Global cities are like that famous quip on obscenity: we know one when we see it. But the definitions of global cities are incredibly varied and there doesn’t seem to be a consensus or well-defined way to think about. I looked at the criteria used in various prominent studies back in 2012 and found them highly divergent. Only the Sassen based one appeared to have a robust definition and theoretical basis, but it’s a pretty narrow definition. While it’s very important and useful, I don’t think it fully captures what the average person or urbanist thinks of on the topic.

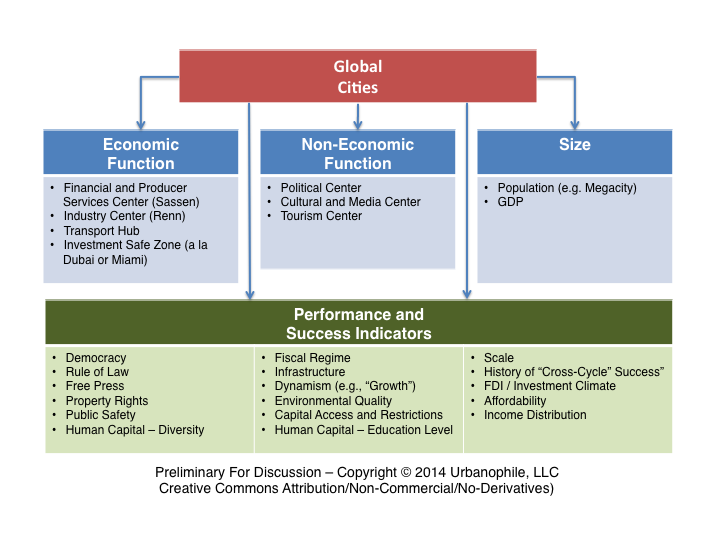

In wrestling with the global city idea while working on the global city study I did some research for, I put together this framework to help organize our thinking.

This framework seeks to capture in a structured manner all the ways people talk about global cities that I’m aware of.

There are three basic categories of criteria people use in defining global cities: economic function, non-economic function, and size.

Economic Function

Some, like Sassen, define global cities by economic function. In her case, just being a financial center isn’t enough. You need to be producing financial services products specifically related to the global economy, not just making mortgages domestically. I list “Financial and Producer Services Center” as a shorthand for this. In all of these definitions, when I say a “center” I’m referring to a center of global or regional (e.g., European or Latin American) significance, not simply a domestic center.

If I have a contribution to the global city definition genre, it’s my contention that places like the Bay Area (tech) or Paris (fashion and luxury) that are important global or regional epicenters of an important 21st century macroindustry are also global cities in a powerful sense by virtue of that.

The idea of being a transport hub for goods or services is self-explanatory, though I’ll note that simply being a goods distribution hub (such as a global air freight hub like Memphis) doesn’t necessarily imply a high value, high wage economy.

Lastly, and perhaps this is one I made some contributions to as well, is the idea of a “safe zone” for investing or parking capital. Much of the world is volatile economically and only has a dubious attachment to the rule of law and property rights. Hence wealthy people in those countries like to stash their cash in places where they consider it safe. Where I would distinguish this from a simple offshore account as in the Caymans is that this investment often includes real estate, and the rich folks in question often establish a personal base there. New York and London as the paradigmatic global cities obviously fall into this category, but I’m more thinking of regional hubs like Dubai, Miami, and Singapore. These places have established themselves as premier business (and in some cases cultural) hubs for their regions.

Non-Economic Functions

These are other aspects of a city’s function that I see as not directly economic, though obviously there are economic impacts. Most of these perhaps could be subsumed under being in an industry epicenter, but since global city surveys often call them out separately, I will as well.

The first item is being an important global political capital like Washington, Moscow or Beijing. Enough said.

Another important dimension is being a cultural and media center. Los Angeles profoundly affects the world because of its entertainment machine and the media that goes along with it. (By contrast, Mumbai may be a huge film center, but serves largely a domestic and Indian ethnic audience). Obviously the English language cities have a big advantage here in terms of media, though cities like Paris have a powerful cultural role.

