Nothing. Seriously. Not a damn thing.

Oh, the occasion is being used to opine on our state of affairs, but nothing is structurally taking shape in America to prevent the next Detroit from occurring. In fact, Detroit is occurring every day inside most of us. We are all getting bankrupt in so many little ways.

America is in a precarious position. Our economy is based on consumption. Our consumption is based on our livelihood. Our livelihood is based on our employment, and in our jobless “recovery”, there just aren’t many decent jobs. With technological advances, it is likely to get worse. Writes columnist Bill McClellan in the St. Louis Dispatch:

[T]he day is coming when trucks will drive themselves. People in the trucking industry say it is inevitable. Within a decade or so, truck drivers will be obsolete. There are currently 5.7 million truck drivers.

McLellan continues, discussing an email he received from a reader:

Pat B. is a conservative businessman. He wrote, “Regarding the truck drivers, I think the bigger issue is how society is going to deal with nonproductive people vs. productive people. Automation will allow ‘productive’ people to be much, much more productive than the ‘nonproductive’ people. Theoretically, a very small segment of the population could produce almost everything. How will we deal with this?”

Good question. Currently, Detroit is ground zero of it. So much busted there, so many poor, so many with blue- and white-collar skills in the new no-collar economy. Do we let the city die on the vine? Au revoir Rust Belt?

Well, a consensus is becoming clear. We need to “First World” Detroit. Get it and other post-industrial cities on the right path.

Enter New York.

Courtesy of Smithsonian

In the late 1970′s, New York City was in trouble: the threat of bankruptcy, and the Bronx was on fire, literally, with broadcaster Howard Cosell famously being attributed to saying “There it is ladies and gentleman, The Bronx is burning” as cameras panned to a fire in an abandoned elementary school during Game 2 of the 1977 World Series. Put simply, the 1970’s NYC was not unlike the modern day Detroit—insolvent fiscally, aesthetically, and, in many respects, sociologically. “Broken youth stumbling into the home of broken age,” wrote Frank Rose in the Village Voice.

But with crisis comes opportunity, particularly for those who can afford to be opportunistic. Specifically, in the book by Paul Harvey entitled The Brief History of Neoliberalism, the crossroads of NYC’s late-70’s fiscal crisis gets center stage. Here, the groundwork for the city’s co-optation had been laid for some time, with the 1960’s urban crisis increasing municipal desperation. Financial institutions smelled blood, and they saw occasion. What happened dictates urban redevelopment to this day. Writes Harvey (h/t Cleveland Frowns):

At first financial institutions were prepared to bridge the gap, but in 1975 a powerful cabal of investment bankers (led by Walter Wriston of Citibank) refused to roll over the debt and pushed the city into technical bankruptcy. The bail-out that followed entailed the construction of new institutions that took over the management of the city budget.

Harvey states that the new budget strategy amounted to “a coup by the financial institutions against the democratically elected government”, one that would subsequently de-emphasize social and physical infrastructure for the priority of a “good business climate”. Harvey continues:

But the New York investment bankers did not walk away from the city. They seized the opportunity to restructure it in ways that suited their agenda…This meant using public resources to build appropriate infrastructures for business…coupled with subsidies and tax incentives for capitalist enterprises…[T]he investment bankers reconstructed the city economy around financial activities, ancillary services such as legal services and the media…and diversified consumerism (with gentrification and neighborhood ‘restoration’ playing a prominent and profitable role). City government was more and more construed as entrepreneurial rather than a social democratic or even managerial entity.

Fast forward to now and you can see how this framework has made modern day New York. A billionaire mayor. Impressive wealth accumulation. Lower crime. Gentrifying areas that are spreading into many parts of the city. The scene in the Bronx:

The South Bronx is on the upswing and this new project proves it,” said Kathy Zamechansky, President of KZA Realty Group. “A gleaming new building is just what this area needs to add life and vitality to a neighborhood…

All good, right?

