During the first ten days of October 2008, the Dow Jones dropped 2,399.47 points, losing 22.11% of its value and trillions of investor equity. The Federal Government pushed a $700 billion bail-out through Congress to rescue the beleaguered financial institutions. The collapse of the financial system in the fall of 2008 was likened to an earthquake. In reality, what happened was more like a shift of tectonic plates.

History will record that the tectonic plates of our financial world began to drift apart in the fall of 2008. The scale of this change may be most visible in who controls the energy that powers our world.

***********************************

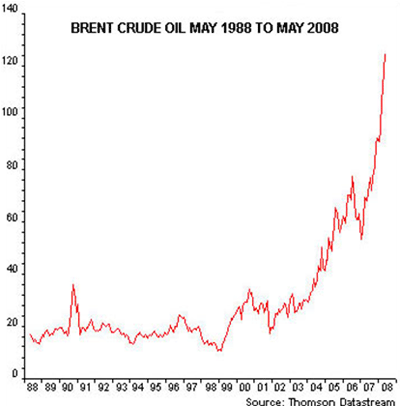

May 2008 brought with it the highest price on record for Brent Crude Oil – $148 per barrel. At the pump that translated into prices in excess of $4.00 per gallon. A sixteen gallon fill-up of a Toyota Prius in Los Angeles cost its owner $72.00 and a fill-up of a twenty-five gallon Cadillac Escalade set its owner back more than $100.00. The largest transfer of wealth in the history of mankind was underway and consumers were feeling the pinch.

The countries that border the Persian Gulf produce and export 20,000,000 barrels of oil per day. At its peak in May of 2008, the Persian Gulf producers (Saudi Arabia, Iran, Iraq, Kuwait, Qatar and the U.A.E) were receiving $3 billion per day, $90 billion per month and $1 trillion per year in revenues from the industrialized nations of the world, including the EU, North America and, most importantly, the rising powers of India and China.

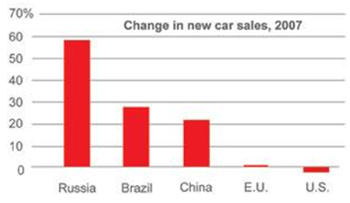

These Persian Gulf nations are mostly monarchies controlled by individuals, royal families or at best a few power brokers. American consumers abandoned their love affair with the SUV and Detroit’s assembly lines began to grind to a halt. New car sales which peaked at 17 million units in 2007 plummeted to a rate of 9.2 million within six months. The inventory of unsold vehicles built up and led inexorably to the bankruptcies of Chrysler and General Motors.

At the same time, the airlines began charging for checked bags and discontinued the ubiquitous bag of peanuts as they reeled under the cost of jet fuel. Bellicose despots in oil rich lands outside the Middle East used their new found wealth to rattle their sabers. Russia, the world’s second largest oil producer after Saudi Arabia, began flying their venerable Backfire bombers to the American coast. Hugo Chavez of Venezuela, the world’s ninth largest oil producer, used his oil wealth to turn himself into an icon of the anti-gringo sentiment always beneath the surface throughout Latin America.

Politicians, who placed America’s coastline off limits for drilling, were forced to recant their precious moratorium under the growing chorus of “Drill here and drill now”. Environmentalists, who destroyed the nuclear power industry with fearmongering over its safety, were increasingly on the defensive. T. Boone Pickens invested millions of his own money to promote wind farms – and more importantly natural gas – across America’s heartland. Sales of little known Jatropha seeds, a plant indigenous to India that produces an oil clean enough to run a diesel engine, skyrocketed. By the fall of 2008, the financial markets were buckling under the strain.

As the economies of the world contracted, demand for oil plummeted and the price of crude collapsed. Terrified by the apparent mismanagement of the economy by the Republicans, Americans elected an untested junior Senator to the most powerful position in the world. Predictably, plans for alternative energy withered as prices plummeted and gas dropped to $1.50 per gallon. Russia, whose cost to develop crude is $50 per barrel, lost its swagger as its currency and stock market collapsed with the price of crude. The collapse of oil to $35 per barrel even silenced Hugo Chavez, at least for a moment.

Sadly, the America public lost interest in energy as they were distracted by a 40% loss in their 401ks, corporate bankruptcies and the growing numbers of lay-offs. Politicians quickly shifted their focus from drilling, nuclear energy and independence from imported oil and began espousing the Obama administration mantra of “green energy” and “green collar jobs”. Unfortunately, these words are just a chimera since they are likely, even with massive subsidy, to produce only a small fraction of the nation’s energy for at least decade or two.

