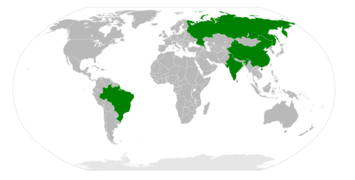

For over a decade, conventional wisdom has held that the future of the world economy rests on the rise of the so-called BRIC countries: Brazil, Russia, India, China (and, in some cases, with the addition of an ‘S’ for South Africa). A concept coined by Goldman Sachs economist Jim O’Neill, the BRICs were widely touted as the building blocks of the “post-American world.”

Such notions are particularly popular among intellectuals like India’s Brankaj Mishra, who sees world power shifting inexorably to “ascendant nations and peoples” — i.e. the BRICs — while “America’s retrenchment is inevitable.” Yet in reality, it is increasingly clear that the BRICs upward trajectory is slowing and many long-term trends suggest that their growth rates will continue to fall in the coming decades. Like other former “America-killers” such as Europe (1960s), Japan (1970s and 1980s) and the Asian Tigers (1990s), the BRIC countries appear to be unable to sustain the steady, inevitable progress projected by enthusiasts both at home and abroad.

One sign can be seen in the equity markets. Between 2001 and 2007, BRIC stocks soared, more than doubling in China and rising 369% in Brazil and 499% in India. Faith in the destiny of the BRICs grew even more after the world financial crisis, which these economies seemed to shrug off.

Yet more recently the edifice appears to have begun to erode, and in some cases, could well crumble. After rising almost fourfold from 2000 until the financial crisis, the BRICs’ stock-market value is at a three-year low.

This decline has impacted numerous key BRIC companies such as Petroleo Brasileiro SA, Brazil’s state-controlled oil company. This year it fell to the world’s 39th-largest company by market value from the 10th-biggest in July 2011. China Construction Bank Corp. dropped to 20th from 12th while Rosneft, Russia’s largest oil producer, sank to 106th from 70th. Shares of ICICI Bank Ltd., India’s second-biggest lender, have lost 17% during the past year, compared with an average gain of 9% for global peers.

Mutual funds that invest in BRIC equities, which recorded about $70 billion of inflows in the past decade, also have posted 16 straight weeks of withdrawals, losing a net $5.3 billion, EPFR Global data show.

This reflects serious, deep-seated problems in these economies. Brazilian consumer defaults increased to a 30-month high in May, while prices for Russia’s oil exports have dropped about 10% this year. In India, the central bank unexpectedly left interest rates unchanged last month after inflation accelerated. A gauge of Chinese manufacturing compiled by the government fell to a seven-month low in June.

The BRICS are learning — as the Japanese did before them — the meaning of gravity. With the dollar gaining value against the Brazilian real, Brazil could slip from the world’s sixth largest economy to seventh, overtaken again by the United Kingdom.

BRIC countries are suffering, in part, because of the slowdown in the European Union and North America. Depressed levels of spending in these export markets devastates these economies, in part because their domestic markets are not yet wealthy enough to support strong growth on their own.

Brazil has experienced a rampant property boom in recent years, with house prices in Rio trebling since 2008, and mortgage borrowing soaring. Reduced consumer demand could help drive the country’s economic growth rate to 2.2%, a pace more familiar in developed Western economies, and less than half the rate predicted by official government economists.

India seems to be drifting into a political crisis and remains handicapped by its deep-seated culture of corruption and favoritism. Malnutrition has increased — and is higher than in most African countries — while the political system creaks and blocks reform.

This is one reason why credit default swaps suggest India is already a bigger investment risk than emerging markets such as Vietnam and more than double the risk of Brazil, Russia, China and South Africa. India may also lose its investment-grade credit rating as Prime Minister Manmohan Singh’s administration struggles to curb a record trade deficit, a budget shortfall that exceeded targets and fighting within the ruling coalition, Standard & Poor’s and Fitch Ratings said last month.

In the short run, things are likely to get worse in India; S&P recently cut its forecast for growth in 2012 to 5.5% from 6.5%. Inflation running at 10% is sending investors fleeing from the rupee in favor of the dollar’s safety. Growth in industrial production fell from 9.7% in 2010 to 4.8% in 2011. The pace has slowed further in 2012.

BRIC member Russia, as Rodney Dangerfield would have put it, is no bargain either. The crippling problem Russia faces is an economy dependent on oil for 75% of its export income. In 2008 oil was 5% of Russia’s GDP; now it’s 12.5%.