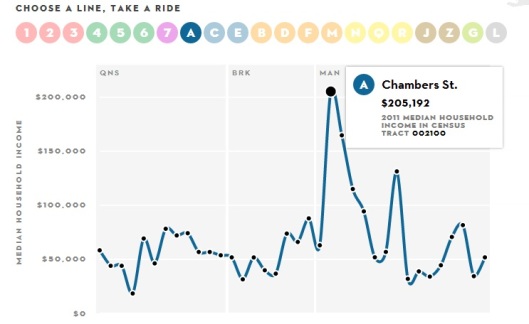

Not exactly. Commoditizing public welfare has come with very personal costs. Particularly, New York City’s economic sphere epitomizes the worsening two-tier system in America, with one study finding that “three of the four most [income] segregated metropolitan areas [in the country] are in the New York City region”. In the city itself, the income disparity rates from subway stop to subway stop are at Namibian levels. “Get off at Chambers St., and you’re averaging $205,192,” writes Fishbowl NY. “Hop off at Kingsbridge Rd., and you’re at $18,610”.

There is cost to personal freedom as well, with Mayor Bloomberg’s “stop-and-frisk” tactics ruled as a violation to the constitutional rights of minorities. The increase in police stops have been significant since Bloomberg took office, going from 160,851 in 2003 to 685,724 in 2011. In a 195-page response just released, the federal judge wrote: “No one should live in fear of being stopped whenever he leaves his home to go about the activities of daily life”.

Heck, there’s even consternation from the city’s creative types. Specifically, New York’s legacy of nurturing the next generation of thought is being homogenized by the fact that elites talking to elites creates for shitty cultural capital. Writes Gawker’s Hamiliton Nolan on how the influx of money is turning the city into “a game of urban Candy Crush”, “Everything is an orgy of destruction! Who’s hip now? Nobody!” Echoes creative class troubadour Lena Dunham:

It’s news to no one that the middle class and up-and-coming talent struggle in this city. As a result, New York is seeing an exodus of its creative population. As Dunham says, “If they struggle for too long, they’re leaving New York for Seattle, Chicago, Austin, and in some cases, even Tampa. We can’t have our generation’s Patti Smith moving to Tampa. That’s going to seriously f*ck our shit up.

But the bridge had been crossed. Not simply for the reasons Dunham fingers, but because New York City is the head of a teetering set of bones. Writes eminent economic scholar Joseph Stiglitz in a recent essay entitled “The Wrong Lesson from Detroit’s Bankruptcy”:

Rather than deal purposefully with this changing economic landscape with useful policies encouraging the growth of other industries, our government spent decades papering over the growing weaknesses by allowing the financial sector to run amok, creating “growth” based on bubbles. We didn’t just let the market run its course. We made an active choice to embrace short-term profits and large-scale inefficiency.

America does have an urban renewal program, but it is aimed more at restoring buildings and gentrification than at maintaining and restoring communities, and even at that, it is languishing.

Which brings us back to Detroit. Consider it America’s “Back to the Future” moment. There is municipal bankruptcy. There is fiscal management being taken away from an elected government. There are financial institutions wreaking havoc on the middle class via a collective Alfred E. Neuman-like exasperation. There is the subsidy environment going full bore in the midst of economic trauma, with the Governor of Michigan giving the okay to Detroit billionaire Mitch Ilitch on his $650 million dollar publicly-subsidized hockey arena one day after signing off on the country’s largest city bankruptcy filing. And then there’s the gentrification-as-economic-development silver bullet, with real estate developer Dan Gilbert buying up downtown properties for the price of a song and then using the spatial grease of placemaking to fill his square feet with the rise of the creative class. “Stand up and gentrify: 7 days in Detroit” reads a series running in the The Windsor Star.

“It was a face that didn’t have a care in the world, except mischief.” Quote from Mad editor Harvey Kurtzman.

Taken together, the framework of Detroit’s progression is to simply go forth into who we are as a country—a group of people on a collision course with the inevitable failings of economic disparity, or more generally: a nation without good jobs.

