For much of the past decade, "declinism" – the notion that America is heading toward a deadly denouement – has largely been a philosophy of the left. But more recently, particularly in the wake of Barack Obama's election, conservatives have begun joining the chorus, albeit singing a somewhat different variation on the same tune. read more »

Newgeography.com - Economic, demographic, and political commentary about places

The Gero-Economy Revs Up

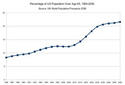

Green jobs? Great. Gray jobs? Maybe an even better bet for the new jobs bill. If there is a single graphic that everyone concerned with the nation’s future should have tattooed on their eyeballs, my vote goes to the one on your left. Here is its central message:

Forty years from now, one out of four Americans will be 65 or older.

Twenty million will be over 85.

One million will be over 100. read more »

Reforming Anti-Urban Bias in Transportation Spending

State governments have to stop treating transportation like yet another welfare program.

Among urban and rural areas, who subsidizes whom?

It's methodologically difficult to measure net taxation, but the studies that have been done suggest that, contrary to the belief of some, urban areas are big time net tax donors. For example, a recent Indiana Fiscal Policy Institute study found that Indiana's urban and suburban counties generally subsidize rural ones. read more »

Blame Their Parents, Not Us

We appreciate Pete Peterson’s attention to our work, but in responding to his complaint that we are denigrating Generation X and underrating its civic participation, we should begin at the beginning, define our terms, and give credit where credit is due. In writing our book, Millennial Makeover: MySpace, YouTube, and the Future of American Politics, we borrowed heavily from the thinking of and acknowledged our intellectual debt to Neil Howe and the late William Strauss, the founders of generational theory. read more »

Memo To Obama: Banks Are Beautiful

In his search for what Theodore Roosevelt called “a good, safe menace,” President Barack Obama has settled on the nation’s largest commercial banks, which as late as last year’s bailouts were still considered the best hope for economic salvation.

At first Obama was content to rail about the filthy lucre of banker bonuses. Then he got the idea of maybe hitting the bonus babies with special taxes. But the reason that the Secretary of the Treasury is often the former chairman of Goldman Sachs is because the bank is one of the instruments that keeps the government afloat. read more »

- Login to post comments

A Race Of Races

When Americans think of our nation's power (or our imminent lack of it) we tend to point to the national debts, GDP or military prowess. Few have focused on what may well be the country's most historically significant and powerful weapon: its emergence as the modern world's first multiracial superpower. read more »

Get Real About Generation X Stereotypes

Pity Generation X, the Americans born between 1965 and 1981, who have been derided for years as “apathetic,” “cynical,” and “disengaged.” Meanwhile, the greatness of the Greatest Generation is clear in its very name. Much laudatory ink has been spilled on the Baby Boomers...usually by Boomers themselves. As for the Millennials, those born between 1982 and 1998, the quantity of reportage lauding their public-spiritedness has quickly become tiresome. But a new report casts doubt on the widely accepted stereotype of Gen X-ers as inferior to these other groups. read more »

Our Exurban Future and the Ecological Footprint

‘How shall we live?’ is a question that naturally concerns architects, planners, community representatives and all of us. It is a question that turns on the density of human settlements, the use of resources and the growing division of labour. read more »

The Fate of Detroit – Revisited Green Shoots? The Changing Landscape of America

During the first ten days of October 2008, the Dow Jones dropped 2,399.47 points, losing 22.11% of its value and trillions of investor equity. The Federal Government pushed a $700 billion bail-out through Congress to rescue the beleaguered financial institutions. The collapse of the financial system in the fall of 2008 was likened to an earthquake. In reality, what happened was more like a shift of tectonic plates. read more »

- Login to post comments

Connecting Facts to Forecast 2010

Anyone can figure out the State of the Union by taking a good look around. I mean, I was born in the afternoon – but not yesterday afternoon – I don’t need four days of press coverage and a long speech by the President to tell me that Americans are suffering.

This time of year, though, everyone is looking for some hint of what is to come. Even the most rational among us are tempted to seek out some prediction of the future. Economists often rate high on the list of seers sought out by most Americans – right up there with stock brokers, Dionne Warwick’s Psychic Friends Network, and Joan Quigley (White House astrologer to the Reagans).

In this article, I’ll give you a few of my own predictions and then invite you to tell me the subject areas you want predicted. When pressed for my vision of the future, I like to add up what I already know to arrive at what I think will happen. read more »