“We must make our choice. We may have democracy, or we may have wealth concentrated in the hands of a few, but we can’t have both.” —Justice Louis Brandeis

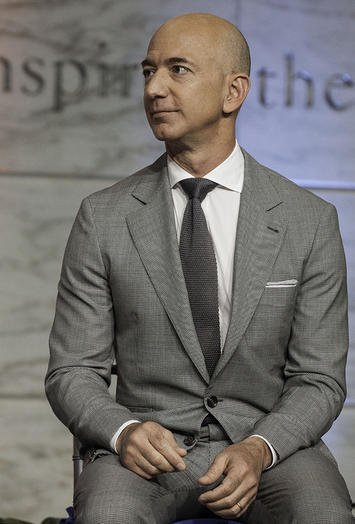

With his $13.7 billion acquisition of Whole Foods, Amazon’s Jeff Bezos has made clear his determination to dominate every facet of mass retailing, likely at the cost of massive layoffs in the $800 billion supermarket sector.

But this, if anything, understates the ambitions of America’s new ruling class, almost entirely based in San Francisco and Seattle, as it moves to take over industries from entertainment and transportation to energy and space exploration that once thrived and competed outside the reach of the oligarchy.

Brandeis posed his choice at a time when industrial moguls and allied Wall Street financiers dominated the American economy. Like the oligarchs of the past, today’s new Masters of the Universe are reshaping our society in ways that could, if unchallenged, undermine the foundations of our middle-class republic. This new oligarchy has amassed wealth that would impress the likes of J.P. Morgan. Bezos’ net worth is a remarkable $84.7 billion; the Whole Foods acquisition makes him the world’s second richest man, up from the third richest last year. His $600 million gain in Amazon stock from the purchase is more than the combined winnings of Whole Foods’ 10 top shareholders.

The Emergence of Oligarchic America

Founded two decades ago, Amazon revenue has grown eightfold in the last decade. Bezos now wants to “reorganize the world,” as one tech writer put it, “as an Amazon storefront.” He has done this by convincing investors that despite scant profits, the ample rewards of monopoly await. Kroger, or the corner-food store, enjoys no such luxury. With a seemingly endless supply of capital and the prospect of never-ending expansion, the Silicon Valley-Puget Sound oligarchy now accounts for six of the world’s 13 richest people, and virtually all billionaires who are not either very old or merely inheritors.

Apple, even as it it evades American taxes, enjoys a $250 billion cash reserve that surpass that of the United Kingdom and Canada combined. Their new $5 billion headquarters in Cupertino—like those of firms such as Facebook, Alphabet, and Salesforce.com—reflect the kind of heady excess that earlier generations of moguls might have admired. The peculiar nature of the tech economy rewards even to failures, like Yahoo’s Marissa Mayer, who earned $239 million, almost a million a week, as she drove one of the net’s earliest stars toward oblivion.

The tech booms of the 1980s and 1990s rode on a wave of entrepreneurialism that provided enormous opportunities for millions of Americans, the current wave is characterized by stagnant productivity, consolidation, and disparities in wealth not seen since the mogul era. As one recent paper demonstrates, the “super platforms” of the so-called Big Five depress competition, squeeze suppliers, and drive down earnings, much as the monopolists of the late 19th century did.

Indeed for most Americans the once-promising new economy has meant a descent, as one MIT economist recently put it, toward a precarious position usually associated with Third World countries. Even Silicon Valley, the epicenter of the oligarch universe, has gone from one of the most egalitarian places in America to a highly unequal one where the working and middle class have, if anything, done worse, in terms of income, than before the boom.

The Oligarchs Outsmart the Political Class

In the past, progressive political thinkers like Brandeis sought to curb over-concentrated wealth and power. In contrast, today’s Democratic establishment rarely addresses such issues. That’s no wonder given that the party is now financed in large part by the tech giants, which have backed in almost lock-step the environmental, social, and cultural agenda that dominates today’s left. In exchange, they have bought political cover for things such as misogyny, lack of ethnic diversity, and of unions and fair labor practices that old-line companies like Walmart, Exxon, or General Motors could never enjoy.

Hillary Clinton made clear that she would, at best, tinker at the edges of the so-called sharing economy. That after President Obama’s Justice Department did virtually nothing to employ antitrust to block the tech oligarchs’ domination of key markets like search, social media, computer, and smartphone operating systems. Nor did they pressure them to stop avoiding taxes that burden most other businesses.

Nor can we expect the Republicans, with their instinctive worship of great wealth, to stand up against monopoly and abuse of power. A White House run by Donald Trump, whose true religion seems to be that of the Golden Calf, and his Goldman Sachs economic henchmen are inherently unable to oppose ever greater concentration of money in the hands of a select few. It’s no surprise that so far, in terms of stocks, the tech giants have been among the biggest winners under Trump.

