Lately, Texas has been noted frequently for its superior economic performance. The most recent example is the CNBC ratings, which designated the Lone Star state as the top state for business in the nation. Moreover, Texas performed far better than its principal competitor states during the Great Recession as is indicated in our How Texas Averted the Great Recession report, authored for Houstonians for Responsible Growth.

Introduction: How Texas averted the Great Recession:

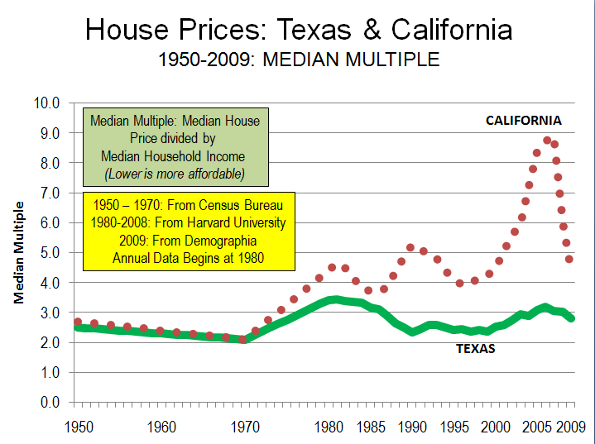

One reason that Texas did so well is that it fully escaped the “housing bubble” that did so much damage in California, Florida, Arizona, Nevada and other states. One key factor was the state’s liberal, market oriented land use policies. This served to help keep the price of land low while profligate lending increased demand. More importantly, still sufficient new housing was built, and affordably. By contrast, places with highly restrictive land use policies (California, Florida and other places, saw prices rise to unprecedented heights), making it impossible for builders to supply sufficient new housing at affordable prices (overall, median house prices have been 3.0 times or less median household incomes where there are liberal land use policies).

The Great Recession: The world-wide Great Recession was the deepest economic decline since the Great Depression: This downturn hit average households very hard. According to Federal Reserve Board "flow of funds" data, gross housing values declined 9 quarters in a row through the first quarter of 2009. The previous modern record is a single quarter. From the peak to the trough, household net worth was reduced a quarter, which is more than 1.5 times the previous record decline.

Texas Largely Avoided the Great Recession. Texas has largely escaped the economic distress experienced around the nation, and especially that of its principal competitors, California and Florida. By virtually all measures, Texas has performed better in growth of gross domestic product, employment, unemployment, personal income, state tax collections, and consumer spending This is in part due to much less mortgage distress in Texas. At the bottom of the economic trough, the Brookings Institution Metropolitan Monitor ranked the performance of the 6 largest Texas metropolitan areas among the top 10 in the nation. The latest Metropolitan Monitor ranked each of the 6 metropolitan areas in the highest performance category.

Throughout the past decade, Texas has experienced far smaller house price increases than in California, Florida and many other states. During the bubble, California house prices increased at a rate 16 times those of Texas, while Florida house prices increased 7 times those of Texas. As a result, after the bubble burst, subsequent house price declines were far less severe or even non-existent in Texas. Texas had experienced its own housing bubble in the 1980s, however even then overall prices did not exceed the Median Multiple of 3.0 (The Median Multiple is the median house price divided by the median household income).

Unlike Texas, all of the markets with steep house price escalation had more restrictive land use regulations. This association between more restrictive use regulation and higher house prices has been noted by a wide range economists, from left-leaning Nobel Laureate Paul Krugman to the conservative Hoover Institution’s Thomas Sowell. It is even conceded in The Costs of Sprawl ---2000, the leading academic advocacy piece on more restrictive land use controls, which indicates the potential for higher house or land prices in 7 of its 10 recommended strategies.

Comparing Texas and California: Unlike California, housing remained affordable in Texas. California’s housing affordability - in relation to income – largely tracked that of Texas (and the nation) until the early 1970s (Figure). After more restrictive land use regulations were adopted prices started to escalate. This relationship has been well demonstrated by William Fischel of Dartmouth University. Other factors have had little impact. Construction cost increases have been near the national average in California. Other factors, like underlying demand as measured by domestic migration, have been lower in California than in Texas..

Comparing Texas and Florida: The contrast with Florida is similar. Housing affordability in Florida was comparable to that of Texas as late as the 1990s. However, with strict planning control of land for development in Florida, land prices rose substantially when profligate lending increased demand.

