Just how bad is the current economic downturn? It is frequently claimed that the crash of 2008 is the worst economic downturn since the Great Depression. There is plenty of reason to accept this characterization, though we clearly are not suffering the widespread hardship of the Depression era. Looking principally at historical household wealth data from the Federal Reserve Board’s Flow of Funds Accounts of the United States, summarized in our Value of Household Residences, Stocks & Mutual Funds: 1952-2008, we can conclude it’s pretty bad, but nothing yet like the early 1930s.

But this Panic of 2008 is no picnic. And in some key areas, notably housing, it could be even worse than what was experienced in the Great Depression.

Housing: It all started with the housing bubble that saw prices in some markets rise to unheard of levels, principally in California, Florida, Phoenix, Las Vegas and the Washington, DC area. Mortgage lenders, unable to withstand the intensity of losses in these markets caused by declining prices, collapsed like a house of cards. This precipitated the Lehman Brothers bankruptcy on Meltdown Monday (September 15, 2008) and a far broader economic crisis since that time.

Before the bubble, housing had been a stable store of wealth (equity or savings) for Americans. According to federal data, the value of the US owned housing stock increased in every year since 1935. The bursting of the housing bubble, however, brought declines in both 2007 and 2008, the longest period of housing value decline since between 1929 and 1933. The value of the housing stock was down 20 percent from its peak at the end of 2008. In some markets the losses amounted to more than double this amount. By comparison, the 1929 to 1933 house value decline was 27 percent. However, only one Great Depression year (1932) had a larger single-year decrease than 2008.

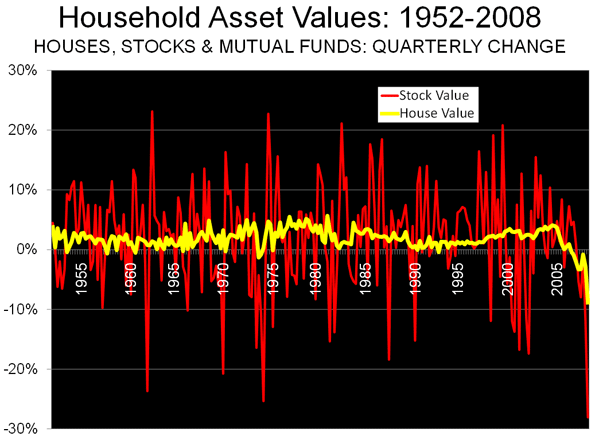

Indeed, between 1952 and 2006, the value of the housing stock never declined for more than a three month period. The bubble changed all that. The value of the housing stock has now fallen eight straight quarters. An investment that has been safe for most middle class Americans – the house in the suburbs – suddenly experienced the price volatility usually associated with the stock market, as is indicated in the chart below.

The resulting losses have been substantial. By the end of 2008, the value of the housing stock has fallen $4.5 trillion. In Phase I of the housing downturn, before Meltdown Monday, the largest losses were concentrated in the markets with the biggest “bubbles,”. But since that time the market has entered a Phase II decline, while a more general decline has characterized housing markets around the country in the fourth quarter of 2008. The decline continues.

California, the largest of all the states, has been particularly hard hit. New data for both the San Francisco and Los Angeles areas show price drops of approximately 10 percent in January, 2009 alone, as prices fall like the value of a tin-pot dictatorship’s currency. This decline, it should be noted, has spread from the outer ring of these areas – places like the much maligned Inland Empire region and the Central Valley – into the formerly more stable, and established, areas closer to the larger urban cores, which some imagined would be safe from such declines.

Sadly, there may well be some time before house price stability can be achieved. To restore the historic relationship between house prices and household incomes to a Median Multiple (median house price divided by median household income) of 3.0 would require another $3 trillion in losses, equating to a more than 15 percent additional loss. Losses are likely to be greater, however, not only in the “ground zero” markets of California and Florida but also other hugely over-valued markets, such as Portland, Seattle, New York and Boston. Of course, these are not normal times, and an intransigent economic downturn could lead to even lower house values than the historical norm would suggest.

Stocks and Mutual Funds: As noted above, stocks and mutual funds have been inherently more volatile than housing values. According to Federal Reserve data, the value of these holdings fell 24 percent over the year ended September 30. Based upon later data from the World Federation of Exchanges, we estimate that the value declined sharply after September 15, and at December 31 stood at 45 percent below the peak.

