NewGeography.com blogs

The Kauffman Foundation, the "world's largest foundation devoted to entrepreneurship," recently released the 2008 edition of their "Index of Entrepreneurial Activity."

The index, which measures the rate of business creation at the individual owner level, reports that despite the recession, "new business formation increased in 2008." This growth was not present in all sections of the nation, however. According to the Kauffman survey, the Midwest saw a slight decline in business start-ups in 2008. Unfortunately, while entrepreneurship was apparently on the rise, there was a drop in the formation of the "highest-income-potential types of businesses".

On a more local level, the states of Georgia, New Mexico, and Montana led the pack, each showing over 500 per 100,000 adults creating businesses each month. Bringing up the rear were West Virginia, Iowa, and Ohio, with the last showing a rate of creation of 190 per 100,000 adults per month.

In general, 2008 rates of entrepreneurial activity as reported by the Kauffman survey are higher along the west coast and in the Rocky Mountain states, and lower in the midwest and mid-atlantic regions. These findings would seem to have some overlap with the patterns reported by Newgeography's "2009 Best Cities for Job Growth" rankings, which, in general, showed stronger conditions in the west (outside of California) and pockets of weakness in the midwest and mid-atlantic regions.

The wind of change is blowing, but for once, that change might be affecting the wind.

Wind, often championed as a viable alternative-energy source in the United Kingdom, might not be as energy efficient as it was once thought to be. Independent reports of the wind-energy efforts in the UK “have consistently revealed an industry plagued by high construction and maintenance costs, highly volatile reliability and a voracious appetite for taxpayer subsidies.”

The cost for the energy alternative is sizable. Over the course of fiscal year 2007-2008, UK electricity customers paid a total of over $1 billion to the owners of wind turbines. That number is only expected to rise by 2020 to $6 billion a year as the government builds a national infrastructure of 25 gigawatts of wind capacity.

Currently, wind produces only 1.3 percent of the U.K.’s energy needs while a 2008 report from Cambridge Energy Research Associates warns that over-reliance on offshore wind farms would only further create supply problems and drive up investor costs.

Additionally, the average load factor for wind turbines in the UK was about 27.4 percent, meaning a typical 2-megawatt turbine only produced 0.54 megawatt of power on average. Dismissing the fact that low wind days would produce even less, all figures seem to point to poor return on investment.

Some have suggested the building of cheaper wind farms, but ultimately higher maintenance costs and spare gas turbines to replace broken ones would cancel out any perceived benefits, as gas for the turbines would only add to carbon dioxide emissions.

At this point, the outlook for wind to be a major source of UK electricity seems grim. Much like the wind itself, the problem just might be uncontrollable.

by Anonymous 05/08/2009

Consider the tax credits for alternative fuels such as ethanol and biomass that were rolled into the 2005 Transportation Law to encourage energy independence. At the same time, re-consider the law of unintended consequences, enshrined in Adam Smith’s notion that the unregulated behavior of capitalists gives rise to an invisible hand “to promote an end which was no part of their intention.”

The tax law included a fifty-cent-a-gallon credit for the use of fuel mixtures that combined "alternative fuel" with a "taxable fuel" such as diesel or gasoline.

This ill-conceived legislation is now producing an $8 billion windfall for the nation’s paper companies that, in order to qualify for the subsides, began adding diesel fuel to a paper-making process that required none.

Paper has been produced in basically the same way since the 1930s, when scientists learned how to leach cellulose from wood chemically. The chemical reaction produces a sludge containing lignin, which is so rich in carbon that the paper makers use it as fuel in the process that transforms the pulp into paper. It's wonderfully efficient, and allows the nation’s paper companies to operate largely without foreign oil. But not, however, with subsides. That’s why the companies added diesel fuel to the lignin, effectively replacing a green technology with one that is dependent on foreign oil.

The road to hell, as Adam Smith’s contemporary Samuel Johnson ironically observed, is paved with good intentions. But one can arrive there just as easily with bad intentions and bad faith.

