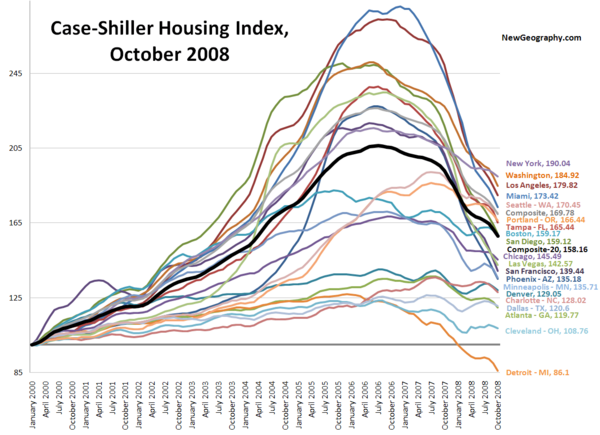

Today's latest release of the Standard and Poor's Case-Shiller Housing Price Index indicates a continued price free fall across the board. Hyper-inflated markets such as Miami, Los Angeles, Washington, DC, San Diego, and Las Vegas continue to come back to earth. Check out the chart.

Even Charlotte, Denver, Dallas, and Atlanta, which seemed to be holding their own after never seeing a huge price escalation, seem to be sliding again since July. Cleveland seems to have stabilized, but Detroit continues its drop into a black hole. Home prices in Detroit have fallen to almost 14% below levels in early 2000.

Detroit is

a black hole.

Detroit (and Buffalo) will continue to slide downhill for the next 20+ years.

And many small cities in upstate New York (and Ohio, Pennsylvania) will join them.

For examples I give you: Utica, Rome, Poughkeepsie, Troy in New York.

Dave Barnes

+1.303.744.9024

http://www.MarketingTactics.com

Doesn't look pretty but according to this survey it''ll be worst

A recent survey conducted at the site:

http://www.homepricetrend.com

shows that over 97% feel that home prices would continue it's downfall. And over 50% feel it'll fall beyond 2015!! So I expect more of the graph above from Case Schiller.