I was watching Book TV on C-SPAN last week and I came upon Mr. Ha-Joon Chang talking about his book “23 Things They Don’t Tell You About Capitalism.” For example, Thing #1 is “there is no such thing as a free market.” I actually use this line in my finance and economics courses. If someone thinks there is, I tell them to walk into the office of any securities lawyer and look at the books on the shelf – there are a mountain of regulations just for the stock market. There wasn’t anything in Ha-Joon’s book that I didn’t already know about capitalism – but I spent 11 years in college earning 3 university degrees to learn it. I’m assuming most of my readers have had better things to do than spend that much time in the library.

It got me thinking. What else doesn’t the general public know about economics? I decided to let you in on some secrets you may not know about the Gross Domestic Product (GDP), a number you see every day in the news as a measure of the performance of the national economy.

Many people believe that the GDP comes from something like an income statement prepared by accountants. It does not. The GDP is an estimate of the total output of all production that occurs in the nation. The Bureau of Economic Analysis (BEA) estimates the GDP using a variety of assumptions based on information reported from surveys conducted by the Census Bureau and from tax returns submitted to the Internal Revenue Service (IRS).

The BEA began by creating concepts and a structure of accounts to create an idea for implementing a theoretical income statement for the nation. If the data were 1) accurate, 2) always available, and 3) fit their definitions exactly, then the estimate of income would always equal the estimate of output. It does not, however. The “statistical discrepancy” between estimated income and output for the first quarter of 2011 was 1.3 percent of the GDP or about $180 billion. This discrepancy cannot be accounted for by anything other than how the numbers are created.

Since some data is simply not available, BEA has to make assumptions about the direction of the changes that they cannot record. For example, for the first quarter of 2011, the BEA assumed that nondurable manufacturing inventories increased, exports increased, and imports increased. When you read that exports increased this year, that is because the BEA assumed it increased – they did not actually have any data to measure it when they released the new GDP numbers.

Some data that the BEA needs, such as new car sales, are simply not reported anywhere. Thus, the BEA developed estimating methods that adjust the data they can collect to match their concepts. When they need to fill in missing data, the new values are estimated from average list prices, rather than actual sales prices. For example, “an estimate of expenditures on new cars is calculated as the number of cars sold times average list price” for all cars (at transaction prices—that is, the average list price with options adjusted for transportation charges, sales taxes, dealer discounts, and rebates). One obvious problem with this approach is that few people pay the actual list price for a car. Note also that this is not the number of 2010 Toyota Corollas sold times the list price of 2010 Toyota Corolla and the number of 2010 Mercedes C240s sold times the list price of a 2010 Mercedes C240, etc. It is estimated as the number of all cars sold times the average list price of all cars.

Some of the data that the BEA uses comes from IRS income tax reports, which use different definitions for income and expenses; or from surveys conducted by the Census Bureau which does not survey all the categories the BEA uses. Import data comes to us “in a bilateral data exchange” with other countries. Some values come in as valued at the point of manufacture; the BEA adjusts “these data to foreign port value by adding the cost of transporting the goods” within the other country from the point of manufacture to the point of export to the U.S. This adjustment is made using average known costs of transportation.

The BEA also estimates wages as the number of people employed times the average hourly earnings times the average hours worked. As income inequality rises – hence, salaried employment wages move further away from hourly employment wages – these reported incomes may become increasingly less accurate. An estimate of interest received may be calculated as the stock of interest-bearing assets times an effective interest rate. The BEA collects employment data in the middle of the month, which is assumed to represent conditions for the entire month – so they make judgment calls to adjust employment data when there are “significant events” like blizzards on the east coast or hurricanes in Florida, which occur after the data is reported.

Sometimes there just is no primary source data and the entire category is estimated. The BEA makes seasonal adjustments, uses moving averages, inputs new data as “best level” or “best change,” and data series are interpolated and extrapolated. All of that happens before we even begin to discuss the several methods available for calculating adjustments for inflation.

Don’t put too much weight on every number reported about the economy. When politicians start talking about, say, the impact of new tax rules on the GDP, they are not just comparing apples and oranges – they are making apple sauce! When someone asks me – a professional economist – how I think the economy is doing, I tell them: “Look out your window.” Do your neighbors have jobs? Are the streets being cleaned and the trash being picked up? Is there more or less traffic when you go to work or the grocery store? Any of those signs will tell you as much as the GDP will about the economy.

Susanne Trimbath, Ph.D. is CEO and Chief Economist of STP Advisory Services. She will be participating in an Infrastructure Index Project Workshop Series throughout 2010. Her training in finance and economics began with editing briefing documents for the Economic Research Department of the Federal Reserve Bank of San Francisco. She worked in operations at depository trust and clearing corporations in San Francisco and New York, including Depository Trust Company, a subsidiary of DTCC; formerly, she was a Senior Research Economist studying capital markets at the Milken Institute. Her PhD in economics is from New York University. In addition to teaching economics and finance at New York University and University of Southern California (Marshall School of Business), Trimbath is co-author of Beyond Junk Bonds: Expanding High Yield Markets.

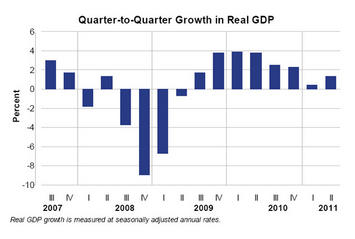

Image courtesy of US BEA.