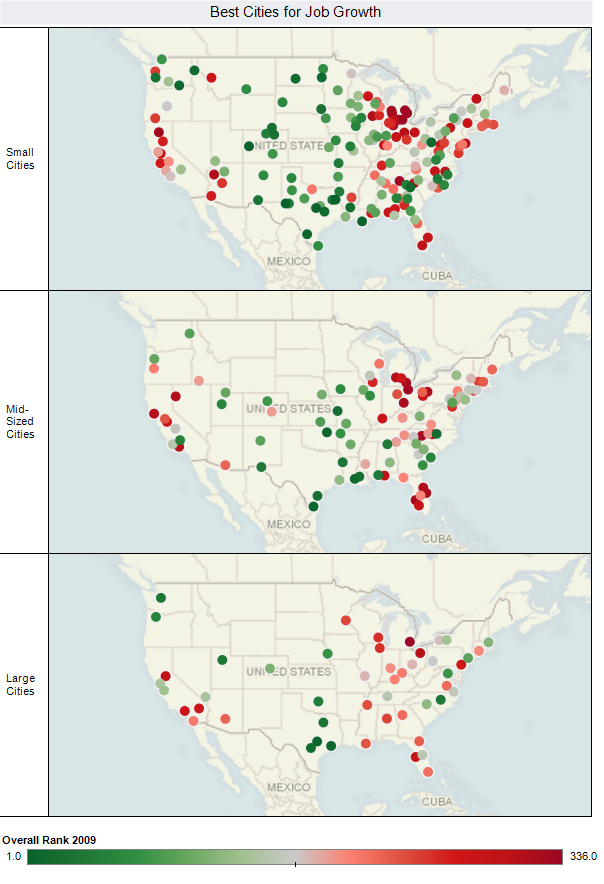

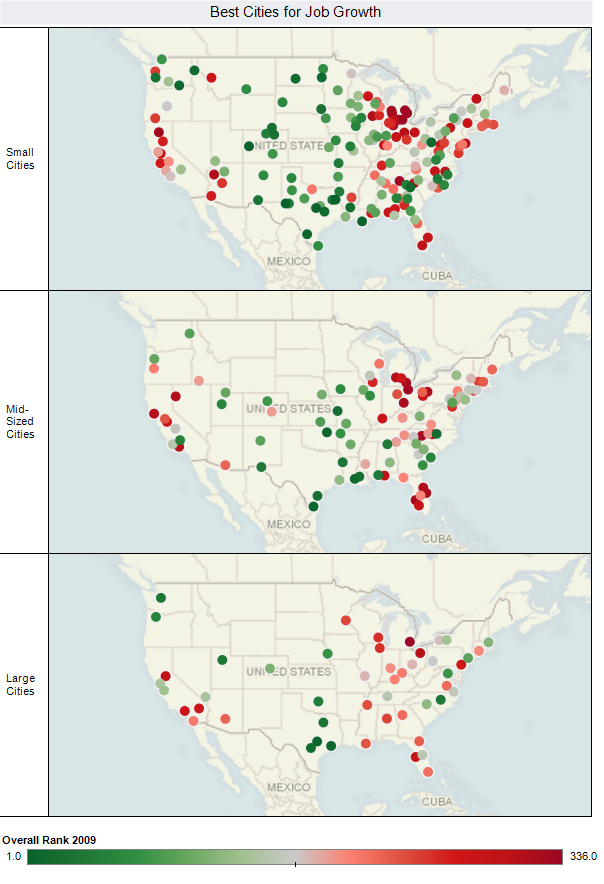

Here's some great maps of our annual Best Cities Rankings created by Robert Morton at Tableau Software. Robert used their software tool to plot a color coded point for each city in the rankings by size group, and immediate geographic patterns emerge:

Check out Robert's post for a map of the biggest gainers and losers from last year, and a rank change by size scatter plot of each place.

Austin fared very well on this year's Best Cities Rankings, and here's another interesting indicator of the difference in migration between Austin and San Francisco:

"When comparing California with Texas, U-Haul says it all. To rent a 26-foot truck oneway from San Francisco to Austin, the charge is $3,236, and yet the one-way charge for that same truck from Austin to San Francisco is just $399. Clearly what is happening is that far more people want to move from San Francisco to Austin than vice versa, so U-Haul has to pay its own employees to drive the empty trucks back from Texas."

This anecdote comes from a report comparing business environments in Texas to California.

