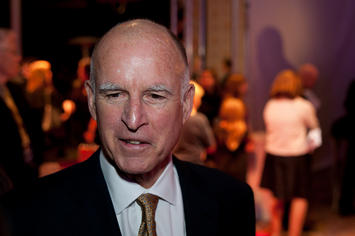

When Jerry Brown was elected governor for a third time in 2010, there was widespread hope that he would repair the state’s crumbling and dysfunctional political edifice. But instead of becoming a Californian Mikhail Gorbachev, he has turned out to be something more resembling Konstantin Chernenko or Yuri Andropov, an aged hegemon desperately trying to save a dying system.

As with the old party bosses in Russia, Brown’s distinct lack of courage has only worsened California’s lurch toward fiscal and economic disaster. Yet as the budget woes worsen, other Californians, including some Democrats, are beginning to recognize the need for perestroika in the Golden State. This was most evident in the overwhelming vote last week in two key cities, San Diego and San Jose, to reform public employee pensions, a huge reversal after decades of ever more expansive public union power in the state.

California’s “progressive” approach has been enshrined in what is essentially a one-party state that is almost Soviet in its rigidity and inability to adapt to changing conditions. With conservatives, most businesses and taxpayer advocates marginalized, California politics has become the plaything of three powerful interest groups: public-sector unions, the Bay Area/Silicon Valley elite and the greens. Their agendas, largely unrestrained by serious opposition, have brought this great state to its knees.

California’s ruling troika has been melded by a combination of self-interest and a common ideology. Their ruling tenets center on support for an ever more intrusive, and expensive, state apparatus; the need to turn California into an Ecotopian green state; and a shared belief that the “genius” of Silicon Valley can pay for all of this.

Now this world view is foundering on the rocks of economic reality. The Soviet Union armed itself to the teeth and sent cosmonauts into space while the public waited on line for toothpaste and sausages. Similarly, Californians suffer from a combination of high taxes and intrusive regulation coupled with a miserable education system — the state’s students now rank 47th in science achievement — and a rapidly deteriorating infrastructure.

The current recession has been particularly severe, continuing at a more acute level than in most states, including places like Florida and Arizona, which also suffered greatly from the housing bust. California now has the third highest unemployment rate in the U.S., beating out only its co-dependent evil twin Nevada and Rhode Island. At the same time, according to a recent Public Policy Institute of California study, inequality in the devoutly “progressive” state has been growing much faster than in the rest of the country.

The most auspicious sign of grassroots support for perestroika was last week’s smack down of public employee unions in San Jose and San Diego. For the first time in recent memory, the unions suffered a humiliating defeat — the measures passed by a margin greater than two to one — as voters endorsed deep reform of the pension burdens bringing these cities to the brink of bankruptcy. Backed by its Democratic mayor, Chuck Reed, San Jose’s measure B aims to reduce pension benefits for both future and current hires. Unsurprisingly, the public employee have threatened to sue.

This may precipitate what could become the California equivalent of a prairie fire. Like San Jose and San Diego, many other California cities are on the verge of bankruptcy. Union-dominated Los Angeles could be the next big domino to fall, according to the city’s own chief administrative office, and has been forced to boost its bonded indebtedness and cut back on critical infrastructure spending to stave off the inevitable.

As services drop and taxes rise — California’s already are among the nation’s highest — voters increasingly realize that one of the main problems is over-generous pensions for public sector workers. This is reflected in the sad reality that the state consistently competes with Illinois for the worst bond rating in the country. Most recently, the state upped its deficit estimate to $16 billion from a $9.2 billion estimate made just in January.

Brown could have used this mounting crisis to reveal his inner Gorbachev. But instead, he has so far chosen a classic Chernenko-Andropov muddle. He proposed a mild pension reform but could not persuade his own party — aware that vengeful the unions will be around long after the old man is gone — to consider it.

More recently, the governor showed his own inner Stalinist by jettisoning his original more modest tax increase proposal for a more radical teachers’ union measure that would raise California’s income tax to the highest in the nation.

Brown’s “millionaire’s” tax, as it is being marketed, starts with individuals making $250,000 or more. Right now it is still ahead in the polls but seems to be losing ground. Joel Fox, a longtime anti- tax activist, senses that people in the state — as evidenced by the San Jose and San Diego votes — are beginning to realize that the tax increases are designed primarily not to improve the schools, keep the parks open or pave the roads but simply to bolster public-sector pay and pensions.

This collective turning on of the civic light bulb comes at the same time that the primary economic delusion that has dominated progressive politics — the myth of the high-tech savior — has fallen into disrepute. Under Brown and his monumentally incompetent predecessor, Arnold Schwarzenegger, state officials maintained a belief that Silicon Valley’s money machine would be able to bail the state out of its budgetary morass.

In this context, the underwhelming performance of Facebook’s IPO last month takes on major political significance. Not only will there be fewer puerile billionaires to inflate the Valley real estate market and bankroll “progressive” candidates and causes, scores of hip wannabe start-ups suddenly may find themselves no longer the darlings of venture capital investors or the stock market. Like California’s budget itself, the social media boom is now looking like something of a fraud.

