To paraphrase Mark Twain, “The report of Phoenix’s death has been greatly exaggerated.” To be sure, the Phoenix metropolitan area, for the first time in years, is suffering through a period of economic distress both in absolute and relative terms. However, the distress is purely transitory, caused primarily by the ripple effects of a 75 percent decline in building permits over the last three years combined with the national slowdown in economic activity. The underlying fundamentals remain strong as does the long-term outlook.

Builders in greater Phoenix, like in many communities, overbuilt during the boom. This creates an oversupply that has been made worse by poor conditions for home sales in places like California, or Michigan, primary places from which people come to Phoenix.

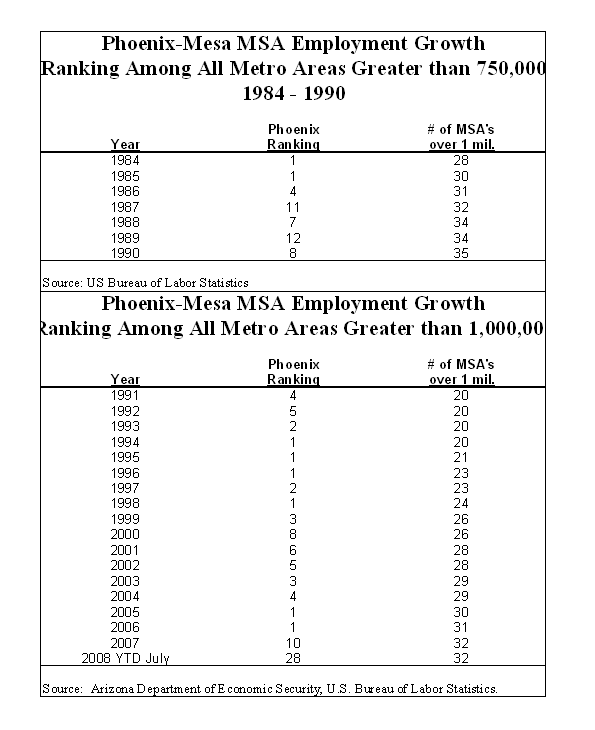

Yet it’s critical not to confuse today’s short-term setback, as many in the national media do, with setting the table for long-term stagnation. This pattern has been seen during previous recessions, notably between 1988 through 1992. After that, greater Phoenix came back with job growth during the expansion that started in November 2001 at three and a half times the national average.

The fundamentals that drove that recovery have not changed. These include factors such as climate; lifestyle; geographic location; pro-growth attitude; competitive tax structure; focused incentives; and relatively low cost of living. The long-term dynamics remain in place.

Why do we Grow?

Let’s consider why some places within the United States grow and others do not. The first test is simple. Do the people want to live in that area?

The quality of life factor, of course, lies in the eye of the beholder. Fortunately, there is an objective measure: people vote with their feet. People simply want to be there. This explains why areas of the country that supposedly have great business climates, South Dakota, with some exceptions, do not enjoy rapid population growth.

A second factor lies with the business climate relative to the area’s competitors. Are there specific local policies that result in constraints on work practices and the application of better production methods? Can firms operate profitably relative to alternative locations? Does the area embrace business expansion and competition?

Greater Phoenix wins here too. Boiled down it’s a matter of whether the government is getting in the way? Specific local policies can result in constraints in work practices and the ability of individual firms to earn a reasonable profit. For the most part, Phoenix remains a good place to grow a business.

All Jobs are Not the Same

These factors are critical in the formation of “export jobs” as opposed to domestic sector jobs. Export sector jobs are generally higher paying jobs. They are created because a company’s product is sold primarily outside of the local area. On the other hand, domestic sector companies serve local markets so they have to locate locally. A domestic sector company; a retailer, insurance agency, title company, lawyer, or barber; are chasing local income. It’s the export jobs that matter most. Think of the ghost towns of the old west. They blew away because their reason for existence --- a mine, a rail crossing, or farming --- lost their relevance.

Greater Phoenix thrives because it generates many “export” jobs in manufacturing, tourism and export service base Why these base industry companies locate in Greater Phoenix as opposed to another city stems from actors described in the book “Barriers to Riches.” The region provides a competitive advantage in their ability to implement the latest technologies and make a reasonable profit --- without a great deal of costly government interference. Yes, there are other relevant factors such as proximity to markets but the key lies in our ability to attract sufficiently skilled labor that can be applied and earn reasonable profits.

The Real Estate Outlook

Phoenix appears to be taking a beating in terms of relative growth this year. A correction is in order. But over the next two years or so the excesses of the sub-prime mortgage crises will have worn off and Phoenix’s intrinsic strengths will assert themselves again.

This recovery will include many of the newer areas. The press is asserting that areas at the edge of the metro area will no longer grow due to gasoline prices. This is a vast overstatement. These communities will change, and so will the habits of the people who live in them. They will replace their pick-up trucks and SUVs for Priuses and their hybrid competitors. Some will work full or part-time at home. Companies may move more of their operations closer to the outer suburbs, if that’s where the majority of their workforce lives.

Critically, keep in mind that jobs opportunities tend to follow people. Unlike many cities, greater Phoenix does not have one job core, it has several. And, jobs tend to migrate out to where the labor shed is. That will continue to be the case. Many of the areas that are the outlying today will be the job centers of tomorrow.

On the other hand, the market for dense development --- the favorite of planners and pundits --- may be limited. Even during the strongest period of housing starts on record, high-rise condos only accounted for 2.2 percent of all the housing construction in greater Phoenix. But that market has fizzled. Many high-rise projects throughout the area have been put on hold or have been cancelled due to market conditions. Some will never be built. Others (in Tempe and Downtown Phoenix) may be turned into student housing. Indeed, since 2001, 7,400 units have been added to the high-rise condo inventory. Only 3,700 of those are sold or have a hard contract and 3,700 remain unsold or unreleased. That compares to total single-family housing starts during that period of 330,000 units.

High-rise condos will continue to be a niche market, accounting for a relatively small percentage of total housing. The predominant housing style in greater Phoenix will remain a single-family home on a 45 to 75 foot lot on the periphery of town where land is plentiful. Phoenix will remain a place where people can have their piece of the American dream --- and with the end of the bubble it will become affordable once again.

Greater Phoenix Outlook

A combination of events --- the national recession, the local housing bubble, and the rapid rise in food and oil prices --- have all worked against greater Phoenix in the short term. But, the national economy will recover as it always does. Housing supply and demand will get back into balance. If oil prices remain high, people will substitute vehicles that get better mileage. But although greater Phoenix is going through a difficult period at present, do not bet against it in the long run.

Elliott D. Pollack is Chief Executive Officer of Elliott D. Pollack and Company in Scottsdale, Arizona, an economic and real estate consulting firm established in 1987, which provides a broad range of services, specializing in Arizona economics and real estate.