The 15th Annual Demographia International Housing Affordability Survey covers 309 metropolitan housing markets (metropolitan areas) in eight countries (Australia, Canada, China [Hong Kong Only], Ireland, New Zealand, Singapore, the United Kingdom and the United States) for the third quarter of 2018. A total of 91 major metropolitan markets (housing markets) --- with 1,000,000+ population --- are included, including three megacities, with more than 10,000,000 residents (New York, London and Los Angeles).

Middle-Income Housing Affordability

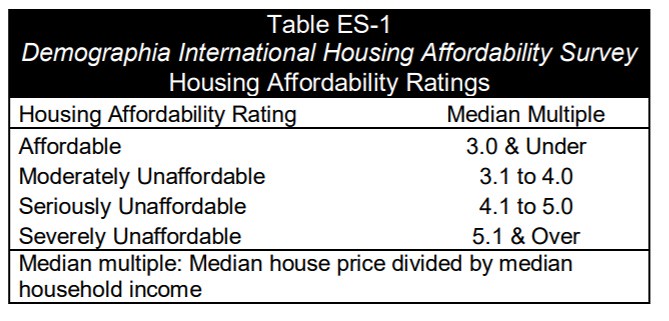

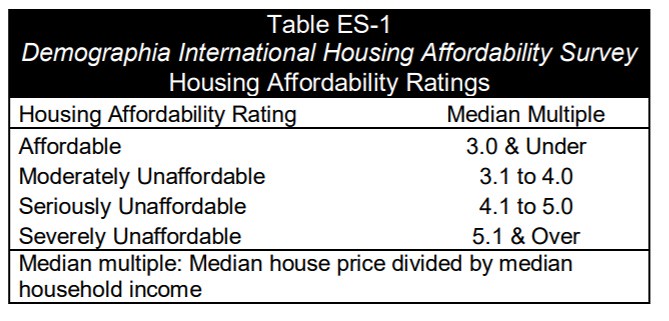

The Demographia International Housing Affordability Survey rates middle-income housing affordability using the “Median Multiple,” which is the median house price divided by the median household income. The Median Multiple is widely used for evaluating housing markets. It has been recommended by the World Bank and the United Nations and has been used by the Joint Center for Housing Studies at Harvard University. The Median Multiple and other price-to-income multiples (housing affordability multiples) are used to compare housing affordability between markets by the Organization for Economic Cooperation and Development, the International Monetary Fund, The Economist, and other organizations.

Historically, liberally regulated markets have exhibited median house prices that are three times or less that of median household incomes (a Median Multiple of 3.0 or less). Demographia uses the housing affordability ratings in Table ES-1.

Housing Affordability in 2018

Over the past year, there has been moderation of house prices in some of the most unaffordable markets. In some markets, prices have stabilized, while in others actual declines have occurred. However, none of the price declines have been sufficient to materially improve housing affordability. These developments could, in the long run, simply be further indication of the price volatility exhibited associated with stronger land use regulation.

