leasing them.

I identify several flaws in the Chicago parking meter lease as compared to the Indiana Toll Road one, grouped into two categories:

- Things Chicago managed poorly in the transaction (how items). These include the public review process, the transition to the private vendor, squandering the proceeds, and impairing future revenue streams. None of these invalidates the idea of privatization, but rather are areas where governments need to focus to get it right.

- Reasons why parking meters are a bad kind of asset for long term leases (what items). These include regular, recurring compensation events and the dynamic and close interaction of on street parking with neighborhood health and other public policy considerations.

Note that I do not critique the amount of money Chicago got for leasing its parking meters. This is a debatable item at best.

I also do not criticize privatization of parking meter operations. Nobody cares who takes the quarters out of the meter.

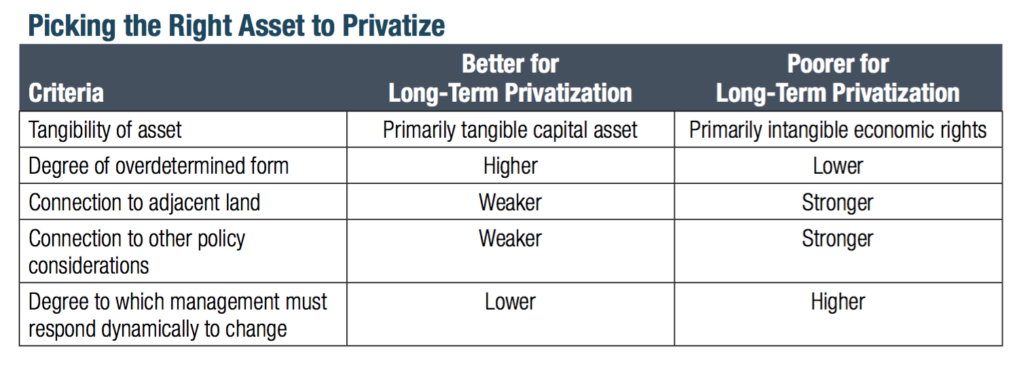

Contrasting toll roads with parking meters, I created a matrix of characteristics to help determine whether or not an asset is a good candidate for privatization.

Items that would appear to be better candidates for long term privatizations would be toll roads and bridges, airports, ports, and hospitals.

Click through to read the entire report.

Greg Hinz at Crain’s Chicago Business kindly posted some of his thoughts about the study.

Aaron M. Renn is a senior fellow at the Manhattan Institute, a contributing editor of City Journal, and an economic development columnist for Governing magazine. He focuses on ways to help America’s cities thrive in an ever more complex, competitive, globalized, and diverse twenty-first century. During Renn’s 15-year career in management and technology consulting, he was a partner at Accenture and held several technology strategy roles and directed multimillion-dollar global technology implementations. He has contributed to The Guardian, Forbes.com, and numerous other publications. Renn holds a B.S. from Indiana University, where he coauthored an early social-networking platform in 1991.