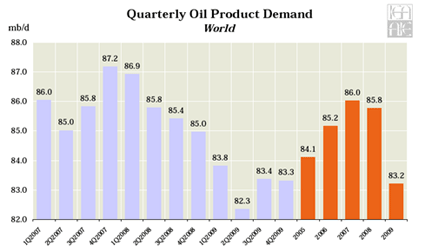

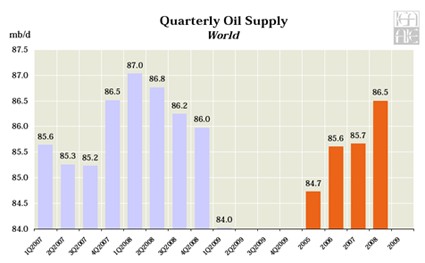

These ephemeral goals only mask the real problem: America’s dependence on imported oil. The world demand for oil averages 85 mbd (million barrels per day). In the darkest days of the global financial crisis during the spring, when we stood at the abyss of The Great Depression, demand dropped to just 82.3 mbd. Conversely, world oil supply peaked at 87 mbd in 2007. This relative parity between supply and demand eliminates the elasticity that puts some control on prices. With literally no elasticity, speculators know that buyers will purchase every barrel of oil and prices rise. The proof of this market force is visible at the pump where gasoline has crested $3.00 per gallon in California and more than $2.66 per gallon nationwide. The United States consumes 20,000,000 barrels of oil per day or 24% of the world’s supply. In previous decades this was not a problem because the United States was a major producer of oil. But our peak production was reached in the 1970s when the US imported just 35% of its oil. Today we import more than 66% and no longer can influence the price of black gold. That price is now determined by despots in the Persian Gulf, Russia and Venezuela.

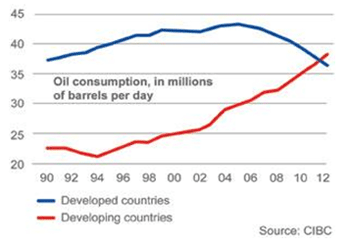

This problem is not going away soon. According to the Energy Information Agency of the U.S. Government, the world demand for oil will require an additional 44 million barrels of oil every day to meet projected demand. The increase of demand is not going to come from the American or European markets. The developed nations through conservation, fuel standards, a reinvigorated nuclear power industry and, over time, the push for alternative fuels will actually reduce their consumption over the next twenty years. The push will come from India, Russia, Brazil, and of course China.

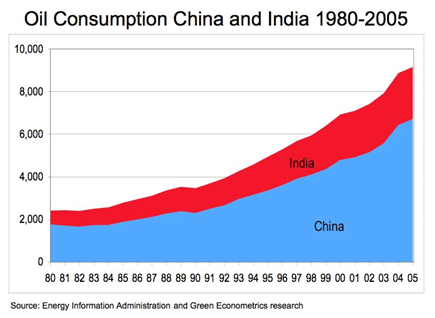

India, with a population over one billion, has announced its version of the Interstate Highway System that opened America to its great Middle Class. After the acquisition of Jaguar and Land Rover, Tata Industries has begun production of the Nano, a car that sells for $2,000 in India. The demand for oil to power the cars for an educated and increasingly affluent Indian society will keep pressure on oil prices for years to come. India uses just 2.7 mbd today but expects that demand to grow to 4.5 mbd by 2030.

There are now more than a billion Chinese. China consumed just 2 mbd of oil in 1990. Oil consumption jumped to 7.6 mbd in 2007 and is projected to grow to 15 mbd in 2030. The Chinese automobile industry grew at 21% last year while the US auto industry contracted by 40%. China displaced Germany as the third largest auto producer and will soon eclipse the damaged US auto industry which is contracting to a mere shadow of its former self. Chinese brands such as Chery and Geely, unknown to American consumers, may soon become as well known in America as Nissan or Hyundai.

Demand will push oil over $100 barrels again. Vast capital will pour into the Persian Gulf, Russia and Venezuela once again. Into this tempest comes America with a thirst for 20,000,000 barrels each day. The major oil producers in the Middle East, Russia and Venezuela are not America’s friends. Russia will use its oil wealth to thwart the US and veto in the United Nations any effort to subdue the North Koreas and Irans of the world. China, with its surplus of US dollars, will continue to harvest natural resources around the world, and forge strategic alliances with the likes of Iran as it secures the flow of oil and natural resources to its industries for years to come.

Meanwhile our politicians ignore our growing dependence on unfriendly nations and our weakening credit rating in the world to chase the chimera of green collar jobs and a green economy. Wind and solar will never power more than a minuscule fraction of America’s engines. America needs the equivalent of the Apollo moon project, a national challenge to move America off its dependence on foreign oil. We need simultaneous development of domestic oil and natural gas drilling, nuclear power, development of hydrogen fuel cells and clean coal technologies along with wind and solar power plants.

A year from now the landscape of America will be forever changed. Five years from now, will American find the fortitude to grasp its energy independence? Or will our weak politicians in both parties keep their heads buried in the sand until China and India emerge to deny us what we are no longer in a financial position to demand?

***********************************

This is the third in a series on The Changing Landscape of America. Future articles will discuss real estate, politics, healthcare and other aspects of our economy and our society. Robert J. Cristiano PhD is a successful real estate developer and the Real Estate Professional in Residence at Chapman University in Orange, CA.

PART ONE – THE AUTOMOBILE INDUSTRY (May 2009)

PART TWO – THE HOMEBUILDING INDUSTRY (June 2009)