The debate surrounding the re-appointment of Ben Bernanke as Chairman of the Board of Governors of the Federal Reserve (the Fed) is not without historical parallel.

Just recall the RMS Titanic: It was April 14, 1912, when White Star’s “unsinkable” RMS Titanic, the largest and newest passenger liner in the world, was steaming from Southampton and Ireland to New York. The ship was traveling through a part of the North Atlantic where icebergs had been reported. The highly decorated Captain Edward J. Smith had rerouted the Titanic a bit to the south, but was aware that there were icebergs in the area. Urgent reports were radioed to the Titanic from other ships in the vicinity. These reports were not delivered to Captain Smith.

Nonetheless, Captain Smith was confident enough that he ordered the ship to continue at its normal speed and apparently saw no reason to be on the bridge through the evening. The story is familiar to everyone. Just before midnight, lookouts spotted an iceberg dead ahead. The ship could not be steered away in time to avoid a collision that fatally wounded the Titanic.

Unsinkable Economy: In the middle of the decade, the American economy, too, was steaming into dangerous waters. Yet the Fed, the nation’s financial watchdog, missed it big and makes one wonder if its website's claim that it provides the nation with a safe, flexible and stable monetary and financial system is a line they borrowed from Conan O’Brien.

The country thrust at near full speed into an abyss of phony mortgage debt in late 2008, which plunged the nation and the world into the worst economic downturn since the Great Depression.

Ben Bernanke had taken over as Chairman of the Board of Governors of the Federal Reserve Bank in early 2006, but his late arrival does not excuse his role, or that of the Fed. Bernanke had long been involved in leading economic roles, immediately before as Chairman of President Bush’s Council of Economic Advisors and before that as a member of the Board of Governors of the Federal Reserve (from 2002 to 2005). There is no indication that Bernanke did anything to sound a serious alarm while in these positions.

Signs of Trouble: Yet the signs were clear. How could it be that the urgent radio reports were not forwarded to Captain Smith? It might have been expected that he or a deputy might be checking frequently with the radio operators. Perhaps the failure resulted from the belief that the Titanic was unsinkable.

Similarly, the warnings of the housing bubble were clear, if only someone had been looking. There is no indication that Ben Bernanke, in any of his capacities, understood the extreme threat that the housing bubble had to the economy or its perverse nature. Many of the nation’s leading economists, Bernanke included, continued to look only at national averages, completely missing the point that a dangerous concentration of far greater intensity plagued many specific markets. These far more severe bubbles represented a far greater threat to financial stability than would have been the case if the national averages had been representative.

Captain Smith was well aware of the dangers of icebergs and knew that they were in the area. Presumably, Ben Bernanke knew – or should have known – of the dangers of an unprecedented housing bubble and of the dangers it could create for the economy. Perhaps he thought the US economy was unsinkable.

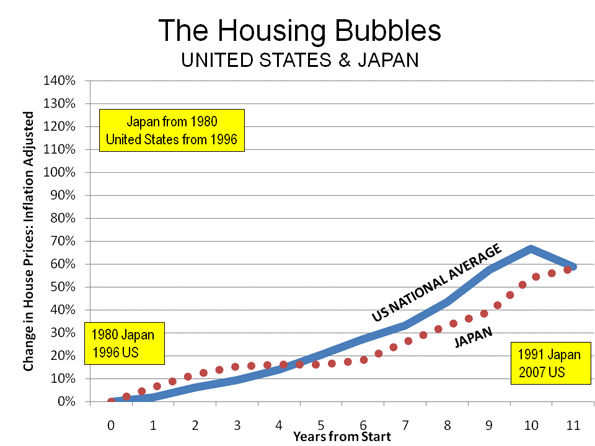

How Bad It Was: It’s not like this was a bubble without precedent. Bernanke and the Fed should have been alarmed that the American housing bubble was equal in its overvaluation to the fabled housing bubble in Japan that hobbled that economy for many years (Figure 1).

But the problem was even bigger. During the housing bubble, the economic community, Bernanke and the Fed were afflicted with a myopia that prevented looking beyond national average house prices. But those few willing to “dirty their hands” and look further found even more troubling developments.

