Many of the nation’s youth (and a few of their elders) are expecting a magical turnaround of America’s economic fortunes as soon as their candidate for President, Barack Obama, is sworn in on January 20th 2009. But the Millennial Generation, born between 1982 and 2003, may be more the source of the country’s economic salvation as any initiative the new President might propose.

Millennials are the largest generation in American history, more than 91 million strong. They are coming of age just in time to join the workforce, enter the housing market, stabilize home prices, and buy the nation's expanding inventory of durable goods to furnish their new homes. Despite being burdened with student loan debt and graduating just when the job market is shrinking, this group of optimistic, civic-minded young Americans is ready to demonstrate that it is not only capable of electing a President, but also helping to resolve the country's housing crisis.

The “helicopter parents” of Millennials constantly hovered over their children as they grew up in order to protect them from anything that might harm their self-esteem. As a result, many older Americans, especially the 27 to 43 year old members of Generation X, think the Millennials’ “can do” attitude will crumble once they are confronted by the “realities of the real world.”

But this ignores the cyclical nature of generational change. The GI Generation – the Millennial civic generation’s great-grandparents who came of age in the 1930s and 1940s – were raised in much the same way and acquired many of the same values cherished by Millennials. These members of what have come to be called “the Greatest Generation” were able to draw upon a deep reservoir of confidence and determination to lead America’s recovery from the Depression and later win the struggle against both fascism and communism.

To give Millennials the same opportunity to rescue America, the new Obama administration should give the emerging generation the same attention in its policy initiatives that it expended getting their votes. Certainly the opportunity is there, particularly in rescuing the now devastated housing market.

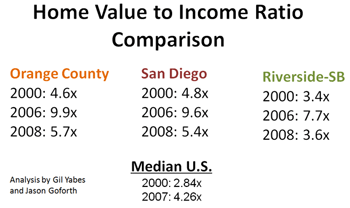

One unintended collateral benefit of the rapid drop in housing prices across the nation is to put many suburban homes within reach of first time home buyers, something that has not occurred for at least a decade. Even in pricey California, for example, the ratio between income and cost of housing has begun to drop dramatically, notes a recent paper by Chapman University graduate students Gil Yabes and Jason Goforth, with the ratio between income and mortgages dropping by one half or more in Orange, Riverside, and San Bernardino Counties, close to pre-bubble levels.

That’s a big opportunity, one that President-elect Obama’s “Home Ownership Initiative” should seize on. The Millennials could well be the demographic that could buy these more affordable homes and staunch the rise of foreclosures threatening the U.S. economy.

That’s a big opportunity, one that President-elect Obama’s “Home Ownership Initiative” should seize on. The Millennials could well be the demographic that could buy these more affordable homes and staunch the rise of foreclosures threatening the U.S. economy.

It’s not that these young people don’t want to own homes. A 2004 study of students enrolled in a four-year university, a community college and an historically black college found that about the same 40-percent plurality in each group preferred to live in a “suburban community, single family home,” upon graduation. The second choice of these Millennials was to live in a “rural area, with large lots and open space.” Only about a quarter wanted to live in an “urban setting with mixed housing styles.” Luckily for them, five years later, their preferred housing stock has just become imminently more affordable.

Now the Democratic Congress and President Obama should enact a significant tax credit incentive for first time homebuyers, many of whom would be Millennials. By rapidly expanding the universe of potential homebuyers, this program would help stabilize housing prices in the critical lower cost housing market. At the same time it would help stem foreclosures among existing homebuyers, whose loss of home equity has made abandoning mortgages more rational economically than keeping up payments.

In 1934, during an earlier time of far greater economic pain, the Federal Housing Agency (FHA) was created to provide financing for a new type of mortgage requiring a lower down payment with the loan to be paid off over 25 or 30 years. The federal agency’s financing authority was greatly extended through Title II of the Housing Act of 1949, which provided federally guaranteed mortgage insurance and helped a flood of returning GIs own a home. Now it is time for Fannie Mae and Freddie Mac to be given the authority to finance a new mortgage structure for homebuyers under thirty.

By lowering down payment requirements for this select group of home buyers to 10% and stretching the terms of mortgages to the number of years these young people are likely to be active in the workforce, forty, monthly payments on starter homes could be brought in line with the Millennials‘ ability to pay. Initially, this combination of tax credits and new types of mortgage financing would slow the decline in home prices that triggered the problems in the country's financial markets. In the longer run, it will make sure that the benefits of widespread homeownership will expand to a new generation of Americans.

One young Millennial to whom we talked recently was concerned that the hours her retail employer wanted her to work were being cut as holiday shopping continued to sour. She expressed concern that there was still “more than a month before Obama gets sworn in and everything turns around again.”

Her statement exhibits the kind of economic naiveté that frustrates some older Americans, but does provide an important lesson – political as well as economic – for the incoming administration. The Millennial Generation, whose votes were key in nominating and then resoundingly electing President Obama, want to see things improve rapidly. After all, they lack either the experience or the equity that Baby Boomers have acquired over the years.

Once in office, President Obama should embrace the impatience of America's youth as one way to insure that his economic policies are enacted quickly. By making an explicit appeal to America's largest generation’s desire for homeownership, he would not only take a big step toward ensuring the popularity of his economic program, but its effectiveness as well.

Morley Winograd and Michael D. Hais are fellows of NDN and the New Policy Institute and co-authors of Millennial Makeover: MySpace, YouTube, and the Future of American Politics (Rutgers University Press: 2008), named one of the New York Times 10 favorite books of 2008.

| Attachment | Size |

|---|---|

| StudentLivingPreferences.pdf | 109.08 KB |

great post

excellent. one of the best articles I have every read. This is the information which I have been searching. Great information. Ecopolitan EC | Ecopolitan EC price | Ecopolitan | Ecopolitan Punggol | Ecopolitan Executive Condo | Sea Horizon | Sea Horizon EC | Sea Horizon Executive Condo | Sea Horizon Executive Condominium | Sea Horizon Pasir Ris | Sea Horizon EC price | Tembusu Condo | Tembusu at Kovan | Tembusu Kovan | Tembusu condo Price | Tembusu | Vue 8 residence | Vue 8 residence price | Vue 8 Condo | Vue 8 Pasir Ris | Vue 8 | the inflora | inflora condo | inflora loyang | inflora this article is worth bookmarking. keep it up !

Why should we prevent the fall?

"Now the Democratic Congress and President Obama should enact a significant tax credit incentive for first time homebuyers, many of whom would be Millennials."

Why?

Why help this particular group?

Why not let market forces drive prices down to an affordable 2.5x income?

Then, everyone that wants to own a house will be able to.

We just need one more year of price drops and we should get to 2.5x.

Also, why is it assumed that home ownership is automatically a "good thing"? I used to think it was until I read about how it reduces labor mobility.

Dave Barnes

+1.303.744.9024

http://www.MarketingTactics.com