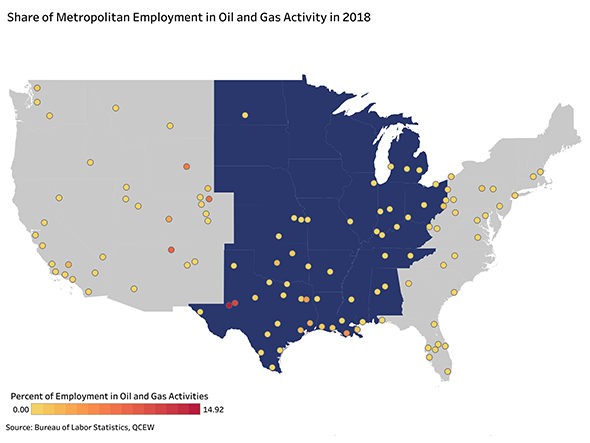

As the COVID-19 pandemic continues to wreak havoc on many areas of the economy, the Heartland's oil and gas industry is poised to take one of the hardest hits. In particular, Texas, Oklahoma, North Dakota and Louisiana are likely to face severe impacts. At a national level, the most severe economic damage from COVID-19 will disproportionately hit a handful of sectors – travel, tourism, lodging, dining and recreation. However, our analysis shows that the most extensive negative consequences of COVID-19 on the Heartland will be attributable to the related, but indirect impacts, of reduced oil and gas exploration and extraction operations. This is significant for the region, as 20 U.S. Heartland states produced 9.7 million barrels of oil a day, 76.1 percent of the U.S. total in December 2019.

The impact of COVID-19 on the shale industry is compounded by the fact that the industry was in financial crisis even before the pandemic hit. A group of 34 shale companies spent $189 billion more than they earned over the last decade. In 2019, those companies generated a negative cash flow of $2.1 billion.1 The energy sector was the worst performer of the S&P 500 over the past decade. Bankruptcies among fracking-focused exploration and production companies included 42 firms in 2019, representing $26 billion in debt. This doubled the debt associated with bankruptcies that occurred in 2018.

Now, two additional simultaneous shocks are at play; one a demand shock stemming from lower worldwide demand for oil—currently being exacerbated by plummeting demand in the U.S. caused by the economic fallout from COVID-19—and a supply shock stemming from the explosion in U.S. shale oil production mostly concentrated in Texas’ Permian Basin. This unique combination of events will have far-ranging effects on the Heartland’s major oil-producing regions. On March 6th, a meeting of the Organization of the Petroleum Exporting Countries (OPEC) and other large producers ended without an agreement to cut production to mitigate the decline in oil prices. Russia decided that it would no longer serve as a swing producer along with Saudi Arabia. Russia was going to use this opportunity to take out the source of rising production: shale oil production in the U.S. In an attempt to defend its market share, the Saudis responded by announcing a huge price cut to below $20 per barrel and increased production—and the rout in oil markets was on.

U.S. oil production has more than doubled over the past decade and hit 13.2 million barrels per day in late February. This expansion in shale oil production aided economic recovery from the Great Recession and resulted in turning a huge U.S. petroleum deficit of $436 billion in 2008 into a surplus in September 2019.2 Moreover, it made the U.S. the largest oil producer in the world, eclipsing Russia and Saudi Arabia.

Despite this explosion in shale oil production, the industry has been burning through cash for over a decade. Nearly 20 percent of high yield bonds (below investment grade) have been issued in the fracking sector since 2009. Financial projections were based upon oil prices of around $100 per barrel, which were not maintained. In 2014, crude oil prices fell from $110 per barrel to $60 per barrel. By the time OPEC and Russia agreed to scale back production in 2016, prices fell below $40 per barrel. These prices put dozens of shale drillers out of business. 3 U.S. employment in the oil sector fell by one-third, and it slashed 170,000 jobs between 2014 and 2016.

The current situation is so dire that even Texas Railroad Commissioner, Ryan Sitton, offered a series of potential proposals to address it, including a mandated 10 percent cut in oil production in the state. Many analysts believe that would be a drop in the bucket compared to the impact of an agreement between Russia and Saudi Arabia to slice production and could prove counterproductive.

Read the rest of this piece at heartlandforward.org

Ross DeVol is President and CEO of Heartland Forward. Heartland Forward’s goal is to promote regional innovation and entrepreneurial ecosystems that foster job creation, wage gains and economic growth for the American Heartland.

Photo: Donald Giannatti on Unsplash.

Endnotes

- Cunningham, Rich, (2020, March 22) “Not Even Higher Oil Prices Can Save U.S. Shale,” OilPrice.com. https://oilprice.com/Energy/Energy-General/Not-Even-Higher-Oil-Prices-Can-Save-US-Shale.html

- Graham, Jed, (2020, March 6) “Is The U.S. Shale Boom Over? Four Major Threats To The Fracking Revolution,” Investors Business Daily. https://www.investors.com/news/us-shale-oil-boom-threats-fracking-revolution/

- Sadasivam, Naveena, (2020, March 13), “Coronavirus Fallout Could Be the Nail in the Coffin for Smaller Oil Companies,” Grist, https://grist.org/energy/coronavirus-fallout-could-be-the-nail-in-the-coffin-for-smaller-oil-companies/