In delivering the Annual Report of the Bank to the House of Representatives Standing Committee on Economics, Finance and Public Administration on August 18, 2006, (now former) Reserve Bank of Australia Governor Ian MacFarlane expressed concern about Australia’s house prices, which had escalated severely in relation to incomes.

"…why has the price of an entry-level new home gone up as much as it has? Why is it not like it was in 1951 when my parents moved to East Bentleigh, which was the fringe of Melbourne at that stage, and were able to buy a block of land very cheaply and put a house up on it very cheaply? Why is that not available? Why is that not the case now?"

MacFarlane told the Committee that “that reluctance to release new land plus the new approach whereby the purchaser has to pay for all the services up front—the sewerage, the roads, the footpaths and all that sort of stuff—has enormously increased the price of the new, entry-level home. That is a supply-side issue, not a demand-side issue.” MacFarlane questioned whether the existing “land release policies” are “front-loading of all charges” are the right set of policies.

Urban Containment

For context, by the time of MacFarlane’s testimony virtually all Australian states as well as the Australian Capital Territory (Canberra) and the Northern Territory had adopted land release policies characterized by urban containment strategies (called “urban consolidation” in Australia) with urban growth boundaries (or equivalent). These policies severely ration or even prohibit new houses from being built on the urban periphery.

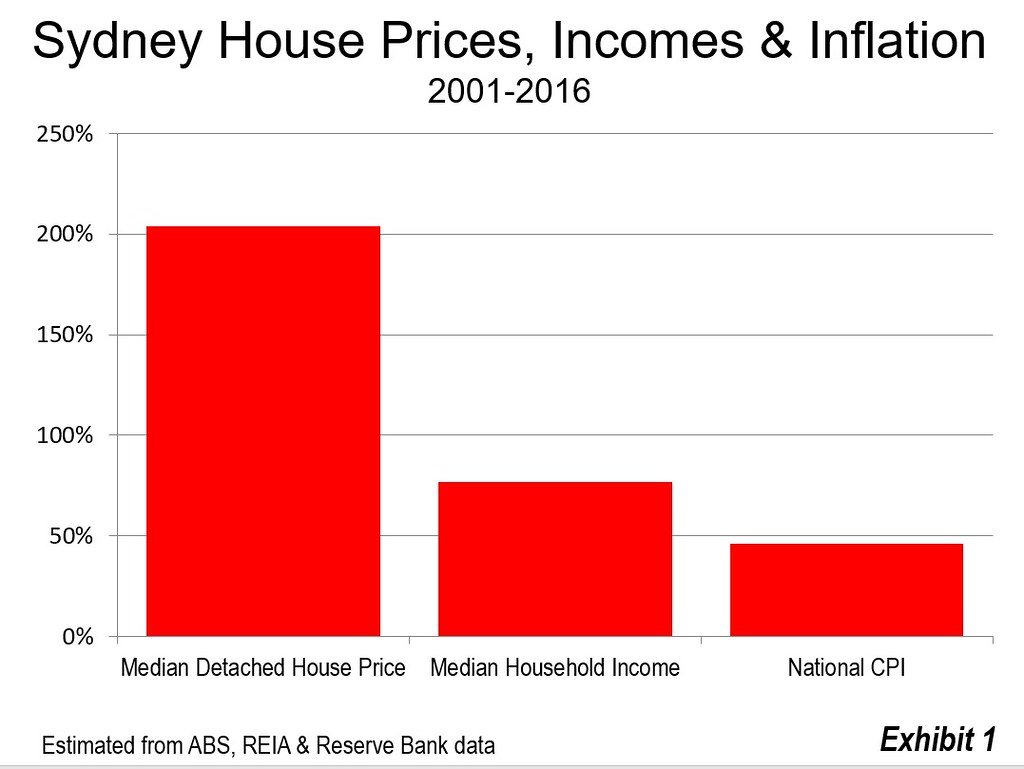

These policies mimic those of Great Britain, which spread not only to Australia, but also to other metropolitan areas around the world (such as Vancouver, Portland, Seattle, San Francisco, Toronto, Auckland and many others). It should not be surprising that much higher land prices are associated with urban containment’s rationing of land, much like petroleum prices shot up during the oil embargoes of the 1970s. Meanwhile, corrective policy reforms have not been implemented by the states and housing affordability has deteriorated compared to median household incomes and inflation, as is clear by looking at Sydney (Figure 1).

Another central banker, former Governor of the Reserve Bank of New Zealand, Donald Brash explained the consequences: “...the affordability of housing is overwhelmingly a function of just one thing, the extent to which governments place artificial restrictions on the supply of residential land.”

