There is probably no issue more requiring resolution in California than poor housing affordability. It is a threat to the preservation of the middle-class and the competitiveness of the state.

Housing Affordability: Background

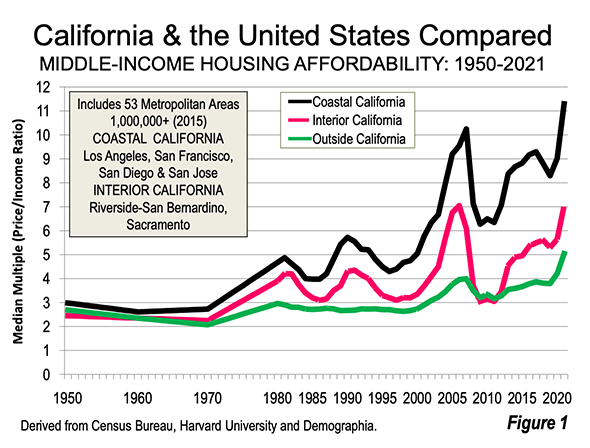

Housing affordability is more than house prices --- it is house prices in relation to income. Price-to-income ratios are widely used, such as by the World Bank,1 the Organization for International Cooperation and Development, and others to measure housing affordability. This chapter uses the “median multiple,” a price-to-income ratio (median house price divided by the gross median household income), to measure middle-income2 housing affordability (Table 1).

| Table 1 Demographia Housing Affordability Ratings |

|

| Housing Affordability Rating | Median Multiple |

| Affordable | 3.0 & Under |

| Moderately Unaffordable | 3.1 to 4.0 |

| Seriously Unaffordable | 4.1 to 5.0 |

| Severely Unaffordable | 5.1 & Over |

| Median multiple: Median house price divided by median household income | |

Housing affordability herein is at the housing market level --- the metropolitan area, which is both a housing market and labor (commuting) market.3 This excludes submarkets, such as municipalities or neighborhoods.

Housing affordability is compared (1) between housing markets (such as between the San Francisco metropolitan area and the Dallas-Fort Worth metropolitan area) or (2) over years within the same housing market (such as in the San Francisco metropolitan area).

This article is adapted and updated from Chapter 2 (“California’s Housing Crisis”) by Wendell Cox in Saving California: Solutions to California’s Biggest Policy Problems, Stephen Greenhut, editor. The chapter is being published by newgeography.com with permission of the Pacific Research Institute, in three parts:

Part I: Housing Affordability in California: The Situation (this piece)

Part II: Housing Affordability in California: Land Markets

Part III: Housing Affordability in California: A Way Forward

Housing Affordability In California: Context

Until about 1970, housing was affordable (less than 3.0 median multiple) throughout the United States, including California. All but one of today’s 53 major markets4 was rated “Affordable.” Since then, huge housing affordability differences have arisen, especially between California and the nation (Figure 1). This has been due to much higher land costs, as construction costs have risen more modestly.5

The Legislative Analyst’s Office reports that an average California home costs 2.5 times the national average and monthly rent is about 50 percent higher.6 In 2019, the median California house value was $325,000 above the US.

More recently, there has been an unprecedented deterioration in housing affordability. The driving factor has been the result of the pandemic and its related demand shock. According to Sam Khater, chief economist at the US Federal Home Loan Mortgage Corporation (Freddie Mac) characterized “the effect of the Covid-19 pandemic” as “unusual in that it spurred housing demand because higher-income households who were able to work from home wanted more space and were willing to live farther from their offices. At the same time, the pandemic caused supply-chain bottlenecks and permitting delays that slowed new-home construction.” The pandemic continues to disrupt standards of living, housing markets and national economies.

During this period, California’s housing affordability also deteriorated. In 2021, San Jose had the least affordable housing among the 92 major US housing markets, with a median multiple of 12.6. San Francisco had a median multiple of 11.8, Los Angeles was at 10.7, followed by San Diego, at 10.1).7 Housing was severely unaffordable even in the interior markets, with Riverside-San Bernardino at 7.4 and Sacramento at 6.7.

California’s excessively high cost of living is a formidable barrier for middle-income and hopeless for lower-income households.

