According to an October 21, 2018 Los Angeles Times article, experts “agree that the fundamental issue underlying the state’s housing crisis is that there are not enough homes.” In contrast, according to the article, is that “the public doesn’t believe it.” Only 13 percent of registered voters cited “too little homebuilding” as a principal reason for California’s housing unaffordability, in a USC/Dornsife Los Angeles Times poll.

The ultimate cause of California’s housing crisis is more than just not enough houses. More precisely, it is not enough houses that can be afforded by a shrinking middle-class, while the cost of affordable housing for low-income households has become insanely prohibitive for taxpayers (below). There may be no better proof than the fact that many households are “doubling up” (a term coined by the Census Bureau to describe sharing of houses by two households) --- a phenomena far more common in places like Southern California or Silicon Valley’s San Jose metropolitan area than in the rest of the country. (Note 1).

The housing affordability problem in California cannot be solved unless its causes are understood. This article outlines the fundamental causes.

(1) Middle-Income Housing Affordability

It is beyond comprehension that California’s many nominally affluent middle-income households have been priced out of the market, while similar incomes elsewhere are enough to purchase larger and better houses.

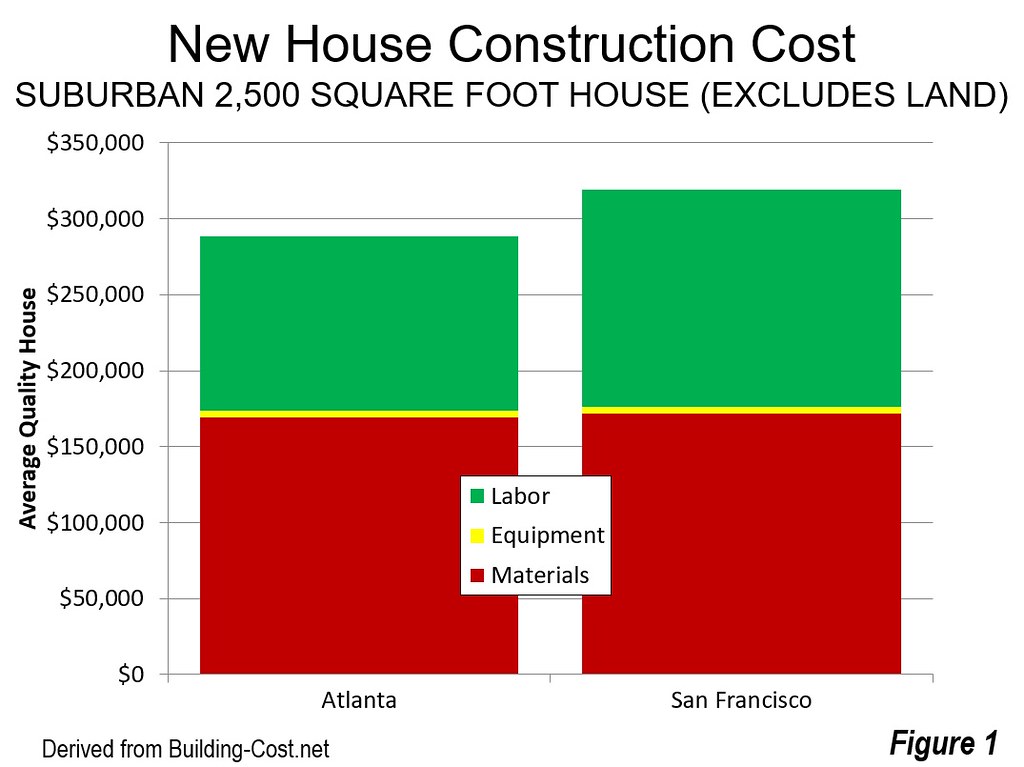

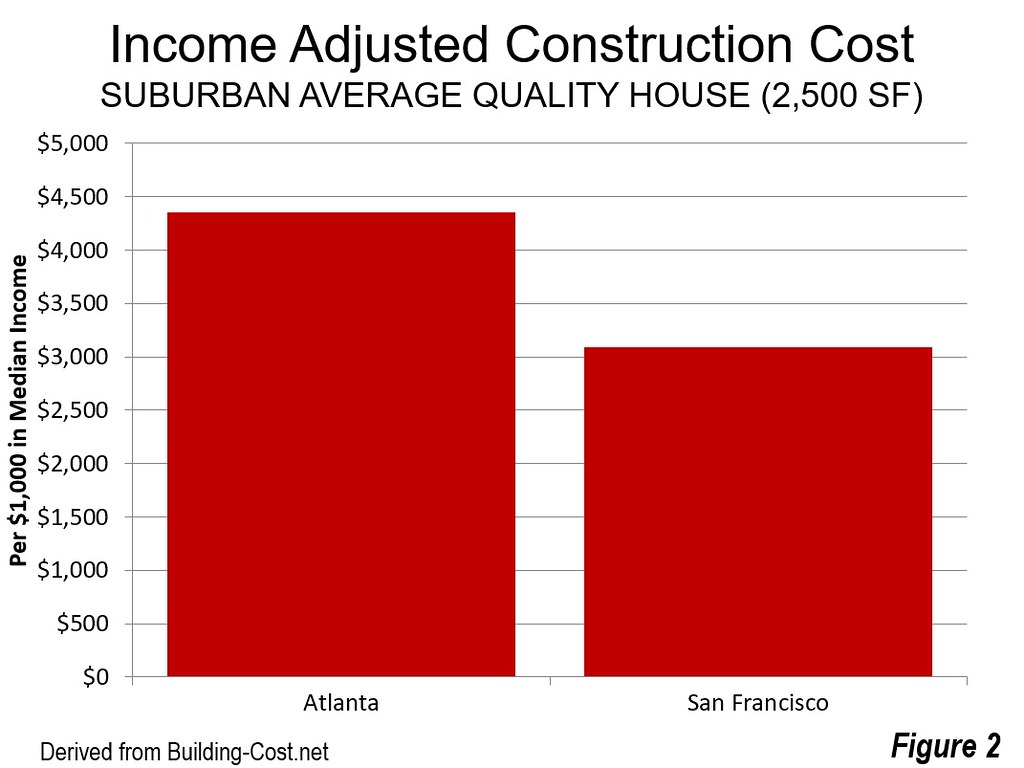

Construction Costs are Not the Problem: Construction costs are not the problem. In fact building a house (excluding the land) in California is just a little more expensive than elsewhere. For example, the construction costs for a new 2,500 square foot house in the Atlanta suburbs are only about 10% less than for the same house in the San Francisco metropolitan area suburbs, based on calculations from Building-Cost.net (Figure 1). Astoundingly, when adjusted for incomes, construction costs are about 30 percent lower in San Francisco than in Atlanta (Figure 2).

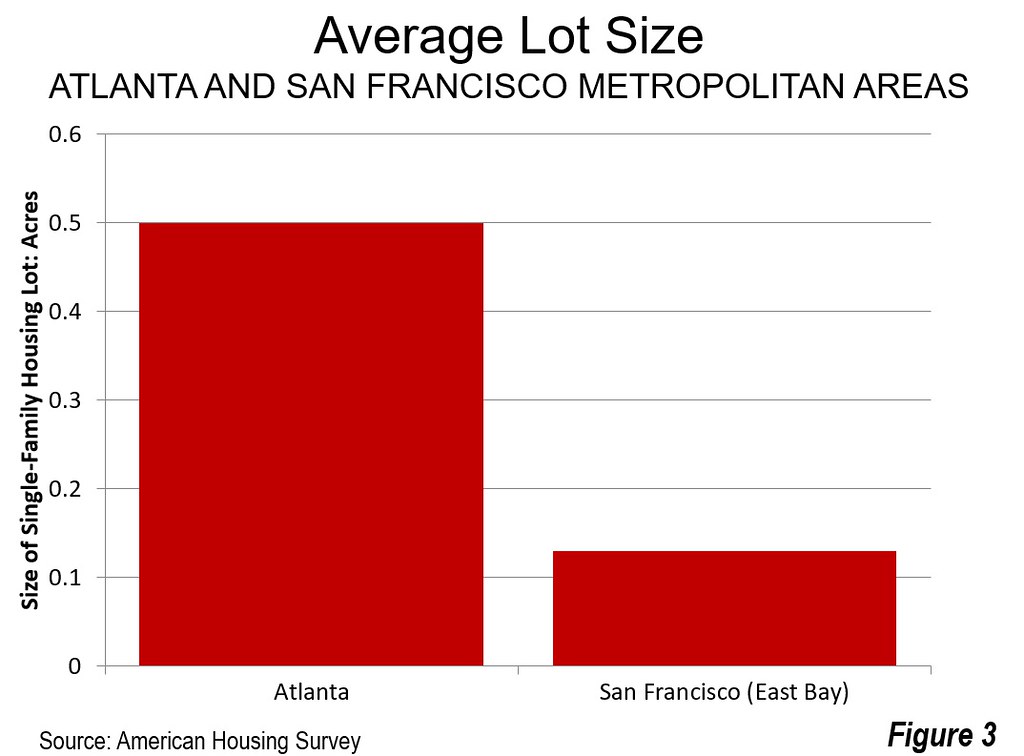

Yet San Francisco area house prices are nearly triple those of Atlanta, and this is after accounting for San Francisco’s higher income. Similar comparisons show California prices to be far higher than virtually all markets across the nation. Further, Atlanta’s houses are on lots three times the size in San Francisco, according to the American Housing Survey (Figure 3).

