As the financial bailout fiasco worsens, President Obama may want to consider a do-over of his whole approach towards economic stimulus. Instead of lurching haphazardly in search of a "new" New Deal symphony, perhaps he should adapt parts of the original score.

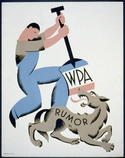

Nothing makes more sense, for example, than reviving programs like the Works Progress Administration (WPA), started in the 1935, as well as the Civilian Conservation Corps (CCC), begun in 1933. These programs, focused on employing young people whose families were on relief, completed many important projects – many still in use today – while providing practical training to and instilling discipline in an entire generation. read more »