The most recent jobs report was again below consensus. With fewer than 100,000 new jobs, unemployment fell only because people continue to leave the labor force in huge numbers. People are discouraged, and many don't believe we are in a recovery. Why would they think that we aren't in a recovery? After all, GDP is above its pre-recession high, and we hear all the time about how many jobs have been created over the past couple of years.

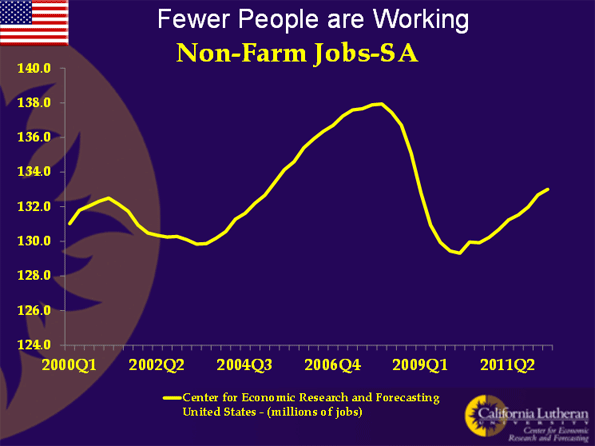

People think we're still in a recession because fewer of them have jobs than prior to the recession. Below is a chart showing total non-farm U.S. jobs since 2000. Today, we have millions fewer working than we did in 2007:

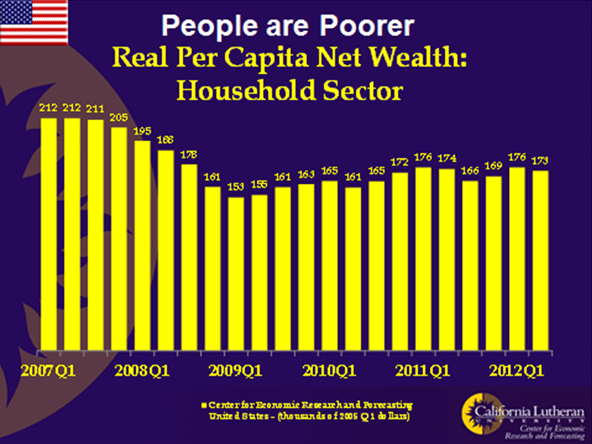

People think that we are in a recession because they are poorer than they were prior to the recession. As the following chart shows, Americans' wealth is down a lot. The average American's wealth is down $39,000 or about 16 percent from its pre-recession high in 2005 dollars. That is on average every man, woman, and child is $39,000 poorer than they were at the beginning of the recession. An average family of four is $156,000 poorer than it was just a few years ago.

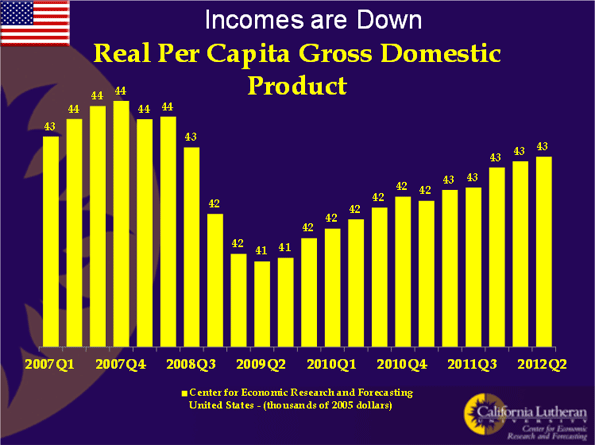

Not only are Americans poorer than they were at the beginning of the recession, their income is down too. Real (inflation adjusted) GDP may be climbing, but all of those gains are a result of increased population. Real-per-capita GDP (the source of income) is still down more than $1,000 in 2005 dollars.

Americans are poorer than they were, and their income is lower, and they are out of work or they know someone who is out of work. Of course they don't believe we are in a recovery. The real question is that why, when things are this bad, does the chattering class spend its time debating trivial topics, such as which of the presidential candidates mistreats dogs the most?

I think the answer is that the chattering class isn't out of work, and they don't know anyone who is out of work. Maybe they know a banker who lost her job, but being a banker, she was probably evil. So, no worries.

This recession has hit sectors like construction and manufacturing disproportionally hard, and people who work in these sectors are not well represented in the chattering class. Small businesses have also been badly hurt, and they too are poorly represented in the chattering class.

Other sectors have been hurt far less. Education, healthcare, government, and professional services have each faced challenges, but these sectors' job losses have been small compared to the most hard-hit sectors.

One result of the different patterns of job losses across sectors is that we've seen an increase in income inequality. Even worse, the increased inequality may be accompanied by declining upward mobility. Income inequality without upward mobility is prescription for social trouble and slower economic growth. Calls for income redistribution are only the beginning.

Huge numbers of young people have failed to find jobs. Many are living with their parents at ages far beyond what was normal just a few years ago. Unemployed and disillusioned young people are another prescription for social trouble.

What are our leaders doing? Not much. Congress is gridlocked and the President is campaigning. The republicans call for tax cuts and spending cuts. The democrats call for increased spending and tax increases. Neither plan will work.

The FED is trying to help. It has instituted QE3, promising to purchase $40 billion in mortgage backed securities every month until economic conditions improve, whatever that means. This will not do anything. The FED has run out of bullets. Policy now is all about convincing themselves and everyone else that they are doing something.

Our deficit is huge. It's so large that if we were to cut all defense spending and cut all social security spending, we would just about eliminate the deficit. But at what a cost! We'd get rid of every soldier, gun, ship, and airplane. We'd cut Granny off from her monthly check.

We're not going to do that. We're not going to cut the budget enough to get rid of the deficit. So, give it up. Budget battles on this scale are disastrous for democracies. Best not to do it.

Government spending is a problem. That's for sure, but you can't fix it by cutting the spending. That sounds wrong, I know, but the dynamics of democracy won't let it work.

Tax policy won't do it either. You can't tax yourself to prosperity, and cutting taxes won't help without a whole slew of complementary policies. Increased spending won't help. The problem is that government is already too big relative to the economy.

Government at all levels is now about 37 percent of the economy. This is higher than it was during World War Two. It needs to become smaller as a percentage of the economy, but not by cutting.

What we have to do is cap government spending on a real-per-capita basis. We just keep spending what we're spending per person, even after adjustment for inflation. That way, there are no losers. It should be relatively easy to gain support for a simple cap.

Then, you grow your economy. How to do that is another big topic. But, we know the outlines: Increase immigration. Evaluate regulations for efficiency and economic impact. Restructure the tax code to maintain productive incentives. Restructure the safety net to improve incentives. Restore incentives to education. Remove barriers to trade.

That is a big task, but it is a lot easier than cutting the budget as much as would be required. It's also a lot easier than suffering through a decade of anemic growth. The benefits would be big too. We'd be setting the stage for persistent prosperity.

Bill Watkins is a professor at California Lutheran University and runs the Center for Economic Research and Forecasting, which can be found at clucerf.org.

Unemployment photo by BigStockPhoto.com.