The Problem - Exorbitant Land Costs: All of the house cost difference --- and then some --- is land. Indeed, California is so expensive that if builders sold camping tents as houses, they would still be unaffordable because of the costly land underneath.

In urban areas, land tends to be the least expensive per acre on the urban fringe, where housing meets rural, largely agricultural, areas. Land values increase toward the urban core and commercial centers. Since World War II, land, like labor and materials, was priced in a competitive market. Generally, the land cost including infrastructure represented 20% of the price of a new house and lot, both nationally and in California. But that has changed radically in California as the price of land (as opposed to construction) have virtually exploded. For example, in the San Jose metropolitan area, land values have reached $925,000, 77% of the cost of a house.

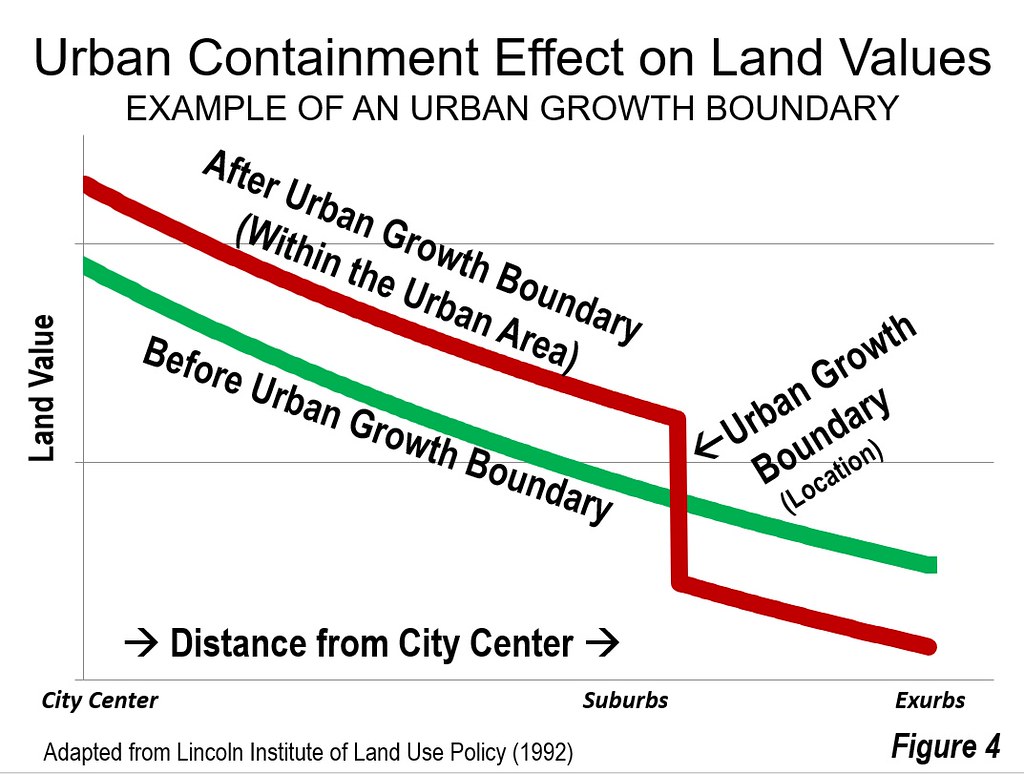

Why Land Costs are so High: California’s high land prices can be largely traced to its environmental and land use regulations --- notably called “urban containment” --- that have driven up land prices and even outlawed new houses on perfectly developable urban fringe areas. The land on which houses are allowed is quickly snapped up by developers where artificial scarcity creates much higher prices. The higher land costs are natural consequence of supply that falls far short of demand.

Urban growth boundaries (UGBs) are a principal strategy of urban containment, and are intended to reduce or stop the expansion of urban areas. According to the economic and planning literature, UGBs increase the value of land within the contained urban area. This reality is indicated by research showing that land values per acre for adjacent comparable properties can jump 10 times (1,000 percent) or more at an urban growth boundary (Figure 4).