Controlling the Means of Information

The Masters’ ascendency has been enhanced by their growing control of the means of communications. Facebook is already the largest source of news for Americans, particularly the young. They, along with Google, seem capable of shaping information flows to suit their particular world view, one increasingly hostile to any dissenting opinions from the right. (One key to understanding post-election concerns about “fake news” is to realize that a staggering 99 percent of growth in digital advertising in 2016 went to Google and Facebook.) At the same time, those two, along with Apple and Amazon, increasingly shape the national culture, essentially turning Hollywood into glitzy contract laborers.

But no one practices the politics of oligarchy better than Bezos. Under his ownership The Washington Post has been transformed into the Pravda of the gentry left. Last year, for example, they worked overtime to undermine Bernie Sanders’ campaign, whose victory might have led to stronger antitrust enforcement and the confiscation of some of their unprecedented wealth. Once Sanders was dispatched, Bezos, fearing the rise of uncontrollable Trumpian populism, sank his editorial resources into supporting the big money favorite, Hillary Clinton.

The New Political Agenda

Populism, left or right, represents the only viable threat to oligarchic ambitions. Bank of America’s Michael Harnett recently warned that if the growth of stock market wealth continues to be concentrated in a handful of tech stocks, that “could ultimately lead to populist calls for redistribution of the increasingly concentrated wealth of Silicon Valley.”

Deflecting populism is the central imperative of an oligarchy. They feel their dominance as evidence of their superior intellect and foresight, not the result of such things as political influence, or easy access to capital. They embrace, as former TechCrunch reporter Greg Ferenstein put it, the notion of “a two-class society of extremely wealthy workaholics who create technologies that allow the rest of society to enjoy leisurely prosperity. The cost for this prosperity will be inequality of influence.”

What Google’s Eric Schmidt calls the Valley’s “religion in-of-itself” has little in common with resuscitating grassroots Democratic capitalism, the old dream of libertarians, or empowering the working class, that of old leftists. The founders of the big tech firms may embrace progressive ideas on the environment, free trade, and immigration, but have little use for unions or raising capital gains rates.

Overall, notes Ferenstein, they eschew nationalism, favoring global governance, want more immigration and embrace the notion of a government nanny state to tell the masses how to live. They also prefer highly unequal conditions of urban density over the more traditionally egalitarian suburbs. Largely childless San Francisco, impossibly expensive and deeply divided by class, is the preferred model of the future.

The Problem is People

People, little or otherwise, now constitute the Masters’ biggest problem. Unlike the old moguls like Andrew Carnegie or Henry Ford, the new Masters do not promise greater prosperity, or even decent jobs for the middle or working class. Their vision, increasingly, seems to be a world where most people’s labor is largely superfluous, and will need to be satiated with regular basic income from the state, a position now widely embraced by such luminaries as Mark Zuckerberg and Elon Musk, supplemented by occasional “gig” work.

They imagine a future where few will ever own homes or control any real assets. Rather than being parts of a geography or even a country, the increasingly socially isolated masses can be part of Zuckerberg’s “global community” while ordering food from Amazon, delivered by a drone from an automated warehouse, employing social media and virtual reality to fill their long periods of idleness.

As Brandeis warned, this vision—dominated by the interests and influence of the few who possess the bulk of the wealth—is incompatible with the democracy that we have known.

This piece originally appeared on The Daily Beast.

Joel Kotkin is executive editor of NewGeography.com. He is the Roger Hobbs Distinguished Fellow in Urban Studies at Chapman University and executive director of the Houston-based Center for Opportunity Urbanism. His newest book is The Human City: Urbanism for the rest of us. He is also author of The New Class Conflict, The City: A Global History, and The Next Hundred Million: America in 2050. He lives in Orange County, CA.

Photo by National Museum of American History, via Flickr, using CC License.

Exaggerated

In round numbers we have an annual GDP of $20 trillion. That constitutes our annual income, which presumably represents the return on investment in the total capital stock of America. If one supposes a 5% return, that means the total capital stock is worth about $400 trillion. Of which Apple's cash hoard ($250 billion) is about 0.0625%.

Apple is hardly taking over the world. Please don't exaggerate.

Your fears about free speech, etc., are slightly more warranted, but I think also overstated. Google is very much at risk of competition from a Wikipedia-like start-up. Or put another way, the cost of entry into their search business is very low. If for whatever reason they betray the trust we give to them, they can lose market share just as quickly as Yahoo did before them.

I think the same holds true for Facebook--there is no intrinsic reason why they have the loyalty they currently do, and public affection is fickle.

All true, and yet. . .

Everything Kotkin says is correct, but as far as Trump and his supporters are concerned, they are not populists according to the classic mold, but feel threatened far more by the over-empowerment of US central government than by the monstrous accretions of wealth to individuals who do not present as the classic factory-owning, proletarian-crushing robber barons of Brandeis' day but rather as people who have legitimately earned their hoards. Perhaps that perception will change as they come more out into the open as de facto, quasi-State agencies of progressive lifestyle control, but for now, they just do not loom as so large a threat as the government they increasingly control and which, owing to its over-empowerment by successive generations of the Left, is now in a position to order every aspect of our daily lives and does so with gusto.