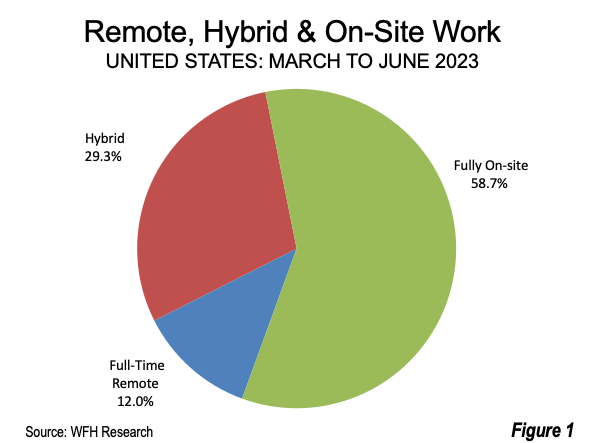

Despite the continuing pressure from employers for employees to work on-site, working from home continues at a strong pace. Just released data from WFH Research indicates that 41.3% of US workers worked at home at least part of the time between March and June 2023. Among these, 29.3% had “hybrid” work schedules, consisting of working at home part time. Another 12.0% worked full-time from home. This left 59.7% of workers on-site five days per week (Figure 1).

WFH also reports that 28% of full workdays were remote or hybrid during the first six months of 2023. This figure has barely changed from 30% or slightly below since the first quarter of 2022 six times the pre-pandemic level of 4.7 percent.

Reduced Downtown Activity

The nation’s downtown areas (central business districts or CBDs) had work forces — essentially people working on computers — particularly susceptible to being performed from home. They were also made up of people who previously took transit and suffered the longest commutes. The seven largest downtowns are in seven municipalities (cities, in contrast with metropolitan areas) that account for 60% of all the transit work trip destinations in the United States (New York City, Chicago, Philadelphia, San Francisco, Boston, Washington and Seattle). These cities have only seven percent of the nation’s jobs, according to American Community Survey data yet have nearly 10 times as large a share of transit work trip destinations than their share of employment.

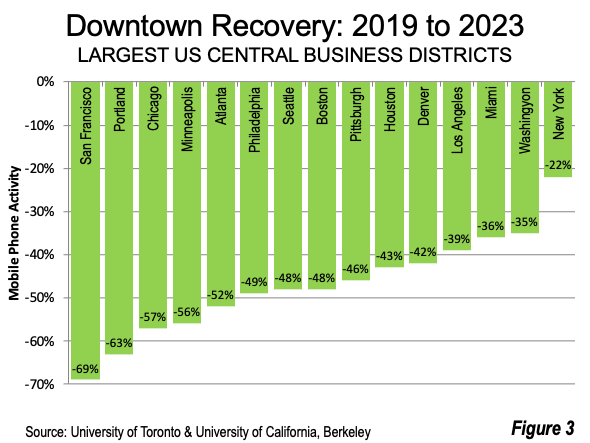

Economic activity in these downtowns has fallen substantially and not returned to its former level, according to research at the School of Cities at the University of Toronto. Among the cities with the seven largest CBD’s New York which is the largest CBD in the US, has done the best, now 22% below its pre-pandemic level (based on mobile phone activity) as reported in April 2023. The weakest recovery has been in downtown San Francisco, the fourth largest CBD, now 69% below its 2019 level. Downtown San Francisco has experienced a steep decline in retail activity as well (see Photograph above).

Chicago, home of the second largest CBD in the United States, was down 57%. Philadelphia was down 49%, Seattle and Boston were each down 48%, and Washington was down 35% (Figure 2).

Among the CBDs outside the top seven, three had activity reductions compared to 2019 greater than 50%. These included Portland, with a loss of 59%, Minneapolis, with a loss of 56% and Atlanta, with a loss of 52%.

The average overall loss was 47% in the 15 downtown areas.