Planners and other advocates of urban containment believed that their strategies increase densities, while sufficiently reducing the land cost per unit to keep housing affordable. It has not worked out that way and not even close --- not in California, and not in other markets with urban containment policy, such as Vancouver, Sydney, Melbourne, London, Auckland along with Liverpool and virtually all of England’s economically depressed Midlands and North.

Before all else, land prices must come down to restore middle-income housing affordability.

(2) Low-Income Affordable Housing:

The impact on low-income households has been at least as destructive. Outrageously, rich California has the highest housing cost adjusted poverty rate in the nation, well above Mississippi and West Virginia, long known for high poverty rates.

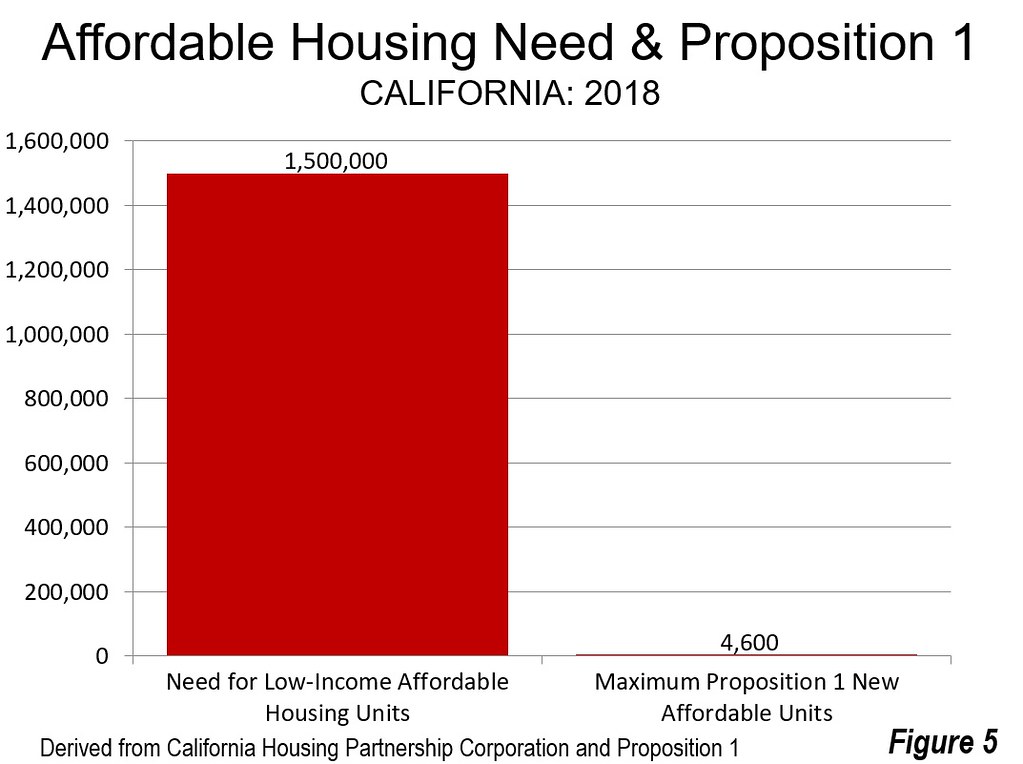

A consequence of the housing crisis is indicated by the California Housing Partnership Corporation estimate that 1.5 million additional subsidized houses are needed in the state.

Proposition 1, the affordable housing referendum with $2 billion for affordable housing, which at an average cost of $425,000 could build a maximum of 4,600 houses. At least 300 more identical ballot measures would be required to solve the problem. Obviously that is not going to happen. Make no mistake about it, the lucky few receiving the new houses would benefit greatly. But it would be misleading to characterize Proposition 1 as anything more than a “drop in the bucket.” This problem is beyond the power of the state to solve itself; there needs to be a more market-based solution.

Eligibility for low income housing is based on the ratio of housing costs to income. California’s high housing costs produce a much greater need for subsidized housing. There is probably no surer way to reduce the cost of subsidized housing to levels practical for taxpayer support than to improve housing affordability for middle-income households. For example, if California’s housing affordability were at the level of Colorado’s (itself an expensive state), the need for subsidized housing likely would reduced by least 200,000 units. California has a need for three times as many new subsidized houses as Texas (using the same methodology), despite having a higher income. (Note 2).

Less Expensive Land: The Key to Solving California’s Housing Crisis

Without reform, housing affordability and the challenge of financing subsidized housing is likely to worsen over time,. This routinely occurs when demand exceeds supply. The price of land is the key. California’s housing crisis cannot be solved without reforms that restore a competitive land market, reducing the price of new houses on the urban fringe and obviously allowing their construction.