The household value of stocks and mutual funds has declined for five consecutive quarters, as of December 2008. There was a more sustained drop over six quarters in 1969-1970, although the decline in value was less than the present loss, at 37 percent. A larger decline (47 percent) was associated with the four quarter decline of 1973-1974. Comparable data is not available for household stocks and mutual fund holdings before 1952. The less complete data available indicates that the gross value of common and preferred stocks fell 45 percent from 1929 to 1933. As late as 1939, a decade after the crash, the loss had risen to 46 percent, indicating both the depth and length of the Great Depression.

The present downturn seems on course at a minimum to break the post-depression loss record with an overall decline at 55 percent as of February 20. This would correspond to a household loss of $8 trillion from the peak.

Consumer Confidence: The Conference Board’s Consumer Confidence Index reached an all time low of 25.0 in February, down a full one-third in a month. Even with its gasoline rationing, the mid-1970s downturn saw a minimum Consumer Confidence Index of 43.2. Normal would be 100; as late as August of 2007, consumer confidence was above 100. Consumer confidence is important. Where it is low, as it is today, there is fear and even people with financial resources are disinclined to spend. Confidence is a major contributor to economic downturns, which is why they used to be called “panics.” Restoring confidence is a requirement for recovery.

Government Confidence: If there were a federal government index of confidence, it would probably be near zero. This is demonstrated by the trillions that both parties in Washington have or intend to throw at banks, private companies and distressed home owners to stop the downturn. Never since the Great Depression have things become so bad that Washington has opened taxpayer’s checkbooks for massive financial bailouts.

How Much Wealth has been Lost: The net worth of all US households peaked at $64.6 trillion in the third quarter of 2007, according to the Federal Reserve Board. Since that time, it seems likely that the housing, stock and mutual fund losses by the nation’s households could be as high as $12 trillion – $4 trillion in housing and $8 trillion in stocks and mutual funds. This is a major loss and is unlikely to be recovered soon. Yet it makes sense to consider these losses in context. Unemployment is far lower than in the 1930s, when it reached 25 percent, and the Dust Bowl is not emptying into California (indeed, more than 1,000,000 people have migrated from California to other states this decade).

Born Yesterday Jeremiahs: It is fashionable to suggest that the current economic crisis is the result of over-consumption and an unsustainable lifestyle. The narrative goes that the supposed excesses of the 1980s and 1990s have finally caught up with us. In fact, however, even with the huge losses, the net worth of the average household is no lower than in 2003 and stands at 70 percent above the 1980 figure (inflation adjusted). This may be a surprise to “born yesterday” economic analysts.

The reality is that the country achieved astounding economic and social progress since World War II. The reality remains that even after the losses we are not, objectively speaking, experiencing Depression-like conditions. Critically, the answer to the question, "Are you better off today?" in 1950, 1960, 1970, 1980, 1990 and even 2000 is “yes”. This is a critical difference with the situation in the 1930s when the country overall was much poorer, and far less able to withstand such punishing losses.

Beware the Panglossians: Even so, it seems premature to predict that the economy will turn around soon. Some Panglossian analysts predict recovery later in the year or in 2010 seem likely to miss the mark by years. Remember analysts – particularly those tied to both the real estate and stock sectors – who have discredited themselves with their past cheerleading. In addition, the international breadth and depth of this crisis cannot possibly be fully comprehended at this time. Last week the Federal Reserve predicted a declining economy over the next year.

And even when the recovery starts, it is likely to be slow because of the public debt run up to stop the bleeding. When the recovery begins, the nation and the world will have to repay the many trillions in bailouts one way or the other. This can take the form of higher taxes, inflation, rising real interest rates or, if you can imagine, all three.

How Bad Is It? Bad Enough. The present downturn is not as serious as the Great Depression. Nonetheless, the Panic of 2008 is without question, the most serious economic downturn since the Great Depression. The real question is whether the government will react as ineffectively as it did back then, and prolong the downturn well into the next decade.

Wendell Cox is a Visiting Professor, Conservatoire National des Arts et Metiers, Paris. He was born in Los Angeles and was appointed to three terms on the Los Angeles County Transportation Commission by Mayor Tom Bradley. He is the author of “War on the Dream: How Anti-Sprawl Policy Threatens the Quality of Life.”

