In a number of Western world cities, there is rising concern about foreign housing purchases which may be driving up prices for local residents. Much of the attention is aimed at mainland Chinese buyers in metropolitan areas where housing is already pricier than elsewhere. The concern about housing affordability is legitimate. However, blaming foreigners misses the point, which is that the rising prices are to a large degree the result of urban containment policies implemented by governments.

London and the United Kingdom

The Daily Mail reports that London being deluged with foreign house buyers, who are buying not only expensive properties but also "starter homes," driving prices up. The Mail singles out Russian and Chinese buyers, many of whom pay cash for their purchases. Paula Higgins of the Home Owners Alliance lamented the fact that many foreign buyers are paying cash. She questions the appropriateness of foreign investment in "family homes." David King, of Priced Out, said: "Foreign investment is driving up prices, making it even harder for ordinary people to get a decent place to live."

Real estate firms headquartered in Russia are steering their clients to less expensive locations, outside London, such as to the north of England and Wales. A London real estate firm said that only 15% of its sales were to buyers from the UK. There is pressure for the government to protect local home buyers

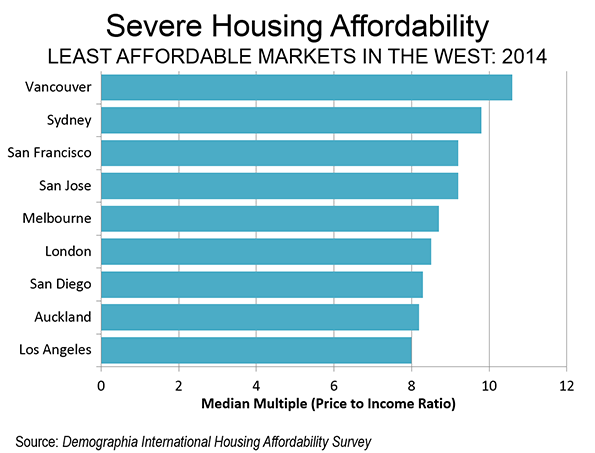

Certainly these investors are stepping into an already pricey market. The 11th Annual Demographia International Housing Affordability Survey found London house prices to be a severely unaffordable 8.5 times household incomes in 2014. London has the seventh worst housing affordability out of the 86 major markets rated in nine nations. The outside-the-greenbelt exurbs of London have house prices 6.9 times incomes.

Vancouver

Vancouver is a city of immigrants. According to data compiled by University of British Columbia (UBC) Geography Professor David Ley, nearly 90 percent of metropolitan Vancouver's growth over the past two decades has been from foreign immigration (this article contains a graph with the numbers). Yet, there is significant concern about home purchases in the Vancouver area by mainland Chinese. UBC Professor Henry Yu's history class described the issue in a video (Blaming the Mainlander).

The Demographia International Housing Affordability Survey found Vancouver house prices to be a severely unaffordable 10.6 times household incomes in 2014. Vancouver has the second worst housing affordability out of the 86 major metropolitan areas rated in nine nations. Hong Kong has the worst housing affordability, with a median multiple of 17.0.

California and New York

Ilya Marritz of Public Broadcasting Systems (PBS) radio station WNYC remarked on how foreign investment is driving up prices in the New York and San Francisco bay areas: "There’s this relatively new trend of people buying properties in the city and not actually spending a lot of time living here." The Demographia International Housing Affordability Survey found New York metropolitan area housing to cost 6.1 times incomes, a 65% increase since before the housing bubble.

The Diplomat, which specializes in Asia-Pacific affairs, commented that “there’s no doubt that China’s presence in the Bay Area market is driving up prices. The Diplomat quoted real estate executive Mark McLaughlin; “it’s added a demographic of buyers who, generally, take a long-term view. They’re not sellers in the next five to seven years.” Chinese buyers are sitting on much of this property as housing in the Bay Area becomes increasingly scarce, causing its value to skyrocket."

The Demographia International Housing Affordability Survey places both San Francisco and San Jose metropolitan area house prices at 9.2 times incomes, tied for fourth least affordable in the 9 nations.

The Los Angeles Times reports strong mainland Chinese purchasing activity in the suburbs of Los Angeles, from the San Gabriel Valley to Orange County, particularly Irvine as well as in Riverside-San Bernardino (the Inland Empire).

The Demographia International Housing Affordability Survey found house prices to be 8.0 times incomes in Los Angeles, the 10th least affordable major metropolitan area in the Survey. Nearby San Diego prices are even higher, at 8.3 times incomes, earning it the 8th least affordable major metropolitan area in the 9 nation Survey.

New Zealand

Things have become more heated in New Zealand. The Labour Party opposition housing spokesperson Phil Twyford blamed foreign investors for driving up house prices in Auckland, New Zealand's only metropolitan area with more than 1,000,000 population.

"Kiwi families who are struggling to buy their own home want to know the impact offshore speculators are having on skyrocketing Auckland house prices. They are sick and tired of losing homes at auction to higher bidders down the end of a telephone line in another country."

