A systematic mapping of where the world’s global leading companies in deep tech are located shows a massive lead for the USA – however the leading edge of particularly Santa Clara Valley shows signs of gradual normalization relative to the rest of the world.

The vast majority of globally leading deep tech companies are found in North America. North America has particularly strong dominance in the areas of artificial intelligence, biotechnology, robotic & communication, quantum & computing and pharmaceuticals. In these five fields of deep tech, around four out of five of the world-leading deep tech companies are found in North America.

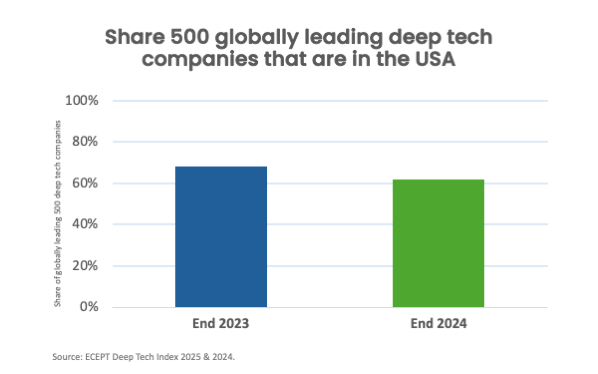

In the USA alone, fully 61.6 percent of the globally leading deep tech companies are located. This is the finding of the Deep Tech Index, conducted annually by the European Centre for Entrepreneurship and Policy Reform (ECEPR) with the support of Nordic Capital, which maps and evaluates the global deep tech landscape.

However, while the latest data from the end of 2024 shows that close to two thirds of the world-leading deep tech companies are located in the USA, this is less than the previous year. At the end of 2023 fully 68.4 percent of the world-leading deep tech companies existed in the USA.

Santa Clara Valley, Los Angeles, Austin and Chicago are the leading robotic & communication tech regions. Santa Clara Valley, Boston as well as Vancouver in Canada are centers for quantum and computing development.

The share of global deep tech companies in North America has fallen by 5 percentage points since last year, representing a normalization process. Particularly the USA but also Canada remain dominant, but competition is on the rise.

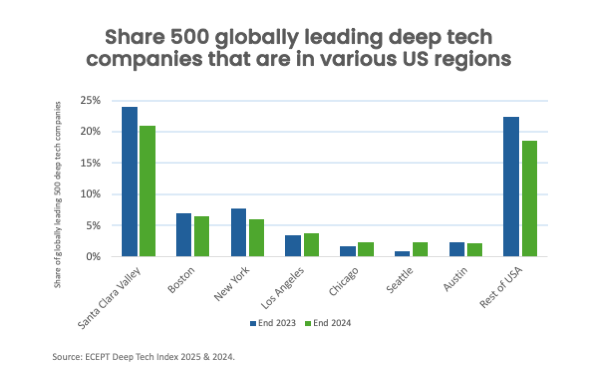

Besides Santa Clara Valley, the USA also has numerous other world-leading deep tech companies. In Boston fully 6.4 percent of the world-leading deep tech companies are located. Also New York (6.0 percent), Los Angeles (3.8 percent), Chicago and Seattle (2.2 percent each), and Austin (1.8 percent) each host significant share of the world´s deep tech companies. These regions have more deep tech companies in them than most European countries individually, as comparison.

There are also numerous other deep tech companies spread throughout the USA outside the main hubs. Fully 18.8 percent of the world-leading deep tech companies exist in the USA outside of the main urban tech regions.

The share of US-based world-leading deep tech companies that exist in Santa Clara Valley has between the end of 2023 and the end of 2024 fallen from 35 to 33 percent. The share of all world-leading deep tech companies in the USA that are located outside the major urban hubs has also been reduced slightly, from 32 to 31 percent. At the same time the share in the other major urban hubs except Santa Clara Valley (Boston, New York, Los Angeles, Chicago, Seattle and Austin) has grown from 33 to 36 percent.

Two different economic forces are influencing the development. The first is the advantages of specialization. Thomas Edison founded the world’s first industrial innovation laboratory in this valley 150 years ago, and it has since become the most significant region for development of new technologies. The capital, knowledge and entrepreneurship networks needed are in place in Santa Clara Valley, more than any place else in the world. Similarly, the USA is dominant as a nation, compared to the rest of the world.

Yet, the success brings higher costs, for Santa Clara Valley as well as the USA. There are ample talents around the world, at lower prices than the talents of the USA and particularly of the expensive main tech hubs. Current policies relating to trade and international talents is also likely to influence. The trend is that Europe which is second best in deep tech and willing to trade, is catching up somewhat to the USA. Institutional competition will also be significant gradually more from places such as India. Much of globally leading universities in technology and mathematics, as well as global technology firms, are strongly dependent on Indian students and researchers.

The USA retains its dominant leading position, particularly medium-sized regions such as Boston, Los Angeles, Chicago and Seattle. Yet the global competition is growing, hinting at gradual further normalization. Within the coming years, it is likely that we will pass a milestone where less than half of the global deep tech companies are situated in the USA, while no other single country can catch up all the rest of the world combines will do so within coming years. However, the USA can still remain dominant particularly in specific areas. Deep technology is closely linked to prosperity, lower unemployment and national security. Countries around the world need constructive policies to foster deep tech.

The deep tech index demonstrates that countries with a high density of deep tech firms per million adults typically enjoy robust property rights, low capital gains taxes, strong educational outcomes in PISA tests, and prestigious universities specializing in mathematics and engineering disciplines. Boosting universities remains a key challenge now, given the current development in the USA. It is important to remember that Europe and Asia each already have a higher number of the world´s 100 leading universities in mathematics and engineering, the competition is already underway.

Nima Sanandaji, Director, European Centre for Entrepreneurship and Policy Reform (ECEPR)

Photo: cover of Deep Tech Index, 2025 edition.