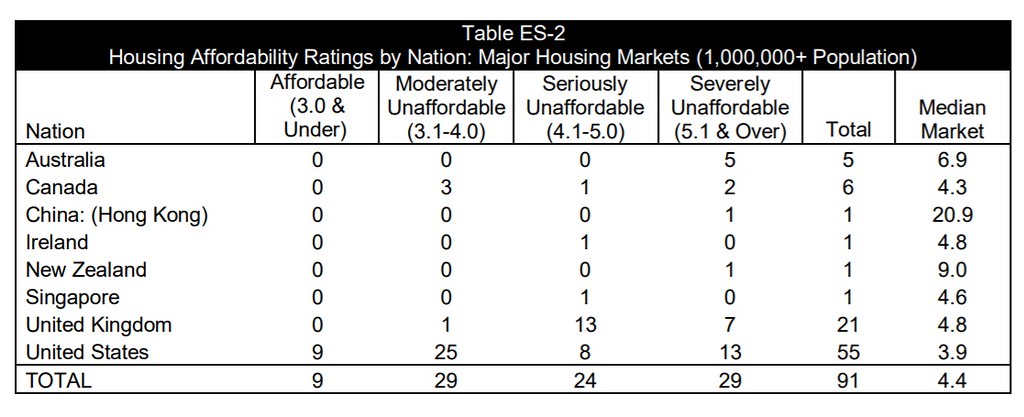

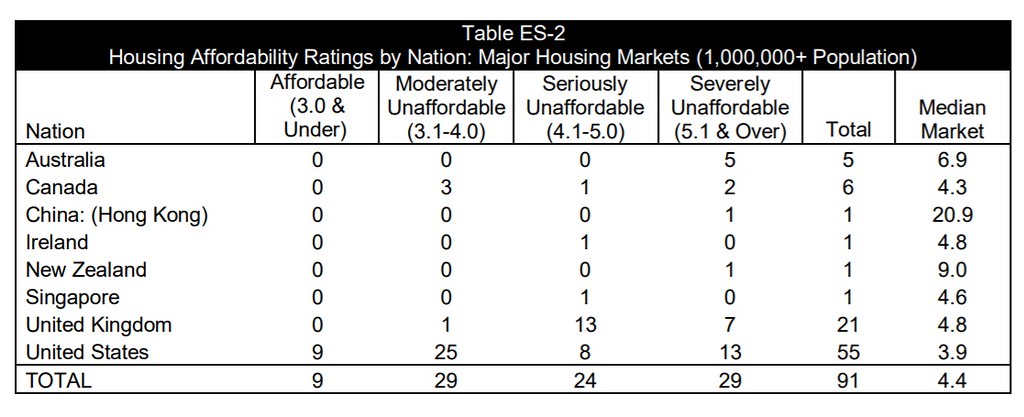

There are 9 affordable major housing markets, all in the United States. There are 29 severely unaffordable major housing markets, including all in Australia (5), New Zealand (1) and China (1). Thirteen of the major markets in the United States are severely unaffordable (out of 55), seven in the United Kingdom (out of 21 major markets) and two out of Canada’s six.

The most affordable major housing markets are in the United States, with a moderately unaffordable Median Multiple of 3.9, followed by Canada (4.3) and Singapore (4.6). Ireland and the United Kingdom both have Median Multiples of 4.8. The major markets of Australia (6.9), New Zealand (9.0) and China (20.9) are severely unaffordable (Table ES-2).

There are 9 affordable major housing markets, all in the United States. Pittsburgh and Rochester are the most affordable, with a Median Multiple of 2.6. Oklahoma City has a Median Multiple of 2.7, while Buffalo, Cincinnati, Cleveland and St. Louis each has a 2.8 Median Multiple. Indianapolis (2.9) and Detroit (3.0) are also affordable.

There are 26 severely unaffordable major housing markets in 2018. Again, Hong Kong is the least affordable, with a Median Multiple of 20.9 up from 19.4 last year. Vancouver has replaced Sydney as the second least affordable, with a Median Multiple of 12.6. With slightly declining house prices, Sydney’s Median Multiple dropped to 11.7. Melbourne (9.7), San Jose (9.4), Los Angeles (9.2) and Auckland (9.0) were also among the least affordable. San Francisco (8.8), Honolulu (8.6), as well as London (Greater London Authority) and Toronto (both 8.3) were also among the 10 least affordable major markets. Schedule 1 includes Median Multiples for all major markets.

