Our mental model of the world shapes our behavior at fundamental levels in ways we often can’t even recognize. I was struck by this when reading two books almost back to back, Scott Adams’ How to Fail at Almost Everything and Still Win Big and Peter Thiel’s Zero to One.

Both authors lay out a schema for modeling the future and how to behave relative to it, but come to very different conclusions.

Scott Adams, creator of the Dilbert comic strip, has a simple model: systems over goals. That is, it’s better to have a good system with high odds of success vs. setting a concrete goal and working towards it. In other words, get your lifestyle right when it comes to diet and exercise, don’t focus on losing X pounds to reach Y weight.

This strategy implies a single worldview axis: goals-systems, with a preferred end of the axis on which one should align his personal decision making.

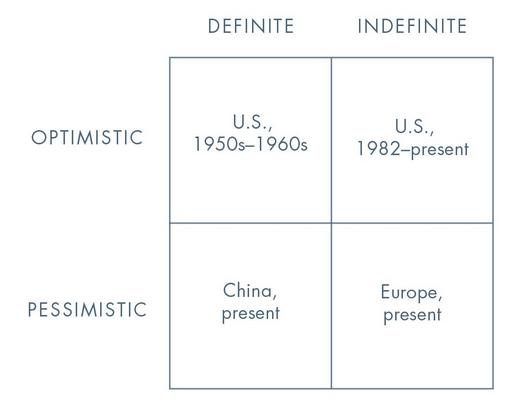

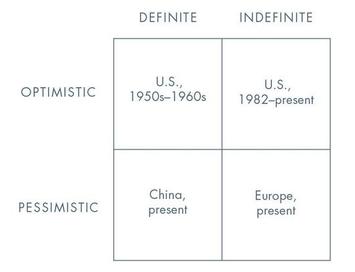

Thiel, founder of PayPal, has a more formal framework, but adopts the same axis of decision making. In his case, he labels it definite-indefinite. He then combines this with an axis of optimist-pessimist to produce the following 2×2 matrix:

Both Thiel and Adams are American, so reside in the top half of the chart, so let’s focus there. To Thiel, a goal is a definite view of the future. That is, you have an exact idea of what the future should be, and set about making it happen. A system would be an indefinite future. In this view, we can’t fundamentally control the future, so we put ourselves in the best position to benefit from the chance that comes our way.

Now these two don’t have perfect alignment. Adams’ systems are in many cases designed to achieve results that could be viewed as a goal (e.g., a ripped physique). As a serial entrepreneur, he’s not afraid of starting companies, but does not put everything at risk while doing so. Most of what Adams would call goals Thiel would still label indefinite because they present incremental improvement vs. revolutionary change (e.g., lose 15 pounds vs. “We chose to go to the moon.”) But there’s a rough correspondence.

Adams, as we saw, comes down firmly on the indefinite/systems side of the equation. Thiel says that the would be startup founder should be in the definite/goals quadrant, and believes that part of the reason America has gone off course is that we’ve shifted from a definite to indefinite view of the future.

In the 1950s, people welcomed big plans and asked whether they would work. Today a grand plan coming from a schoolteacher would be dismissed as crankery, and a long-range vision coming from anyone more powerful would be derided as hubris.

In addition to his more formal framework for thinking about the future, Thiel also tries to explain why people like Adams have an indefinite view of the future:

But perhaps you can’t understand Malcolm Gladwell without understanding his historical context as a Boomer (born in 1963). When Baby Boomers grow up and write books to explain why one or another individual is successful, they point to the power of a particular individual’s context as determined by chance. But they miss the even bigger social context for their own preferred explanations: a whole generation learned from childhood to overrate the power of chance and underrate the importance of planning. Gladwell at first appears to be making a contrarian critique of the myth of the self-made businessman, but actually his own account encapsulates the conventional view of a generation.

Adams is a baby boomer, putting him squarely within this generational psychoanalysis.

Is one of the two right? I think it’s more complex than that, and in part comes down to what you want, what your temperament is, and what your experiences have been in life.

Thiel obviously has gargantuan Silicon Valley ambitions and an ego to match. And he’s got over a billion dollars to show for it.

Adams’ success is much smaller scale – but still well into the millions of dollars, plus a significant amount of fame. He appears to be fully satisfied with his life.

So at the individual level, you can succeed either way. At a societal level, Thiel may have a point, though Robert Gordon and others posit different explanations for the economic growth slowdown.

In any case, the key is that how you think about the future, particularly the degree to which you can shape the future, determines a lot about the strategies you are going to use for your life. On the one hand perhaps a concentrated bet and effort to sculpt the future. On the other a more open or diversified strategy to try get the best result in in uncertain future. (I should note that Thiel says this kind of diversification is a myth, saying, “Life is not a portfolio”).

I also recently read and reviewed Antifragile by Nassim Taleb. While I’m not familiar with his full corpus, his high view of randomness suggests that he’s favors a more Adams-like approach. He advocates that people should adopt what he calls a “barbell” strategy. That is, on one end you try to derisk your core life as much as possible. And on the other you place multiple, small, high risk bets with a chance of a significant payoff. This sounds like a system to me. On the other hand, Taleb also says that entrepreneurs who risk the definite should be treated with honor as heroes, even if they fail.

In any case, it’s worth thinking about how we view the future. Is it something that’s primarily within our control or something that’s more dominated by outside forces or even chance? How we answer that question will determine a lot about how we go about living our lives.

Aaron M. Renn is a senior fellow at the Manhattan Institute, a contributing editor of City Journal, and an economic development columnist for Governing magazine. He focuses on ways to help America’s cities thrive in an ever more complex, competitive, globalized, and diverse twenty-first century. During Renn’s 15-year career in management and technology consulting, he was a partner at Accenture and held several technology strategy roles and directed multimillion-dollar global technology implementations. He has contributed to The Guardian, Forbes.com, and numerous other publications. Renn holds a B.S. from Indiana University, where he coauthored an early social-networking platform in 1991.