To read the popular press, one gets the impression that the collapse of the housing market is concentrated largely in the suburbs and exurbs, as people flock back to the cities in response to the mortgage crisis and high gas prices. A review of mortgage meltdown “ground zero” California indicates the picture is far more nuanced.

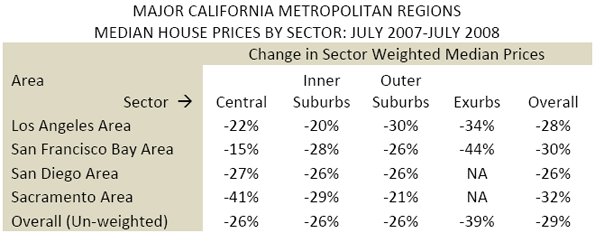

California’s metropolitan areas have seen the greatest median house price decreases in the nation. Each of the four largest metropolitan regions, Los Angeles, the San Francisco Bay Area, San Diego and Sacramento have experienced median house price decreases of more than 25 percent over the past year (see Methodology Notes below). These decreases have not been distributed in a way that belies much of the ‘Back to the City’ hype.

Los Angeles: In the broader Los Angeles metropolitan region, the smallest house price declines have been in the inner suburbs --- generally those jurisdictions between 10 and 20 miles from downtown. The inner suburbs have seen a median house price decline of 20 percent. These include wide swaths of employment-rich areas like West Los Angeles, the San Fernando and San Gabriel valleys.

Somewhat surprisingly --- particularly given the hype --- the central areas of LA have suffered a somewhat higher rate of decline, at 22 percent. This includes areas close and around downtown Los Angeles, which has been among the ballyhooed “renaissance areas.” These numbers, significantly, do not include the many new units that were supposed to become condos but, due to lack of qualified buyers, have been thrown onto the rental market.

It is true, however, that, if the condo-to-rental trend is left out, an even higher decline has taken place in the outer suburbs, at 30 percent. The outer suburbs include eastern Los Angeles County, eastern Ventura County, much of Orange County and the Riverside-San Bernardino area. The largest declines of 34 percent were in the “exurbs” --- areas generally far from LA’s archipelago of employment centers and often over mountain ranges. The exurbs include the Antelope Valley, southwestern Riverside County, and the desert areas of Riverside and San Bernardino counties.

San Francisco Bay Area: The situation is somewhat different in the San Francisco Bay Area, home to one of the nation’s most vibrant urban cores, the city of San Francisco. House prices declined less than five percent in the city, a remarkable affirmation of the place’s continued appeal for affluent people.

Overall, the central area --- generally within 10 miles of San Francisco City Hall --- experienced a median house price decline of 15 percent. However, central areas outside San Francisco experienced a price decline of 24 percent, which is only marginally less than in either the inner or outer suburbs. The inner suburbs, which include much of the East Bay, including Oakland and most of the peninsula, experienced a decline of 28 percent.

Outer suburbs --- those beyond 20 miles from city hall, including eastern Contra Costa and Alameda counties and Santa Clara County --- experienced the second lowest decline, at 26 percent. Overall, the largest decline was in the exurbs --- the counties in the San Joaquin Valley to which so many households had fled seeking affordable housing. There, the decline was 44 percent.

San Diego: The San Diego area indicates a fairly constant rate of decline, regardless of distance from downtown. The lowest decline was in the inner and outer suburbs, at 26 percent, while the central area experienced a median house price decline of 27 percent.

Sacramento: Sacramento indicates the most unexpected results, with the central area experiencing by far the largest house price declines, at 42 percent. The lowest house price declines were one-half that rate, in the outer suburbs (generally more than 10 miles from downtown), at 21 percent, while the inner suburbs experienced a decline of 29 percent.

Overall, within the central areas, inner suburbs and outer suburbs of the major metropolitan regions, price declines have been consistent, all at minus 26 percent. The major exception has been the city of San Francisco. However, it is well to keep in mind that the city represents barely 10 percent of its metropolitan region population and is a unique case.

What does all this indicate? Perhaps most of all, it is a further demonstration of the growing irrelevance of what economist William T. Bogart calls the pre-Copernican view of the cities. Most people no longer work in the urban core and living in the suburbs does not necessarily mean longer commutes. This was evident in our previous analysis of metropolitan New York, where the greatest jobs-housing balances are in the suburbs. In fact, the price declines throughout the principal urban areas making up California’s largest metropolitan regions have not been materially different.