It's really not that

It's really not that complicated - the thing is, you have to realize that people will always act in their best interests. I feel once you have that concept down, it's just a trickle down effect to predict what people will do and what will happen next.

James | the latest information

Good straightforward piece

But one that lacks historical perspective and can most definitely be broadened beyond the past two years to at the very least a decade and, if I had more time, the past sixty some odd years.

“It all started with the housing bubble that saw prices in some markets rise to unheard of levels.”

In 2001/2001 I remember watching Alan Greenspan on Capitol Hill informing us that the housing market could never become one big bubble that bursts because the housing market was like a glass of champagne comprised of tiny little bubbles that upon reaching the top would burst, always to be followed by yet another bubble and yet another and another...I started thinking to myself, what happens when the champagne goes flat? Being one of those dismal economists, I waited and waited, expecting each passing year to be the year it happened, for almost eight years when ta-da.

“Before the bubble, housing had been a stable store of wealth (equity or savings) for Americans.”

Greenspan lowered the Fed Funds Rate (FFR) from 6.5% to 1.0% during 2001-2003, which he argues did not cause the housing bubble. Because it would be overly simplistic to argue that the Fed's interest rate manipulations during the early years of this decade caused the housing bubble, in a sense he is correct; it would be more appropriate to view the Fed as the “great enabler” of the range of monetary excesses that led to the bubble and the subsequent bust. But it is clear that the Fed set and kept its official target rate too low for too long during much of 2001-2005. Such mistakes inevitably occur when you give a person or a group of people too much power. So to re-jigger the quote directly above this paragraph: “Before the bubble, housing had been an unsustainable mirage of wealth for Americans.”

“An investment that has been safe for most middle class Americans.”

In no way should the, if you will, “masses” or especially so-called experts have construed subprime mortgages to be a safe investment, Ever-risky lending practices led or, better, expedited what Minsky termed “Ponzi Borrowing,” which occurs when an entity is unable to pay either the principal or the interest and yet they are able to borrow more and more. This is pretty much the root cause of the recent housing market crash. How did the banks get away with their subprime mortgaging practices for so long? Because Greenspan deregulated the industry, which he acknowledged to be a mistake: “Those of us who have looked to the self-interest of lending institutions to protect shareholders’ equity, myself included, are in a state of shocked disbelief.”

Which means he hasn’t read his Adam Smith, who would in no way have been shocked: “[The capitalist class] ought always to be listened to with great precaution, and ought never to be adopted till after having been long and carefully examined, not only with the most scrupulous, but with the most suspicious attention. It comes from an order of men, whose interest is never exactly the same with that of the public, who have generally an interest to deceive and even to oppress the public, and who accordingly have, upon many occasions, both deceived and oppressed it."[i]

“The Federal Reserve had broad authority to prohibit deceptive lending practices under a 1994 law called the Home Owner Equity Protection Act. But it took little action during the long housing boom, and fewer than 1 percent of all mortgages were subjected to restrictions under that law…In 2008 the Fed greatly tightened its restrictions. But by that time, the subprime market as well as the market for other kinds of exotic mortgages had already been wiped out. Mr. Greenspan said that he had publicly warned about the “underpricing of risk” in 2005 but that he had never expected the crisis that began to sweep the entire financial system in 2007.”[ii]

Representative Henry Waxman: “You had the authority to prevent irresponsible lending practices that led to the subprime mortgage crisis. You were advised to do so by many others. Do you feel that your ideology pushed you to make decisions that you wish you had not made?”

Greenspan: “Yes, I’ve found a flaw. I don’t know how significant or permanent it is. But I’ve been very distressed by that fact.”

Greenspan: “This crisis has turned out to be much broader than anything I could have imagined. It has morphed from one gripped by liquidity restraints to one in which fears of insolvency are now paramount.”

Greenspan: “The evidence strongly suggests that without the excess demand from securitizers, subprime mortgage originations (undeniably the original source of the crisis) would have been far smaller and defaults accordingly far lower.”

“Critically, the answer to the question, "Are you better off today?" in 1950, 1960, 1970, 1980, 1990 and even 2000 is ‘yes’.”

Alas most economists are asserting that this young generation will fare worse than their parents’ generation, the first time that that has happened in American history.

“Some Panglossian analysts predict recovery later in the year or in 2010 seem likely to miss the mark by years. Remember analysts – particularly those tied to both the real estate and stock sectors – who have discredited themselves with their past cheerleading.”

