Perhaps for the first time in nearly seven decades a serious debate on housing affordability appears to be developing in the United Kingdom. There is no more appropriate location for such an exchange, given that it was the urban containment policies of the Town and Country Planning Act of 1947 that helped drive Britain's prices through the roof. Further, massive damage has been done in countries where these polices were adopted, such as in Australia and New Zealand (now scurrying to reverse things) as well as metropolitan areas from Vancouver to San Francisco, Dublin, and Seoul.

A healthy competition has developed between the Conservative-Liberal Democrat coalition and the Labour Party to finally address the problem of the resulting land and housing shortage that has driven prices up so much relative to incomes.

It probably helps that public opinion seems to be changing. A recent MORI poll found that 57 percent of respondents considered rising house prices to be a bad thing for Britain, compared to only 20 percent who though it a good thing.

It has been more than a decade since Kate Barker, then a member of the Monetary Policy Committee of the Bank of England (the central bank) was commissioned by the Blair Labor government to examine the issues. Her conclusions were clear. Britain has a serious housing affordability problem and its restrictive land use policies were the cause. These higher housing costs, the largest element or household expenditure have reduced the standard of living and increased poverty beyond what would have occurred if urban containment regulation had not destabilized house prices. The Economist notes that home ownership is falling and that the number of couples with children who are renting has tripled since the late 1990s.

Planning and Chickens

This week, The Economist weighed into the debate (Britain’s planning laws: An Englishman’s home):

"Now that the economy is at last growing again, the burning issue in Britain is the cost of living. Prices have outstripped wages for the past six years. Politicians have duly harried energy companies to cut their bills, and flirted with raising the minimum wage. But the thing that is really out of control is the cost of housing. In the past year wages have risen by 1%; property prices are up by 8.4%. This is merely the latest in a long surge. If since 1971 the price of groceries had risen as steeply as the cost of housing, a chicken would cost £51 ($83)."

For those of us unfamiliar with the cost of chicken in British hypermarkets, The Daily Mail says it is about £2 ($3). Indeed, even the chicken industry suffers, as planning restrictions are getting in the way of adding the chicken farms Britain requires.

Moreover, the high costs cited by The Economist are after the house prices increases that had already occurred by 1970. Even then, before such inflationary pressures were seen elsewhere, Sir Peter Hall characterized soaring land and house prices as the biggest failure of the 1947 Act. Hall had led a major research effort on the subject, which produced a two-volume work, The Containment of Urban England (See The Costs of Smart Growth Revisited: A 40 Year Perspective).

From Affordable to Unaffordable

While the historic relationship between household incomes and house prices (the "median multiple") was under 3.0 across the United Kingdom as late as the 1990s, it has now deteriorated to more than 7.0 inside the London Greenbelt. Unbelievably it has risen to elevated levels even in the less prosperous the north of England. For example, depressed Liverpool has a median multiple over 5.0, which is 60 percent above the maximum historic range and making the metropolitan area "severely unaffordable." Liverpool is probably best compared to Cleveland in the United States for its economic distress.

The shortage of housing in Britain has become acute. There are additional concerns that the globalization of housing markets has hit London particularly hard and is driving households out of the housing market.