Land Use Regulation In California

Economic research attributes California’s housing affordability crisis to stronger land-use regulation starting around 1970.8

Dartmouth economist William Fischel published an early seminal review 9 of housing affordability in California (1970 to the 1990s). Fischel suggested that regulatory research should look for major changes that “are adopted in some places but not in others.”

Fischel examined the higher house price increases that occurred in California compared to the rest of the nation between the late 1960s and late 1980s. Fischel cites various possible causal factors. He found that the higher prices could not be explained by higher construction cost increases, demand, higher personal income growth, the quality of life, amenities, Proposition 13, land supply or water issues.

Instead Fischel cites stronger land use restrictions --- There were two principal issues, the California Environmental Quality Act (CEQA) and local growth management restrictions.10

Growth Control: Fischel notes that California “became the leader in the “growth control,”11 a new land use strategy that limited new housing development (especially “greenfield” development). According to Fischel, under growth management, “Allowable growth is held below the rate that was both permitted under previous zoning laws and below the rate at the community's vacant land inventory can reasonably sustain.” Growth management could impose building moratoria, annual quotas and limits on conversion of vacant land to housing.12

Fischel contrasts growth management with “ordinary zoning, which is nominally dedicated to the good-housekeeping rule of a “place for everything, but everything in its place," In contrast, “growth-control communities attempt to reduce future residential “development.” “Growth management” regulations were superimposed by municipalities upon their ordinary zoning.

Before the later evolution of growth management to counties and housing markets, builders could “shop around” for more affordable municipal regulatory environments.

CEQA: CEQA imposed far stronger environmental review for private housing projects than elsewhere. Under CEQA anti-development interests routinely challenged major “greenfield” 13 housing projects. Some projects have been blocked, others have been delayed for decades 14 and become far more costly through the CEQA process. As regards its effect on greenfield development, CEQA has effectively acted as urban containment.

Other early research raised concerns. Massachusetts Institute of Technology professor Bernard J. Frieden noted in 1979, “the public benefits are small, costs to the consumer’s big and inequities unmistakable.”15 David E. Dowell, a University of California economist found that “wherever stringent land-use controls have come up against burgeoning demand for housing, land and home prices have skyrocketed.”16

Impact Fees: In response to Proposition 13, municipalities began to use impact fees on new houses and apartments to fund new development. Single-family fees average four times ($28,000) the rest of the nation.17 Fees range to more than $150,000 per house.

There are huge impact fee variations between municipalities18 and questions about the “nexus” between such fees and new development.19 At the same time that costs for new development have been transferred to new owners,20 existing owners received, in effect, windfall profits from extraordinary house value increases in California’s regulatory environment.

From Municipal Regulation to Housing Market Regulation: Growth management started as a municipal issue. However, it expanded to cover counties and entire housing markets.21

The balance between supply and demand has been upset by seriously restricting land for residential development, at the same time as demand increased. This, as predicted by economics, leads to higher prices, all else equal.

View and download endnotes (PDF opens in new tab or window)

Wendell Cox is principal of Demographia, an international public policy firm located in the St. Louis metropolitan area. He is a founding senior fellow at the Urban Reform Institute, Houston, a Senior Fellow with the Frontier Centre for Public Policy in Winnipeg and a member of the Advisory Board of the Center for Demographics and Policy at Chapman University in Orange, California. He has served as a visiting professor at the Conservatoire National des Arts et Metiers in Paris. His principal interests are economics, poverty alleviation, demographics, urban policy and transport. He is co-author of the annual Demographia International Housing Affordability Survey and author of Demographia World Urban Areas.

Mayor Tom Bradley appointed him to three terms on the Los Angeles County Transportation Commission (1977-1985) and Speaker of the House Newt Gingrich appointed him to the Amtrak Reform Council, to complete the unexpired term of New Jersey Governor Christine Todd Whitman (1999-2002). He is author of War on the Dream: How Anti-Sprawl Policy Threatens the Quality of Life and Toward More Prosperous Cities: A Framing Essay on Urban Areas, Transport, Planning and the Dimensions of Sustainability.

Lead photo: METRO-LAND cover, a suburban promotional publication by the London Metropolitan Railway, 1921 in Public Domain.