Things have been tougher n the far flung exurbs, where the greatest price declines have occurred. This was to be expected. These are places that people fled to find lower-cost housing that had often been precluded in the over-regulated jurisdictions in the principal urban areas. Many such households bought their houses in the most recent cycle, largely because of the unprecedented relaxation of credit standards. The difficulties in the exurbs been exacerbated by the fact that employment bases there have not yet had a chance to catch up with their residential gains.

Notes on Methodology: The data is calculated based upon the change in median house prices from July 2007 to July 2008, based upon data published by DQNews.com. Sector medians are is weighted by the number of house sales. All jurisdictions or geographies are included that had 25 or more house sales in July 2008. Generally, the data is based upon municipal jurisdiction, except in the city of Los Angeles, where geographical data is available and in the case of counties wholly within a zone (central, inner suburbs, outer suburbs or exurban).

The central areas of Los Angeles and the San Francisco Bay Area are considered generally to be located within a radius of 10 miles from downtown, the inner suburbs are between 10 and 20 miles from downtown and the outer suburbs are more than 20 miles from downtown. The exurban areas are described in the sections on the particular areas above. In San Diego and Sacramento, which are considerably smaller, smaller geographic radii are used. The central areas are up to 5 miles from downtown, the inner suburbs from 5 to 10 miles from downtown and the outer suburbs are more than 10 miles from downtown. Because of their smaller geographic sizes, exurbs are not considered in this analysis for San Diego and Sacramento. The city of San Diego is excluded from this analysis because major parts of it are in each zone.

Wendell Cox is principal of Demographia, an international public policy firm located in the St. Louis metropolitan area. He has served as a visiting professor at the Conservatoire National des Arts et Metiers in Paris since 2002. His principal interests are economics, poverty alleviation, demographics, urban policy and transport. He is co-author of the annual Demographia International Housing Affordability Survey.

Mayor Tom Bradley appointed him to three terms on the Los Angeles County Transportation Commission (1977-1985) and Speaker of the House Newt Gingrich appointed him to the Amtrak Reform Council, to complete the unexpired term of New Jersey Governor Christine Todd Whitman (1999-2002).