More Money, Less House

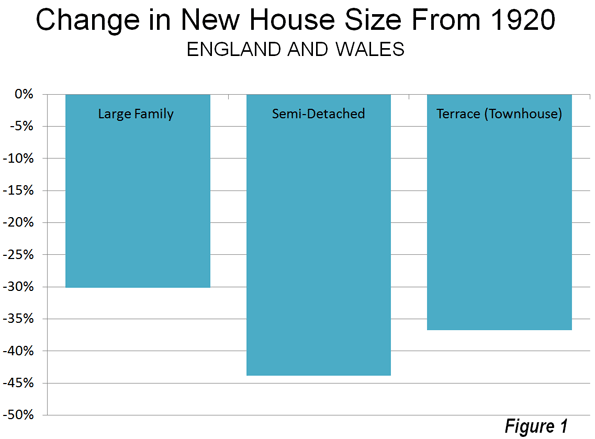

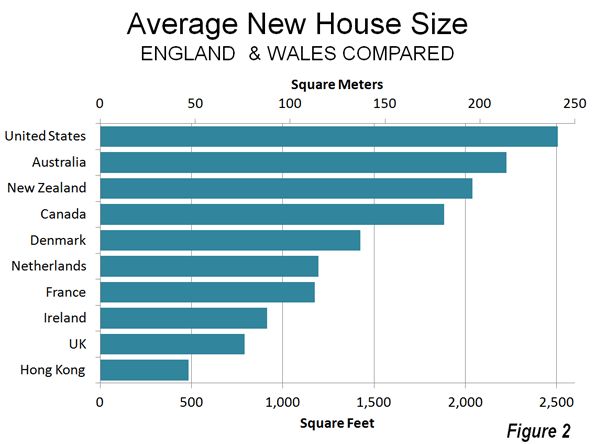

Through all of this, Briton's are getting less for their money. Since 1920, the average size of a new large family house has been reduced 30 percent. Semi-detached houses are 44 percent smaller and townhouses (terrace housing) is 37 percent smaller (Figure 1). Britain now has some of the smallest new housing in the world. The average new house in continental Europe is 50% or more larger than in England and Wales. New houses are two to three times as large in Canada, New Zealand, Australia and the United States (Note 1). In some US cities, residents can build "granny flats" which are larger than new houses in Britain. For example, San Diego's limit for granny flats of 850 square feet exceeds Britain's average new house size of 818 square feet.

Paving Over Ohio?

Of course, those who see urban expansion (the theological term is "sprawl") as ultimate evil imagine an England and Wales being literally paved over by allowing people to live as they prefer. They need not worry.

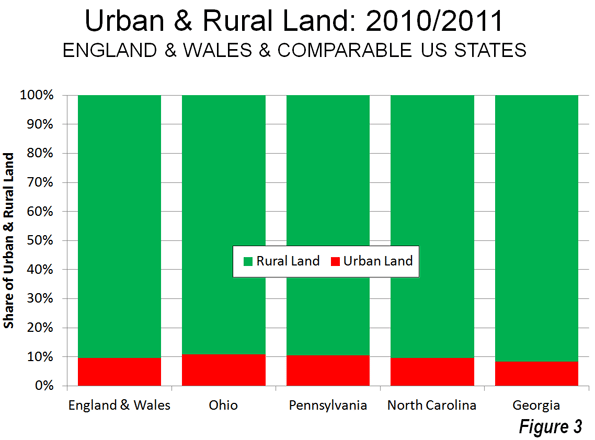

For example, England and Wales is less crowded than spacious Ohio, with its rolling hills and extensive farmland. According to the 2011 census, only 9.6% of the land in England and Wales is urban, the other 90.4% is rural. In Ohio, on the other hand, 10.8% of the land is urban and only 89.2% of the land is rural. Even the state of Georgia, with the least dense large urban area in the world, Atlanta, has roughly as much rural land (91.7 percent) as England and Wales (Figure 3).

Every Gram is Sacred?

Originally, urban containment was justified on social and aesthetic grounds. However, curbing greenhouse gases is now used as the raison d’etre for highly restrictive housing policies. Urban policy in England and Wales and elsewhere has been hijacked by a philosophy that any gram of greenhouse gas that can be reduced must be, regardless of its impact on society, the economy, the standard of living or poverty.

One of the worst conceivable strategies for reducing greenhouse gas emissions is to waste money on costly and ineffective measures. The Intergovernmental Panel on Climate Change (IPCC) has indicated that sufficient reductions in greenhouse gas emissions can be achieved for a range of from $20 to $50 per ton. Urban containment policy cannot deliver for this price. In contrast, improving automobile fuel efficiency is forecast improve greenhouse gas emissions, even as driving continues to rise with a growing population (see Urban Planning for People). In addition, the higher house prices associated with urban containment policy are well beyond the IPCC range.

