The takeover of Merrill Lynch by Charlotte-based Bank of America represents another step in the emergence of a true full-tilt competitor to New York as a financial capital. Already dominant in commercial banking, the acquisition places the North Carolina metropolis into the first ranks of cities in wealth management.

Charlotte’s emergence has been remarkably rapid. When John Harris was growing up on a dairy farm outside Charlotte some six decades ago, it was still a sleepy little southern town. “It was a quiet kind of place back then,” he recalls. “We were a stepchild to the people back East.”

Today, Charlotte is a stepchild no longer. Taking advantage of a traditional Southern sense of being under-estimated, the leadership in this region of some 1.5 million has worked to become not only a bigger place but an important one.

“The stepchild always has to work harder,” explains Harris, one of the region’s leading real estate powers. “We’ve always known what it’s like to be ‘have nots,’ not the ‘haves.’”

Like Houston, Charlotte represents a classic opportunity city, a place built by newcomers used to not getting too much respect. While other New York rivals like Chicago and San Francisco could seem cosmopolitan enough to be real contenders, Charlotte has emerged very much out of nowhere, in a charge led by people who, at least before the last decade or so, seemed like nobodies.

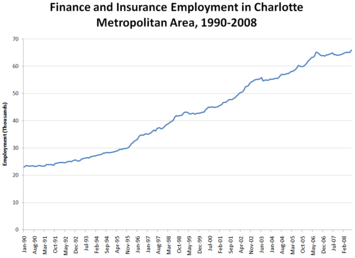

Charlotte’s ascendancy has not been brought about by a well-developed hierarchy but by entrepreneurs like Bank of America’s Hugh McColl, many of whom came from smaller southern cities to Charlotte in the 1960s and 1970s. In the ensuing decades, through mergers and regional expansion, Charlotte has vaulted past not only its southern rivals but traditional banking power centers like Chicago, Pittsburgh and San Francisco.

Although Charlotte had been home to banks for generations, two men dominated the city’s ascendancy, McColl and Wachovia’s Ed Crutchfield. Taking advantage of North Carolina’s liberal banking laws, these two dynamic leaders spent much of the 1980s and 1990s gobbling up other region’s banks, including the 1998 takeover of San Francisco’s greatest financial institution, the Bank of America.

In the process, Charlotte basically wiped out most of its major competitors, and now has more than three times the assets of the remaining San Francisco banks. Today only New York stands ahead of Charlotte --- and as the Merrill takeover suggests, what’s left of its humbled financial sector now sits in the crosshairs. Like other opportunity cities, Charlotte has the lure of greater affordability to lure younger talent to their city. The top flight multi-millionaire players may stay in New York and Greenwich for decades to come, but Harris and others believe more and more of the financial industry will continue to migrate to their city.

“People come down here for the cost of living and the weather,” suggests Buffalo native Joe Riley, a recruiting consultant at Wachovia, who claims 50 percent of his recent hires hail from the Northeast and Midwest. “Everyone misses the food and culture, but it’s great to be in a growing city, and be a part of it.”

Although banks are important, they are not the only major players. Equally important, Charlotte has become home to other big Fortune 500 employers such as Nucor Steel, Duke Power and Lowe’s. Unlike New York, San Francisco and Chicago, which are all rapidly losing their good blue-collar jobs, Charlotte continues to develop its industrial and warehousing sectors. Over the last 15 years, for example, the Charlotte area has added jobs at a 2.57 percent rate, compared to under one percent for New York, Los Angeles, San Francisco and Chicago.

Reasonable housing costs and a diversified employment base, notes Harris, allows Charlotte to compete broadly not only at the top levels of management, but across the board far more than a more expensive metropolitan region. “It’s hard to be a mass employer in San Francisco,” he notes.

Yet, despite the relative advantage of affordability, the financial industry will likely determine the city’s future. Much as Houston has used its port and the energy industry to move from an opportunity to a nascent world city, Charlotte’s business leaders feel that the clustering of financial and high-end business service firms in the area will take them to the next level.

“Charlotte for years was not quite a world class city but a very large town,” notes real estate broker Louis Stephens. “But now it’s a very fine city that’s trying to be a world class city.”