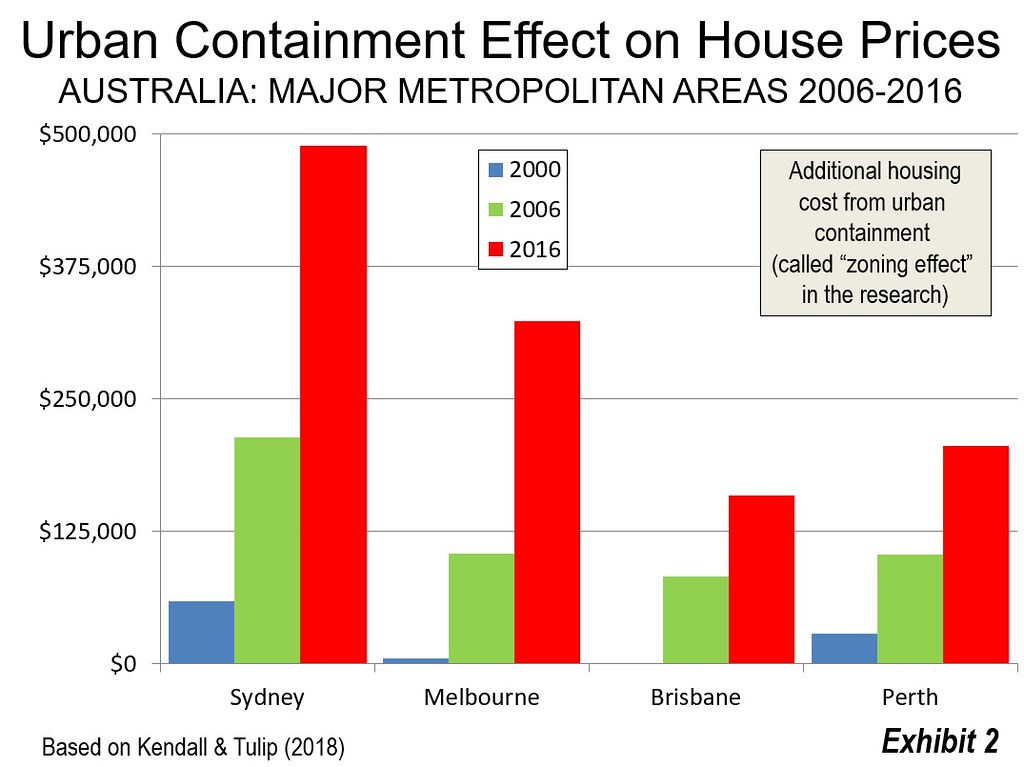

The New Reserve Bank of Australia Published Research

This insight is illustrated by a new report by Reserve Bank of Australia (RBA) economists Ross Kendall and Peter Tulip (The Effect of Zoning on Housing Prices). According to supplemental data published with the report, the effect of overly restrictive land use regulations, which the authors call the “zoning effect,” had added considerably to the cost of the detached houses that most Australians prefer. By 2006, the zoning effect had already added 55% (nearly $155,000) to the cost of a house in the Sydney metropolitan area, up from 21% in 2000. This phenomena was also significant by 2006 in the three other largest metropolitan areas studied by Kendall and Tulip, Melbourne, Brisbane and Perth, where the zoning effect added from $74,000 to $98,000. Australia’s other major metropolitan area (more than 1,000,000 population), Adelaide, was not included in the analysis, though its housing affordability is now the third worst, behind Sydney and Melbourne.

The Zoning Effect Urban Containment Effect

Actually, the term “zoning effect” is insufficiently precise. There are plenty of arguments for and against zoning, but zoning’s effect on housing affordability between metropolitan markets was only marginal until metropolitan areas began adopting urban containment. Pre-urban containment zoning, such as parking requirements, permitted uses in small areas of a municipality and building lot sizes have not been associated with housing affordability differences that can “hold a candle” to the huge differences caused by urban containment.

It was only with the imposition of urban containment policies that the huge disparities in housing affordability emerged, whether in Australia, the United Kingdom, or New Zealand, as well as the troubled U.S. markets. For example, traditional zoning did not seek to outlaw the housing most people preferred, or ban building outside the already built-form. Urban containment represented a “sea-change,” a radical turn in urban land use policy. Indeed, urban containment is urban planning’s “killer app.” The term “zoning effect” is far too broad. The more appropriate term would be “urban containment effect.”