Here's a table of the latest domestic migration numbers from US Census for all metropolitan areas of more than 1.5 million total population (rate numbers are per 1,000 population):

|

NAME

|

Population, 2008

|

Net Domesitc Migration Rate, 2008

|

Ave. Net Domesic Mig Rate, 2001-2008

|

| New York-Northern New Jersey-Long Island, NY-NJ-PA |

19,006,798 |

-7.6 |

-12.0 |

| Los Angeles-Long Beach-Santa Ana, CA |

12,872,808 |

-9.0 |

-12.2 |

| Chicago-Naperville-Joliet, IL-IN-WI |

9,569,624 |

-4.4 |

-6.8 |

| Dallas-Fort Worth-Arlington, TX |

6,300,006 |

7.0 |

5.7 |

| Philadelphia-Camden-Wilmington, PA-NJ-DE-MD |

5,838,471 |

-3.8 |

-2.3 |

| Houston-Sugar Land-Baytown, TX |

5,728,143 |

6.6 |

4.5 |

| Miami-Fort Lauderdale-Pompano Beach, FL |

5,414,772 |

-8.7 |

-5.1 |

| Atlanta-Sandy Springs-Marietta, GA |

5,376,285 |

8.2 |

10.2 |

| Washington-Arlington-Alexandria, DC-VA-MD-WV |

5,358,130 |

-3.4 |

-2.9 |

| Boston-Cambridge-Quincy, MA-NH |

4,522,858 |

-1.8 |

-7.1 |

| Detroit-Warren-Livonia, MI |

4,425,110 |

-13.9 |

-9.1 |

| Phoenix-Mesa-Scottsdale, AZ |

4,281,899 |

12.3 |

17.9 |

| San Francisco-Oakland-Fremont, CA |

4,274,531 |

1.3 |

-10.5 |

| Riverside-San Bernardino-Ontario, CA |

4,115,871 |

-1.9 |

16.1 |

| Seattle-Tacoma-Bellevue, WA |

3,344,813 |

3.6 |

0.9 |

| Minneapolis-St. Paul-Bloomington, MN-WI |

3,229,878 |

-1.1 |

-1.0 |

| San Diego-Carlsbad-San Marcos, CA |

3,001,072 |

0.1 |

-4.8 |

| St. Louis, MO-IL |

2,816,710 |

-2.0 |

-1.8 |

| Tampa-St. Petersburg-Clearwater, FL |

2,733,761 |

2.4 |

12.9 |

| Baltimore-Towson, MD |

2,667,117 |

-4.6 |

-1.6 |

| Denver-Aurora, CO /1 |

2,506,626 |

7.3 |

1.8 |

| Pittsburgh, PA |

2,351,192 |

-1.0 |

-2.9 |

| Portland-Vancouver-Beaverton, OR-WA |

2,207,462 |

8.3 |

6.2 |

| Cincinnati-Middletown, OH-KY-IN |

2,155,137 |

-1.7 |

-1.2 |

| Sacramento--Arden-Arcade--Roseville, CA |

2,109,832 |

2.2 |

8.7 |

| Cleveland-Elyria-Mentor, OH |

2,088,291 |

-7.1 |

-7.5 |

| Orlando-Kissimmee, FL |

2,054,574 |

1.6 |

15.9 |

| San Antonio, TX |

2,031,445 |

11.5 |

10.4 |

| Kansas City, MO-KS |

2,002,047 |

0.7 |

1.5 |

| Las Vegas-Paradise, NV |

1,865,746 |

7.9 |

23.7 |

| San Jose-Sunnyvale-Santa Clara, CA |

1,819,198 |

-1.5 |

-16.4 |

| Columbus, OH |

1,773,120 |

1.4 |

1.8 |

| Indianapolis-Carmel, IN |

1,715,459 |

4.0 |

4.8 |

| Charlotte-Gastonia-Concord, NC-SC |

1,701,799 |

20.9 |

18.2 |

| Virginia Beach-Norfolk-Newport News, VA-NC |

1,658,292 |

-9.4 |

-0.6 |

| Austin-Round Rock, TX |

1,652,602 |

22.0 |

17.2 |

| Providence-New Bedford-Fall River, RI-MA |

1,596,611 |

-6.6 |

-3.7 |

| Nashville-Davidson--Murfreesboro--Franklin, TN |

1,550,733 |

10.9 |

9.6 |

| Milwaukee-Waukesha-West Allis, WI |

1,549,308 |

-4.2 |

-5.9 |

|