Exactly. Just like what happened with Tulips and Law’s Mississippi Scheme.

[i] http://www.adamsmith.org/smith/won-b1-c11-conclusion-of-the-chapter.htm

[ii] http://www.nytimes.com/2008/10/24/business/economy/24panel.html?_r=3&hp&...

David Parvo

Most Senior Fellow

THE Placemaking Institute

http://placemakinginstitute.wordpress.com

Unemployment in Inland Southern California.......

Unemployment in Inland Southern California increased sharply in December, rising to 10.1 percent from an adjusted reading of 9.5 percent in November. Unemployment isn't pleasant to think about, and is very unpleasant to endure. Some people wonder just where unemployment is the worst. Well, I can tell you which cities that unemployment is the highest in the U.S. El Centro, in southern California, has 25.1% unemployment. (To be fair, most work there is seasonal agriculture.) Merced, California, is just over 20%. Yuba City, also California, sits at 19.5%. The only non-California city hit with high joblessness is Elkhart-Goshen, Indiana, with 18.8%of people living off credit cards during this recession. California's stats are inflated due to seasonal unemployment, as it revolves around farming. Still, that's a lot of people that can't get payday loans due to unemployment.

Dealing with the financial

Dealing with the financial crisis is not complicated. The solutions are SIMPLE. Businesses need capital to stay in business. Businesses need capital to pay their employees. It is about jobs in the private sector. People who have jobs in the private sector are able to make mortgage payments, buy things, and pay taxes. People cheap cialis should not expect immediate results. It took decades to cause our problems. It may take several years to solve many of our problems.

The federal government and state governments should be making it easier for businesses to obtain capital. The federal government and state governments need to stop taxing interest from savings accounts, dividends, capital gains, and estates. More Americans and foreigners may be willing to invest in our country over time.

be hopeful, think of solutions

I highly recommend people read

"Join Me On A Mission" by Christopher Thompson

http://catch22solutions.typepad.com/catch_22_solutions_blog/2009/02/join...

I agree with him that it is important not to allow negativity to harm your ability to be successful.

Our country and the human race have had to deal with far worse.

The more hopeful people are the more solutions they may be able to come up with. The more hopeful people are the more opportunities they may be able to think of to make money for themselves and others.

Dealing with the financial crisis is not complicated. The solutions are SIMPLE. Businesses need capital to stay in business. Businesses need capital to pay their employees. It is about jobs in the private sector. People who have jobs in the private sector are able to make mortgage payments, buy things, and pay taxes. People should not expect immediate results. It took decades to cause our problems. It may take several years to solve many of our problems.

The federal government and state governments should be making it easier for businesses to obtain capital. The federal government and state governments need to stop taxing interest from savings accounts, dividends, capital gains, and estates. More Americans and foreigners may be willing to invest in our country over time.

The federal government should increase the odds that Americans and foreigners will be willing to invest in American businesses and that American businesses will be willing to create jobs by not having the federal corporate tax rate be greater than 15 percent. IT IS ABOUT JOBS IN THE PRIVATE SECTOR. If the federal corporate tax rate is reduced, many businesses may hire more people, increase wages of many people, buy more products and services, and increase their dividends. The more products and services that large businesses buy from small businesses the more people who are likely to be employed by small businesses.

Competent economists should be able to discuss why it is better to tax consumption than savings and investments. To reduce the national debt, the federal government should increase sales taxes, adopt sales taxes it has not had for a while, and may want to have sales taxes it has never had before. I discuss sales taxes, dealing with the financial crisis, and other topics on http://www.newgeography.com/users/kenstremsky

The financial crisis took place because Congress did not learn from the Savings and Loans Crisis about the importance of competent government regulation. Congress should have required down payments on homes and fixed rate mortgages. Allowing mortgage backed securities to be sold based on no money down mortgages was nuts.

Many people who live in apartments may want to buy foreclosed homes with other people they know.

Many people who live in homes that may be foreclosed may want to see if people who live in apartments may want to share the costs of the mortgages in exchange for an ownership stake. Many banks may want to get active in helping make this happen. It is better for banks to have some money coming in than no money coming in at all.

Many colleges may want to buy foreclosed homes to increase student housing. This may be cheaper than building new dorms. Many graduate students might be more interested in living in foreclosed homes than dorms.

Sincerely,

Ken Stremsky