• Annual new home starts were up 14% compared to 3Q16 – and this is the first time since 1Q08 that annual starts were above 6,000.

• Start activity has shifted over last year into the price ranges above $400K; during the past year, only 5% of new homes started were priced under $300k.

• The lack of affordable lot supply and rapid price increases are all factors which may cause new homebuyers to rethink their home-buying decisions during the next year.

Metrostudy’s 3Q17 survey of the Sacramento housing market shows that annual new home starts were up 14% compared to 3Q16. This is the first time since 1Q08 that annual starts were above 6,000. Annual closings were up 25%. Quarterly new home starts are up 18% compared to 3Q16, and quarterly closings were UP 17%. In fact, 3Q17 marked ten consecutive quarters with more than 1,000 starts. Annual starts have been outpacing closings since 2Q12, which is indicative of increased demand. 2017 began a little weaker due to weather, but by second quarter, new home starts rebounded impressively. Builders are effectively managing their inventory levels thus far.

“The average “offer to build” base price for new homes is up 3% regionwide over a year ago to $520K as builders grapple with increased land, construction and labor costs,” said Greg Gross, Regional Director of Metrostudy’s Northern California region. “Start activity has shifted over last year into the price ranges above $400K as builders adjust pricing to offset increased construction costs. Affordability is a concern in most markets, and Sacramento is no exception. During the past year, only 5% of new homes started were priced under $300k.”

Finished inventory has steadily decreased over the past year, but increased during 3Q. With 559 Finished Vacant homes, the market now has only 1.2 months of supply. When the number of homes under construction is factored in, the market has about 8 months of supply. Well within equilibrium. The number of homes under construction in 3Q17 is 20% higher than in 3Q16, so we expect closings to increase. Overall, inventories are manageable.

There were 3,865 new lots completed over the past year, yet more than 5,700 were absorbed. This slowdown of lot development will make finished lots difficult to obtain in high demand areas. As 2017 ends, the overall Sacramento market has grown respectably.

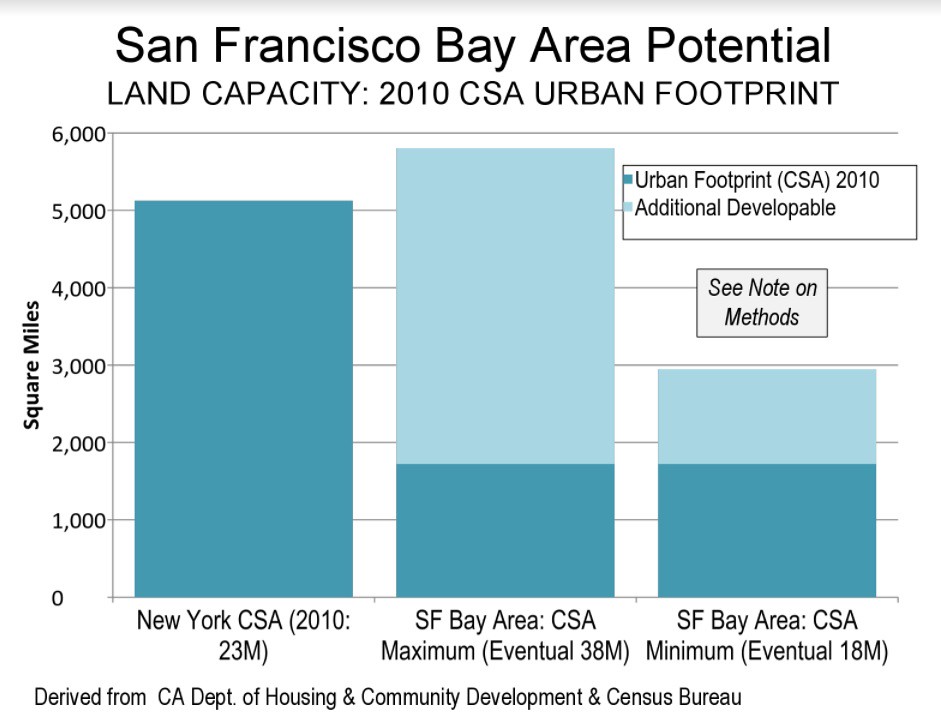

Metrostudy expects demand to remain steady over the next year. However, interest rate increases and daunting fee and construction cost increases will add to worsening affordability which may point to lower production and closings in the broader Sacramento market. Fortunately, the market has the unique ability to attract buyers from the Bay Area.

While general economic conditions are favorable, there is some concern regarding the slowing of job growth. As mentioned earlier, this is most likely due to lack of qualified labor. The lack of affordable lot supply and rapid price increases, are all factors, which may cause new homebuyers to rethink their home-buying decisions during the next year.

Given the above, Metrostudy does not expect the housing market fall, but another steady year as the economy continues grow modestly. We expect 2017 to end with 6,000 new home starts for the year barring any substantial global economic crisis. Sacramento and the Stockton regions continue to benefit from the expanding Bay Area economy, as some homebuyers may seek more affordable homes outside of the Bay area, but stronger local job growth and in-migration will be needed to increase housing demand substantially.