I’m a fan of Strong Towns and share their thesis that the biggest sustainability problem with much of suburbia is its financial sustainability.

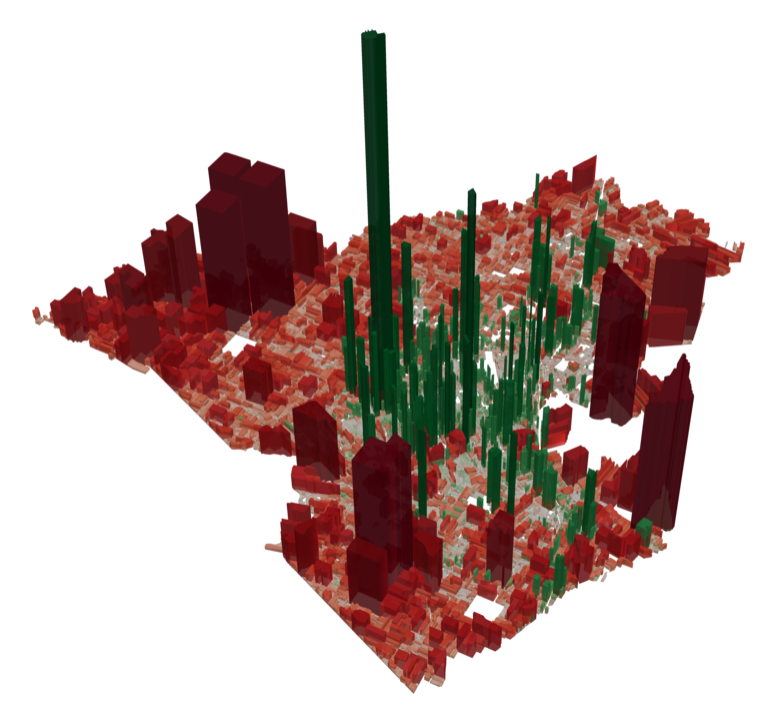

A recent article there about Lafayette, Louisiana has been making the rounds. That city’s public works director made some estimates of infrastructure maintenance costs and which parts of the city turned a “profit” from taxes and which were losses. Here’s their profit and loss map.

The obvious conclusion that we are supposed to draw is that dense, compact, traditional urban development is profitable and good, but low density sprawl is a money loser and bad.

There’s some truth in this, but taking that simplistic view can give a misleading impression. For example, let’s consider why high density central business districts tend to have such density of development and high property values per acre (and thus taxes). It’s obvious that these districts derive a great part of their value from the overall scale of the community, i.e., sprawl.

Let’s do a quick thought experiment. Lower Manhattan below 59th St. is certainly incredible valuable property. However, if the rest of the metro area were some how chopped away leaving only this super-valuable part, how much value would that land retain? In part, Manhattan is valuable because it’s the center of a vast megacity region where tremendous amounts of human capital that lives in dispersed communities can be concentrated in a small area for commercial purposes.

This article says that only about five cities in America don’t suffer from a fatally flawed financial model. I seem to recall that elsewhere they said NYC and SF are the only two cities that can survive in the long run financially.

But it wasn’t that long ago that NYC nearly went bankrupt and had to be rescued. A recent study just said that its structural finances are the second worst of any major city in the country, primarily because of its gigantic liability for retiree health care. NYC looks good now because its economy has been booming. Let’s see how it does it a major downturn, particularly without a strong fiscal hand like Bloomberg at the tiller.

San Francisco is unaffordable to all but very high income residents. It’s a de facto gated community. It may well be that pricing everybody but the rich out is a viable strategy for financial sustainability, but that’s obviously a path foreclosed to most places, even if they wanted to try it.

We also need to consider that there’s infrastructure we have maintained. By and large our telecommunications infrastructure and electricity infrastructure are in very good shape, for example. For telecom especially we’ve made vast investments to not only maintain, but dramatically upgrade our infrastructure. How did we manage to pull that off if it’s financially impossible to maintain and upgrade infrastructure? What lessons could we learn from that?

In short, I agree with the general Strong Towns thesis that we need to look at the long run “total cost of ownership” of sprawl. In many cases, the math just doesn’t add up and some cities are in an infrastructure hole so deep they’re unlikely ever to get out. But they are overstating their case here.

Aaron M. Renn is a senior fellow at the Manhattan Institute, a contributing editor of City Journal, and an economic development columnist for Governing magazine. He focuses on ways to help America’s cities thrive in an ever more complex, competitive, globalized, and diverse twenty-first century. During Renn’s 15-year career in management and technology consulting, he was a partner at Accenture and held several technology strategy roles and directed multimillion-dollar global technology implementations. He has contributed to The Guardian, Forbes.com, and numerous other publications. Renn holds a B.S. from Indiana University, where he coauthored an early social-networking platform in 1991.

Photo "Downtown Lafayette, Louisiana" by Patriarca12 (Own work) [CC BY 3.0], via Wikimedia Commons

Infrastructure and Pension Costs

As a general rule, cities don't go (directly) bankrupt from infrastructure costs. It is almost always indirect. If a city underfunds it's roads, schools, parks, water system and sewer system, the net result will be that people move away. (It is the "moving away" process that bankrupts cities, not the cost of the roads.)

When a city finds out that their roads are underfunded by $1 billion, it most certainly didn't happen in a single year. What happened was the city underfunded road repair and replacement by a few million every year for decades.

Pension costs are similar. The costs themselves do not bankrupt any city (ever). The bankruptcy is the long-term result of getting a bill for $1 million, and deciding to pay only half.

Even in Detroit, for example, the pension plan would have remained 85% funded for many years except for a string of high-profile cases of mismanagement and theft.

Actuaries are perfectly capable of calculating what it costs to fund pension benefits. People who complain about pension benefits make it sound like the benefits to firefighters and police are to blame, which is absolutely untrue. The culprit is the Mayors and Governors who decide to balance their budget by knowingly underfunding the pension cost.