No program can produce substantial greenhouse gas emission reductions that does not focus on higher value strategies. Urban containment has no high value strategies.

Planning, People and Poverty

Britain's land policy competition between the political parties is long overdue. Coalition Communities Secretary Eric Pickles, decries "the way families are trapped in ‘rabbit hutch homes’." The Labour Party opposition has promised that, if elected in 2015, steps will be taken to increase land supply and housing affordability, so that "working people and their children" have the "decent homes they deserve."

The Economist states the issue squarely:

"Building on fields in a country that is as crowded as England will always rile some people, however well-designed the system. But the alternative is worse: a nation of renters and rentiers, where only the rich own houses."

-----------------

Note 1: As Figure 2 indicates, Hong Kong housing is considerably smaller than that of England and Wales. Hong Kong really is the ultimate smart growth or urban containment city. It has the highest urban population density in the high income world. It has the highest share of its commuters using mass transit to get to work. Its traffic congestion is intense. And, predictably, it has the highest house prices relative to incomes yet documented in the high income world.

We need to be spared the "sun rises in the west" economic studies claiming that somehow the laws of economics, that work so relentlessly to drive up prices where supplies are constrained in other industries (such as petroleum, corn, etc.) have no effect on land and housing.

Wendell Cox is a Visiting Professor, Conservatoire National des Arts et Metiers, Paris and the author of “War on the Dream: How Anti-Sprawl Policy Threatens the Quality of Life.

Photo: St. Pancras Station (London), by author

What about the class dimension?

Wendell

I had the pleasure of meeting you at All Planned Out? in 2007 in London to mark the 6o years of the 1947 Town and Country Planning Act.

1947 was the moment that the British state innovated nationalising all development rights on land, without nationalisation of the property of land. In Britain that was considered too Socialist by the Attlee Labour government, even though it was an aristocratic idea to nationalise all land in Britain in the 1880s.

In America state intervention in matters of land use would be a matter of eminent domain I think.

By the early 1950s the attempt by the state to capture all "betterment" or planning gain was abandoned. Labour had stifled all speculative development, and the Conservatives abandoned the financial provisions of the 1947 Act. That meant the planning gains that followed the granting of a planning approval by a Local Authority empowered by the state's planning legislation was kept by the favoured landowner. A situation that Peter Hall moans about, while wanting to keep the 1947 denial of development rights in his dream of recapturing planning gains. Since the 1950s Local Authorities, land owners in the zone red lined for development, developers, contractors, and their legions of middle class consultants (like me) have negotiated who gets the share of planning gain. It can turn agricultural land at £10,000 a hectare into the same area worth millions for housing. It is a large business for the ruling and middle class. Planning Committee Councillors and their loyal officers can make a person rich. Profits of a small percentage on the cost of construction are insignificant by comparison to the gain made through planning approvals.

I say all this knowing that you are fully aware of the situation.

But what you underplay is that the predicament we are in has winners and losers clearly aligned along class lines.

The middle classes have done alright out of a situation in which the planning system regulated land and housing shortage has driven prices up so much relative to incomes. Middle class owner occupied homes are treated as savings and pensions, from which equity can be withdrawn.

Working class households managed to become owner occupiers until 2008 and were also subsidising their low pay with equity withdrawal. That crashed as a consequence of American markets, not because the British housing market was particularly in trouble. Since then the lower paid households have fallen out of the owner occupying tenure, and have to resort to renting. Landlords in the private and public housing rental sectors have cranked up rents to follow the inflation of owner occupied housing. There is no cheap housing to be had, but at least the most struggling renters could get housing benefits. These too are being removed.