This evoked considerable criticism for ethnic insensitivity not only among New Zealand's large Chinese minority, but also ordinary citizens. Radio New Zealand opined: "For a party that has diligently and deliberately courted the ethnic vote, including the Chinese community in Auckland, this was a risky strategy." The Economics Minister accused Labour of playing "the race card." There was predictable reaction in China, which is New Zealand's largest goods export partner. The Shanghai Daily headlined: "New Zealand housing market debate descends into race row. "Meanwhile, the National Party government continues its difficult task of trying to reverse the consequences of urban containment policy in Auckland.

The Demographia International Housing Affordability Survey found Auckland house prices to be a severely unaffordable at 8.2 times household incomes in 2014. Auckland has the ninth worst housing affordability out of the 86 major metropolitan areas rated in nine nations.

Australia

In Sydney, the Party for Freedom produced a brochure "blaming Chinese property buyers for pushing up home prices, 'ethnically cleansing' Australian families from their suburbs and creating a new 'stolen generation,'" according to The Sydney Morning Herald (" Race hate flyer distributed in Sydney's north shore and inner city"). The brochure also referred to foreign purchasers as "greedy foreign invaders," and charged them with "pricing locals out of the market." A You-Tube video was posted in which the party chairman burns the flags of China, the Australian ruling Liberal Party, the Labor Party and the Greens and images of Australia's Prime Minister and the New South Wales Premier.

Predictably, this brought a sharp reaction from public officials, such as Lane Cove mayor David Brooks-Horn, whose affluent North Shore community was targeted for distribution of the brochures.

Despite this "vile attack," as New South Wales Multiculturalism Minister characterized it, there remains serious concern in Australia about rising house prices, which many blame on foreign investors aalthough avoiding the extremes indicated above.

The Demographia International Housing Affordability Survey found Sydney house prices to be a severely unaffordable 9.8 times household incomes in 2014. This is the third most unaffordable market among the 86 major metropolitan areas rated in nine nations. Today, The Australian Financial Review reported that the median house price in Sydney has reached $1,000,000 for the first time. This is a 23% increase in just one year.

Melbourne, with prices 8.7 times incomes is sixth least affordable.

"Supply, Supply, Supply"

There is a common theme among those who are blaming foreigners for the escalation in their local house prices: foreign buyers have driven up demand, thus increasing prices and driving local purchasers out of the market. That might be a plausible theory if demand by itself raised prices. But, all else equal, demand results in higher prices only when there is a shortage of supply. And a shortage of supply is exactly what has been produced by government policies in each of the metropolitan areas described above.

The problem lies largely with the blunt policy instrument of urban containment, which makes it virtually impossible to build on wide swaths of suburban greenfield land. Urban containment policy's most destructive strategies are urban growth boundaries or greenbelts, which often prohibit development on virtually all greenfield sites and other regulations that deny planning permission on the majority of parcels suitable for housing on and beyond the urban fringe. The shortage of supply so important to the price increases has been produced by government policies in each of the metropolitan areas described above (Figure).

The problem is that urban containment policy "creates its own weather." Investors are disproportionately drawn to markets where there are shortages. Sir Peter Hall and his colleagues pointed out that development plans provide a guide for developers of where to buy within the metropolitan area (in The Containment of Urban England).

A Canary Wharf buyer in London told The Wall Street Journal: “If I could afford it I’d buy as many as I could”... “Flats [in London] are a great investment. I can’t see that changing." Nor will it so long as the "sure thing" of extraordinary house price increases supported by planning policy continues. San Francisco Bay Area public officials may as well have hung a "Welcome Speculators" banner from the Golden Gate Bridge.

James Laurenceson, Deputy Director of the Australia-China Relations Institute at the University of Technology in Sydney, told The Sydney Morning Herald.:

"Housing affordability is a real problem. The real reasons are right in front of our eyes - limited land releases, zoning regulations, development charges, record low interest rates and tax breaks to property investors. There’s not a Chinese buyer amongst them."

Indeed, most of the cities above became severely unaffordable well before an affluent middle-class was enabled by China's economic reforms.

New South Wales Premier Mike Baird characterized the solution as "supply, supply, supply," which he sees as "the principal lever" for improving housing affordability. Housing affordability proposals that do not start with the supply shortage are little more than empty rhetoric. Attempts to blame the prices primarily on foreigners are not only misleading, but also diverts the public from the more important role played by limiting supply.

Wendell Cox is Chair, Housing Affordability and Municipal Policy for the Frontier Centre for Public Policy (Canada), is a Senior Fellow of the Center for Opportunity Urbanism (US), a member of the Board of Advisors of the Center for Demographics and Policy at Chapman University (California) and principal of Demographia, an international public policy and demographics firm.

He is co-author of the "Demographia International Housing Affordability Survey" and author of "Demographia World Urban Areas" and "War on the Dream: How Anti-Sprawl Policy Threatens the Quality of Life." He was appointed to three terms on the Los Angeles County Transportation Commission, where he served with the leading city and county leadership as the only non-elected member. He served as a visiting professor at the Conservatoire National des Arts et Metiers, a national university in Paris.

Photograph: Opera House, Sydney (by author).