Comparing Texas and Portland: Further, the Texas housing market avoided the huge price increases that have occurred in Portland (Oregon), which relies on extensive restrictive land use regulation. In 1990, Portland house prices relative to incomes were similar to those of the large Texas metropolitan areas. At the recent peak, the median Portland house price soared to approximately 80% above Texas prices. Portland did not experience the price collapses of California, but due to the greater price volatility associated with smart growth price declines in relation to incomes that were five times those of Texas.

How the Speculators Missed Texas: Speculation is often blamed as having contributed to the higher house prices that developed in California and Florida. This is correct. Moreover, with some of the strongest demand in the United States, Texas would seem to have been a candidate for rampant speculation. After all, it happened back in the 1970s when a huge oversupply of housing, industrial, retail and office space collapsed in the face of falling energy prices.

But it did not happen this time, despite solid population growth. During the housing bubble, Dallas-Fort Worth and Houston ranked second and third to Atlanta in population increases among metropolitan areas with more than 5 million population. Austin is the nation’s second fastest growing metropolitan area with more than 1 million population. Each of these metropolitan areas had strong underlying demand, as indicated by domestic migration data.

Yet the speculators were not drawn to the metropolitan areas of Texas. This is because speculators or "flippers" are not drawn by plenty, but by perceived scarcity. In housing, a sure road to scarcity is to limit the supply of buildable land by outlawing development on much that might otherwise be available.

However, the speculators did not miss California and Florida. Nor did they miss Las Vegas or Phoenix, where the price of land for new housing rose between five and 10 times as the housing bubble developed. Despite their near limitless expanse of land, much of it was off limits to building, and the exorbitant price increases were thus to be expected.

The Threat: Yet, despite the success of the less restrictive land use policies in Texas, there are strong efforts there to impose more smart growth policies. The impact could be devastating, especially from strategies that ration land that would raise land and house prices, as has occurred in California and Florida. In 2009, Governor Perry vetoed a bill that would have required the state to promote smart growth. Federal initiatives, under proposed climate change and transportation acts could do much to destroy not only the affordability of Texas metropolitan markets, but could also make Texas less competitive in the decades ahead.

Photograph: Suburban San Antonio (by the author)

Wendell Cox is a Visiting Professor, Conservatoire National des Arts et Metiers, Paris. He was born in Los Angeles and was appointed to three terms on the Los Angeles County Transportation Commission by Mayor Tom Bradley. He is the author of "War on the Dream: How Anti-Sprawl Policy Threatens the Quality of Life.”

Texas had its real estate bust in the 1980s

Another part of the reason is that Houston at least had a big real estate bust in the 1980s (the assessed value of my house fell 50%) during the time Harris County (Houston) had 3-4k foreclosures a month. Dallas had the great S&L Bust and the see thru apartment house scheme.

Since most every bank in Texas failed over this there was still a strong memory of it in the common point of view. It convinced me that those who say realestate can only go one way in price are smoking something, or using something either of which is illegal.

Other reasons Texas market remains good

Wendell, thanks for the article.

I lived in Texas almost a decade with 1/2 in Houston and 1/2 in Dallas.

One reason that Texas did not attract flippers was that the housing prices did not sky rocket, thus they ignored the market because there was no money to be made (on a flip). I've been told that Texas mortgage restrictions reduced the number of "bad loans".

Currently the bulk of our planning business is in Texas which has been a great market for us with developers on the cutting edge of design.

Suburbia is not a bad name (in Texas) and still something desired for the average citizen - even though much of the urbanized downtowns are also desirable (no flight from the core).

I think the largest part of the differences is that perhaps Texans don't buy into the rhetoric from Planners that know what's good for them! Smart Growth planners see the desire for space as something evil - and in Texas there is plenty space. That said, the typical lot size we plan in Texas is very small compared to the developments in the northern 1/2 of the USA. The typical suburban density is quite high and with the suburban minimums based system people have less space than in the typical suburbs of other states - does this curb sprawl? Probably. But more important is that in Texas even in the most bland poorly designed subdivision, the typical home architecture and landscaping is quite good, especially compared to the more costly Vinyl cladded homes lacking character on sodded lots of the north.

In other States we do not have easy access to low cost labor - when I visit job sites it's obvious these workrs are.... better not go there I guess. But these "workers" must know what they are doing because the homes are pretty outstanding, even at the low end.