Should Detroiters be worried?

Maybe. Reads the New York Observer: “Bloomberg Warns the Next Mayor Could Follow Detroit Into Bankruptcy”.

Back to the future indeed.

Richey Piiparinen is a writer and policy researcher based in Cleveland. He is co-editor of Rust Belt Chic: The Cleveland Anthology. Read more from him at his blog and at Rust Belt Chic.

Lead photo courtesy of Vice.

I agree with your blog and i

I agree with your blog and i will be back to check it more in the future so please keep up your work. michael kors outleti love your content & the way that you write.

http://buyfacebooklikescheapx.blog.com/

I thought it was going to be

I thought it was going to be some boring old post, but it really compensated for my time. I will post a link to this page on my blog. I am sure my visitors will find that very useful.

http://buyfacebook-likescheap.yolasite.com/

Thanks for writing such a

Thanks for writing such a good article, I stumbled onto your blog and read a few post. I like your style of writing...

http://buyfacebooklikescheapx.wordpress.com/

I would also motivate just

I would also motivate just about every person to save this web page for any favorite assistance to assist posted the appearance.

Tv Online

We learned and we have the answer

1. Detroit has taught us that when a single ethnic group of relatively poor people takes over city government and drives out all the other groups, then failure is assured.

2. Frederik Pohl addressed this labor issue in the 1954 short story "The Midas Plague".

Further confirmation of my rent-sucking epicentre hypothesis

Richey, thank you for this very interesting quote:

".....But the New York investment bankers did not walk away from the city. They seized the opportunity to restructure it in ways that suited their agenda…This meant using public resources to build appropriate infrastructures for business…coupled with subsidies and tax incentives for capitalist enterprises…[T]he investment bankers reconstructed the city economy around financial activities, ancillary services such as legal services and the media…and diversified consumerism....."

I have been starting to argue recently, that the USA and the world could have done very nicely without the spatial cluster that is Wall Street, and that this particular "high-income" cluster is nothing more than a rent-seeking leech on the domestic and global economy.

Even the great Ed Glaeser channels Gordon Gekko in "Triumph of the City", praising Manhattan's increasing incomes in the face of declining incomes nationally since 2008, seemingly without shame. And what is more, Glaeser uses Wall Street as an outstanding example of "the cross fertilisation of ideas" in a dense urban setting.

I suggest that the ideas "cross fertilised" were ones that the world could have done without. Enthusiasm for clusters needs to be tempered by a grasp of realism a la Adam Smith:

".....People of the same trade seldom meet together, even for merriment and diversion, but the conversation ends in a conspiracy against the public....."

The rent-seeking nature of the Manhattan economy even extends, in my opinion, to the fact that Federal petrol tax revenues are used to subsidise the transport costs of the wealthiest district in the USA, just because it utilises a politically correct means of transport. The once-famous econometrist and land economist Colin Clark made the following argument in one of his last books, "Regional and Urban Location", 1982.

".....If rail and subway services to the center of large cities were charged at full cost....two consequences would follow. The employers of the lower paid workers in the city center would have to raise their wages, reduce the level of service offered, or move to suburban locations......Meanwhile the higher paid......would have an incentive to move their residences closer to the center......

"......These movements would have their reflection in the price of land.......In net effect, the subsidies on rail and subway transport are subsidies to the owners of certain types of land - for which there is no social justification......"

So you can see why I regard your quote as very confirming of my suspicions. I never knew that aspect of the history before, and I don't think Glaeser mentions it.

The "masters of the universe" need to be reigned in, and that includes the successful spatial rent-seeking associated with their primary clusters. Tobin taxes can't come soon enough.

But I loved the recent "Eunuchs of the Universe" by Tom Wolfe..... economic evolutionary forces may already be dealing to Wall Street. To give Ed Glaeser credit, he has authored an op-ed, "Wall Street Isn't Enough", urging NYC to diversify its local economy.