The corporate headquarters used to be the primary measure of a city’s economic clout. Saskia Sassen, while not ignoring headquarters, documented how in the age of globalization, the resurgence of the global city was driven by demand for financial and producer services, not more and bigger HQs. As she pointed out in her seminal book The Global City, “Major cities such as London, New York, and Chicago have been losing top ranked headquarters for at least three decades.” Yet despite this they were coming back strong.

Back in 2008, I started observing a shift in the marketplace in which corporate HQs were relocating back to the city. But this wasn’t a traditional monolithic HQ, but rather a reconstituted, smaller version consisting of only the most senior people that I call the “executive headquarters.”

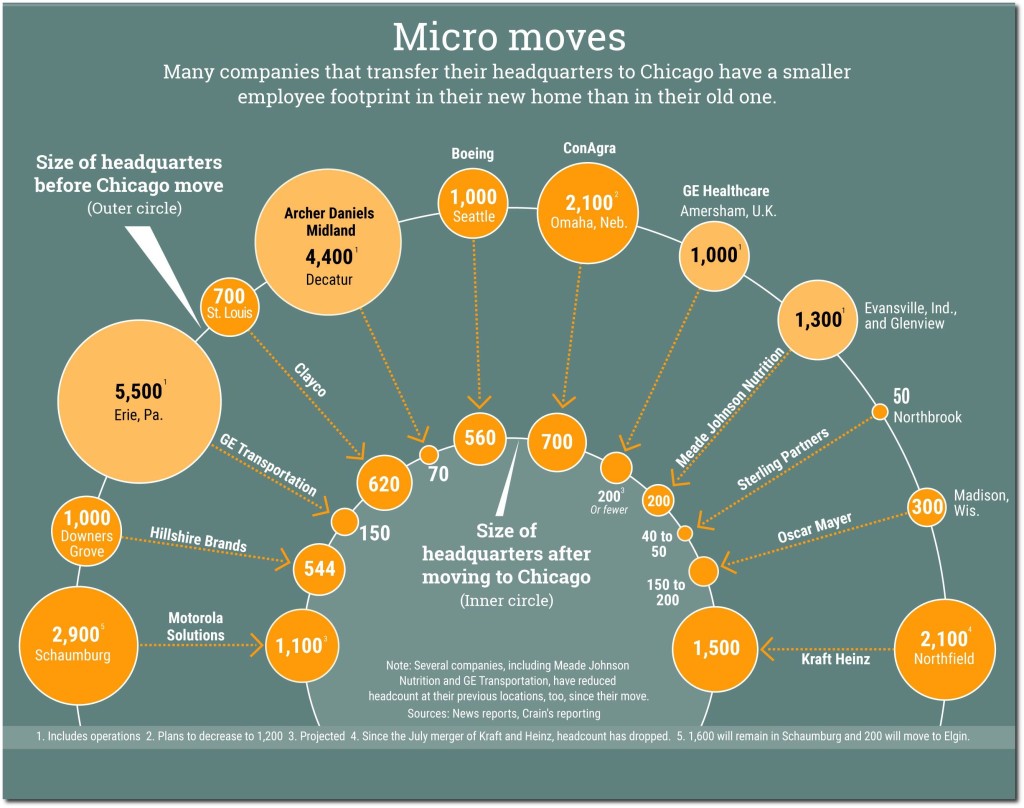

Crain’s Chicago Business has a major feature this week investigating the executive headquarters trend as it is playing out there. They point out that these HQs make for great headlines, but they don’t necessarily result in that many jobs.

ADM is Exhibit A in the rise of a new type of corporate headquarters, one that arrives from afar but packs light. These headquarters represent the pinnacle of the corporate pyramid, snapped off and relocated, free of jobs tied to operations and often midlevel HQ functions such as payroll, human resources or purchasing. To be sure, migrating headquarters offer benefits to the city: They boost demand for business services, their executives join the philanthropic scene and, of course, they confer bragging rights. But in terms of jobs, the farther a company travels to set up shop in Chicago, the fewer people come with it.

“The notion of the corporate headquarters in the ‘Mad Men’ world when there were hundreds or thousands of people in a building with the company logo . . . those days are gone,” says David Collis, a professor at Harvard Business School who studies corporate headquarters.

Click through to read the whole thing, which features me and my work on the topic. This is an important trend to grapple with.

The bad news, which the Crain’s piece highlights, is that the headquarters ain’t what it used to be. On the other hand, Chicago is winning the battle for them. These smaller executive headquarters, particularly for major global businesses, benefit from being in a global city. Chicago has lured a number of these from out of town. In line with Sassen’s findings that the “deep economic history of a place” matters, note that we see a lot of agro-industrial firms choosing Chicago: ADM, Con Agra, Mead Johnson Nutrionals, Oscar Mayer. This industry space is where Chicago has a major advantage over New York and other coastal cities.

A trend I see playing out, and which I am currently researching in more detail, is the bifurcation of HQ attraction. For executive headquarters of global firms, and for companies that are looking for an urban location, Chicago is reasserting its dominance as the interior business capital. But for those who prefer a suburban environment, or which maintain a mass employment HQ, the Sunbelt remains strong, especially Dallas, where Toyota is a building its North American campus. Dallas replicates many of Chicago’s non-urban advantages at lower cost and with a more suburban feel: central location and time zone, a major airport, a diverse economy, and scale. Increasingly it looks like Chicago is the urban interior capital, Dallas the suburban interior one. Stay tuned for more on this in the future.

Aaron M. Renn is a senior fellow at the Manhattan Institute and a Contributing Editor at City Journal. He writes at The Urbanophile, where this piece originally appeared.

Chicago photo by Bigstock.