I'm not sure that restrictions are at fault, as an example, in Minnesota (when there was planning and construction) getting approvals was something that would take 4 to 6 months - not much longer than in Texas. The environmental restriction no doubt added costs, but the acre of land in Minneapolis, Vegas, Phoenix, etc. that sold for well over $100,000 before the crash, was more from the developers bidding against each other when ever there was land available - somehow develors in Texas were much smarter than that. I guess you could say that restricting land made much less of it available, thus promoting bidding wars - I'm not too sure.

Anyhow my 2 cents. Hope all is well Wendell, and great article!

Texas has high property taxes.

I- like about 50% of today's younger California professionals- plan on leaving the state at some point- probably in the next year or so. Texas where we are likely heading. To a person living in the Bay Area seeing countless homes listed for $150,000-$200,000 seems like a miracle. For all practical purposes we could probably buy one with cash versus the mere down payment that would get you in the Bay Area.

But... I did some serious investigation of TX last year, took a few trips and looked at houses, neighborhoods, and job prospects primarily in Austin. I work in the tech industry thus Austin seems like a good fit. Here's a few things I imagine many people don't consider. For starters TX has what I'd refer to as a progressive property tax system. What's more is that the tax is high. Tax levels vary even within districts of a city. Some parts of Austin had a 3% property tax rate while others had 2%. The higher levels seemed to be within areas that had more public schools and services. In other words- the more public services, the more taxes. This actually makes a lot of sense. The system is flexible and the more services there are, the more taxes are increased to pay for them.

That said, a 3% overall property tax on a modest $150,000 house is going to cost you $4,500 a year. A $200,000 house will cost you $6,000. $250,000= $7,500. So as you can see, even the median priced house is going to set you back what amounts to buying a decent used car every year. On top of that your taxes can only do two things: Go up or down. Seeing as how Texas seems to enjoy a modest yet steady 4-5% annual increase in property values means you can almost count on paying more and more as time goes on.

That said, there is no income tax, which as a Californian paying close to 9% of my income to state income tax sounds like heaven. But I am still a tad wary about the prospect of having to shell out $5k-$6k on property taxes every year. On the other hand most Texans we talked to seemed well-aware of this dilemma. As a result the cost of taxes were baked into the cost of a home when it came to buying. The higher the price the greater the tax consequence. Thus perhaps this keeps prices under control to an extent even though there were definitely parts of Austin that were incredibly expensive. We saw one neighborhood where houses regularly had $600,000 asking prices. That's close to $20,000 in taxes a year.

Lastly, jobs- at least in my field- paid less. A LOT less for that matter. I'd basically be taking a 50% cut in pay for the equivalent job I have in the Bay Area. I spent a good 4-5 months applying for jobs in Austin just to see what I could expect. What was shocking was the severe competition for jobs. I am highly seasoned with a senior position yet the response rate from jobs was almost non-existent. Additionally there were simply less overall job postings. Of the one or two jobs I got a response from- one of which I almost got- the interviewer informed me they had received well over 100 resumes. Not only did they get a ton of local responses, but an almost equally large out of state responses as well. In other words a LOT of people like me are trying to get out of dodge ( Or San Francisco).

So in the end I would still like to move there. A 50% cut in pay still means a better overall quality of life. But I have concerns as well. When we visited it was clear that there were A LOT of out of staters moving in, I being one of them so I'm adding to the problem as well. It seemed like all the museums and visitor centers were packed with Midwesterners and people from the coasts ( Cali, NY, MA etc) and in one instance several of them were talking about how they were moving down and buying a house in such and such town. Texas is cheap and people know it. A good thing can only last for so long. At one time California was also cheap, had plentiful jobs and opportunities. Then it got swamped with people and the rest is history. Perhaps my experience in California has me a tad on-edge and if I move to TX I'd rather do so before and if it winds up getting "ruined" like CA and the Northeast.

Move to Colorado

Colorado is great.

1. The weather in greater Denver is very pleasant. Not as nice as Santa Barbara, but very enjoyable.

2. The state income tax is a flat 4.96%

3. The state constitution requires a balanced budget.

5. Sales taxes are slightly above average at 8%.

6. Property taxes on residential property are low at around 0.5% of real market price.

Dave Barnes

+1.303.744.9024

WebEnhancement Services Worldwide

Thank you

Your article is really great! It is very interesting, I like it!

This can be a great idea to

This can be a great idea to work on hillary clinton 2016 campaign volunteer since it can give more results.