Demand for Working from Home Exceeds Supply

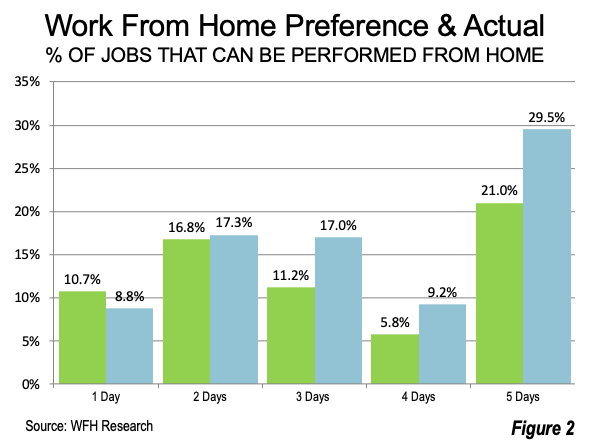

WFH research also reported that employees have a greater appetite for working at home than their employers. The differences with respect to one- and two-day schedules are relatively minor. However, more than 50% of employees would like to be able to work at home for three or four days, compared to the present situation. Forty percent of employees would like to be permitted to work at home five days per week, compared to the present situation (Figure 3).

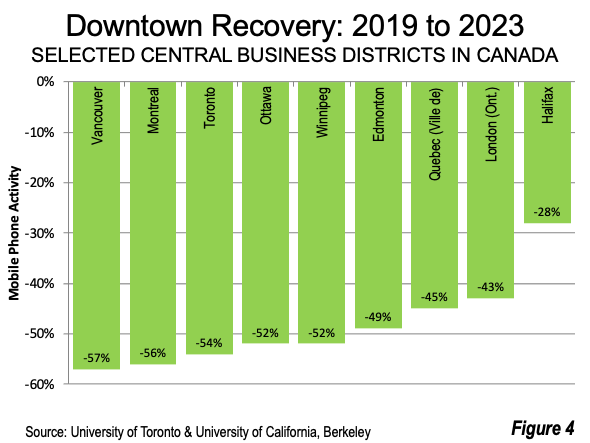

CBD Activity Losses in Canadian Metropolitan Areas

The School of Cities research also provides data on larger CBDs in Canada. The three largest CBDs had the largest drop-in activity between 2019 and 2023. Toronto was down 54%, Montreal 52% and Vancouver 57%. The fourth largest downtown was in Calgary, for which data is not reported. Ottawa had the fifth lowest, at a 52% decline and tied with Winnipeg (Figure 4). The most favorable recovery was in Halifax, the one Maritime metropolitan area included in the data. The Maritimes have experienced a spurt of net domestic migration in recent years, which may have contributed to the better performance of Halifax (see: “Canadians on the Move to Smaller Communities”). The average recovery in the eight Canadian metropolitan areas was an activity loss of 49%. Statistics Canada reported that the decline in working from home from the peak of the pandemic was less in Canada than in the United States.

Remote and Hybrid Working Seems Here to Stay

The indications are that remote and hybrid working from home are here to stay. University of Toronto urban planning professor Richard Florida told Marketplace that “Remote work is just the latest technology that stretches the boundaries of metropolitan areas.” In other words, urbanization and labor markets are dispersing well beyond the metropolitan focus that has been dominant since -World War II, driven by the preferences of both present and future.

Wendell Cox is principal of Demographia, an international public policy firm located in the St. Louis metropolitan area. He is a founding senior fellow at the Urban Reform Institute, Houston, a Senior Fellow with the Frontier Centre for Public Policy in Winnipeg and a member of the Advisory Board of the Center for Demographics and Policy at Chapman University in Orange, California. He has served as a visiting professor at the Conservatoire National des Arts et Metiers in Paris. His principal interests are economics, poverty alleviation, demographics, urban policy and transport. He is co-author of the annual Demographia International Housing Affordability Survey and author of Demographia World Urban Areas.

Mayor Tom Bradley appointed him to three terms on the Los Angeles County Transportation Commission (1977-1985) and Speaker of the House Newt Gingrich appointed him to the Amtrak Reform Council, to complete the unexpired term of New Jersey Governor Christine Todd Whitman (1999-2002). He is author of War on the Dream: How Anti-Sprawl Policy Threatens the Quality of Life and Toward More Prosperous Cities: A Framing Essay on Urban Areas, Transport, Planning and the Dimensions of Sustainability.

Photo:Shopping center location of the Nordstrom downtown San Francisco store, set to close by the end of August 2023, by author.

Canada

Falloff there as well is interesting. Are there similar apprehensions about crime, such as are influence U.S. data?