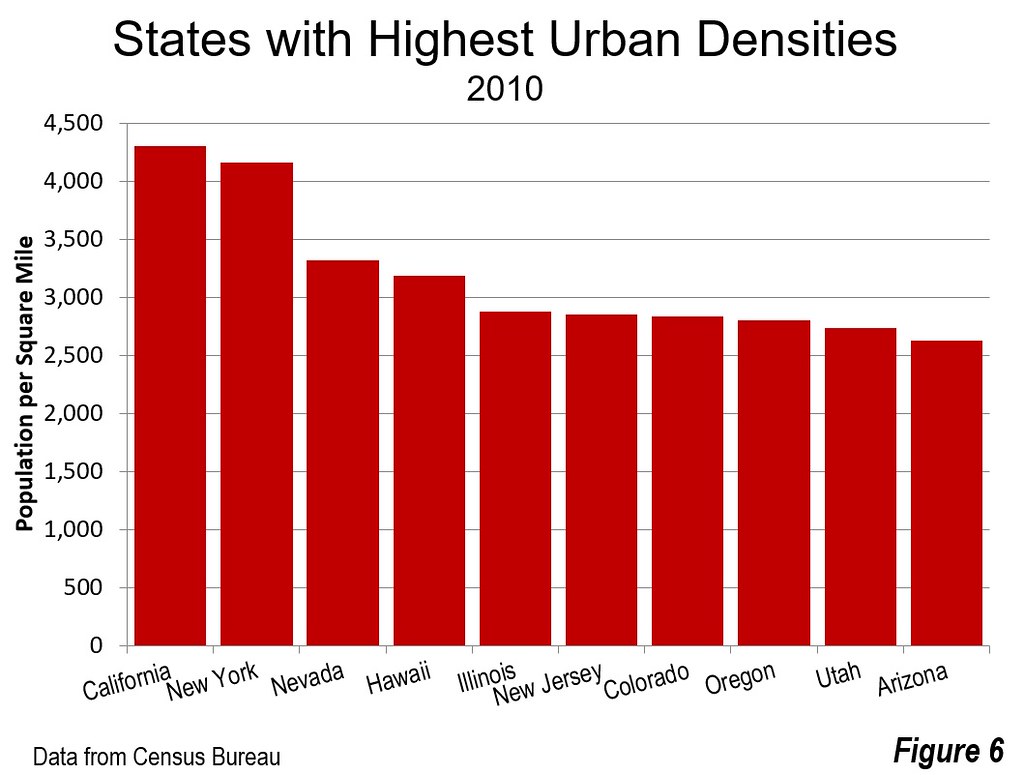

Urban fringe development need not be at the low densities of suburban Atlanta or New York. California has the densest urbanization in the nation (Figure 5). Indeed, Los Angeles suburbs are nearly twice as dense as those of New York City. Appropriately reformed regulations could maintain California’s high urban densities, while allowing housing to be built on competitively priced land, substantially improving housing affordability, and reducing the need for subsidized housing. The result would be a significant improvement in the quality of life for most Californians, which is undeniably a principal purpose of government.

Note 1: The 2017 American Community Survey indicates that 680,000 families in the state are “subfamilies,” defined as families that live in houses owned or rented by other related households. Thus, there is a total of 1,360,000 households that include the 680,000 subfamilies and the 680,000 households with whom they share. The city of Los Angeles has 1,385,000 occupied housing units, slightly more than the state total of sharing households (also see the Census Bureau article: “Households Doubling Up”).

Note 2: The California Housing Partnership Corporation estimate of the affordable housing unit need is based on the number of households with housing costs amounting to 50% or more of their income. ACS 2017 data indicates that Colorado has 14% fewer households paying 50% or more of their income on housing than California. In California, this would be a reduction of more than 200,000 households.

Wendell Cox is principal of Demographia, an international public policy and demographics firm. He is a Senior Fellow of the Center for Opportunity Urbanism (US), Senior Fellow for Housing Affordability and Municipal Policy for the Frontier Centre for Public Policy (Canada), and a member of the Board of Advisors of the Center for Demographics and Policy at Chapman University (California). He is co-author of the "Demographia International Housing Affordability Survey" and author of "Demographia World Urban Areas" and "War on the Dream: How Anti-Sprawl Policy Threatens the Quality of Life." He was appointed to three terms on the Los Angeles County Transportation Commission, where he served with the leading city and county leadership as the only non-elected member. He served as a visiting professor at the Conservatoire National des Arts et Metiers, a national university in Paris.

Photograph: Suburbs (Upland and Ontario) in the densest major urban area in the United States (Los Angeles), by author.