The Urban Containment Effect in Major Australian Cities (2016)

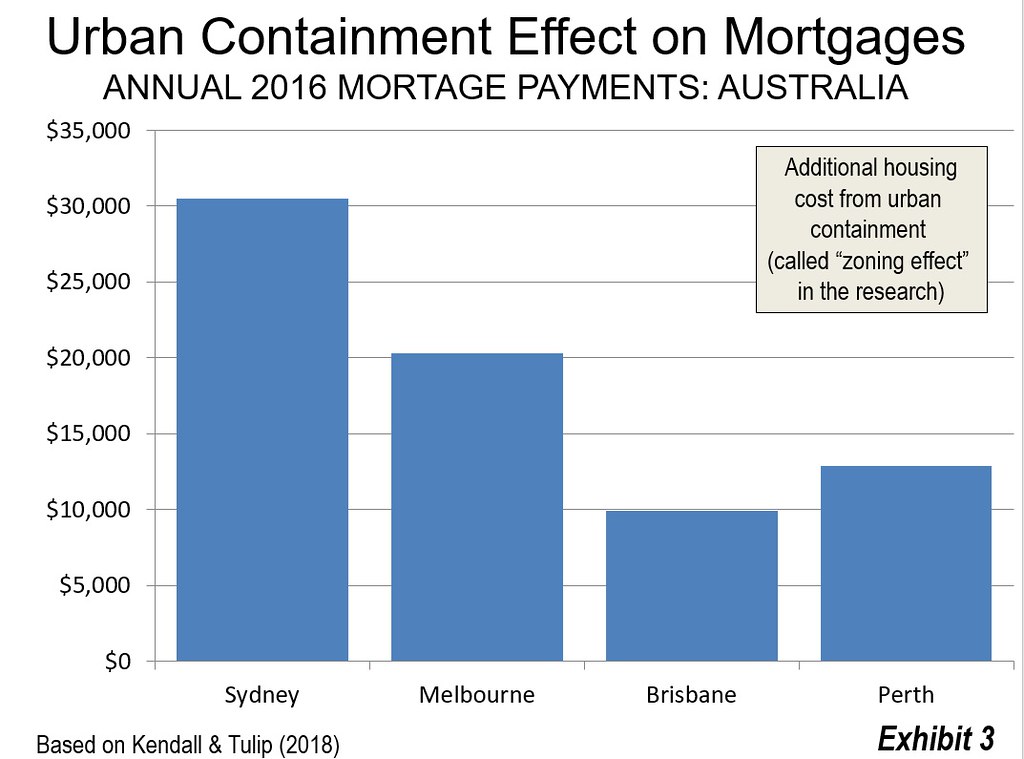

The message of the RBA report is that houses are more costly because as a result of urban containment. According to the research, and assuming typical mortgage provisions, (Note) the urban containment effect (our term) adds from $150,000 to nearly $500,000 to house prices in major Australian metropolitan areas --- this is not the house price, but the additional impact of urban containment (Figure 2). The urban containment adds up to $29,000 to annual payments on the average house in Australia’s major metropolitan areas (Figure 3).