Another potential casualty of the weak economy could be the green drive to remake the state into a kind of Ecotopian paradise. This is evident in growing opposition to some of Brown’s most beloved initiatives, notably a fantastically expensive high-speed rail system. Sold in the euphoric progressive atmosphere of 2008, support has collapsed as the price tag has soared and the state’s grievous fiscal problems have worsened. The most recent LA Times poll currently finds nearly three in five California voters would like to see the project scrapped.

Once unassailable politically, the environmental community is fracturing between those thoroughly allied to rent-seeking capitalists and the Democratic Party and those still primarily concerned with preserving nature. The Sierra Club, for example, objects to Brown’s attempt to exempt the high-speed line from environmental review. Some Greens also object to Brown-supported projects like the massive tortoise-roasting solar farm planned for the Mojave Desert.

Both Brown and the Greens also have failed to deliver many of the much ballyhooed “green jobs” that they insisted their policies would produce. Instead they may soon have to confront an electorate increasingly skeptical about green fantasies and more concerned with a persistently under-performing economy.

Clearly, the conditions for a California perestroika are coming into place. Still missing is a coherent vision — from either Independents, centrist Democrats or Republicans — that can unite business, private-sector workers and taxpayers around a fiscally prudent, pro-economic growth agenda. Yet it’s clearly good news that , for the first time in a decade, there’s hope that the whole corrupt, failing California political edifice could come crashing down, providing a renewed hope for recovering the state’s former greatness.

Joel Kotkin is executive editor of NewGeography.com and is a distinguished presidential fellow in urban futures at Chapman University, and contributing editor to the City Journal in New York. He is author of The City: A Global History. His newest book is The Next Hundred Million: America in 2050, released in February, 2010.

This piece originally appeared in Forbes.

The Turnaround

Great article Joel.

It would take just a few steps to re-ignite just a little confidence and build some momentum to get out of this hell hole. First the "millionaire' tax has to be crushed in the Fall. Second CARB needs its wings clipped and the lunatic Cap and Trade needs to be consigned to the dustbin of history. Third, show some sanity and kill high speed rail. Fourth, a couple of brave Democrats need to break ranks with the Enviros and embrace fossil fuel energy development (note to public sector unions, an income stream from brown energy royalties might give you a chance of collecting your pensions. Study North Dakota). Finally, the Republican party has to become competitive again by making the growth argument and learning from Democrat Chuck Reed's experience that if you give voters a clear choice they might just make an intelligent decision. No more celebrity mush from the likes of Arnold and Meg Whitman.

Taxes in perspective

The Tax Policy Center tallies total state and local taxes in California in 2009 at $4,588 per capita, versus a national average of $4,141 --- so the state's taxes (which are small compared with federal taxes) are about 10 percent higher than the national average. Jerry Brown's tax increase would add a bit more than $200 more per person -- so they'd be 15 percent higher than the national average. Personal income per capita, meanwhile, is about 6 percent higher than the nation's as a whole -- so as a percentage of personal income, taxes are a bit higher, but not extravagantly so. Certainly not "Stalinist."

Mind you, those taxes come on top of an extravagantly high cost of living, especially near the coast. Life is not cheap in California. But the notion that the state is taxing the life out of the economy just doesn't hold up.

It is, however, legally strangling growth. That's the economy's real problem.

Jerry Brown's Tax Hike Compared to Taxes in the Other 49 States

Please allow me to compare California's current tax policy and Governor Brown's proposed tax increases against the policies of the other 49 states.

CHART: California Income Tax Brackets and Governor Brown's Tax Hike Proposal Compared to the HIGHEST Marginal Tax Rate in the Other 49 States

http://www.twitpic.com/9qorqs/full

CHART: California State Sales Tax Rates and Governor Brown's Tax Hike Proposal Compared to the State Sales Tax Rate in the Other 49 States

http://www.twitpic.com/9gfz3z/full

Funny how only one state is tops in both categories. Despite ALREADY having high taxes, California seems incapable of living within its means. If California ALREADY has high taxes and is unable to balance its budget, is the problem that are taxes are too low? Or, is it a structural deficit where spending exceeds the capacity of the underlying economy?

Next question: Who is bankrolling Governor Brown's tax hike initiative?

CHART: The Big Government and Union Special Interests Bankrolling Governor Brown's Tax Hike

http://www.twitpic.com/9gi4e1/full

Strange how these same names also appear on the list of California's biggest political spenders.

CHART: The 15 Biggest Spenders in California Politics

http://www.twitpic.com/75tc0v/full

California could save MILLLIONS of taxpayer dollars ...

... if it reformed its laws regarding marihuana and other drugs that are illegal under state law - and released all nonviolent drug offenders.

The budget numbers for the California Department of Corrections and Rehabilitation (CDCR) are here.

Wake up California

The leftist idea has failed. It is time to move on.

maybe just no more taxes

I'm curious how much of the growing opposition to the proposed income tax increases is simply because of a growing number of California voters tired of taxes? The tobacco tax increase to fund cancer research didn't pass. To me that seems exactly the sort of thing that would've normally passed in Cali. The tax affects those evil smokers AND it is to "fight cancer". But it didn't.

I've pondered if part of the past lack of opposition to taxes was that a portion of those opposed to them were leaving the state. That is they were voting with their feet. Maybe we're seeing a rising demographic of those who love the place too much to leave + are instead raising a fuss?

I mean those as questions as it is - obviously - pure speculation on my part.