Lastly, being a global tourism center is another dimension. Which places draw foreign visitors? You might want to read Nicole Gelinas’ recent taken on international tourism’s affect on New York. NYC attracts a third of all foreign visitors to the United States.

Size

Lastly, many surveys include measures that are purely about size, such as total GDP. The rhetoric about megacities (those with more than 10 million people) shows a fascination with size as well.

Success and Performance Indicators

Beyond the categories that define what global cities are, I include a horizontal layer talking about how to think about whether they are successful. I think there’s a big debate that can be had about whether these are performance indicators or selection criteria. Obviously more global city surveys want to pick highly performing cities, so these are part of their evaluation matrix. I myself originally included diversity and educational attainment (talent hub) on the non-economic function list.

I won’t go through these as they are pretty self-explanatory. I’d be interested to see where you all would put these, and what you’d add to or drop from the list.

By the way, in that global city survey I worked on, we decided to look purely at economic function, though pulling across media hub and treating that as an industry. We felt that taking this sort of view was a gap in the existing inventory of ratings, and also perhaps the most important way to think about global cities.

This is a concept in development, so please share your thoughts.

Aaron M. Renn is an independent writer on urban affairs and the founder of Telestrian, a data analysis and mapping tool. He writes at The Urbanophile, where this piece originally appeared.

Hong Kong photo by BigStockphoto.com

Some thoughts

I am very interested in this subject and glad to share some thoughts.

There is a good term for cities that are not "global" ones but are "national" equivalents as you describe - "Superstar Cities". There is a paper with this title by Gyourko, Mayer and Sinai that is as good on this subject as Sassen is on Global cities.

All such cities have a tendency to "exclusion" by way of forcing up the cost of housing with distortionary regulations and planning. However there is quite a range of different timings of these exclusionary effects. New York was for decades a far more inclusionary, affordable global city than London. I state categorically that this is because the urban area was allowed to sprawl for dozens of miles in several directions. London got a Green Belt urban-land-rent supercharger in 1947. I also argue that New York has ended up running into its own de facto Green Belt in recent years, in the form of rural zoning in municipalities that its fringes have now run up against.

It is a restricted fringe that makes the systemic, order-of-magnitude difference in affordability. Glaeser is flat wrong to argue now that abolishing height limits in Manhattan would make NYC more affordable. It would be flat wrong to argue this about London too.

It is a mistake to regard "anti growth" regulations that are actually anti density, as an effective "superstar" exclusionary tactic. You can have as much of these regulations as you like, but if your fringe can grow and splatter freely, your city will have a median multiple of 3.

The other point I would like to make, is that Sassen also describes a dislikeable feature of global cities, as that they tend to import menial labour and house it in crowded and degrading conditions that locally-born people would not tolerate, all the while keeping wages for menial labour low and averting one of the cost pressures that would normally undermine competitiveness. The global connections and fame make this more possible than for non-global cities. But even non-global cities of superstar status tend to increasingly have these imported, low-paid, overcrowded menial workforces. It is Vancouver's dirty secret that most of its increase in urban density is from this, not from efficient intensification per se. And even worse, the overcrowding tends to be spatially restricted (by the sheer height and spikiness of the land rent curve) to the least efficient locations, necessitating long commutes as well as the overcrowding "in the wrong places". Of course this makes the transit mode share end-in-itself look "good", too.

Tokyo is the global city today with the most competitive housing costs; the reasons why, include that they do not have Anglo property rights or our near-exclusive private sector ownership and operation of important urban sites. However, it still certainly does not have the housing options that New York urban area has, especially in terms of stand-alone large-lot housing within 30 minutes train ride of the city centre. And London is at least as severely deprived of such options as Tokyo is in spite of it being an Anglo tradition city. The power of the rent-seekers in urban land is manifest in all its ugliness in the UK. Anglo property rights are all very well, but they are toxic in combination with removal of the freedom to develop exurban land for housing.

Bear in mind too that it is easy to replicate "global city" or "superstar city" costs of space in cities that are nothing of the sort. All that is necessary is sufficiently arrogant growth containment urban planning. Every city in the UK, even the ones of 500,000 population, has higher floor rents than Manhattan in their cores. See Cheshire and Hilber "Office Space Supply Restrictions in Britain: The Political Economy of Market Revenge".