New companies face obstacles growing in Stockholm, in part this stagnation is due to the combination of a regulated rental market and too high prices for new housing development. Growing companies find it difficult to expand in urban regions with lack of housing, this adds to Sweden already being at a disadvantage due to relatively high taxes.

A study written by Tobias Lundberg, senior partner at McKinsey warns that Sweden is stagnating in growth and prosperity, with 70 percent of the total value of startup companies ending up in other countries.

This is not only because Sweden has high taxes on business and labor, but also because new companies have a hard time expanding in a city that has insufficient housing growth. The need for construction is 20,000 homes per year, in the capital city of Stockholm, but the households of the region can only afford 13,600.

Stockholm can be compared with the Irish capital region of Dublin and the Swiss capital region of Zurich. In Zurich, 13.9 percent of the residents are engineers and researchers, in Dublin the level is clearly lower, 9.2 percent. Stockholm has the second highest level in Europe; 13.1 percent of adults are engineers and researchers.

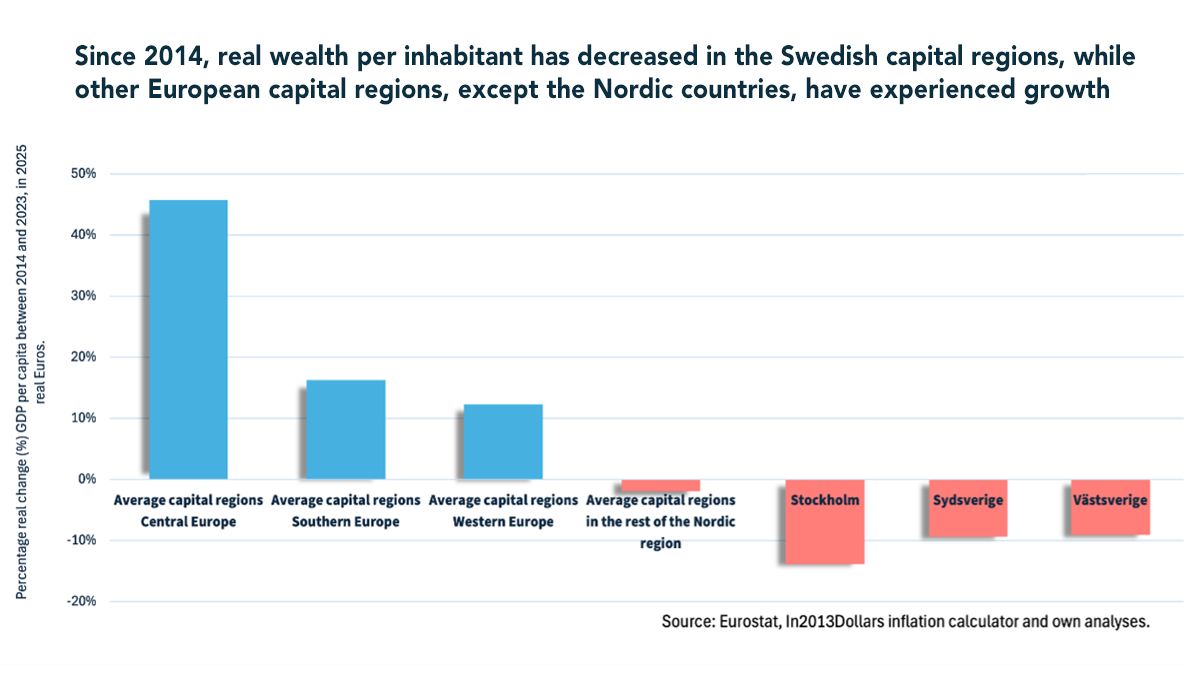

At the same time, Dublin and Zurich now have just over 50 percent higher prosperity per inhabitant compared to Stockholm, illustrating the need for growth reforms. This is shown by a report about conditions for a growing Stockholm, commissioned by Arwidsro real estate company and produced by ECEPR. In Stockholm, GDP per capita, expressed in the equivalent March 2025 krona exchange rate, is 787,100 kronor. That is how much value creation takes place in the economy per adult inhabitant. The level can be compared with 1,269,050 kronor per capita in Dublin and 1,199,350 in Zurich.

Europe's second most knowledge-intensive capital region has a stagnant housing market, which leads to stagnant growth. The new study calculates the economic value that would be created if reforms lowered the cost of construction, so that a thousand more households could afford to establish themselves in the housing market. In that case, individuals could contribute an additional SEK 2.2 billion ($230 million) in value added to the total gross domestic product in Sweden over the course of their careers. Discounted because future gains are worth less today, the social gain is converted to a present value of SEK 1.2 billion ($130 million). This is the productivity gain created by more housing on the margin in the capital region, on top of which there is also extensive value created through capital formation. If the reforms that are implemented are long-term, there will be a similar growth effect every year.

Three reforms that are needed include lowering of the VAT on housing construction, to the lowest level of 6% that is allowed in Sweden. It is problematic that VAT is even charged at all on the construction of private housing, as renting out property is generally exempt from VAT. Balance targets in the planning process are needed, so that social benefit is also weighed up, not just formalities. Planning processes are currently treated so that they are analyzed for what could be considered reasons to stop the plans, without considering the opportunity cost of not building housing.

The Swedish Real Estate Association has pointed out in an analysis that overall Sweden has the highest moving taxes in the EU, and that reforms such as a phased-down capital gains tax where those who have owned the same home for a long time are eventually exempted from the tax. By lowering the thresholds for mobility, moving chains can make more homes available.

Stockholm needs to be a city where more affordable housing is built, allowing more individuals to join the more productive capital region economy, and more of the growing companies of the region to keep growing at home rather than relocating due to growth obstacles.

Authors

Peter Zonabend is CEO of Arwidsro Fastighets AB.

Per Arwidsson is President of Arwidsro Fastighets AB.

Nima Sanandaji is Director of ECEPR (European Centre for Entrepreneurship and Policy Reform).

Photo: Stockholm, by Jonatan Svensson Glad via Wikimedia, under CC-BY-SA 4.0 License. Chart: Comparison of real wealth per inhabitant of Stockholm vs. other European capital regions since 2014; courtesy the authors.

| Attachment | Size |

|---|---|

| Stockholm-wealth-vs-Europe-capitals-wealth.png | 106.21 KB |