The “credit crisis” is largely a Wall Street disaster of its own making. From the sale of stocks and bonds that are never delivered, to the purchase of default insurance worth more than the buyer’s assets, we no longer have investment strategies, but rather investment schemes. As long as everyone was making money, no one complained. But like any Ponzi Scheme, eventually the pyramid begins to collapse.

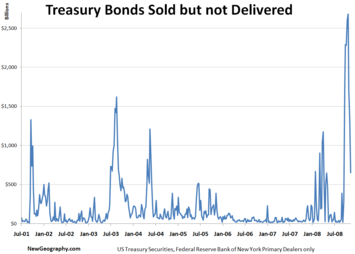

For the last couple of months trillions of dollars worth of US Treasury bonds have been sold but undelivered. Trades that go unsettled have become an event so common that the industry has an acronym for it: FTD, or fail to deliver.

What’s the result? For the federal government, it’s an unnecessarily high rate of interest to finance the national debt. For states, it’s a massive loss of potential tax revenue. And for the bond buyers, brokerage houses, and banks, it’s yet another crash-and-burn to come.

First, a primer: The Federal Government issues as many bonds as Congress authorizes (the total value is an amount that basically covers the national debt). Many are purchased by brokers and investors, who then re-sell them in “secondary” trades. The way the system is supposed to work is that the broker takes your bond order today and tomorrow takes the cash from your account and ‘delivers’ the bonds to you. The bonds remain in your broker’s name (or the name of a central depository, if he uses one). If there is interest, the Treasury pays the interest to your broker and he credits your account for the amount.

What is happening today that strays from this model? Because the financial regulators do not require that the actual bonds be delivered to the buyer, your broker credits you with an electronic IOU for them, and, eventually, with the interest payments as well. But the so-called “bonds” that you receive as an electronic IOU, called an “entitlement”, are phantoms: there aren’t any bonds delivered by your broker to you, or by the government to your broker, or by anyone.

The significant result of the IOU system is that brokers are able to sell many more bonds than the Congress has authorized. The transactions are called ‘settlement failures’ or ‘failed to deliver’ events, since the broker reported bond purchases beyond what the sellers delivered. Since all of this happens after the US Treasury originally issues the bonds, the broker’s bookkeeping is separate from US Treasury records. That means there is no limit on the number of IOUs the broker can hand out...and there are usually more IOUs in circulation than there are bonds.

The ramifications are far reaching for the national budget. Wall Street, by selling bonds that it cannot deliver to the buyer — in selling more bonds than the government has issued — has been allowed to artificially inflate supply, thereby forcing bond prices down. These undelivered Treasuries represent unfulfilled demand by investors willing to lend money to the US government. That money — the payment for the bonds — has been intercepted by the selling broker-dealers. The subsequently artificially low bond prices are forcing the US government to pay a higher rate of interest than it should in order to finance the national debt.

The market for US Treasury bonds has been in serious disarray since the days immediately following September 11, 2001. Despite reports, reviews, examinations, committee meetings, speeches, and advisory groups formed by the US Treasury, the Federal Reserve, and broker-dealer associations, massive failures to deliver recur and persist. Somehow, government, regulators and industry specialists alike believe that it’s OK to sell more bonds than the government has issued. It shouldn’t take a PhD-trained economist to tell you that prices are set where supply equals demand. If a dealer can sell an infinite supply of bonds (or stocks or anything else for that matter), then the price is, technically-speaking, baloney. And the resulting field of play cannot be called a “market”.

If regulators and the central clearing corporation would only enforce delivery of Treasury bonds for trade settlement — payment — at something approaching the promised, stated, contracted and agreed upon T+1 (one day after the trade), there would be an immediate surge in the price of US Treasury securities. As the prices of bonds rise, the yield falls. This falling yield then translates into a lower interest rate that the US government has to pay in order to borrow the money it needs to fund the budget deficit and to refinance the existing national debt.

This week’s drop in the yield on US Treasuries was accompanied by a spike in bond prices. The data won’t be released until next week, but you can expect to see that a precipitous drop in fails-to-deliver occurred at the same time. Don’t get your hopes up, though. One look at the chart above will tell you that the good news won’t last until real changes are made to the system.

As a bonus insult to government, consider the $270 million in lost tax revenues to the states. This is because investors (unknowingly) report the phony interest payments made to them by their brokers as tax exempt; interest earned on US Treasury bonds is not taxed by the states.

For the bond buyer, the situation poses other problems and risks. As an ordinary investor, you’re not notified that the bonds were not delivered to you or to your broker. Of course, your broker knows, but doesn’t share the information with you because he or she plans to make good on the trade only at some point in the future when you order the bond to be sold.

The electronic IOU you received can only be redeemed at your brokerage house, and no one knows what will happen if it goes under, although I suspect we’ll find out in the coming quarters as more financial institutions get into deeper trouble. You’re probably not aware that, in order to cash in that IOU when you’re ready to sell, you depend not on the full faith and credit of the US government, but on your broker being in business next month (or next year) to make good on the trade. In other words, you’re taking Lehman Brothers risk, and receiving only US Government risk-free rates of return on your investment.

Your broker, meanwhile, enjoys the advantages of commission charges for the trade, maybe an account maintenance fee and – more importantly – they use your money for other purposes. Wall Street is not sharing any of this extra investment income with you. In my analysis of Trade Settlement Failures in US Bond Markets, I calculate this “loss of use of funds” to investors at $7 billion per year, conservatively.