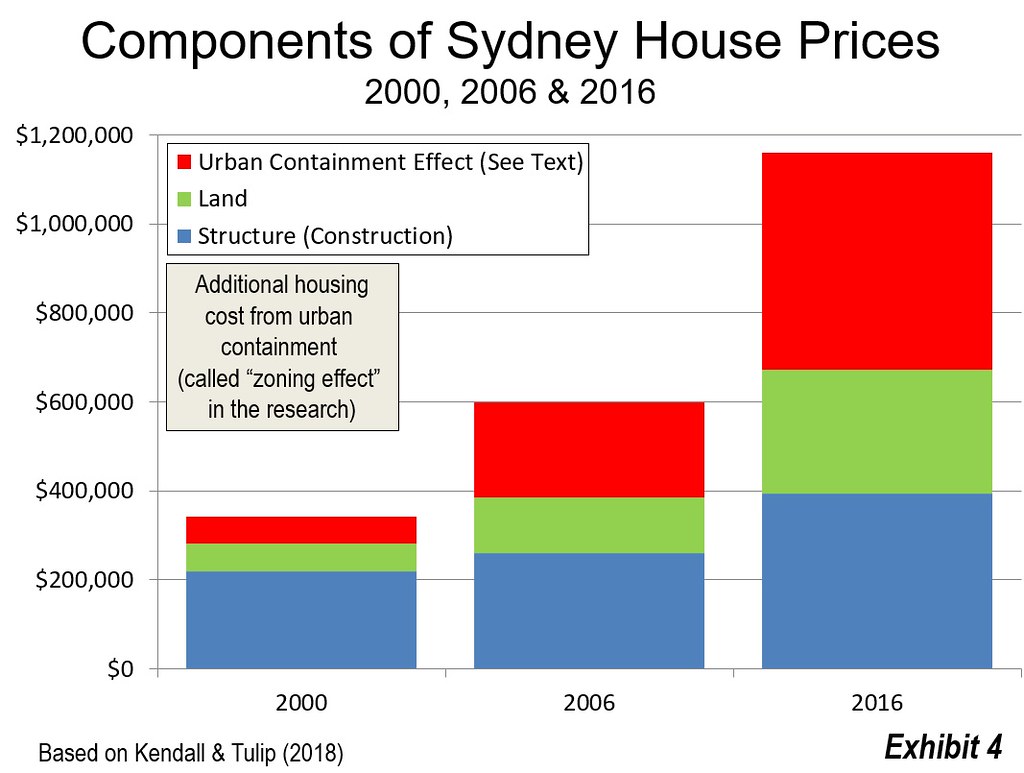

• In Sydney, the urban containment effect adds $489,000 to the house price making the annual mortgage payments $29,000 higher. Figure 4 shows the components of the average house price in Sydney.

• In Melbourne, the urban containment effect adds $324,000 to the house price, making the annual mortgage payments $19,000 higher.

• In Brisbane, the urban containment effect adds $159,000 to the house price, making the annual mortgage payments $9,000 higher.

• In Perth, the urban containment effect adds $206,000 to the house price, making the annual mortgage payments $12,000 higher.

• No data is available for Adelaide, but the present median multiple (median house price divided by median household income) suggests that urban containment effect adds at least $13,000 to the mortgage.

These are significant amounts, especially to families starting out and renters who would like to participate in the proverbial “Great Australian Dream” of home ownership.

The Less Lucky Country (At Least for Some)

Australia is one of the world’s most prosperous countries and Australians enjoy a high standard of living. Home ownership is fundamental to all of this, as the “Great Australian Dream” illustrates (we Americans only have an “American Dream,” without the “Great”). It is not without justification that Australia has been called the “lucky country.” But for those forced to accept a lower standard of living because of its unnecessarily high housing prices, Australia has become a “less lucky country.”

To Restore the Great Australian Dream

Tony Recsei, the President of Save Our Suburbs in Sydney suggested the needed policy reform in a letter to the Australian Financial Review, the Australia’s premier business publication:

The obvious solution is to bring back competition by allowing any landowner on the outskirts to subdivide subject to reasonable environmental constraints. The result decrease in prices will flow through to all markets. This will not suit land hoarders, but will provide our young people with the opportunity to own their own home.

Recsei gets to the heart of the matter. Public policy should seek to maximize the standard of living and minimize poverty. Urban containment does the opposite.

Under the current policy framework, housing affordability is likely to continue getting worse. The RBA researchers were not so much concerned about stronger, recently enacted regulations. They noted that regulation has not been materially strengthened 2000, but that nearly all the urban containment effect had added much more to the price of houses just because as demand has risen, the effects have gotten stronger. In this observation the researchers raised an issue usually missed --- that when land use regulations are too tough, they continue to drive prices higher, unless reformed.

So long as Australian cities have housing markets distorted by urban containment, more and more Australians will be denied the “Dream.” And, it can be expected that more investors, foreign and domestic, will be drawn to Australia’s rigged housing markets. It is as if a “Speculators Welcome” sign has been hung from the Sydney Harbour Bridge (photograph above), a boon to speculators but a bane to the ordinary aspirations of Australians.

Note: Assumes a 5 year fixed rate 30 year mortgage, with monthly payments (from the Westpac Mortgage Repayment Calculator, https://www.westpac.com.au/personal-banking/home-loans/calculator/mortga...).

Wendell Cox is principal of Demographia, an international public policy and demographics firm. He is a Senior Fellow of the Center for Opportunity Urbanism (US), Senior Fellow for Housing Affordability and Municipal Policy for the Frontier Centre for Public Policy (Canada), and a member of the Board of Advisors of the Center for Demographics and Policy at Chapman University (California). He is co-author of the "Demographia International Housing Affordability Survey" and author of "Demographia World Urban Areas" and "War on the Dream: How Anti-Sprawl Policy Threatens the Quality of Life." He was appointed to three terms on the Los Angeles County Transportation Commission, where he served with the leading city and county leadership as the only non-elected member. He served as a visiting professor at the Conservatoire National des Arts et Metiers, a national university in Paris.

Photograph: Sydney Harbour Bridge (by author)