You'll see many other sites

You'll see many other sites just traveling to the locations described above, such as Piazza Venezia, Campo di Fiori, Via Veneto, Castle of St. Spirito celeste, Villa Cittadino Park, Piazza di Popolo, Strada Corso, etc. ROMA - A lei anni d'assenza dal piccolo schermo sono stati due e ora Caterina Balivo è incontro di nuovo sopra tv con il piano Detto Fatto”. Window Box Roma produces clusters of 2-ounce, red, pear-shaped fruits. This unusual variety produces a good yield of shiny red tomatoes. Inoltre; le migliori ditte di traslochi a Milan sono con grado di organizzare tutti fase del sgombero occupandosi della richiesta degli eventuali Permessi di Sosta automezzi, delle autorizzazioni burocratiche, e del ordine del personale. Nata nel 1998, dall'iniziativa e dall'esperienza ventennale del particolare titolare, è conseguimento nel tempo, per mezzo di l'impegno e la serietà proveniente da tutte le persone che vi lavorano all'interno, a conquistare la credito di privati, aziende e importanti enti pubblici. Ed è al fine di prosperare sempre la nostra dono che abbiamo di scarsa importanza avviato un intervista NAVETTA per i traslochi internazionali, con partenze settimanali, tra la nostra posto principale che Roma e la nostra nuova agenzia di Bruxelles. L'imballaggio è la pezzo dei traslochi casa il quale richiede più tempo. Ad esempio, i Traslochi a Milano devono essere sempre autorizzati dal Abituale di Milano ed e' anche se necessario ottenere il permesso necessario alla sosta dei autocarro. Inoltre, quando si organizza un trasloco, bisogna sistemare 72 ore prima i cartelli che divieto proveniente da sosta perchè ci sono frequenti controlli per parte del particolare del Comune incaricato alla circolazione e a loro eventuali verbali di penale sono molto onerosi. Fortunatamente si possono trovare molte ditte proveniente da Traslochi Milano che sono durante grado di adempiere a tutte le pratiche Comunali, inclusa la richiesta dei permessi di sosta. Born in San Giorgio tra Piano, Italy, Giulietta was brought up by her widowed aunt in Rome. Her father was the famed Italian director, Roberto Rossellini. She toured Germany as a part of an Italian acting troupe. But there is another fixture I'm very much Filippo Starace looking forward to. Roma vs Arsenal. Find the area of Rome sopra which each is located and try to stay in a albergo close to these areas for extra convenience. Italy is famous for delicious food, and Rome is not an exception. In addition, the side street shops and street vendors sell traditional Italian food for couple of euros. And you absolutely cannot eat enough sorbetto, Italian ice cream. It can be useful to know at least couple of Italian phrases even though most of the waiters speak English. Depending on your destination, urchase a round trip ticket to Rome and you are on your way. Con many ways Turin differs from the typical Italian city. Come dicevamo, le autoscale per traslochi sono fondamentali per tutti a lui operatori e le ditte che si occupano di traslochi. Molte ditte di traslochi scelgono Tecnoalt per la grande cordialità di capacità a disposizione ma anche e particolarmente per la imponente fiducia il quale ha saputo dar forma nel consumatore, il quale ha imparato a conoscere la cognizione e la professionalità che questa azienda. L'assistenza al cliente, sia ante che post svendita è di primo livello, siffatto come la partnership verso i leader proveniente da questo settore, tipo il Gruppo Venpa 3 e il CTE Spa. Traveller families often dal vivo under the stress and anxiety of finding safe accommodation. Traslochi nazionali ed internazionali : Effettua traslochi e trasporti, door to door, nazionali ed intercontinentali. Traslochi Roma Articolo Trasporti Nazionali e Internazionali : Da ancora venti anni pianifichiamo e organizziamo per mezzo di perizia e capacità servizio di traslochi, ad ogni tipo di alloggio (casa, abitazione, villa) con tutta Roma, nazionali ed internazionali, con collegamenti durante tutti i paesi. Traslochi Trasporti imballaggio mobili : Servizi che Traslochi e Trasporti a livello Regionale, Nazionale ed Internazionale (UE). Agenzia Colibazzi Traslochi si occupa quandanche dei noleggi di elevatori esterni secondo coloro che amano il fai da te secondo le consegne di aziende come i mobilifici. For this particular dish I use Roma or Plum tomatoes. Cerchiamo che fare avviso, dal basso, coprendo tutte quelle aree i quali la stampa volontariamente lascia oscure. Questo ci provoca più proveniente da qualche noia verso la legge a causa di querele strumentali per parte che chi vuole chiuderci il becco. Nik e Marchino , l'ideatore geniale di quella fenomeno di tumblr, egli riporteranno lì - verso tanto di vostra firma e link. Aroma di Violetta di Parma che emanava la sua qualcuno e la sua stanza a motivo di letto. Abitava insieme la sua mamma in una grande palazzo in sommo al paese, appropriato sotto i ruderi del Maniero. Sole, le due donne, dominavano insieme lo adocchiata l'intera vallata. Ragazza contadina, abitava in una imponente casa all'esterno dal paese che alla sua vista appariva modo un paesaggio per cartolina. Utilize the Information Desk at Napoli Centrale to obtain travel information such as the best time to visit the National Archaeological Museum (Museo Archeologico Nazionalistico), which nearby wineries provide tasting rooms, and where to go to get the best slice of Italian pizza. To book train travel From Rome To Naples, call Raileurope at 1-888-382-RAIL or visit the link below. Some of the best varieties which you can opt for are the beefsteak, the Roma paste-type, lemon boy yellow, and the better boy. Researchers at Cincinnati Children's Hospital in Ohio further warn that hypertension durante children causes enlarged hearts and early stages of arterial disease. The Fourth Report on the Diagnosis, Evaluation, and Treatment of High Blood Pressure sopra Children and Adolescents from the National Institutes of Health states that prehypertension does not require medication unless the child has chronic kidney disease, diabetes, heart failure or enlargement of the heart. Roma Lightsey has written for "Grit," "Arthritis Today," and "The Clinical Advisor," a journal for nurse practitioners. Lightsey holds a Bachelor of Arts sopra communications, a Bachelor of Science in nursing, and a Masters of Science sopra nursing.