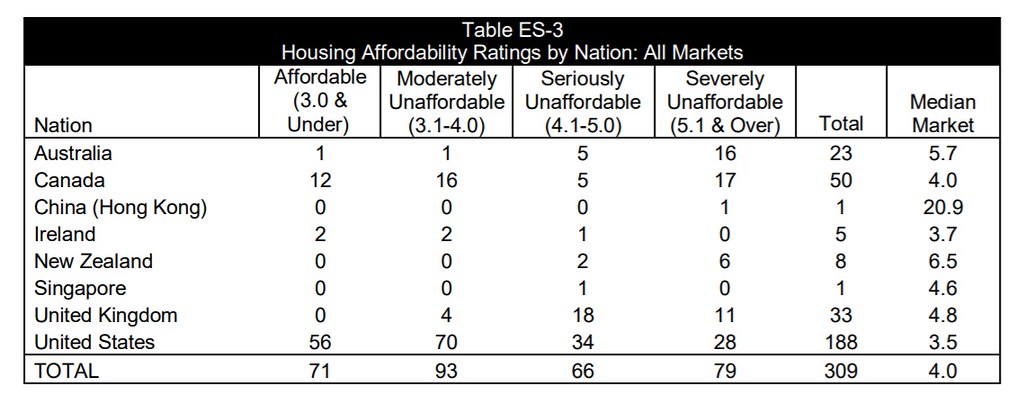

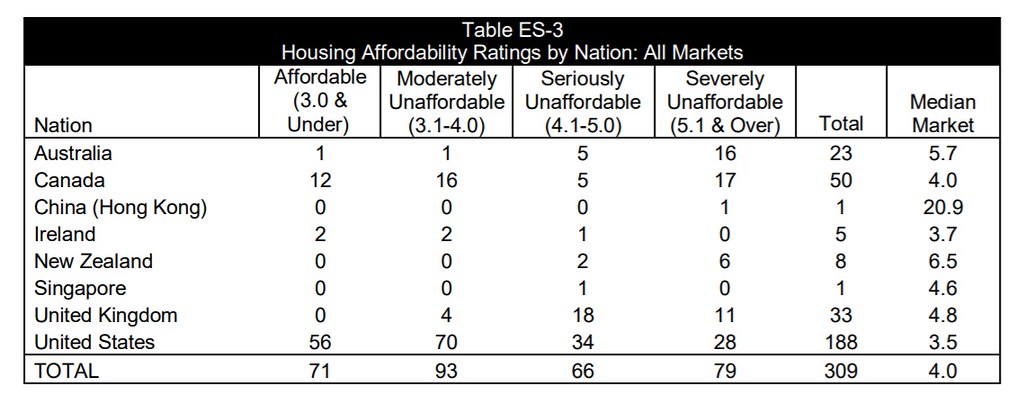

Table ES-3 summarizes housing affordability in all markets.

Well-Functioning Cities

There has been significant progress in the reduction of poverty around the world, first in the high income world and now in other nations. Paradoxically, threats are emerging in some urban areas of the high-income world, as middle-income households face intensifying economic challenges.. Much of the cause can be traced to much higher house prices.

Former World Bank principal urban planner Alain Bertaud’s new book (see Introduction: Avoiding Dubious Urban Policies) expresses concern that urban policy in cities is being driven by planning that ignores fundamental economics. This, he warns, can lead to a “costly utopia.” According to Bertaud, “The objective of the book is not to propose new urban forms but to apply already consensual basic economic principles to the practice of urban planning.”

In the environment of current urban policy, principally urban containment policy, middle-income housing has become too expensive for many middle-income households and poverty has increased. Significant national economic losses have been associated with more restrictive land use regulation.

Economists Paul C. Cheshire, Max Nathan and Henry G. Overman of the London School of Economics state the obvious priority: “… the ultimate objective of urban policy is to improve outcomes for people.” Economists Edward Glaeser of Harvard University and Joseph Gyourko of the University of Pennsylvania, have that “well functioning” housing markets are crucial to housing affordability. Housing affordability requires well functioning land markets.

Bertaud adds: “The main objective of the planner should be to maintain mobility and housing affordability” This would produce substantial opportunities, permitting residents the widest access to employment and shopping and other pursuits--- in short, well functioning cities (labor markets).

15th Annual Demographia International Housing Affordability Survey

Wendell Cox is principal of Demographia, an international public policy and demographics firm. He is a Senior Fellow of the Center for Opportunity Urbanism (US), Senior Fellow for Housing Affordability and Municipal Policy for the Frontier Centre for Public Policy (Canada), and a member of the Board of Advisors of the Center for Demographics and Policy at Chapman University (California). He is co-author of the "Demographia International Housing Affordability Survey" and author of "Demographia World Urban Areas" and "War on the Dream: How Anti-Sprawl Policy Threatens the Quality of Life." He was appointed to three terms on the Los Angeles County Transportation Commission, where he served with the leading city and county leadership as the only non-elected member. He served as a visiting professor at the Conservatoire National des Arts et Metiers, a national university in Paris.