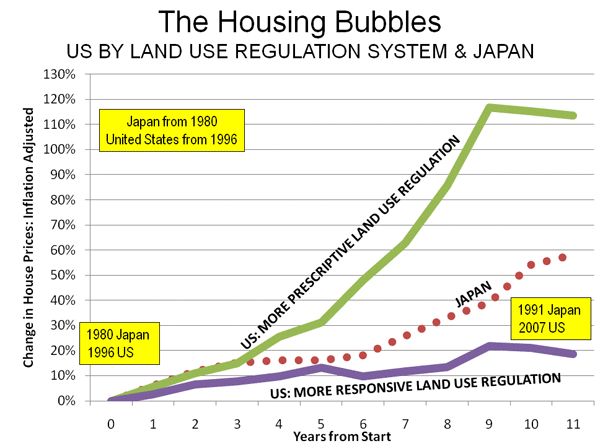

In 2005, eventual Nobel Prize winner Paul Krugman pointed out that the housing bubble was limited to only part of the market; what he called the “zoned zone.” The “zoned zone” refers to what I have been calling the areas with “more prescriptive” land use regulation (also called “growth management” or “smart growth”). These are the types of intensive interventions that reduce the supply of land for development, raise its costs and provide an open invitation to speculators seeking short term, but occasionally enormous profits. It is important to note that not all land regulation produces such results, but that the regulation typical of the bubble markets did exactly that.

This was missed by Bernanke and the Fed. In the more prescriptively regulated markets house prices had risen at double the national rate and double the Japanese bubble rate. In other areas (what Krugman called “flatland” and I call “more responsively regulated” markets), house prices rose at one-third the average rate (Figure 2).

This concentration meant that the bubble in the more prescriptive markets was far more unstable and threatening. In the end, at least 85% of the gross value increase occurred in the more prescriptive markets, with particular concentrations in California, Florida, Phoenix and Las Vegas. When the bubbles in these markets burst, it ravaged the national mortgage finance industry even in the face of far more reasonable prices elsewhere in the country.

Wandering in the Wilderness: That Chairman Bernanke still does not understand this dynamic was amply illustrated by his recent Atlanta speech to the American Economic Association, in which he claimed that the easy money policies of the Fed had little to do with the Great Recession. Instead he blamed lax regulation that permitted “exotic mortgages.” Moreover, it is clear that neither he nor the Fed have managed to scratch below the surface of the bubble in specific markets and its ability to create enormous havoc on the national and world economy.

A Bully Pulpit: What could Bernanke and the Fed have done? First of all, they could have sounded the alarm about the profligate lending that has reduced this nation’s "soundness of banks" rating to 108th out of 133, just behind Tanzania, and seven places behind Bangladesh and 21 behind Nigeria. Second, Bernanke and the Fed could have bothered to suggest corrective actions to prevent development of the unsustainable values in the “zoned-zone.” At a minimum, Bernanke and the Fed could have used their bully pulpit in hopes of sparing the nation and the world an unnecessary financial catastrophe.

The Rescuer: Of course, Chairman Bernanke has earned high marks for his work to avoid a depression. If Captain Smith had somehow survived the ordeal caused by his misjudgments, however, White Star probably would not have awarded him another command.

Wendell Cox is a Visiting Professor, Conservatoire National des Arts et Metiers, Paris. He was born in Los Angeles and was appointed to three terms on the Los Angeles County Transportation Commission by Mayor Tom Bradley. He is the author of "War on the Dream: How Anti-Sprawl Policy Threatens the Quality of Life.”

RMS Titanic - Federal Reserve

Very clever analogy, Wendell. My hat goes off to you. (It also looks like you've done your keyword homework as well ;) Have you by any chance heard of the lesser know conspiracy theory outlining the sinking of the Titanic's relationship to the passing of the Federal Reserve Act? If not, it is definitely worth a look. http://hubpages.com/hub/Titanic-Conspiracy-and-the-Federal-Reserve

-------------------------------------------------------

"In politics, nothing happens by accident.

If it happened, you can bet it was planned that way."

~ Franklin D. Roosevelt

"Thank you, Jordan Maxwell"

~ Strutzin