The appeal of the area can be seen in the migration numbers. Latino immigrants, for example, feature prominently in both lower-end service, construction as well as skilled trade. The region had among the fastest growth rate in immigration of any major U.S. region over the past decade.

The appeal of the area can be seen in the migration numbers. Latino immigrants, for example, feature prominently in both lower-end service, construction as well as skilled trade. The region had among the fastest growth rate in immigration of any major U.S. region over the past decade.

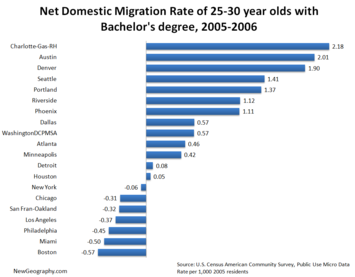

Equally important, the city, like much of the Carolinas, has emerged in the last decade as a primary draw for people fleeing the high costs and slow job growth of the Northeast. Prominent among these newcomers are a strong wave of educated migrants --- since the mid-1990s it has ranked among the top two or three destinations per capita for those with college degrees.

The popularity of Charlotte among younger educated workers has allowed large companies to find adequate trained staff. Perhaps more importantly --- note this New York! --- the town has been developing more sophisticated financial firms, including boutique capital market companies, even before the Merrill acquisition.

Although both Bank of America and Wachovia have been hit by the problems afflicting investment banks everywhere, it would be not be surprising that in the next expansion, more of the action may shift from New York and San Francisco to Charlotte, largely due to its greater affordability. Like Houston after the 1980s energy bust, Charlotte may be well positioned to pick up the pieces even as the finance industry hits the skids.

“You see a migration of talented educated people from the Northeast and the rest of the world,” notes one native entrepreneur, Tim Stump, who runs his own capital market firm in the city. “There’s increasingly an international dimension here that puts us past the regional playpen. We can play in the national and international market.”

For all the big city talk among its elites, many Charlotteans understand that their city’s key competitive edge lies not in becoming not too much like New York. Of course, both natives and newcomers alike appreciate the city’s evolving cultural scene, its improving restaurants as well as some very charming, well-maintained urban districts within walking distance of the burgeoning downtown office district.

But at the end of the day, Charlotte is not New York, and likely will never be. In this sense, history does not repeat itself. What it offers instead is the prospect of a quality of life --- a nice house in a good neighborhood, decent schools, particularly in the affordable nearby suburbs, access to the countryside --- that has become prohibitive for most in entrenched urban centers.

“Many people come here kicking and screaming,” Tim Stump observes. “Then they get here and they realize it’s a lifestyle that is abundant and they don’t want to go.”

“You see people get involved in the arts, the little league, that you have a quality of life where you work hard but you can also be involved in your church and your community. You can live a balanced kind of life here and still be very successful.”

Joel Kotkin is the Executive Editor of Newgeography.com.

I am very much impressed

I am very much impressed from your post.It has amazing information.I learned a lot of new things which explores my knowledge in developments.

purchase worldwide youtube subscribers

Thanks for describing in

Thanks for describing in detail about financial web. E-shopping is increasing with the passage of time because it has lots of benefits as well as business opportunities like affiliate marketing. Affiliate marketing provides a wide coverage of the audience to advertisers for promotion. For example, if you had a lot of mailings and many sites, and thus sales were many, but all of these lists and sites is simply not enough time in theory. Way out of this problem and began to affiliate marketing, if each person will be responsible for one site and a newsletter, then you will be very time consuming. Mostly eCommerce websites are developing in Mangento. Magento is a professional tool for e-commerce, allows you to create an online store based on your own preferences and requirements of the business industry in which you work. Magento eCommerce development ileaddigital.com/services/web-design/ecommerce-web-development

Charlotte?

Charlotte may be the the home of one of the United States largest banks, but anyone who believes Charlotte is a cosmopolitan city is delusional. I suggest the delusion can be cured by a visit to one of the United States' truly cosmopolitan cities...New York City, Chicago or Los Angeles. I have visit all four cities and have first hand knowledge about these cities. Sorry Charlotte!

topseoconsulting

topseoconsultingfirm

An excellent blog site constantly comes-up along with brand new and enjoyable data and while reading through We've think this web site is actually have the many excellent which qualify a blog site to become just one. We've exhibit many of the articles or blog posts on the web page now, and I like your style connected with writing a blog.