As in India, corruption is pervasive, sparking political unrest against Vladimir Putin’s neo-czarist regime. Investment and retail has slowed down. At the same time Russia faces one of the steepest demographic declines on the planet, spurred by unusually low lifespans among males, with excessive drinking a prime contributor. Russia has lost nearly 10 million people since the collapse of the former Soviet Union. By 2050, the population could fall to as low as 126 million from 142 million in 2010. President Vladimir Putin has identified the demographic crisis as Russia’s “most urgent problem.”

Due to its one-child policy, China, too, faces the prospect of demographic decline. The U.S. Census Bureau estimates that China’s population will peak in 2026, and will then age faster than any country in the world besides Japan. Its rapid urbanization, expansion of education, and rising housing costs all will contribute to this process. Most of the world’s decline in children and young workers between 15 and 19 will take place in China during the balance of the century.

But China’s most pressing problems are more immediate. With exports slowing, China’s GDP growth has decelerated from 10.9% in 2010 to 9.5% in 2011. It is estimated by S&P to be 7.5% in 2012. China’s economic growth is set to slow for the ninth consecutive quarter. Schisms within the Communist Party, and growing labor and other unrest, make the Middle Kingdom somewhat less the inevitable replacement power to the U.S. that many have assumed.

South Africa is also pressed by political and economic problems.The economy is slowing down to a very un-BRIC like 2.7% growth rate. This is well below the heady 4% plus of 2011. And, as in China and India, instability, as seen in the recent, violent work stoppage of 26,000 workers at platinum mines, could further hurt growth.

With unemployment roughly at 25%, South Africa will hard pressed to remain an investment star in the years ahead.

So what now? Well, we can expect financial speculators, like Goldman Sachs, to keep trolling for the next thing. Wall Street’s most influential player recently coined a new term — MIST — to cover their new favorites: Mexico, Indonesia, South Korea and Turkey. One can only imagine how long this fixation will last, given the problems these countries face with either political violence and demographic decline, and in the case of Turkey both.

Of course, brokers hawking investments will continue to look for new places of opportunity. But as we are learning from the experience with the BRICS, not all emerging economies maintain their upward trajectory. Sometimes it might make more sense ,even given our inept political parties, to look at opportunities closer to home, where constitutional protections, a large domestic market and a diversified economy may provide better long-run prospects.

Joel Kotkin is executive editor of NewGeography.com and is a distinguished presidential fellow in urban futures at Chapman University, and contributing editor to the City Journal in New York. He is author of The City: A Global History. His newest book is The Next Hundred Million: America in 2050, released in February, 2010.

This piece originally appeared in Forbes.

BRIC country map by Filipe Menegaz.

Mmm.. good to be here in

Mmm.. good to be here in your article or post, whatever, I think I should also work hard for my own website like I see some good and updated working in your site.

Christian links

Economics tuition basically

Economics tuition basically covers all aspects of the subject, from the basic concepts up to the more advanced ideas. payday loan cash advance.

http://www.personalcashadvance.com/

surfing internet

Internet is a tool developed to help learn cooking pizza games through online gaming. They are especially oriented to make children eat all those cuisines which they hate to even look at otherwise and for thoses children who like magic Games can surfing internet,too!

Economics evaluation essays

Economics evaluation essays are often regarded as one of the most difficult assessment components of the IB Economics program. Students often struggle with structuring their evaluations and applying their economic knowledge to the question.

logiciel de facturation

take care your baby

One of the most amazing things about the online food games is that they cost you nothing at all, also no matter how many times you wish to play a shopping games, you can simply get online and play it without worrying about money.Also if you don’t know how to take care your baby as a young mother, you can play baby games online,too!

make her happy

Dora is so cutie and make you want to touch her head and make her happy,now you have the chance to play dora games to dress this lovely girl up and make her much pretty then.

food games

bubble trouble

Everybody likes entertainment ,some entertain themselves by listening or singing music

others like to playing game,and bubble trouble is very tricky, you have to use the directions key to go here and there and you can shoot with the help of space key.

Every one of us is busy fighting for a better life than they having, and more and more youngsters would prefer to play Car Games example to relax because they are not time restricted and you can play them easily using short breaks between your working hours.

In industrial projects

In industrial projects, there is hardly a more important component than the gate valve, they are used in most every industry in ever sector.

The electronic weighing scale machine is more commonly known as a checkweigher

, in the packaging industry. It is specifically used to improve and maintain the weight efficiency of packaged goods.

Economics tuition basically

Economics tuition basically covers all aspects of the subject, from the basic concepts up to the more advanced ideas. The great thing about hiring your tutors in a tuition agency is that you can be confident that the person who is guiding you in your Economics lessons is a qualified professional with expertise in the subject. plante carnivore

After rising almost fourfold

After rising almost fourfold from 2000 until the financial crisis, the BRICs’ stock-market value is at a three-year low. cell phone spy software