The result is a purge. Unemployed and poorly paid workers (who do not act politically as a class as they used to) are being gentrified out of London in particular, but generally from city centres. The middle class are moving into displace them, or buy up the stock to become a class of petty landlords, often supported from the residual housing benefits system of rent subsidy. The middle class are dependent on the planning system and the state, and it is they who are gaining from the ludicrously unaffordable housing market.

The political class meanwhile is seeking to blame immigrants and migrants, either as poor "benefit tourists" or as the "greedy rich". This lets the middle class off the hook and has an appeal to a growing bigotry. Britain is becoming uglier, in a polite middle class way. The barbarism is just under the surface of manners.

I agree - Britain is a divided place because of the unaffordable housing market, whether to rent or buy. You know our website has long sought to show how little land we live in, and how necessary it is to build on a vast scale and at a pace.

But the price of that in Britain would be to collapse the lower sections of the middle class in the housing market. That is something they will fight to avoid, scapegoating foreigners in the process. There is no demand in Britain to repeal the 1947 denial of development rights. When Gypsies tried to house themselves on a polluted scrapyard the Local Authority bulldozed their homes in Essex. Homelessness, overcrowding, desperate debt juggling around pay day for mortgage payments and rents, and the illegal living in garden shanties are all on the rise. My director James Heartfield has pointed that out for years. He has done recently again - www.audacity.org/JH-30-12-13.htm - recognising your excellent work at Demographia.

The answer as my other director James Woudhuysen knows is to boost the construction industry towards manufacturing housing. But as we knew on page 287 of Why is construction so backward? (2004) it is the planning system that stands in the way of industrialising the building trade further. Nor is that where the money is made. The big money is in the inflated value of the inadequate existing British housing stock.

We are in a predicament. But to get out of it means addressing the class dimension. The Conservative-Liberal, One Nation Labour, and UKIP are all about the middle class vote. That means making noises about housing costs, but only doing things that assist the middle class. A repeal of the legislation that underpins the predicament would decimate the members of the Council of Mortgage Lenders as many middle class home owners default, and the working class set about answering how they might build on a £10,000 hectare of redundant farmland. The British economy would struggle.

So the platitudes keep coming, but the predicament heightens.

I have posted this on https://www.facebook.com/iabley

Regards to you and Hugh.

Ian Abley

www.audacity.org

Truly Gordian problem

It is a really knotty problem that could hardly have been better designed as a deliberate subversion of a nation by enemy powers.

A century ago things were much clearer. An upper class minority owned almost all the land and political action was necessary as economic development occurred, to prevent a revolution.

Improved transport systems and diluted economic land rent led to a massive democratisation of "home ownership" in most first world countries. The UK sort of muddled along behind since 1947. I find it extraordinary that the UK has managed to get sufficient majorities of the population owning their own home and hence becoming vested in the racket. Part of the "secret" must be the incredibly small size of housing, and the retention of dilapidated stock that would have been destroyed and replaced in most first world countries.

For decades there was a massive increase in "social" housing, but Thatcher selling it off created a price-lowering effect simultaneously with an increase in "ownership". This is probably the last gambit in a long game that now can only trend to a reduction in the proportion of home owners.

How long might it take before there is sufficient electoral mass of non-home-owning voters to force a change? Of course the vested interests are powerful and use propaganda via the mainstream media to maximum effect. Unfortunately many politicians of the Left have preferred to have dependent constituencies, so that their preferred policy "solution" all over the first world since "saving the planet" became a mania, is "back to government provision of large volumes of social housing". And I am afraid many of the voters fall for it.

But I cannot see an economy caught in a feedback loop of economic rent, which must squeeze out genuine "production", as being sustainable. I am sure "decline and fall" is inevitable. Whether other nations like Canada, Australia and NZ can wake up before it is too late is an open question. I cannot see their economies surviving as long as the UK one, given the considerable difference in the basis of their whole economies (in particular, less global financial services and global media) and their lack of the UK's global connections and past external investments.