Despite this, rather than require that sold bonds be delivered to the buyer, the Treasury Market Practices Group at the Federal Reserve Bank of New York merely points out FTDs as “examples of strategies to avoid.”

Now for the really bad news. The tolerance for unsettled trades and complete disregard for the effect of supply on setting true-market prices is also responsible for the "sub-prime crisis," which everyone seems to agree on as the root of the current global financial turmoil. You see, there are more credit default swaps — CDS — traded on mortgage bonds than there are mortgage bonds outstanding. A CDS is like insurance. The buyer of a mortgage bond pays a premium, and if the mortgage defaults then the CDS seller makes them whole. CDS are sold in multiples of the underlying assets.

A conservative estimate is that $9 worth of CDS “insurance” has been sold for every $1 in mortgage bond. Therefore, someone stands to gain $9 if the homeowner defaults, but only $1 if they pay. The economic incentives favor foreclosure, not mortgage work-outs or Main Street bailouts.

In the same process that is multiplying Treasury bonds, sellers are permitted to “deliver” CDS that were not created to correspond with actual mortgages; call them “phantom CDS”. According to October 31, 2008 data on CDS registered in the Depository Trust & Clearing Corporation’s (DTCC) Trade Information Warehouse, about $7 billion more CDS insurance was bought on Countrywide Home Loans than Countrywide sold in mortgage bonds. That provides a terrific incentive to foreclose on mortgages.

Countrywide is the game’s major player: The gross CDS contracts on Countrywide of $84.6 billion are equivalent to 82% of the $103.3 billion CDS sold on all mortgage-backed securities (including commercial mortgages) and 90% of the total $94.4 billion CDS registered at DTCC sold on residential mortgage-backed securities.

General Electric Capital Corporation is the fifth largest single name entity with more CDS bought on it than it what it has sold; someone is in a position to benefit by $12 billion more from consumer default than from helping consumers to pay off their debt. Only Italy, Spain, Brazil and Deutsche Bank have more phantom CDS than GECC, according to the DTCC’s data.

The US auto manufacturers also have net phantom CDS in circulation: $11 billion for Ford, $4 billion for General Motors, and $3.3 billion for DaimlerChrysler (plus an additional $3.5 billion at the parent Daimler). Of course, these numbers change from week to week and only represent CDS voluntarily registered with the DTCC, so the real numbers could be much greater.

Who stands to gain? There is no transparency for CDS trades, which means that we don’t know who these buyers are. But in order to get paid on these CDS, the buyer must be a DTCC Participant… and that brings us to Citigroup, Goldman Sachs, JP Morgan and Morgan Stanley – all Participants at DTCC and instrumental in designing and developing CDS trading around the world. By the way, these firms are also in the group that reports FTDs in US Treasuries; the top four firms represent more than 50% of all trades. You can do the math from there.

The US government and regulators are in the best position to end these fiascos, turn us away from casino capitalism, and return our financial industry back into a market. It won’t require any new rules, laws or regulations to fix the situation. If someone takes your money and doesn’t give you what you bought, that’s just plain stealin’, and we already have laws against that.

Susanne Trimbath, Ph.D. is CEO and Chief Economist of STP Advisory Services. Her training in finance and economics began with editing briefing documents for the Economic Research Department of the Federal Reserve Bank of San Francisco. She worked in operations at depository trust and clearing corporations in San Francisco and New York, including Depository Trust Company, a subsidiary of DTCC; formerly, she was a Senior Research Economist studying capital markets at the Milken Institute. Her PhD in economics is from New York University. In addition to teaching economics and finance at New York University and University of Southern California (Marshall School of Business), Trimbath is co-author of Beyond Junk Bonds: Expanding High Yield Markets.

More on the US Treasury market's structural failure: The US treasury market reaches breaking point

Increase android app review

Thankx for sharing our ideas through dis post. you can also visit here Visit here

Hi there, this weekend is

Hi there, this weekend is good for me, Traders Learning Center - The Binary Options Advantage

According to October 31,

According to October 31, 2008 data on CDS registered in the Depository Trust & Clearing Corporation’s (DTCC) Trade Information Warehouse, about $7 billion more CDS insurance was bought on Countrywide Home Loans than Countrywide sold in mortgage bonds. That provides a terrific incentive to foreclose on mortgages loans no credit check

March 2011 Update

Other media outlets are finally catching up on this story. Here's a link for a Financial Times Financial Times piece that includes links to work by Kaufman Foundation and others about the on-going nature of the systemic problem of settlement fails.

Susanne

Follow me on Twitter: SusanneTrimbath

I think that in this time of

I think that in this time of world crisis the smartest thing that you can do is to hire the Online Forex Broker because they know their job and they will help you find all the business that you need or want .

More on Geithner's role in Phantom Bonds

This article came out yesterday and is already being passed around on investment message boards:

"Treasury Nominee Failed to Halt Bond Scam"

By Lucy Komisar [http://thekomisarscoop.com/]

http://www.ipsnews.net/news.asp?idnews=45472

Something Else about Geithner

Last night, I sent copies of this article to the Chairs of the House and Senate finance committees. This morning they delayed the Senate hearing to January 21. Also, note that Senator Dorgan has a bill that “establishes a national task force to prosecute financial fraud that contributed to the financial collapse”. http://dorgan.senate.gov/newsroom/record.cfm?id=306509.

Support the Bill, oppose Geithner. Enforce your political will.